“Wisdom of the crowd!” That is what trading is all about. It is not about knowing what the right price should be. As retail traders, we cannot dictate where price should go. Our 1 lot, mini lot or micro lot cannot do anything to change the direction of the market. Instead of dictating where the market should go based on what we think is a fair price, we should listen to what the market is saying. Then we follow wherever the market would lead us. It is all about riding the momentum or trend. It is about being keen to signs about what the market wants to do.

This saying, “wisdom of the crowd”, also applies to trading signals. Trading on just one signal might not be the best strategy. Sometimes, technical indicators, however reliable it is, could be wrong. However, trading on the same trade direction coming from different indicators occurring at the same time could have a stronger probability. This is called confluence.

De Munyuk Parabolic Momentum Forex Trading Strategy is a strategy that trades based on momentum and short-term reversals. It makes use of confluences coming from different technical indicators. Signals do not usually occur in confluence, however, whenever these signals are in confluence or are closely aligned, chances are price would move in the direction of the signal.

Parabolic SAR

Parabolic SAR stands for Parabolic Stop and Reverse. It is a trend following technical indicator used by traders to determine trend direction and trend reversals.

Parabolic SAR is based around the concept of an Extreme Point. This refers to the highest value that price has reached before a trend reverses.

The Parabolic SAR indicator plots dots on the price chart forming a parabola. A parabola plotted below price indicates a bullish trend bias, while a parabola plotted above price indicates a bearish trend bias.

The dots of the Parabolic SAR indicator are mainly used as a trend direction indicator. Traders could interpret the shifting of the dots a trend reversal and trade it as an entry signal. This assumes that the trader is always willing to expose himself to the market, being in a trade at all times. This is because the end of a current trend is assumed to be the start of another trend. This is why the indicator is called a Parabolic “Stop and Reverse”.

Some traders also use the dots as a stop loss placement. This is based on the assumption that the trend is reversing if price breaches the parabola.

De Munyuk Indicator

De Munyuk indicator is a custom trend following indicator used as a trend filter.

It basically plots boxes on a separate window to indicate trend direction bias. The boxes change color whenever the indicator detects a change in trend direction. It plots lime boxes to indicate a bullish trend direction bias and orange red boxes to indicate a bearish trend direction bias.

This indicator is mainly used as trend filter. Traders could filter out trades that are going against the current trend direction using the De Munyuk indicator. It could also be used as an entry signal. Traders could assume a trend reversal based on the changing of the color of the boxes being plotted.

100 Pips Momentum (Oracle Move)

100 Pips Momentum or Oracle Move is a custom trend following technical indicator based on a pair of modified moving averages.

It plots two moving averages on the price chart. One moving average is red while the other is blue. The red moving average line tends to move slower than the blue moving average line. The moving average lines also tend to be very smooth yet are also very responsive to price changes.

The indicator is mainly used as a trend reversal signal based on the crossover of the moving averages. Traders could take the crossing over of the lines as a signal that the trend is reversing and use it as an entry signal.

Trading Strategy

This strategy trades based on the confluence of a momentum signal and a trend reversal signal. It makes use of the confluence of the three indicators mentioned above and price action.

The Parabolic SAR is the first indication of a probable trend reversal. Trend reversals will be based on the shifting of the dots from below price action to above it or vice versa.

This is usually followed by the De Munyuk indicator. Trend reversals are simply based on the changing of the color of the boxes being printend.

The Oracle Move or 100 Pips Momentum indicator usually occurs last. Trend reversals on this indicator is simply based on the crossover of the two lines.

These signals should be in confluence with each other and should occur in confluence with a momentum candle.

Indicators:

- !De_Munyk

- Parabolic SAR

- Step: 0.02

- Maximum: 0.2

- 100pips Momentum

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

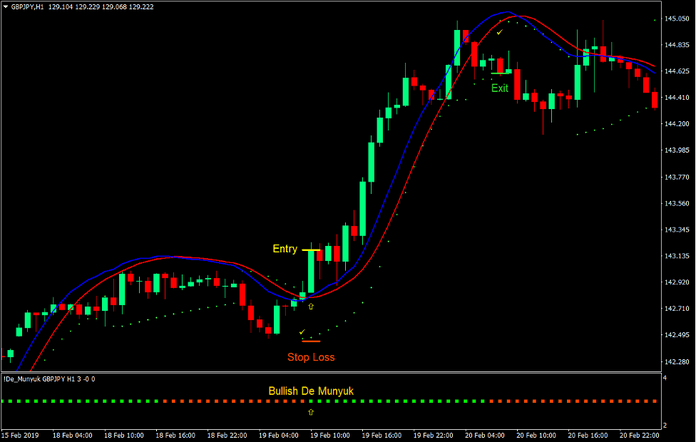

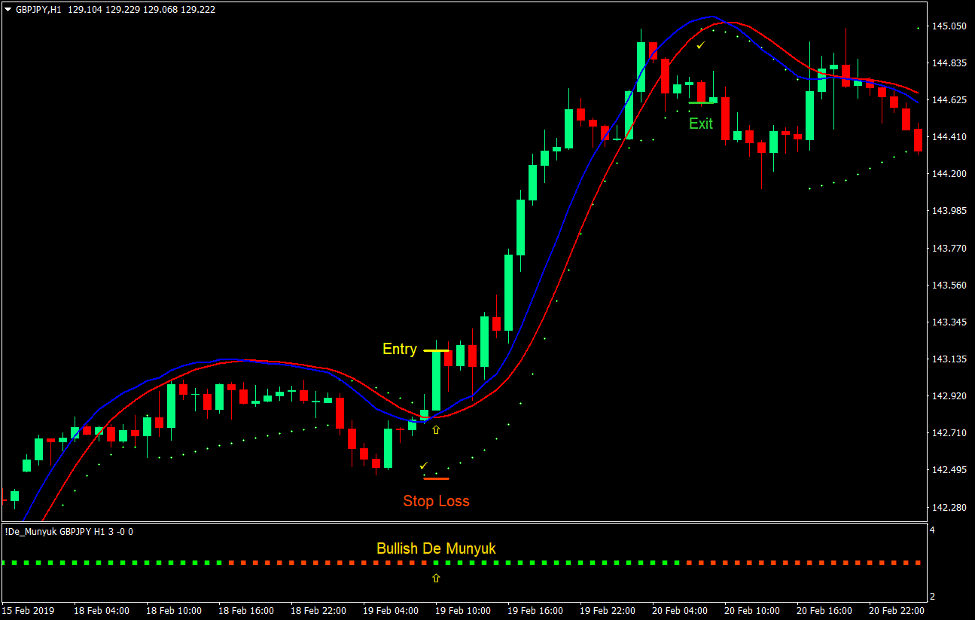

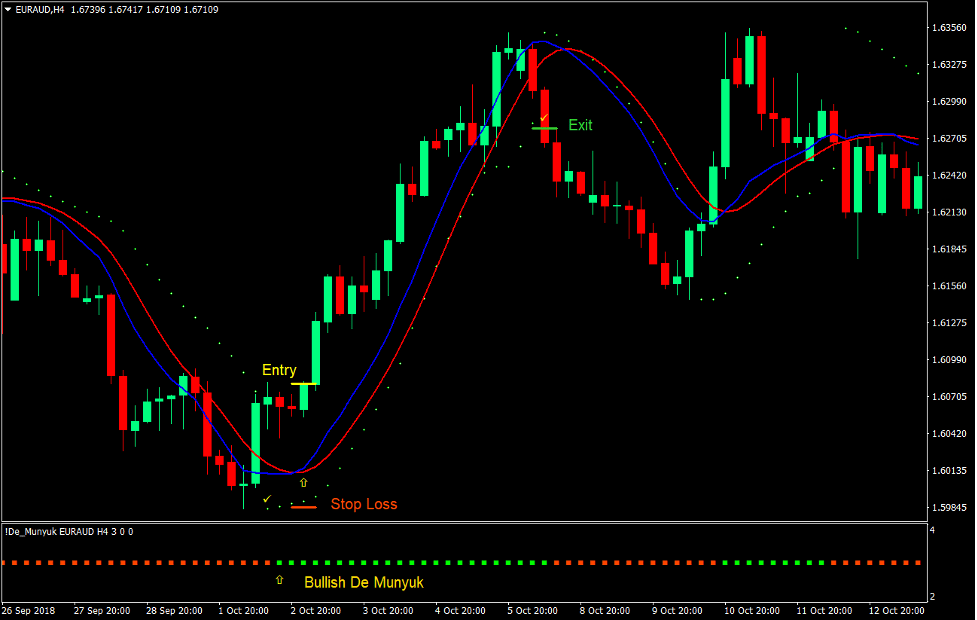

Buy Trade Setup

Entry

- The Parabolic SAR dots should shift below price action.

- The De Munyuk boxes should change to lime.

- The blue line of the Oracle Move indicator should cross above the red line.

- A bullish momentum candle should be printed.

- These bullish signals should be closely aligned.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss below the Parabolic SAR dot.

Exit

- Trail the stop loss below the Parabolic SAR dot until stopped out in profit.

- Close the trade as soon as the Parabolic SAR dot shifts above price action.

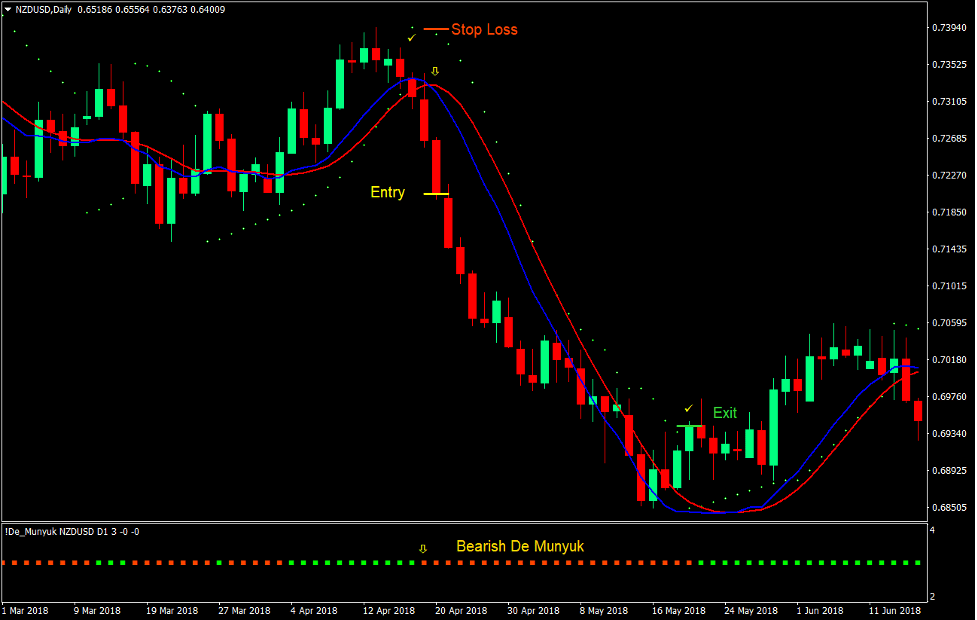

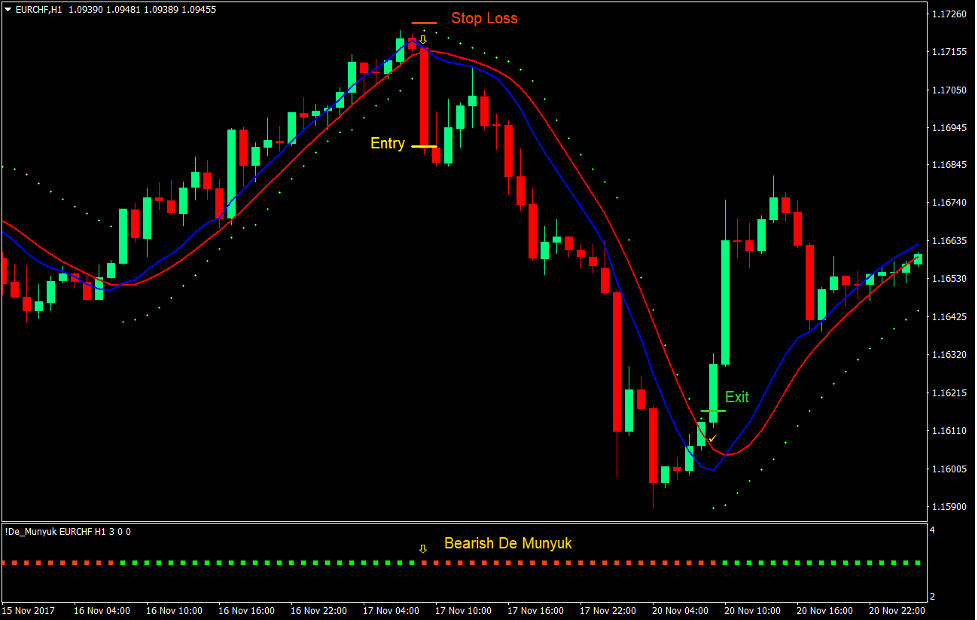

Sell Trade Setup

Entry

- The Parabolic SAR dots should shift above price action.

- The De Munyuk boxes should change to orange red.

- The blue line of the Oracle Move indicator should cross below the red line.

- A bearish momentum candle should be printed.

- These bearish signals should be closely aligned.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss above the Parabolic SAR dot.

Exit

- Trail the stop loss above the Parabolic SAR dot until stopped out in profit.

- Close the trade as soon as the Parabolic SAR dot shifts below price action.

Conclusion

This trading strategy is a high probability trading strategy based on momentum and trend reversals. The confluence of the three indicators simply mean that the reversal momentum is strong enough to start a trend reversal.

This causes price to move in a trending manner in the direction indicated by the three technical indicators.

Traders who could identify these momentum reversals could make use of this strategy profitably.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: