5-min Scalping Forex Trading Strategy

Scalping… the all too sexy trading that many are drawn to, and probably for good reasons. Many traders, newbies and intermediate traders alike, are drawn to the allure of scalping. Many claim to have multiplied their trading account a thousand fold doing this. Some of it out of sheer luck, some of it false claims, and some of it are legitimate constantly profitable professional traders. One popular small caps trader even turned his $200 to more than a hundred thousand dollars in just a few months doing the same scalping strategy again and again.

On the flip side, some also strongly profess against scalping claiming that it only does more damage than good, and to some extent they are also right. For one, market noise is extremely high on the lower time frames. Many minute market movements that could have meant nothing to the market might seem significant in the lower timeframes and this generates confusion among traders. Quick decision making is also so important in scalping, as just a few seconds of delay could already cost you money. Also, losing money in a matter of a few minutes, or even seconds, could be taxing on psyche of a trader. On top of that, high frequency trading (HFT) algorithms greatly affect the lower timeframe charts, and often times these HFT Algos prey on the pending orders of retail and institutional traders, especially those who scalp with high volume. Death by a thousand cuts. So, scalping seems so daunting, right?

However, there are merits to scalping that swing traders just don’t have. For one, just as anything in life, it is easier to predict the immediate future than that of a distant future. It is easier to predict what will happen around you in the next few seconds or minutes, than to predict what will happen a week, or even a day into the future. It is just that more things could happen in a span of a week, than in a few seconds. Market crashes, political troubles, business troubles, etc., all that could happen in a week. But it is highly unlikely that it will happen in the next few minutes.

Aside from this main merit of scalping, there are a lot more benefits of scalping. Tighter spreads could be used, which in turn could mean higher position sizes, at the same dollar figure risk, as you would if you were swing trading. More opportunities to be taken in a smaller span of time. No overnight risk. And more.

So, if you would want to try scalping, here is a simple strategy that you could start with. Just a couple of rules and your good to go. We don’t need complicated systems when scalping as that would just delay and confuse us when making decisions on the fly.

The Setup

What we would be needing is a basic Relative Strength Indicator (RSI), with 14 periods, basic knowledge of how to use Fibonacci rulers, and the basic understanding of what a pinbar candle pattern is.

For a start, a pinbar is a reversal candle pattern which shows a long wick on one end, and a small body on the other end. What makes pinbars significant? Price rejection. Having a long wick on one end simply means that the market is rejecting the price on that end and is an indication of a probable reversal.

This pattern, on its own, is not perfect. There would be a lot of false signals if we are to base our decisions on pinbars alone. However, we will be filtering out some false signals with this strategy.

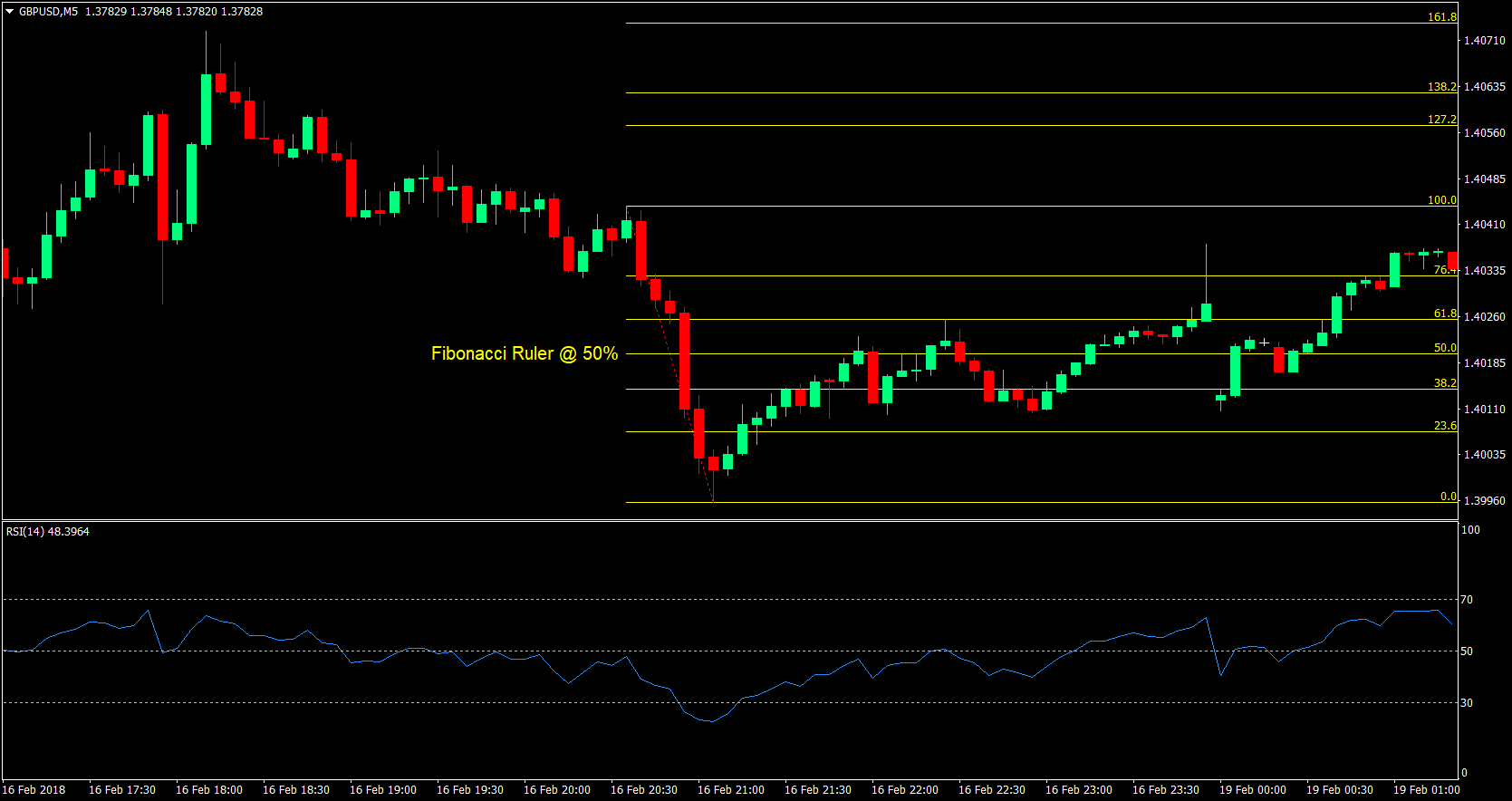

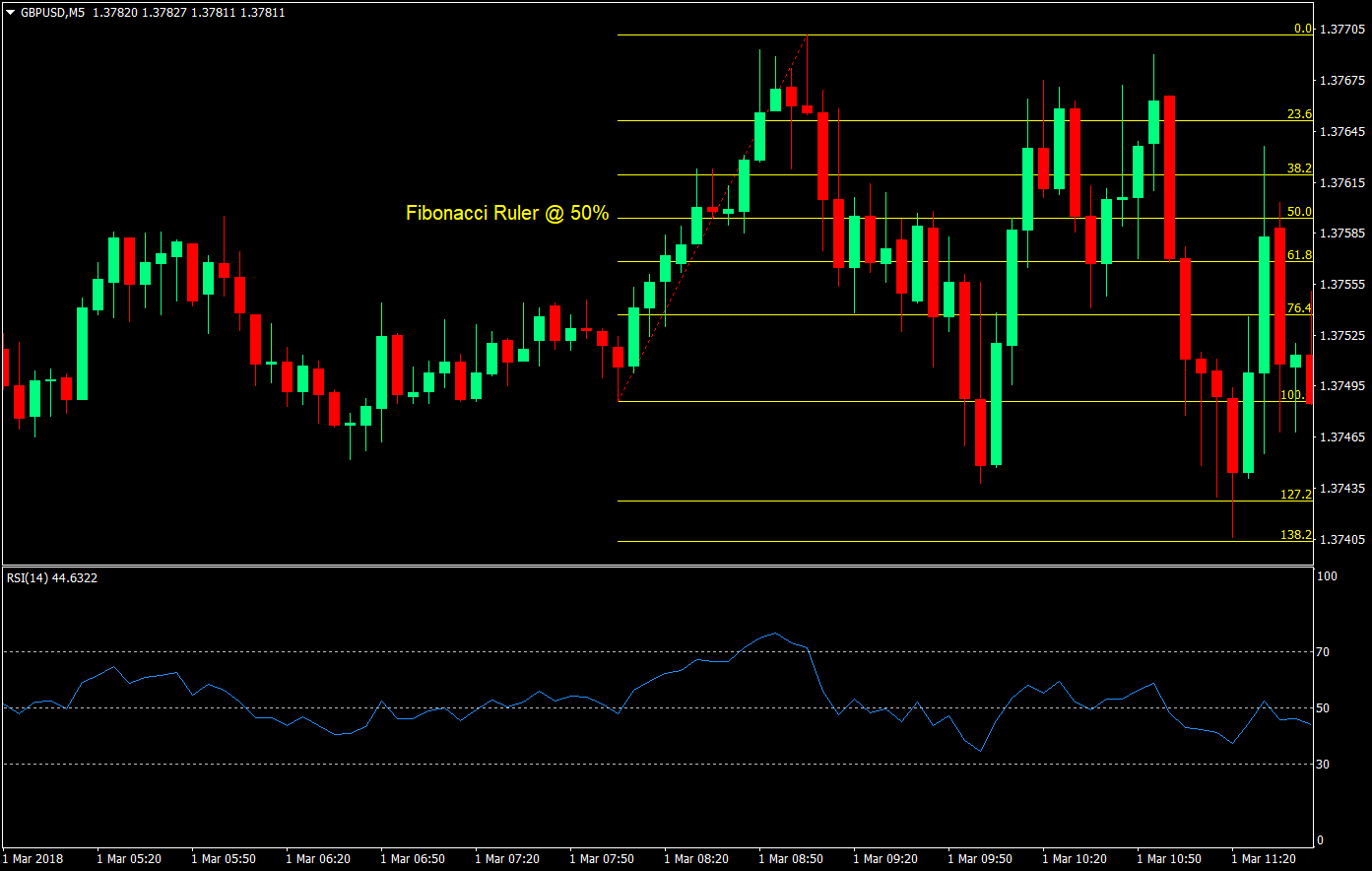

Fibonacci ruler, what is it? It is a ruler coming from a mathematical ratio, which for some, the market does respect. I personally don’t know the magic behind it, but it works. So, we will be using it.

Lastly, the Relative Strength Indicator (RSI). It is an indicator that basically shows overbought and oversold scenarios, which is one of the main reasons for market reversals. This will be our filter.

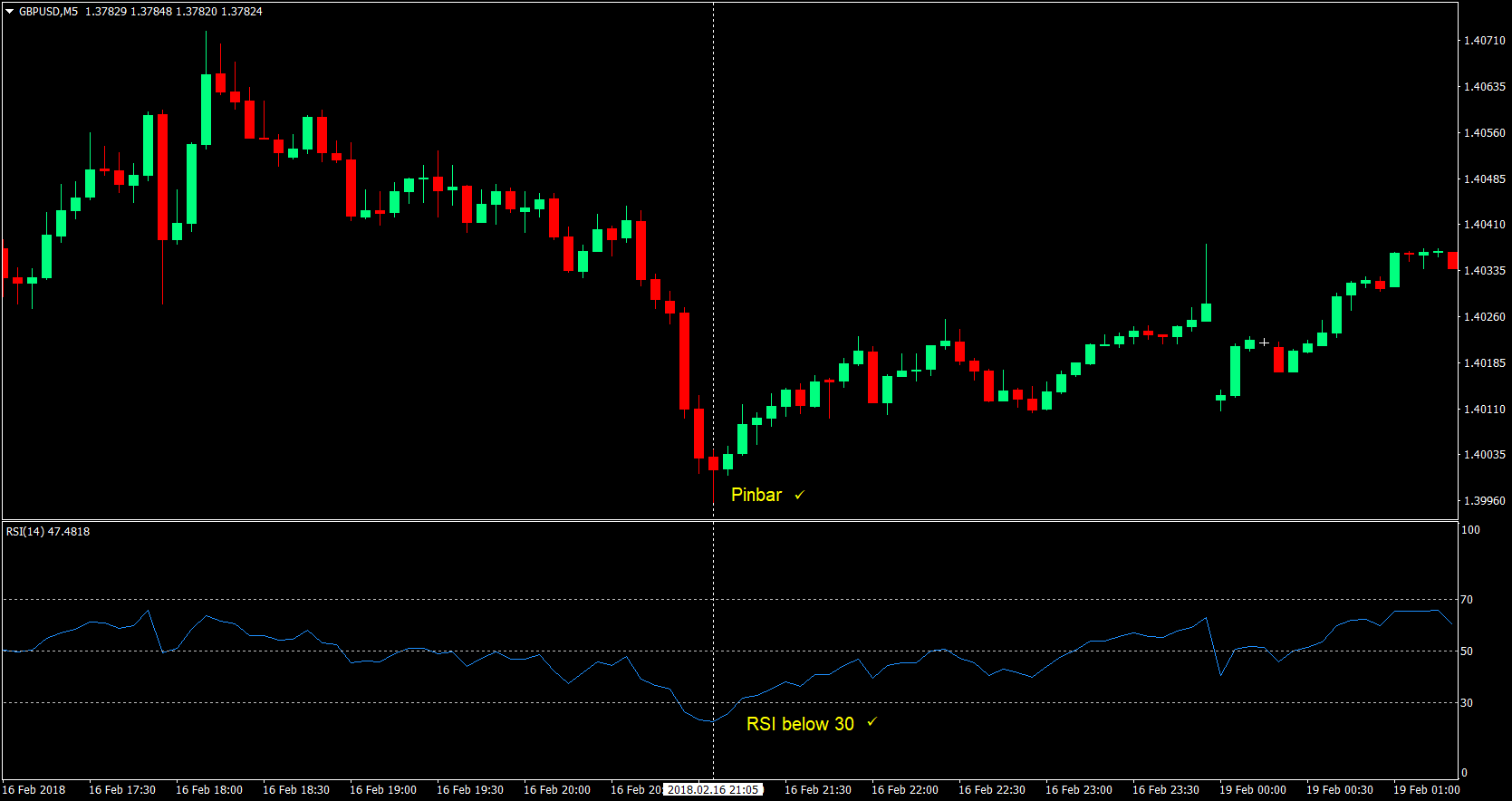

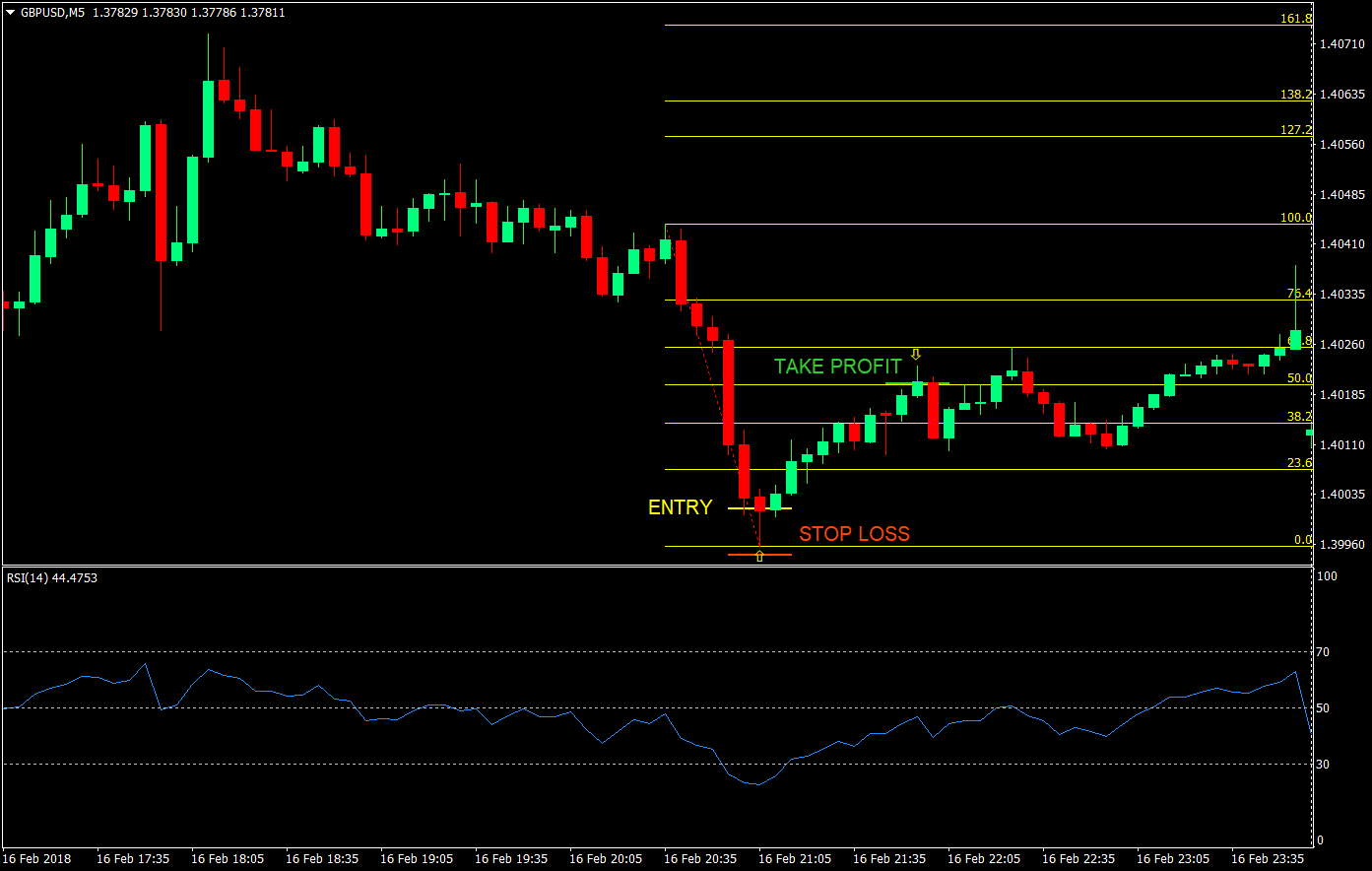

Buy Entry:

- RSI is below 30 indicating that it is already oversold.

- A bullish pinbar corresponds with the RSI being oversold.

- Enter at the close of the pinbar candle.

Stop Loss: A few pips below the entry candle.

Exit: 50% of the Fibonacci ruler as drawn from the latest thrust causing the oversold scenario.

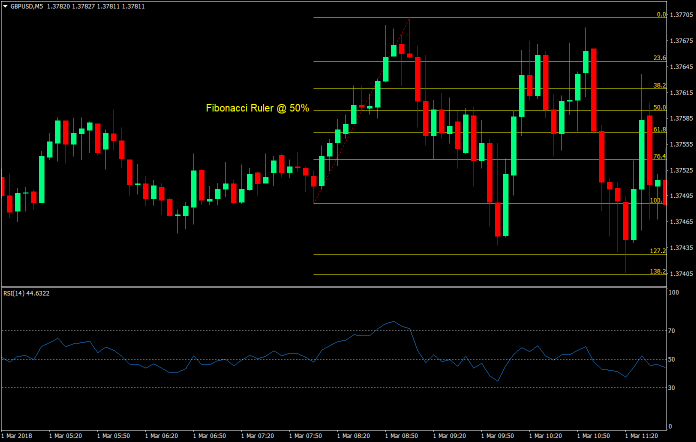

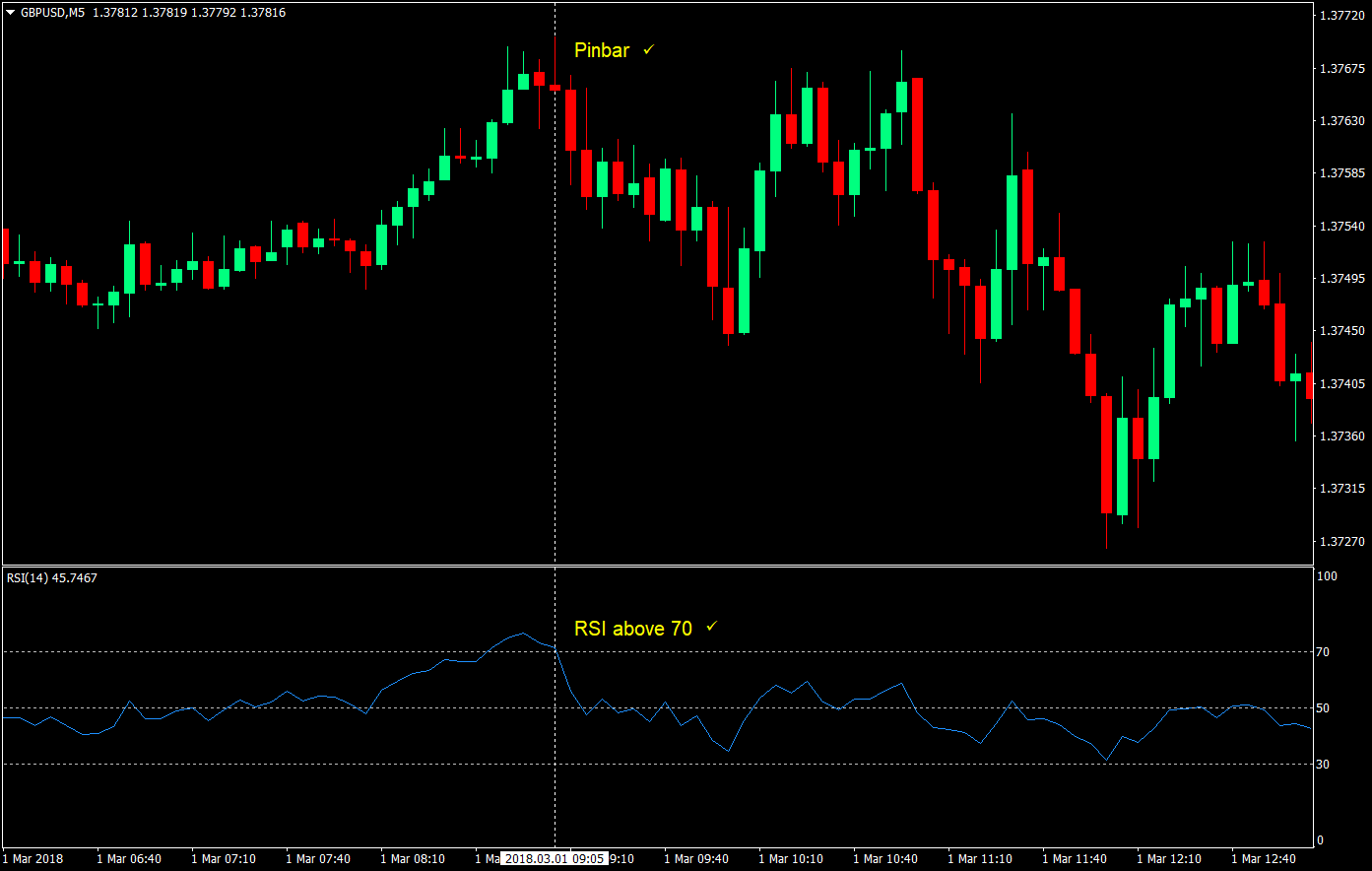

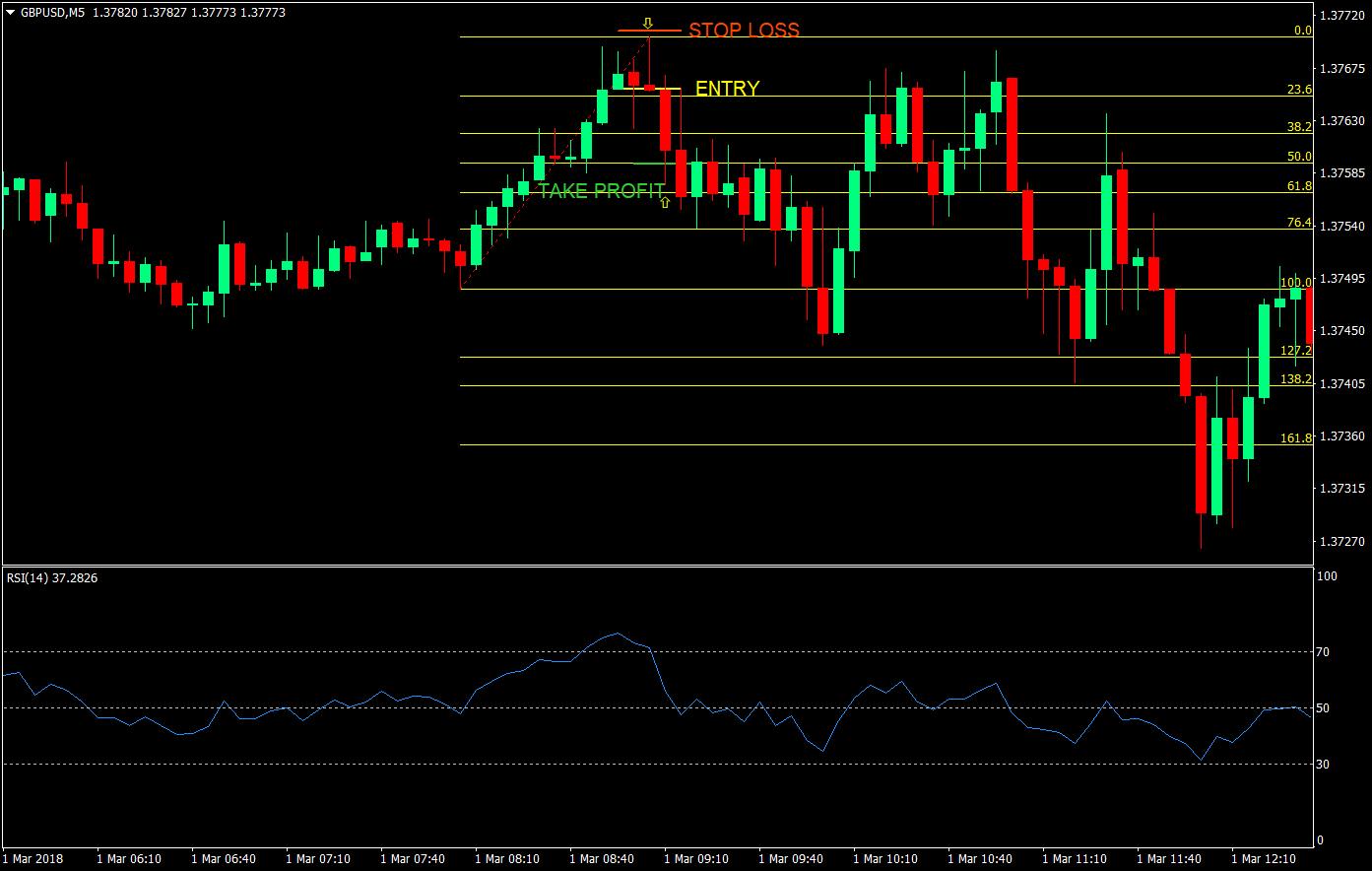

Sell Entry:

- RSI is above 70 indicating that it is already overbought.

- A bearish pinbar corresponds with the RSI being overbought.

- Enter at the close of the pinbar candle.

Stop Loss: A few pips above the entry candle.

Exit: 50% of the Fibonacci ruler as drawn from the latest thrust causing the overbought scenario.

Conclusion

Scalping, although not for everybody, is a profitable endeavor with the right strategy.

Pinbars on their own, are not that reliable, especially in the forex market, due to the sheer size of the market, and the sophistication of traders. On top of that, algorithmic trading also plays a role in this market, which usually do not take patterns into consideration. However, by filtering out other pinbars using the Relative Strength Indicator (RSI), we are in a way raising the probabilities in our favor.

This strategy, is something that one could start with and even develop further. A word of caution however, it is better to start with smaller lot sizes and risk when trying to scalp, then raise the position sizes later as you get comfortable in the lower timeframes. It doesn’t feel good loosing money in seconds, trust me on this.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: