Most traders want to have trades that are entered in at the start of a big trend and hope to ride it out until the end of a trend. This is because these types of trades produce the most profit. Big trending waves allow traders to earn the most profits for the risk they place on each trade. However, catching these big trends can prove to be very difficult.

The market is very unpredictable. It is even more difficult to predict when the market would trend. This is because the market trends for only about 20% of the time and ranges during the other 80%. Still, there are many trend following and trend reversal traders who can easily catch big trending market moves.

One of the most common initial stages of a market trend is a strong momentum shift. Without a strong momentum, it is very difficult for the market to reverse and start a trend in the opposite direction. Although it does not always follow, strong momentum price action signals are often followed by a trending market condition.

High Low Momentum Forex Trading Strategy is a strategy that trades on momentum shifts that are identified at the beginning of a new trend. It makes use of a couple of trend following indicators to simplify the task of identifying such trend reversal signals.

Gann HiLo Activator Bars

Gann HiLo Activator Bars is a momentum indicator which was developed to help traders identify the short-term trend or momentum direction.

The Gann HiLo Activator Bars indicator indicates the direction of the short-term momentum by overlaying bars on the price candles. These bars change color depending on the direction of the trend. Blue bars indicate a bullish short-term trend bias, while red bars indicate a bearish short-term trend bias.

This indicator can be used as a short-term trend reversal entry signal. Traders can simply take the changing of the color of the bars as a reversal signal and trade accordingly. However, it is still best to apply confluences with other trend following indicators in order to align the direction of the short-term trend and the long-term trend.

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator which is based on the comparative analysis of the closing price of a tradable security to a range of its historical prices over a period of time. The term stochastic refers to the point of a current price in relation to its range. This creates an oscillator that is more sensitive to momentum rather than the absolute price.

The Stochastic Oscillator is plotted as two lines that oscillate within the range of 0 to 100. These two lines cross over each other as it oscillates with the momentum of price movements. These crossovers can be interpreted as a short-term momentum reversal. If the faster line crosses over the slower line, the short-term momentum might be going up. On the other hand, if the faster line crosses below the slower line, the short-term momentum might be going down.

The Stochastic Oscillator window also typically has markers at level 80 and 20. These levels indicate the overbought and oversold territories. Bearish crossovers occurring above 80 is indicative of a reversal coming from an overbought market condition. Bullish crossovers occurring below 20 is indicative of a reversal coming from an oversold market condition. These reversal conditions tend to have a stronger probability.

Trading Strategy

This trading strategy is a simple trend reversal strategy which trades on the confluence of the Stochastic Oscillator and the Gann HiLo Activator Bars.

However, instead of trading on short-term momentum, this strategy attempts to trade on a mid-term trend. To do this, we have modified the Gann HiLo Activator Bars and the Stochastic Oscillator in order to have accommodate a slower movement and produce more reliable trend reversal signals.

First, the Gann HiLo Activator Bars should change color indicating the direction of the trend reversal.

Then, the Stochastic Oscillator should follow. The signal will be based on the crossing over of the two lines over the midline, which is 50. A cross above the line indicates a bullish signal, while a cross below indicates a bearish signal.

Indicators:

- Gann HiLo activator bars

- Lb: 36

- Stochastic Oscillator

- %K Period: 19

- %D Period: 6

- Slowing: 9

- Add Level: 50

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

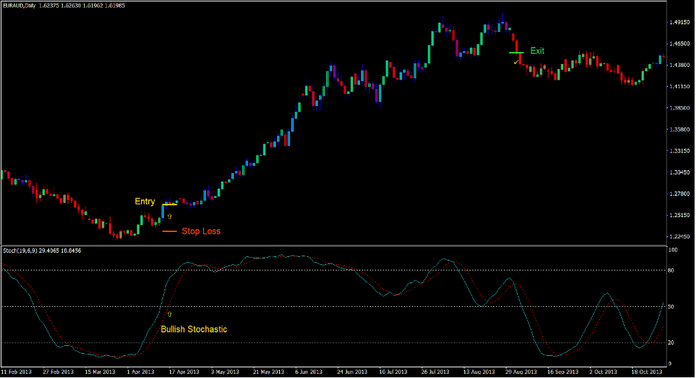

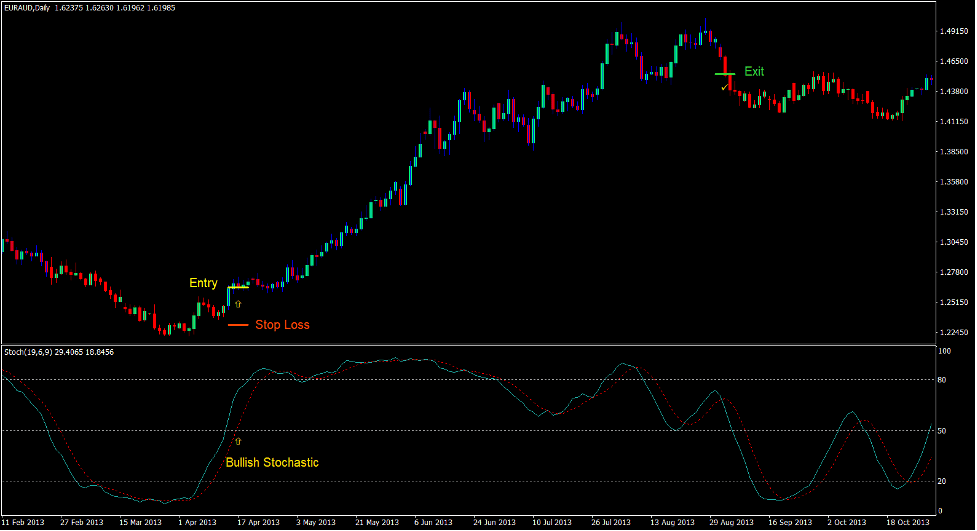

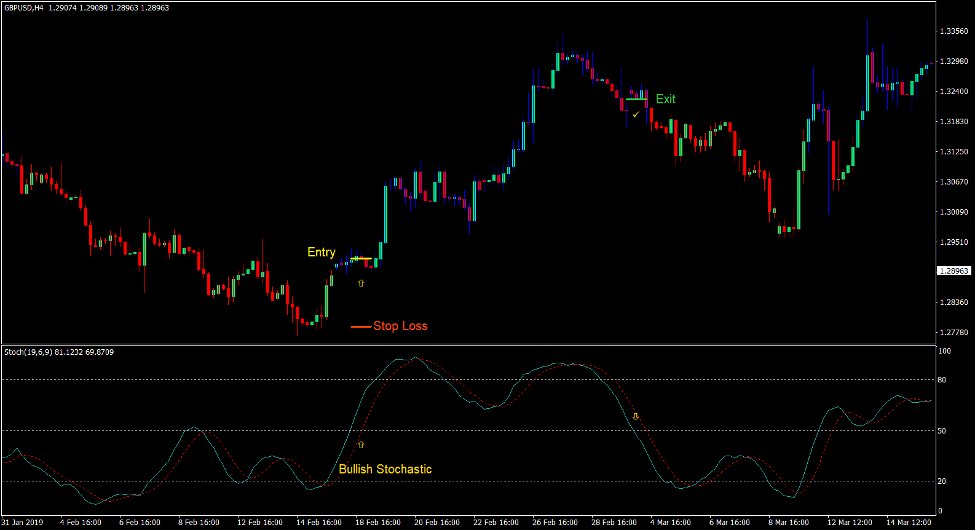

Buy Trade Setup

Entry

- The Gann HiLo Activator Bars should change to blue.

- The two Stochastic Oscillator lines should cross above 50.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Gann HiLo Activator Bars change to red.

- Close the trade as soon as one line of the Stochastic Oscillator crosses below 50.

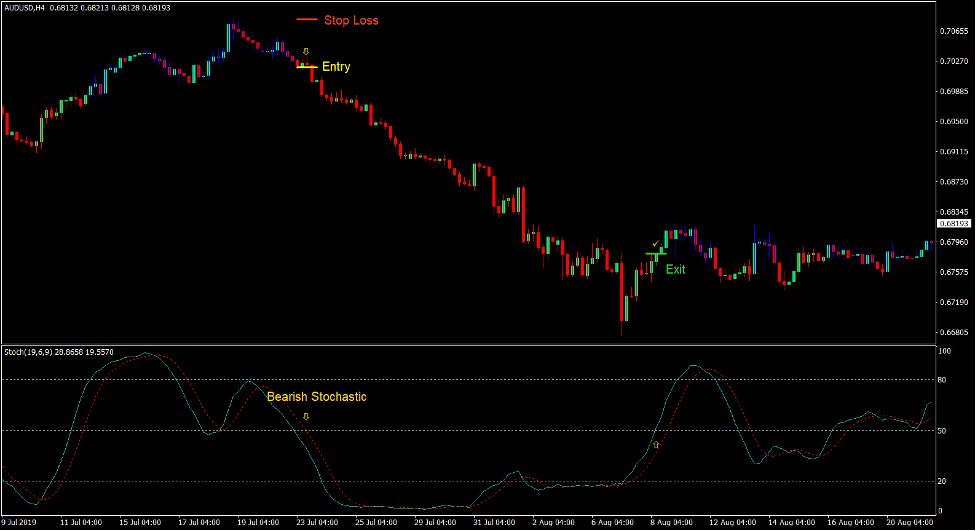

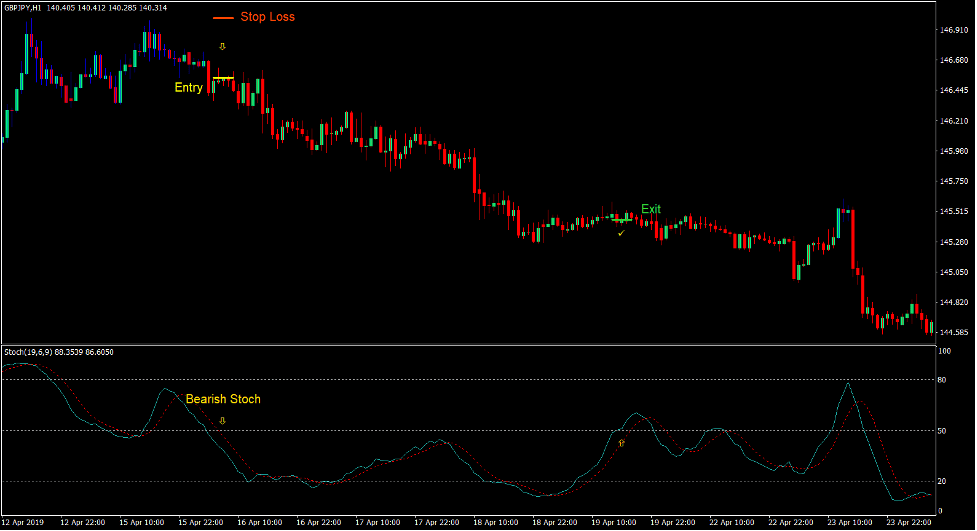

Sell Trade Setup

Entry

- The Gann HiLo Activator Bars should change to red.

- The two Stochastic Oscillator lines should cross below 50.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Gann HiLo Activator Bars change to blue.

- Close the trade as soon as one line of the Stochastic Oscillator crosses above 50.

Conclusion

This trading strategy works well in capturing strong trending markets which are initiated by strong momentum.

The combination of the modified parameters of the Stochastic Oscillator and the Gann HiLo Activator Bars synergize well to produce good quality mid-term trend reversal signals.

However, traders should still take into consideration the momentum characteristics of price action. Some traders would also prefer to trade only when price action indicates a strong reversal momentum. This would produce better quality signals as candlestick patterns are also highly reliable.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: