Ranging bound and choppy markets are like turbulent waters. Traders all know the dangers of trading in such markets, so most traders avoid trading in such conditions as much as possible. However, there are traders who could still navigate their way through such turbulent markets.

The advantage of being able to trade in such conditions is that there are more opportunities available compared to being able to trade only when the market has a clear direction. Remember, the market ranges and chops around at about 80% of the time and trends only around 20% of the time.

Ultimate Oscillator Reversal Forex Trading Strategy is a reversal trading strategy that trades on reversals coming from overbought or oversold market conditions. It uses a custom oscillating indicator which identifies overbought and oversold conditions and pinpoints when the market might possibly reverse towards the opposite end of the range.

It also identifies conditions where there are imbalances between the oscillations of price action and an oscillating indicator, also known as divergences. These divergences support the assumption that price might reverse at any time. The market reverses rapidly during these market conditions. Our job is to enter the trade prior to the reversal, thereby increasing our yield potential.

Ultimate Oscillator

Ultimate Oscillator is a custom oscillating indicator which is bound within the range of 0 to 100. It then plots a line mimicking price action depending on how the market is behaving. These oscillations provide traders some clues where price might be going next.

This indicator helps traders identify overbought and oversold market conditions. It has a marker at level 30 and 70 to help traders identify if the market is overextended or not. If the line is below 30, then the market could be considered oversold. If the line is above 70, then the market could be considered overbought. Traders could then assume a probable reversal as soon as price reacts at around these levels.

Traders could also confirm momentum using this indicator. We could add a marker on level 50 to identify the midpoint of the range. Momentum could then be identified whenever the oscillator line crosses 50.

Trading Strategy

This strategy trades on reversals coming from overbought and oversold market conditions as indicated by the Ultimate Oscillator indicator.

To trade this strategy effectively, traders should identify three things.

First, traders should identify overextended market conditions. These are basically oversold markets and overbought markets. Identifying these are simple using this indicator. We basically just wait for the oscillator line to breach beyond the 30 to 70 range.

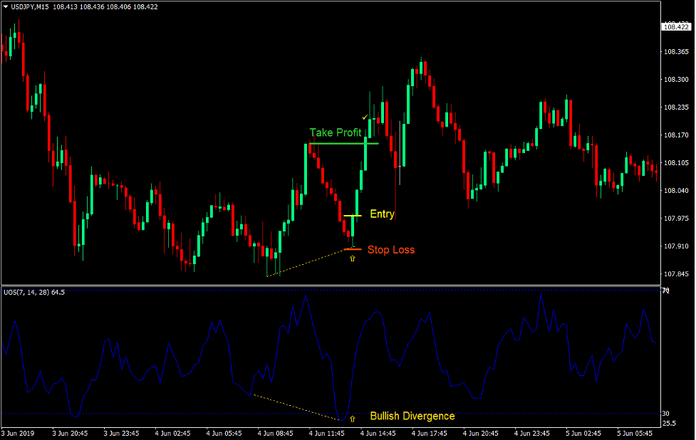

Next, we should be able to observe clear divergences. Divergences are telltale signs of a probable reversal. There are many different types of divergences that could occur in range bound or choppy market. Whether the divergence is a regular divergence or a hidden divergence, both will support the thesis that price could reverse soon.

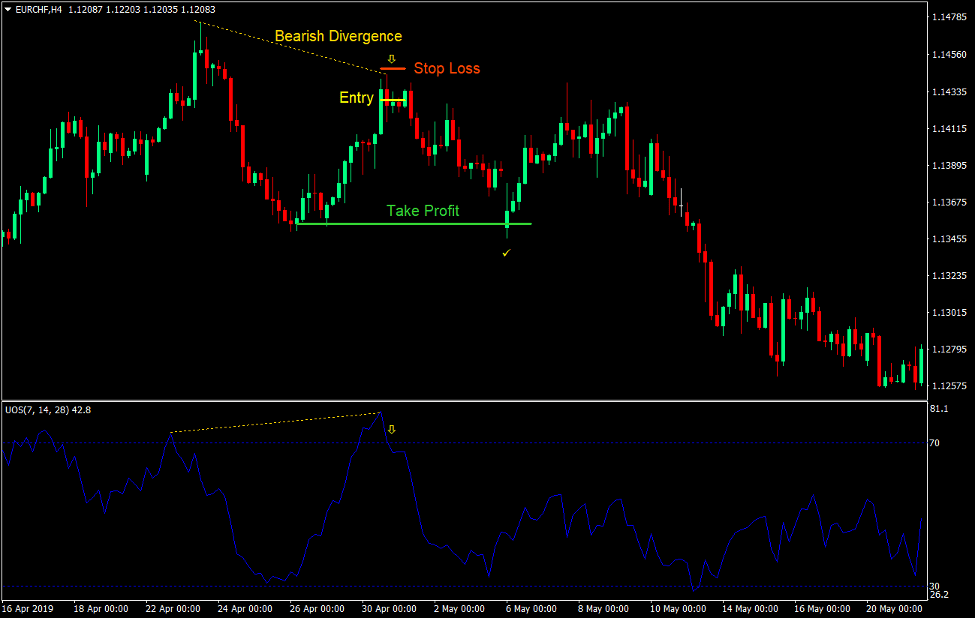

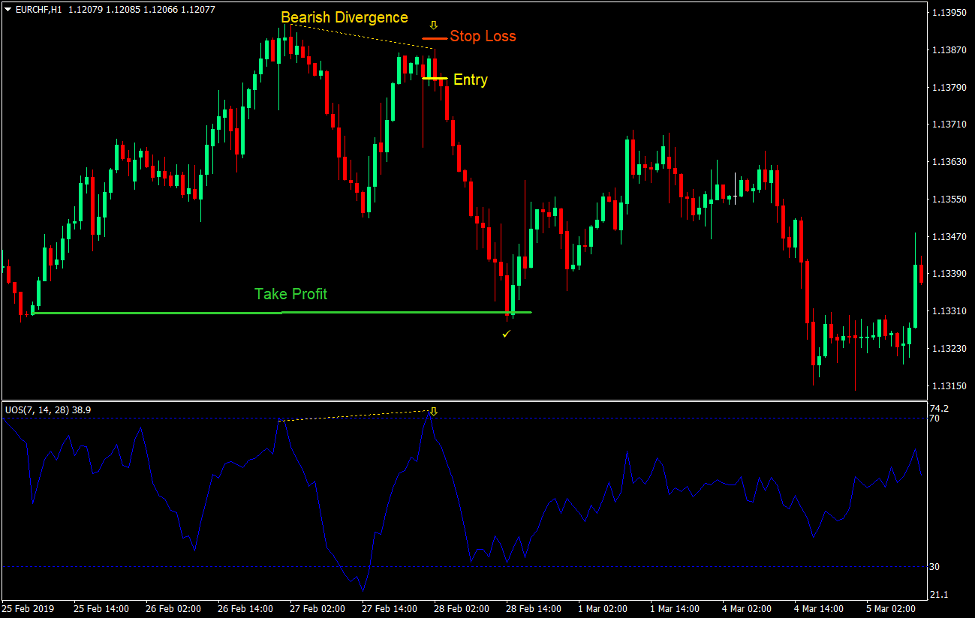

Below is a chart of how divergences look.

Lastly, we will be looking for price rejection. This is probably the most important factor when looking for a reversal coming from an overextend price. There are many candlestick patterns that could help identify price rejection. There are pin bars, engulfing patterns, morning and evening stars, etc. While it is important to be able to identify these patterns, traders could also identify price rejection by looking at how the candles behave at a certain price point. Candles would typically have wicks on the area where price is rejecting. Another sign of a probable price rejection would be indecision or congestion at a certain price point.

These characteristics are indications of a probable reversal as price reaches an overbought or oversold condition.

Indicators:

- ultimate-oscillator (default setting)

Preferred Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

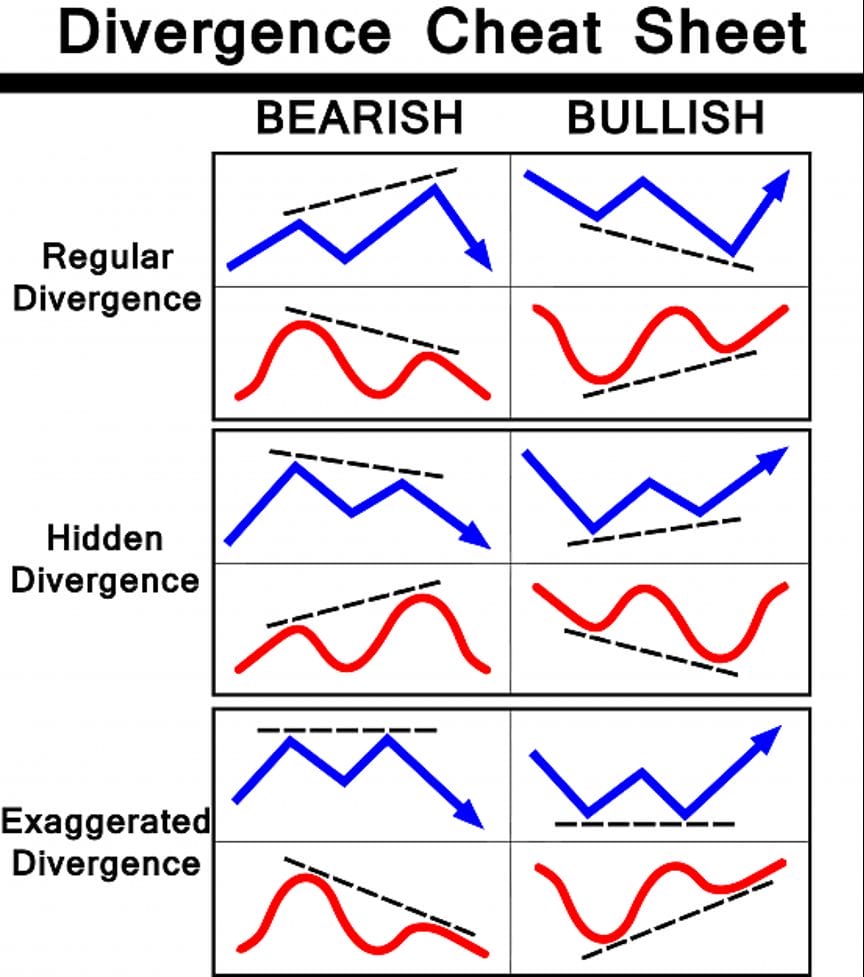

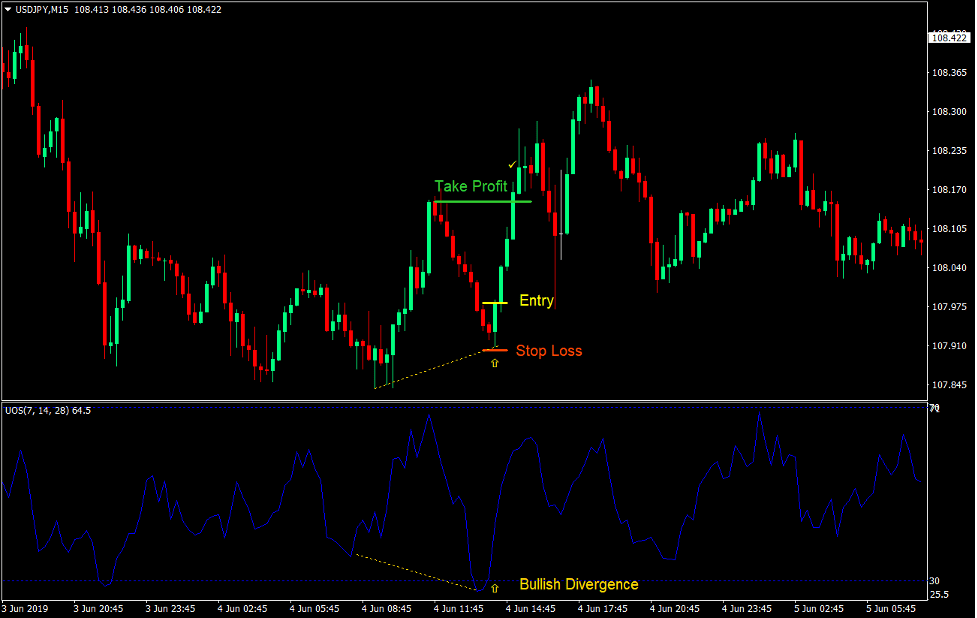

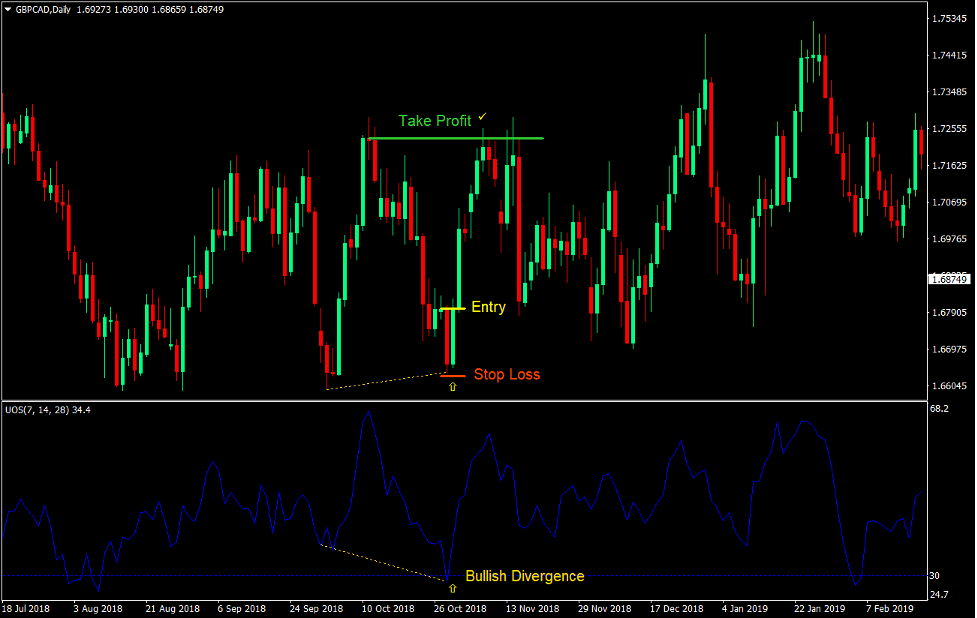

Buy Trade Setup

Entry

- The Ultimate Oscillator line should be below 30.

- A bullish divergence should be observable on the chart.

- Price should show signs of price rejection on the area below the candles.

- The Ultimate Oscillator line should start to curl up.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the fractal near the entry candle.

Exit

- Set the take profit target on the swing high above price action.

Sell Trade Setup

Entry

- The Ultimate Oscillator line should be above 70.

- A bearish divergence should be observable on the chart.

- Price should show signs of price rejection on the area above the candles.

- The Ultimate Oscillator line should start to curl down.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the fractal near the entry candle.

Exit

- Set the take profit target on the swing low below price action.

Conclusion

Trading on choppy and ranging markets is quite difficult. However, traders are often left no option other than a ranging market. Some opt not to trade, while some trade at their own risk.

This strategy helps traders navigate such turbulent markets, however the risk is still there. Price could still chop around and confuse traders.

Traders who are adept to such conditions could easily trade through this using their knowledge of price action, market flow and their general experience with such markets.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: