The Dance Forex Trend Following Strategy

This system works only on these trading sessions:

Trade ONLY during the London/ NY Overlap for USD pairs.

Trade ONLY during the Asian/London Overlap for JPY pairs.

Trade ONLY during the Frankfurt for EUR pairs.

This works only in 15 minute chart.

Chart setup:

- No more than ONE “main” chart set to M15 and three smaller charts for each “main” currency.

Smaller charts are to be set to M5, to H1 and one to D1. M5 is optional if you find you are getting confused at any point or that you end up paying too much attention to it, losing lots of trades.

Entries:

- Trade WITH the trend of the moment FOR ALL trades and assume the trend will continue from the previous session on the first entry.

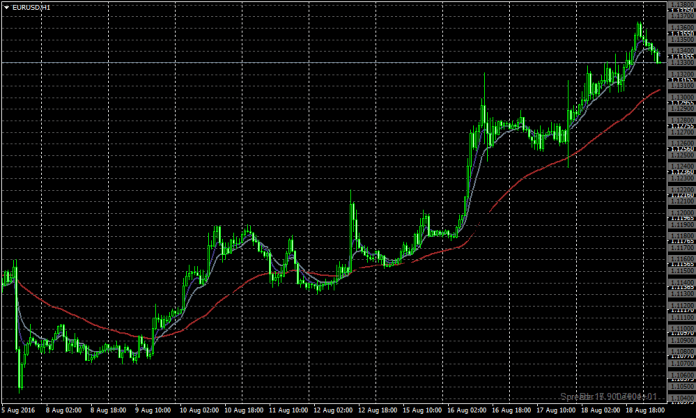

- Let EMA 50 and SMA 35 determine the trend.

For LONG:

- If price goes above the EMA 50 and SMA 35, GO LONG.

- 5 and 10 EMAs must also be above the 50 EMA/ 35 SMA Lines unless already in a counter trend trade.

- During the first touch of the EMA 10, clarify if it is in the second bar, then you can open position. Then set SL to 9 pips.

- Do not trade “touches” of the 5.

For SHORT:

- If price is below EMA 50 and SMA 35. GO SHORT.

- 5 and 10 EMAs must also be below the 50 EMA/ 35 SMA Lines unless already in a counter trend trade.

- During the first touch of the EMA 10, clarify the second bar on the retracement and set SL to 9 pips.

- Do not trade “touches” of the 5.

Price and THE 50 EMA and 35 SMA must agree with the trade, preferably from a pullback to the 50 or 35.

CONSTRAINMENT is the BEST and easiest to see entry.

Touch Trades are next best signals against the 35 or 50. They can also happen at the 10

EMA.

In touch trades, there is a 2 bar rule. It retrace trade if it takes more than 2 large bars to get there and touch the MA. Pass on the trade and wait for P/A to reveal where Price is really going.

GAINS

1. Maximum of 5 successful trades.

2. Stop when you lose 3 trades.

Stop Loss:

- Stop Losses need to be “adequate” and that means different SL on different currencies. If you find yourself using more than 15 pips consistently for the SL, you need to refine your entries.

- Move the SL to BE as soon as you feel the trade will not take out your SL on a “breath.”

- A good place to set your original SL is Spread + just a couple of pips below or above the

previous “round number” or ema that price touched and moved away from. Be sure to include the spread. - SL must be tight. Move to the bottom or top of the previous bar every time one closes.

Profit Targets:

Trail stop, like moving the SL to the top or bottom of the previous bar. The only exception to this is when approaching a “round number” level or a stronger EMA like the 50 EMA/ 35 SMA Lines on a retrace. Tighten your stops at those levels as price has a nasty tendency to reverse at them. The other option, with more experience will be to exit and immediately short at that “first touch” of the 50 EMA/ 35 SMA Lines.

If it becomes apparent you are in a ranging or choppy market, just be a bit more careful and look only for solid entries based on S/R levels such as the Round Numbers and constrainment of the lower level EMAs, usually around a “round number” or previous P/A or S/R level.

Take your pips early like 20 or 20.

Exit trade if P/A indicates a reversal between “round number” levels.

During NFP, take small pips like 10 pips.

Locking in Profits:

Be mindful in moving your SL too aggressively, but keep it no farther back than the bottom (or top) of the second bar back from current price action and preferably no farther back than the last bar bottom (or top).

If you have an extremely large bar, move the SL to the just below the last “Round Number” it passed land watch price movement very closely. If it hasn’t yet passed a Round Number level, move to slightly less than 70% of the bar’s total and wait. It will either continue to explode or retrace pretty rapidly or take out your stop. LARGE BARS RETRACE OFTEN, so don’t hesitate to take your pips before it hits the SL you are trailing AND USE THE “round number” levels.

If a large bar “dead ends” at a stronger EMA, or a “round number” level, move your SL very close to the level. Probably about 2 times Spread or less and wait. If the move is strong, it will continue and blow through pretty quick. If not it will take out your stop.

Ranging/ Consolidating Markets:

The 50 EMA/ 35 SMA Lines have a strong tendency to either “wind” around each other and “flattening” while sticking close to each other during a period of consolidation or ranging. On “ranging” days you will often see price also wind around them and give you definite

opportunities to enter at solid S/R levels or at Round Number levels on either side of the 50 EMA/ 35 SMA Lines.

Be very cautious in these markets unless you are experienced with this strategy. Wait for better signals if not experienced.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: