Different traders have different styles, different strategies and different methods in trading. However, despite the differences, traders have one common goal in every trade setup they take, it is to buy low and sell high, or in the case of short trades, sell high and buy low. Because of this, traders often have some sort of reversal incorporated in their trading strategies. It may be trend reversal, a shorter mean reversal, or even reversal candlestick patterns based. Even trend following strategies look for a hint of a reversal of momentum on the very short-term.

Mean reversal strategies are one of the many ways to trade the forex market. This idea behind this method is to take trades whenever price is at an overextended condition. This is because price usually reverts to its mathematical mean. In most cases, price would even swing to the opposite extreme. Think of price as a rubber band. If you would pull it to one side, as soon as you release the tension, the rubber band would surely swing to the opposite side. The same thing happens with price. As soon as the market realizes that price is overbought or oversold, price tends to reverse. This creates a cyclical pattern wherein price would oscillate up and down the price chart.

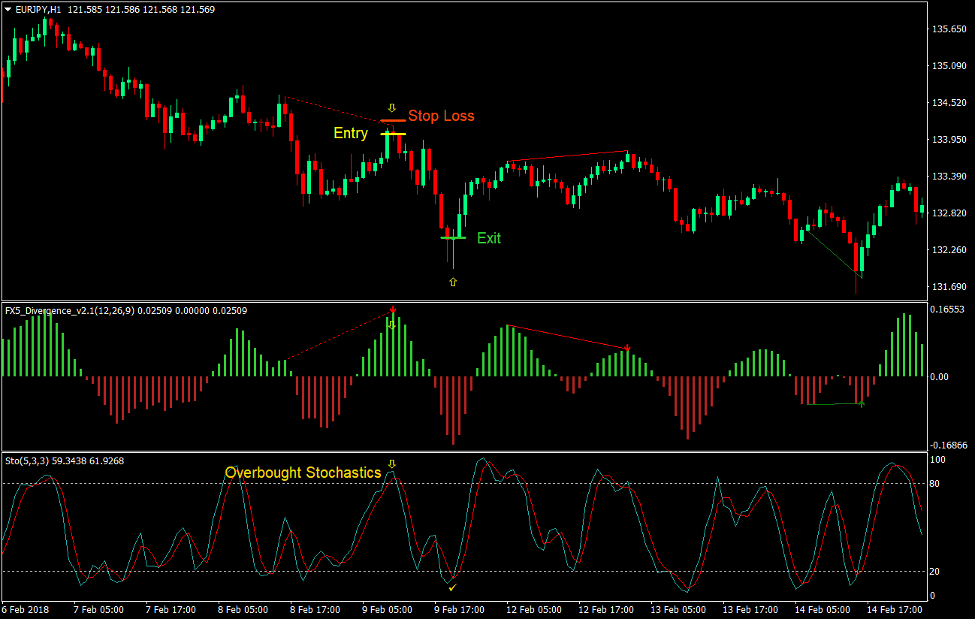

FX5 Divergence Reversal Forex Trading Strategy is a mean reversal strategy that incorporates divergences in order to create higher probability trade setups.

FX5 Divergence v2.1

FX5 Divergence v2.1 is a custom indicator which helps traders identify divergences.

It is an oscillator that displays histogram bars which could move to positive or negative. Positive bars indicate a bullish momentum, while negative bars indicate a bearish momentum.

The indicator also identifies divergences by comparing the peaks and troughs of price action and the peaks and troughs of the indicator. The indicator then draws a line on the peaks and troughs to help traders identify the divergence. Broken lines indicate a hidden divergence while solid lines indicate a regular divergence.

Divergences are simply discrepancies between the depth and height of price swings and the swings of an oscillating indicator. In such cases, price tends to compensate for such discrepancy causing it to reverse.

Stochastic Oscillator

The Stochastic Oscillator is a popular technical indicator used by many traders. It is a momentum indicator that compares the closing price of a security, commodity or currency pair to its historical price. This creates an oscillator that helps traders identify the cyclical oscillations of price.

The Stochastic Oscillator is composed of two lines that oscillate between 0 to 100. Having the faster line above the slower line indicates a bullish momentum, while having the faster line below the slower line indicates a bearish momentum.

It could also be used to identify overbought and oversold conditions. The Stochastic Oscillator often has markers on level 20 and 80. Having the lines below 20 indicates an oversold condition, while having the lines above 80 indicates an overbought condition.

Trading Strategy

Price tends to reverse whenever it is in an overbought or oversold condition. It also tends to reverse whenever there are divergences between price and an oscillating indicator. Individually, these conditions tend to indicate a high probability of a reversal. However, when used together, these conditions create an even higher probability mean reversal setup.

This strategy uses the Stochastic Oscillator to identify overbought and oversold conditions. Traders should be on the lookout whenever the stochastic lines are above 80 or below 20 as these are prime conditions for a mean reversal.

The FX5 Divergence v2.1 would be used to identify divergences. Divergences that occur while the Stochastic Oscillator is in an overbought or oversold condition tend to work well. This confluence between an overbought or oversold condition and a divergence creates a strong pressure for price to reverse which makes it work most of the time. Price is then allowed to swing to the opposite side as the Stochastic Oscillator lines swing to the opposite extreme.

Indicators:

- FX5_Divergence_V2.1 (default setting)

- Stochastic (default setting)

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

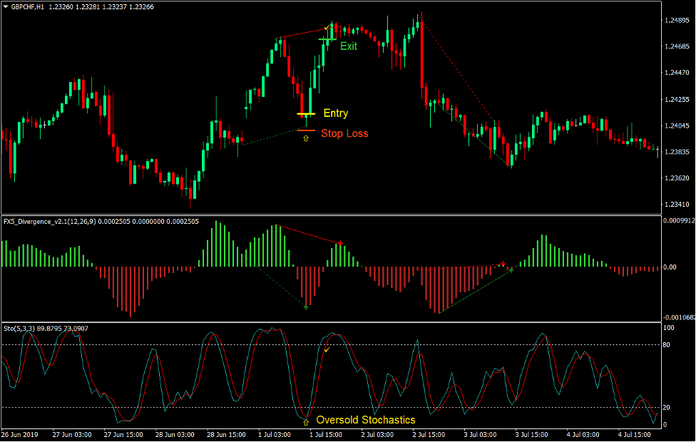

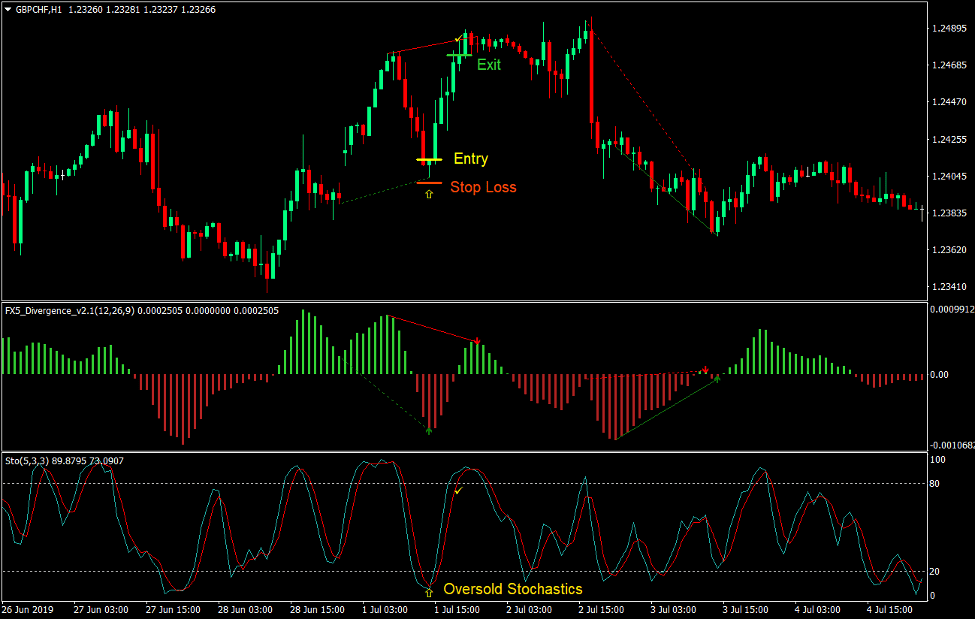

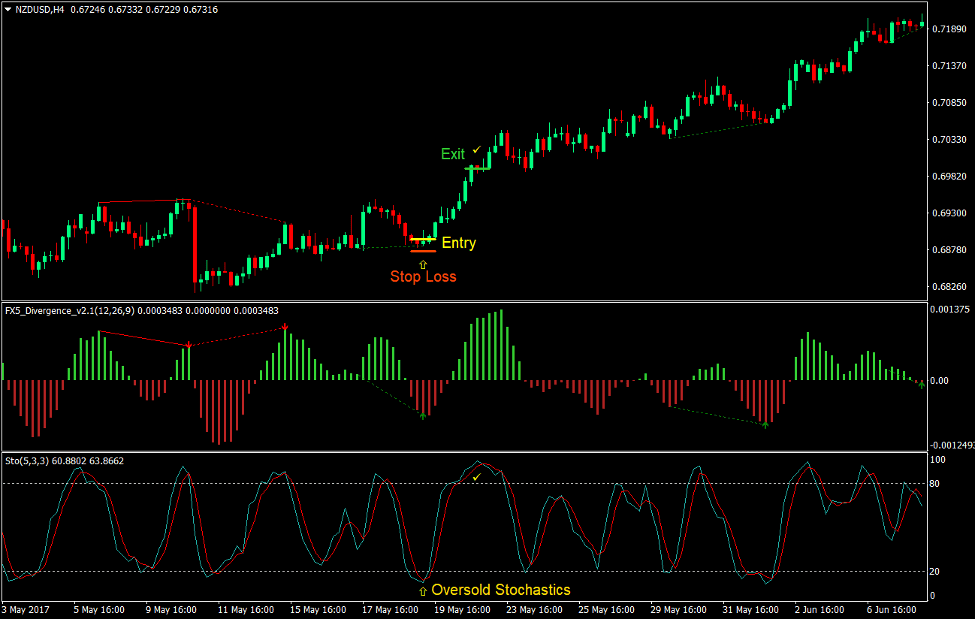

Buy Trade Setup

Entry

- The Stochastic Oscillator lines should be below 20.

- The FX5 Divergence v2.1 indicator should detect a bullish divergence.

- Enter a buy order on the confluence of the conditions above.

Stop Loss

- Set the stop loss a few pips below the entry candle.

Exit

- Close the trade at the first sign of indecision as the Stochastic Oscillator lines breach above 80.

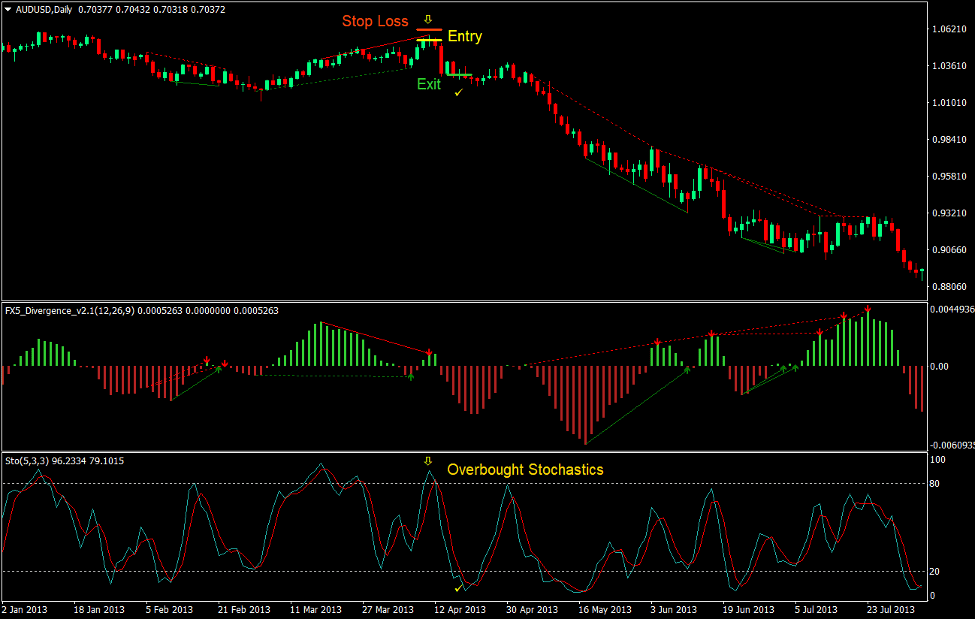

Sell Trade Setup

Entry

- The Stochastic Oscillator lines should be above 80.

- The FX5 Divergence v2.1 indicator should detect a bearish divergence.

- Enter a sell order on the confluence of the conditions above.

Stop Loss

- Set the stop loss a few pips above the entry candle.

Exit

- Close the trade at the first sign of indecision as the Stochastic Oscillator lines fall below 20.

Conclusion

This strategy works in most market conditions. It could work even on ranging markets. As long as the market swings are well defined, price have a high probability of reversing as price becomes oversold or overbought.

When trading this strategy, it is best to look at previous price movements if price tends to reverse with the Stochastic Oscillator.

During trending markets, price would often have longer price movements when trading with the trend. In this case, it is best to trade only in the direction of the trend.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: