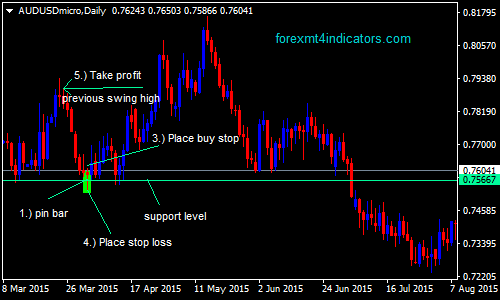

Pin Bar Forex Swing trading Strategy

This trading strategy is a great strategy to use because it is profitable. If you can identify a pin bar on the chart and knowing where is the location on the chart, then you can make a great swing trade.

The pin bar trading strategy relies on the Pin Bar Formation. It is a price action reversal pattern and when it forms, it clearly shows that the price was rejected by the market at a certain price level or point.

.A pin bar is a bar or candlestick with a long tail or wick, a very short body. The name itself refers to using a bar chart.

For Bearish Pin Bar Formation:

The very long tail means that the bulls took over and pushed the price a very long way up to form a high, but that high was not maintained. The bears came with such a great force and took over and pushed the price down all the way, wiping away all the price gains made by the bulls. The price fell, made a low and then close a little bit below the opening price in the red. It means that bears are likely to take over and will continue to push the price down.

For A Bullish Pin Bar Formation:

The long tail tells you that the bears took control of the market and pushed the price all the way down to make a low but this low was not sustained. After the low was made, the bulls took over with such ferocity and force and pushed the price all the way up, completely wiping all the downward price moves made by the bears and making a high and finally closing a little bit below the high. It means that the bulls are taking over and the market will continue to go up.

In order for the pin bar to be effective, it should be located on 31.8 & 61.8 Fibonacci levels, Major support and resistance, traders action zone, pivot levels, and trendline bounce.

Trading Rules:

- The pin bar must form on the levels listed above.

- For SELL: Place sell stop order below the low of the bearish pin bar.

- For BUY: Place a buy stop order 3-5 pips above the high of the bullish pin bar.

- Place the stop losses on the other side of the pin bars. Place stop loss 3-5 pips above the high if you have a sell stop order and 3-5 pips below the low if you have a buy stop order.

- Take profit at the previous swing high or low . You can also lock in profits if it moves into your favor by trailing the stop.

This strategy is best used in a higher timeframe such as 1-hour to daily timeframes. If you use an hour chart, refer to 4-hour or daily chart to check the trend.

Open AUDUSD daily chart for the template.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: