Divergences are generally considered as a reversal trade signal. Many seasoned traders use divergences as part of their trading arsenal or as an integral part of their trading strategy to identify high-probability trade setups. However, with the right combination of trade signals, divergences can be made even more effective if traded in the direction of the trend.

This strategy is an example of how divergences can be traded with the trend based on the Chaikin Oscillator.

Divergence Reversals

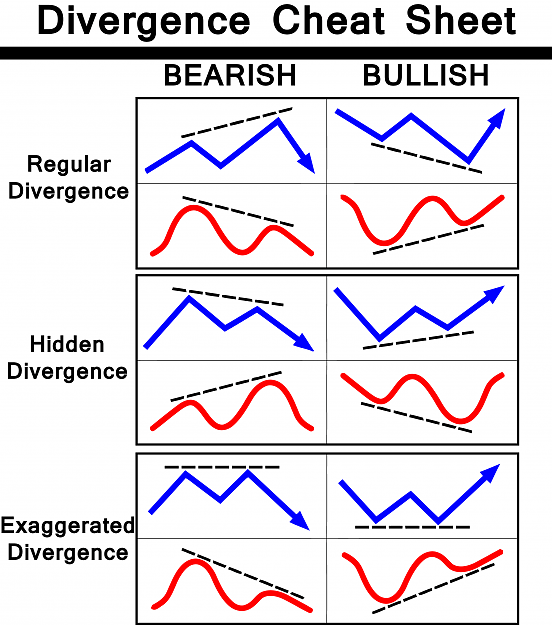

Divergences are points on the price chart wherein price action and its corresponding oscillator type of indicator disagree on the intensity of a price swing.

Price action moves up and down a price chart in a series of pulses going up and down. These pulses or waves and their subsequent reversals in the opposite direction create peaks and troughs which are called swing highs and swing lows.

Oscillators mimic the movement of price action based on their underlying mathematical calculations of price movements. Its movements also create peaks and troughs which usually mirror that of price action. However, at times the height or depth of the peaks and troughs on the oscillator would not be commensurate to the height or depth of the swing highs and swing lows on price action. This is what we call a divergence. Below is a chart that shows the different types of divergences.

Divergences tend to be a high probability indication that price action might soon reverse quite strongly in a certain direction.

Chaikin Oscillator

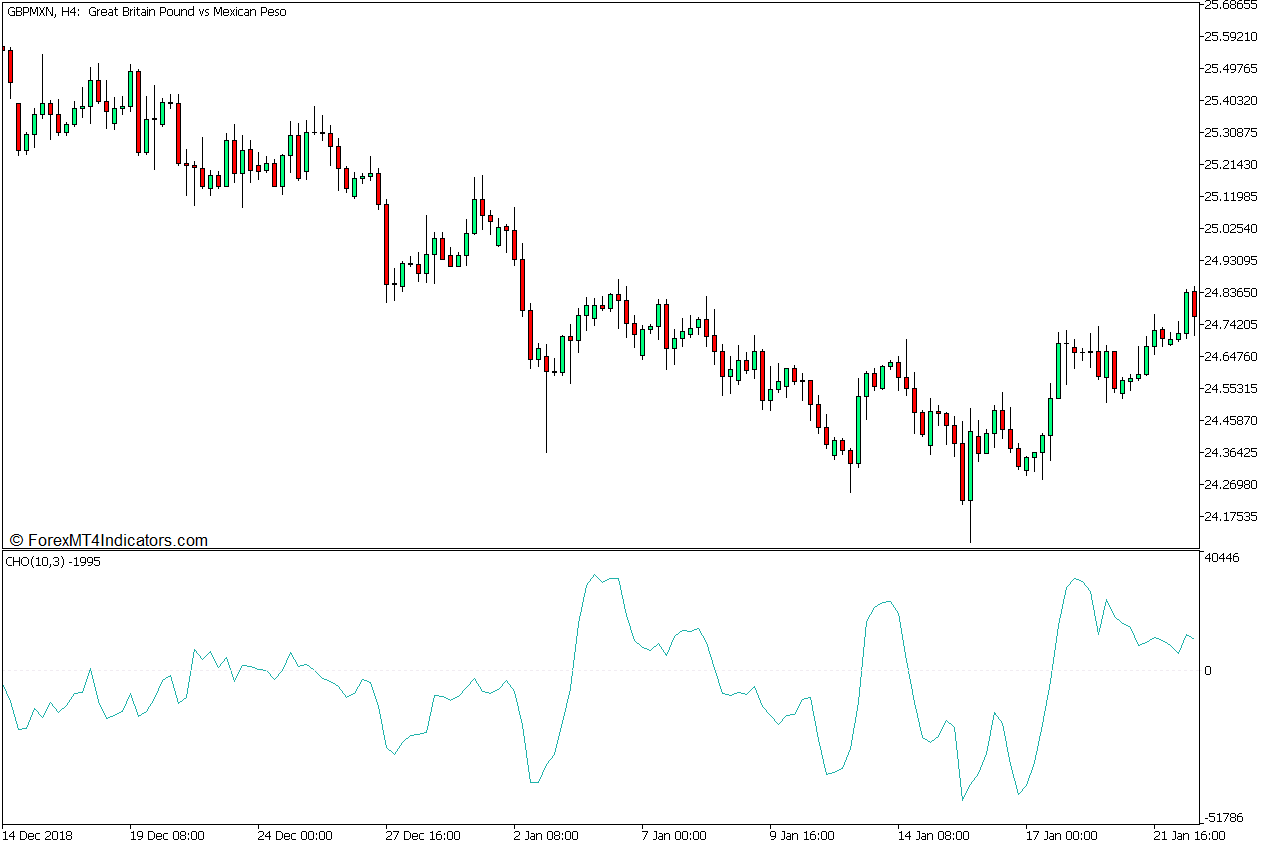

The Chaikin Oscillator is an oscillator type of indicator developed by Marc Chaikin. It is a momentum oscillator that plots a line based on the Accumulation Distribution Line similar to the MACD method.

The Chaikin Oscillator calculates for the difference between a 3-bar Exponential Moving Average (EMA) and a 10-bar Exponential Moving Average (EMA) of the Accumulation Distribution Line. It then plots the result as an oscillator line that oscillates around a midpoint which is zero.

Below is the long-form formula of the Chaikin Oscillator.

- Money Flow Multiplier = [(Close – Low) – (High – Close)] / (High – Low)

- Money Flow Volume = Money Flow Multiplier x Volume for the Period

- ADL = Previous ADL + Current Period’s Money Flow Volume

- Chaikin Oscillator = (3-day EMA of ADL) – (10-day EMA of ADL)

The Chaikin Oscillator plots a line that freely oscillates around its midline, which is zero. This means that it is not bound within a specified range. This makes the Chaikin Oscillator very useable for identifying divergences since it plots a line that is not skewed to fit within a specified range.

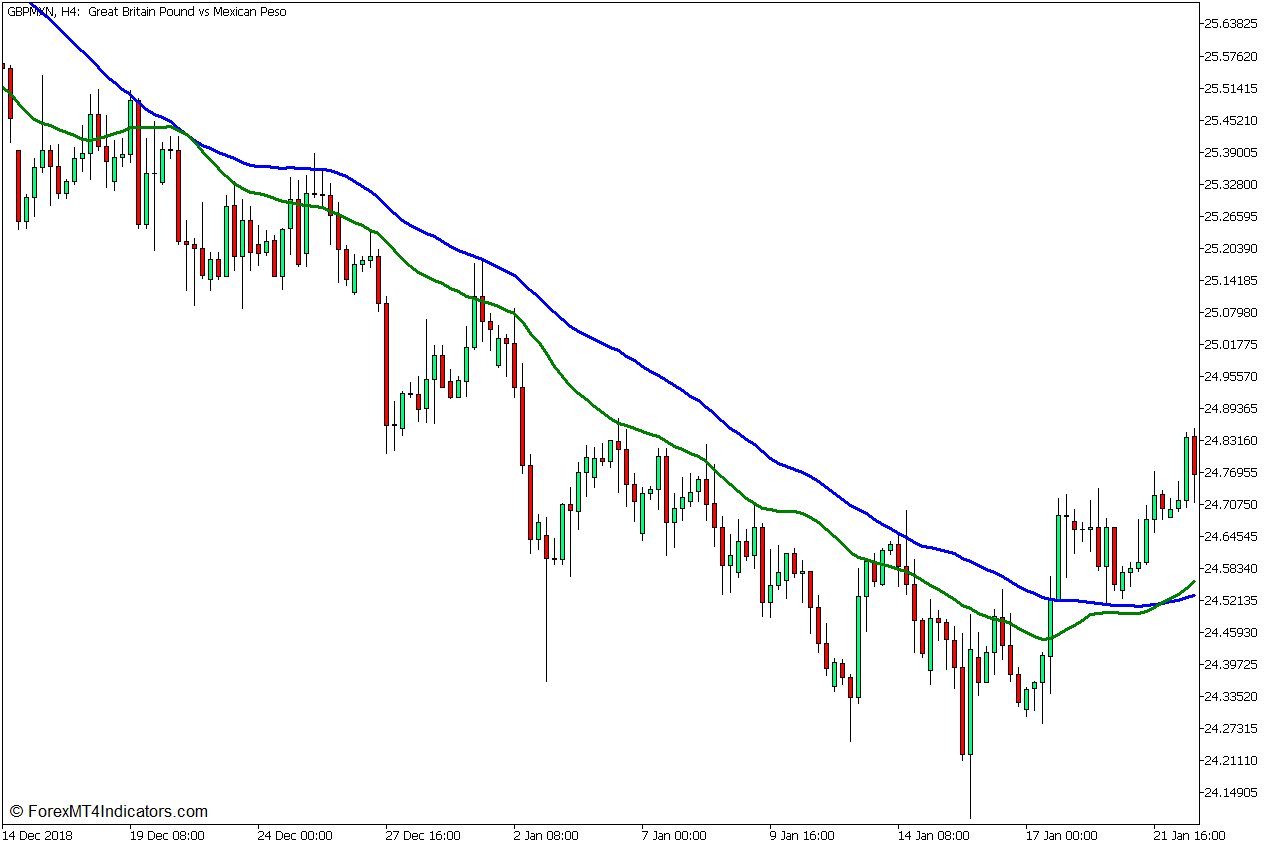

30 SMA and 50 SMA Dynamic Area of Support or Resistance

Moving average lines are usually used to determine trend direction and trend reversals. This could either be based on the location of price action about a moving average line, the slope of the moving average line, or the crossing over of a pair of moving average lines.

Aside from this, moving average lines can also be used as a basis for a dynamic support or resistance area, especially in a trending type of market. Price may bounce from an area between two moving average lines, which acts either as a dynamic support area or a dynamic resistance area.

The 30-period Simple Moving Average (SMA) and 50-period Simple Moving Average (SMA) is a good pair of moving average lines that can act as a dynamic area of support or resistance. Price does tend to bounce off this area whenever the market is trending on the mid-term horizon.

Trading Strategy Concept

This trading strategy incorporates both a trend continuation element and a reversal trading element using the 30 SMA and 50 SMA lines, as well as the Chaikin Oscillator.

The 30 SMA and 50 SMA lines are used as the trend direction indicator and as a dynamic area of support or resistance. Trend direction is first identified based on how the two lines overlap. Trade opportunities are then anticipated as the price pulls back to the area between the 30 SMA and 50 SMA lines.

As the price pulls back to the 30 and 50 SMA dynamic area of support or resistance, price action should quickly reverse from the area, which should form an engulfing pattern or a momentum candle pushing against the area.

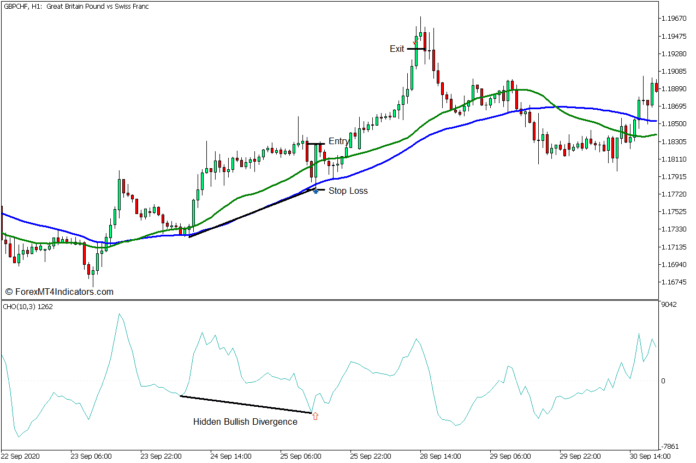

We could then compare the price action based on the most recent price swings with its corresponding oscillator line on the Chaikin Oscillator and observe for possible hidden divergences. Trade opportunities are considered valid if a hidden divergence is confirmed.

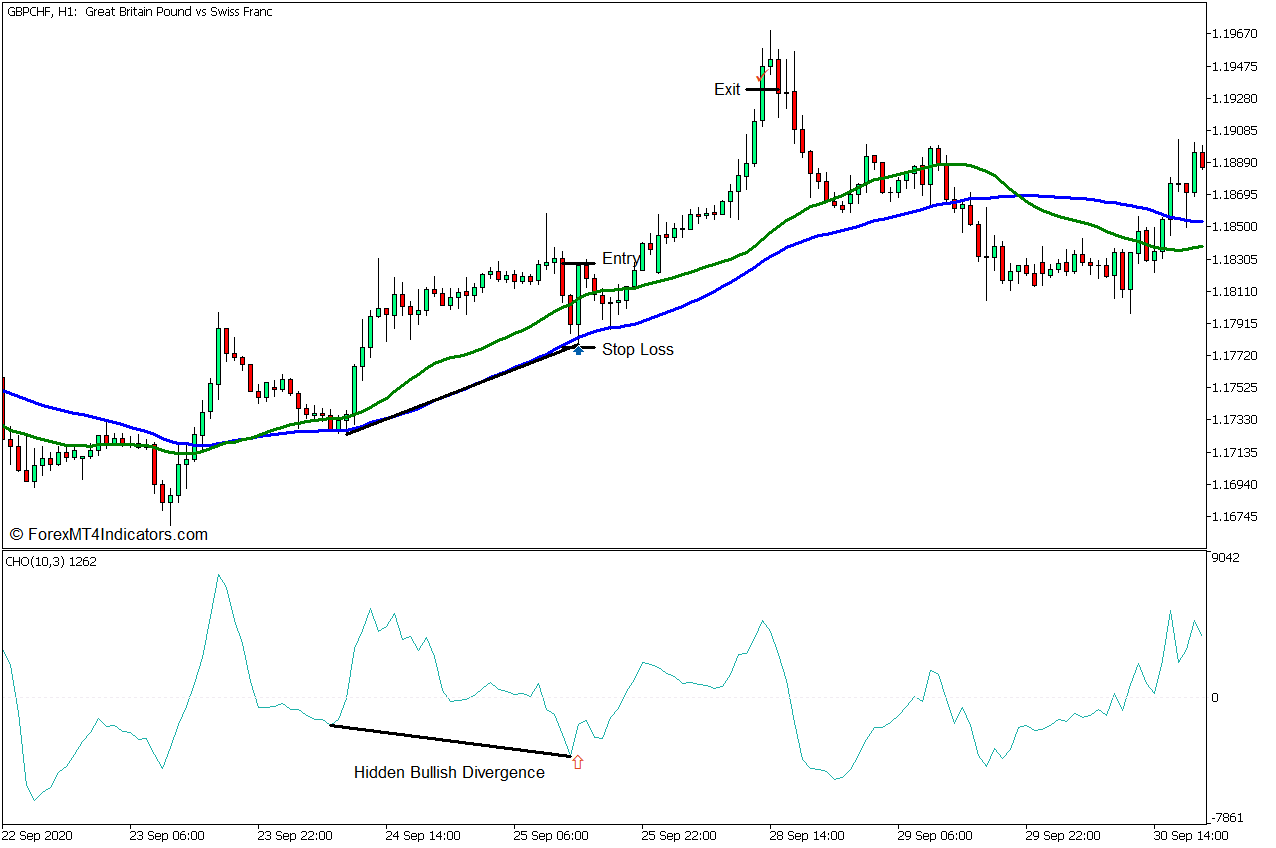

Buy Trade Setup

Entry

- Price action should be above the 30 SMA and 50 SMA lines.

- The 30 SMA line should be above the 50 SMA line.

- Price should retrace towards the area between the 30 SMA and 50 SMA lines and bounce up forming a bullish momentum candle.

- Enter a buy order if the bullish momentum candle is in confluence with a bullish hidden divergence.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Set the take profit target at 2x the risk on the stop loss.

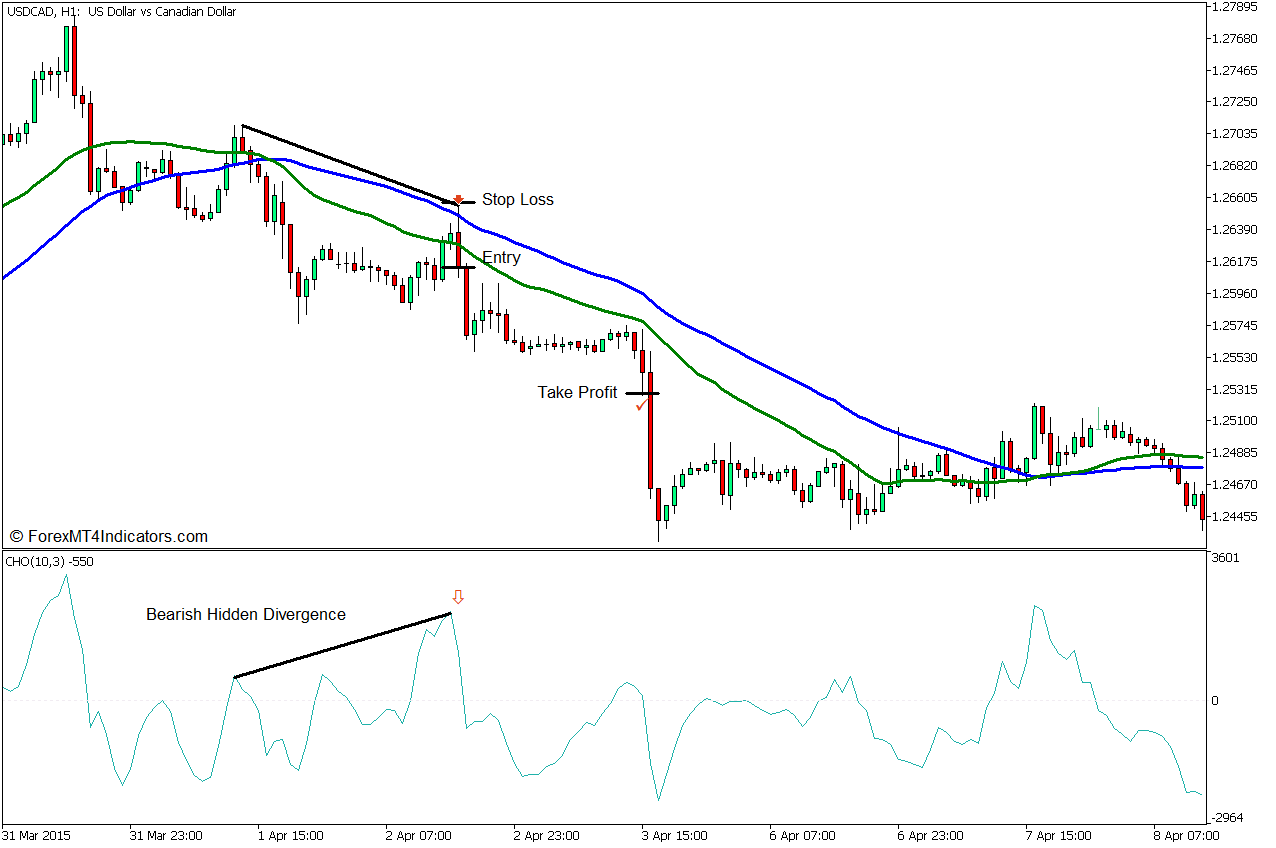

Sell Trade Setup

Entry

- Price action should be below the 30 SMA and 50 SMA lines.

- The 30 SMA line should be below the 50 SMA line.

- Price should retrace towards the area between the 30 SMA and 50 SMA lines and bounce down forming a bearish momentum candle.

- Enter a sell order if the bullish momentum candle is in confluence with a bearish hidden divergence.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Set the take profit target at 2x the risk on the stop loss.

Conclusion

Trading bounces off of a dynamic area of support or resistance during a trending market is in itself a high-probability trade setup. Adding a confluence based on divergences increases the probabilities more in our favor. This gives us a high probability trade setup that can give us decent profits on some of its trades.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: