トレンドの反転は、トレーダーが利益を得ることができる最も収益性の高い取引シナリオの一部です。 トレンドのある市場は、かなり長い間、一方向に続く傾向があります。 これにより、トレンドの開始近くでトレンドの反転を予測できたトレーダーは、そのような取引から大きな利益を得ることができます. ピップがトレンド反転トレーダーによって行われた取引の方向に移動すると、利益が高くなる可能性があります。

トレーディングトレンドの反転は非常に良いアイデアのように思えますが、言うは易く行うは難しです。 これは、トレンドの反転を予測するのが非常に難しいためです。 多くの場合、トレーダーは深いリトレースメントをトレンド反転のシグナルとして誤って受け取り、強力な優勢トレンドの方向に逆らって取引することになります。

トレンドの反転から大きな利益を得るためにトレーダーが必要とすることは、トレンドの反転を予測するための論理的かつ体系的な方法を持つことです。

トレンドの反転を予測する最良の方法の XNUMX つは、移動平均線のクロスオーバーを使用することです。 適切なパラメータと取引設定を使用すると、移動平均線のクロスオーバーは、移動平均線が低速の移動平均線を超えることに基づいて、潜在的なトレンドの反転を体系的に特定できます。 ただし、すべての移動平均クロスオーバーが機能するわけではありません。 一部の設定は、他の設定よりも優れています。 修正移動平均やカスタム テクニカル インジケーターが使用される場合もあります。

ドンチアンチャンネル

ドンチャン チャネルは、Richard Donchian によって開発されたバンドベースのトレンド追跡テクニカル指標です。

これは、指定された期間またはろうそくの数内で最高値と最低値のアクションを取ることによって形成されます. ドンチャン チャネルの正中線は、指定された範囲の中央値に基づいてプロットされます。 同じ価格帯の最高値と最低値も、ドンチャン チャネルの上部と下部のバンドによってマークされます。

ドンチャン チャネルは、他のバンドまたはチャネル ベースのテクニカル指標と同じように使用できます。 価格が上下のバンドを上回ったり下回ったりすると、モメンタム ブレイクアウトの可能性を示している可能性があります。 上記の領域で拒否の兆候を示す価格行動は、平均値の反転の可能性を示している可能性もあります.

ドンチャン チャネルの正中線も、他の移動平均線と同じように使用できます。 それに関する価格行動の一般的な位置に基づいて、トレンドの方向を特定するために使用できます。

三角移動平均

三角移動平均線 (TMA) は、基本的な移動平均線の修正版です。

移動平均線は、最も広く使用されているトレンド フォロー テクニカル指標の XNUMX つです。 そのシンプルさと有効性により、トレーダーはトレンドの方向を簡単に解読できます。 トレーダーは、移動平均線に対する価格アクションの一般的な位置と、線の傾きの方向に基づいてトレンドの方向を特定できます。

その単純さと有効性にもかかわらず、移動平均は、レンジバウンド市場で一般的に発生する誤ったシグナルの影響を受けやすい傾向があります。

三角移動平均は、修正された計算に基づいて移動平均線を平滑化することにより、これに対処しようとします。 実際、TMA は移動平均線を二重に平滑化します。 これにより、より安定する傾向のあるラインが作成され、誤った信号の影響を受けにくくなります。

相対力指数

相対力指数 (RSI) は、オシレーターとしてプロットされる古典的なモメンタム テクニカル インジケーターです。

RSI は、0 を中点として 100 から 50 の範囲内で振動する線をプロットします。50 を超える RSI 線は強気トレンド バイアスを示し、50 を下回る RSI 線は弱気トレンド バイアスを示します。

また、通常、レベル 30 と 70 にマーカーがあります。価格アクションが弱気の反転の兆候を示しているときに 70 を超える RSI ラインは、価格が買われすぎており、平均的な反転が予定されていることを示している可能性があります。 一方、価格行動が強気の反転を示しているときに30を下回るRSIラインは、価格が売られ過ぎであり、強気の平均反転が予定されていることを意味する可能性があります.

一方、モメンタム トレーダーは、70 を超えて 30 を下回ると、強いモメンタムの兆候と見なします。 要約すると、価格行動が反転の兆候を示しているか、強いモメンタムのブレイクアウトを示しているかにかかわらず、これらの状況での価格行動の特徴だけです。

一部のトレーダーは、価格チャートにレベル 45 と 55 を追加して、トレンド市場を確認します。 レベル 45 は、強気トレンド中のサポート レベルとして機能します。 レベル 55 は、弱気トレンド中にレジスタンス レベルとして機能します。

取引戦略

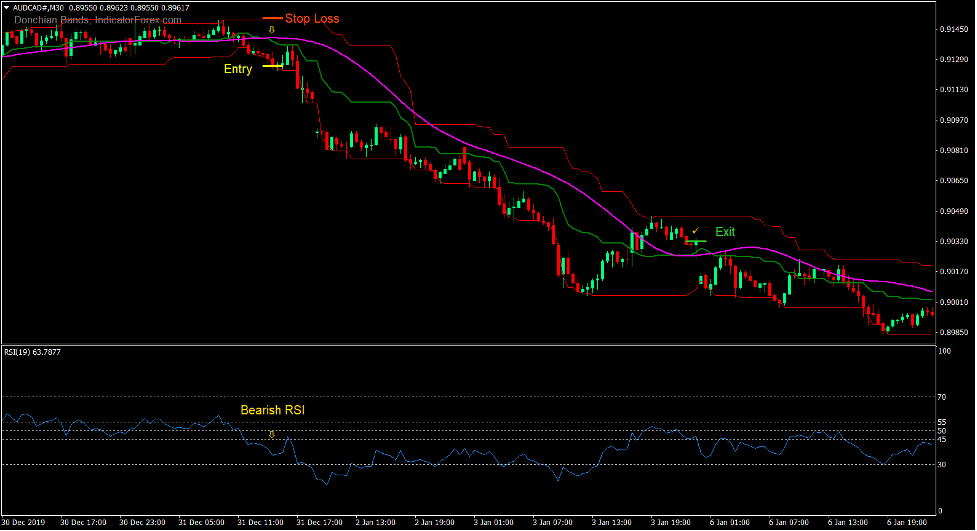

Donchian MA Crossover Forex Trading Strategy は、XNUMX つのトレンド フォロー テクニカル インジケーターのクロスオーバーに基づくシンプルなトレンド反転戦略です。

トレンド反転のセットアップは、ドンチャン チャネルの正中線と TMA ラインの交差に基づいて識別されます。

トレンドの反転は、RSI ラインが強気トレンドで 55 を超えるか、弱気トレンドで 45 を下回ることによって確認されます。 次に、取引設定がトレンドに発展した場合、ラインはレベル45を強気トレンドのサポートとして、または55を弱気トレンドのレジスタンスとして尊重します.

モメンタムは、ドンチャンチャネル外での終値にも基づいて確認されています.

インジケータ:

- ドンチアンバンド

- TMA

- ピリオド: 36

- 相対力指数

- 期間:19

優先時間枠: 30分、1時間、4時間、および毎日のチャート

通貨ペア: FXメジャー、マイナー、クロス

取引セッション: 東京、ロンドン、ニューヨークのセッション

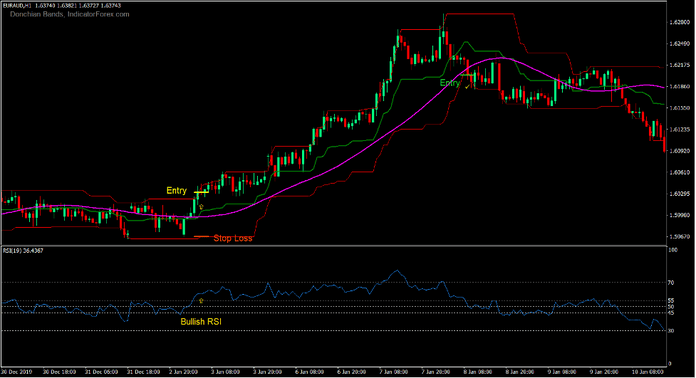

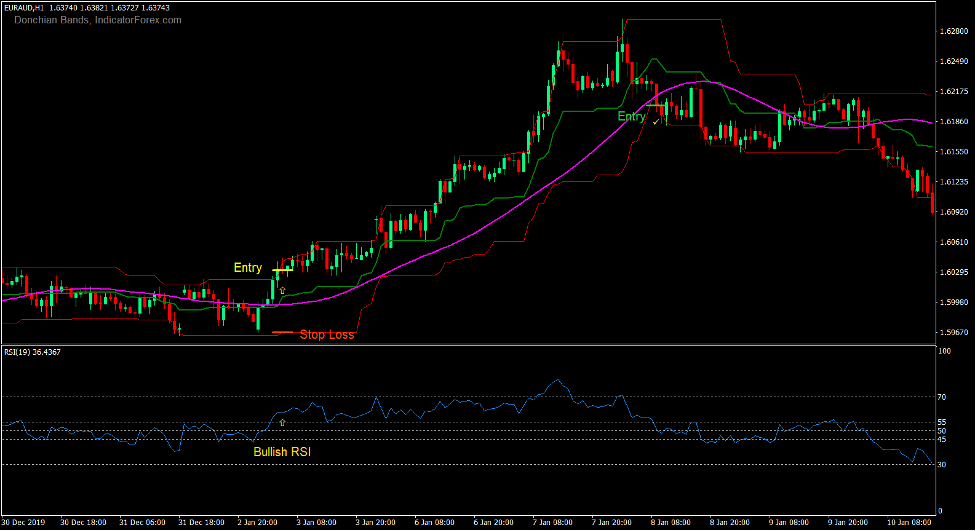

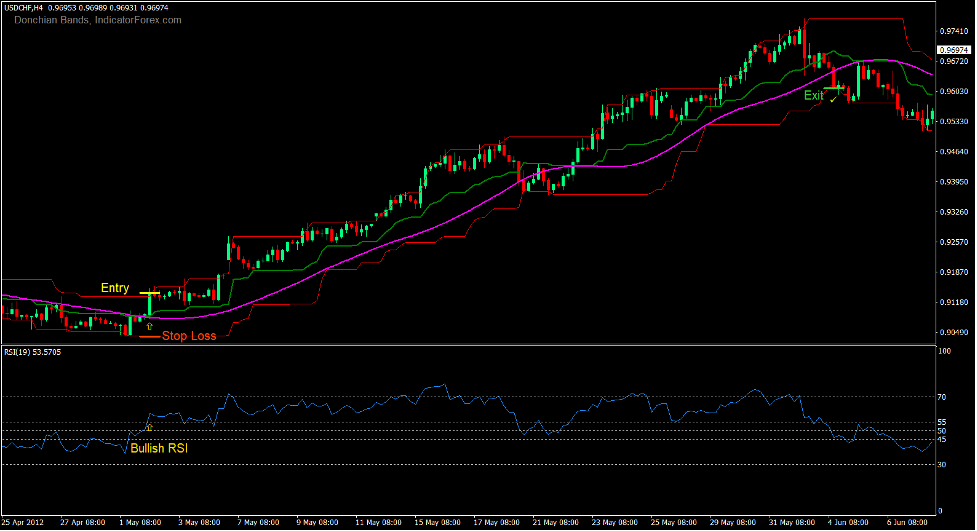

トレードセットアップを購入する

入門

- ドンチャン チャネルの正中線は、TMA ラインの上を横切る必要があります。

- RSIラインは55を超える必要があります。

- 強気のろうそくは、ドンチャンチャネルの上部線の上で閉じる必要があります.

- これらの条件を確認して、購入注文を入力します。

ストップロス

- エントリーキャンドルの下のサポートにストップロスを設定します.

出口

- 価格がドンチャン チャネルの下線を下回ったらすぐに取引を終了します。

- ドンチャン チャネルの正中線が TMA ラインを下回ったらすぐに取引を終了します。

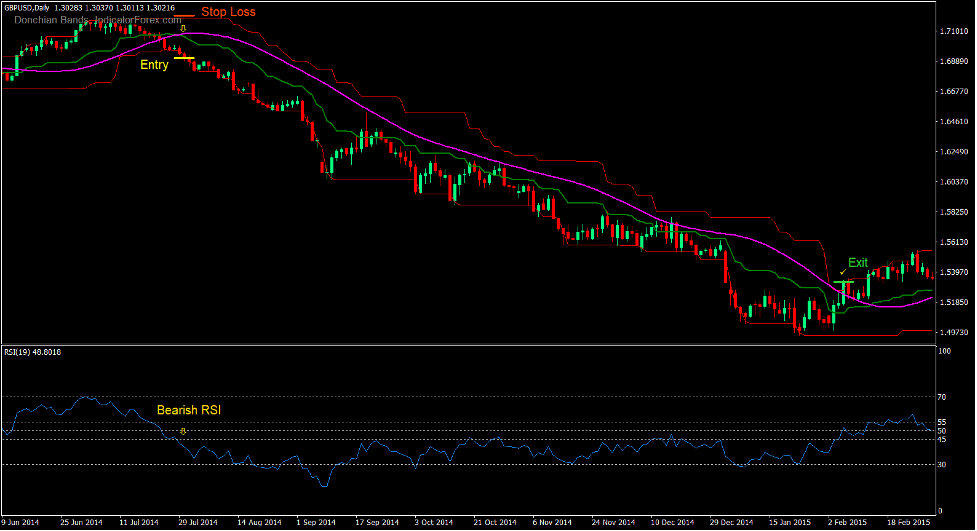

トレードセットアップを売る

入門

- ドンチャン チャネルの正中線は、TMA ラインより下に交差する必要があります。

- RSIラインは45以下で交差するはずです。

- 弱気のろうそくは、ドンチャンチャネルの下線の下で閉じる必要があります.

- これらの条件を確認して、販売注文を入力します。

ストップロス

- エントリーキャンドルの上のレジスタンスにストップロスを設定します.

出口

- 価格がドンチャン チャネルの上限線を超えたらすぐに取引を終了します。

- ドンチャン チャネルの正中線が TMA ラインの上を横切るとすぐに取引を終了します。

まとめ

この取引戦略は、適切な市場条件で非常にうまく機能する単純なトレンド反転戦略です. 強く反転する傾向が強く、価格変動が激しい市場で非常に効果的です。

モメンタムブレイクアウトのプライスアクションシナリオと合わせて、この戦略を取引することも最善です.

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。