Momentum Indie Forex Trading Strategy

There are a couple of ways to trade the forex markets, mean reversals or momentum trading. Most trading strategies are a form of either of these two classifications. Between the two, momentum trading or trading with the trend is probably more popular. But what is it really?

What is Momentum Trading?

In science, outside of trading, momentum is defined as the product of velocity and mass, or distance, time and mass. This means, if something has a strong momentum, an object with a big mass is being moved from one point to another in a relatively short period of time. But how does this relate to trading.

In trading, what we often see on the charts are two things, the distance of price movements, which is the y-axis, and the time elapsed, which is the x-axis. Movements with strong momentum often take up a lot of movement on the y-axis covering huge price differences in a very short time, within a few periods. This result to long and big candles. These hints are telltale signs of momentum.

However, distance and time alone will not suffice to determine momentum. There is one thing that is missing – mass. In trading, mass would be equated to volume. However, volume is often generic. As long as a transaction is made, it is accounted as part of volume, not taking into consideration which direction the transaction pushed price to. This makes making use of volume a bit difficult. This is especially true in forex, since you are trading money for money. Demand and supply is not unidirectional. Price is being pulled both ways.

So, if volume is difficult to use, and thus momentum is quite difficult to determine, should we forgo it as a whole? Should you throw the baby with the bath water? No!

Good thing there are custom trading indicators that simplify determining momentum, which we can make use of.

Trading Strategy Concept

This trading strategy is based on a custom trading indicator that determines momentum automatically. By trading with the momentum in conjunction with other parameters, we hope to be trading higher probability setups.

For this strategy, we will be trading momentum in confluence with a MACD custom indicator and the intermediate trend determined by the 100 Exponential Moving Average (EMA).

Indicators:

- BB MACD: bars count = 400000000

- Momentum: 28-period

- 100 EMA (Brown)

Currency Pairs: GBPUSD, EURUSD, GBPJYP, EURJPY, EURGBP

Timeframe: 5-minute chart

Trading Session: London Session

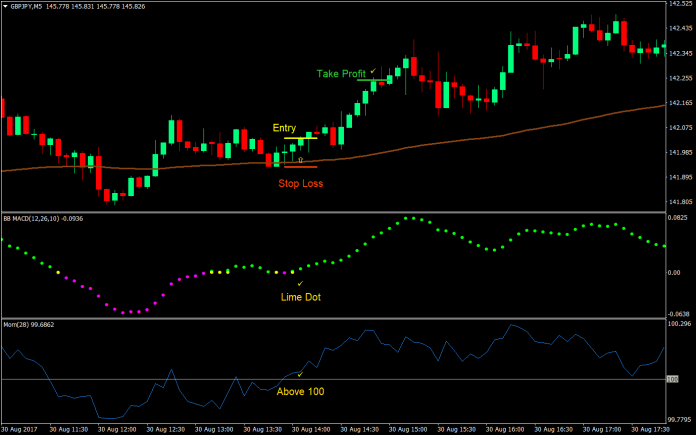

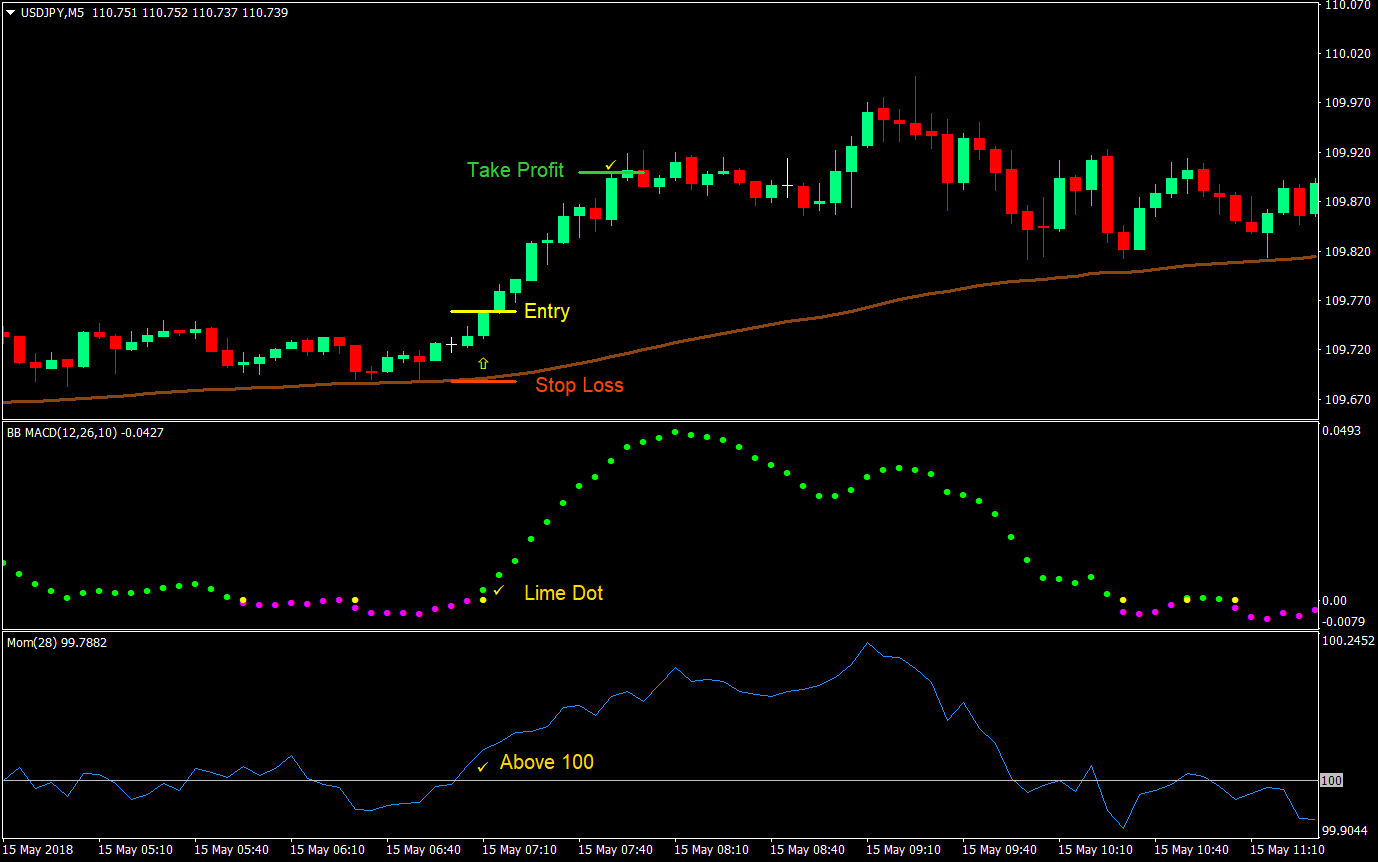

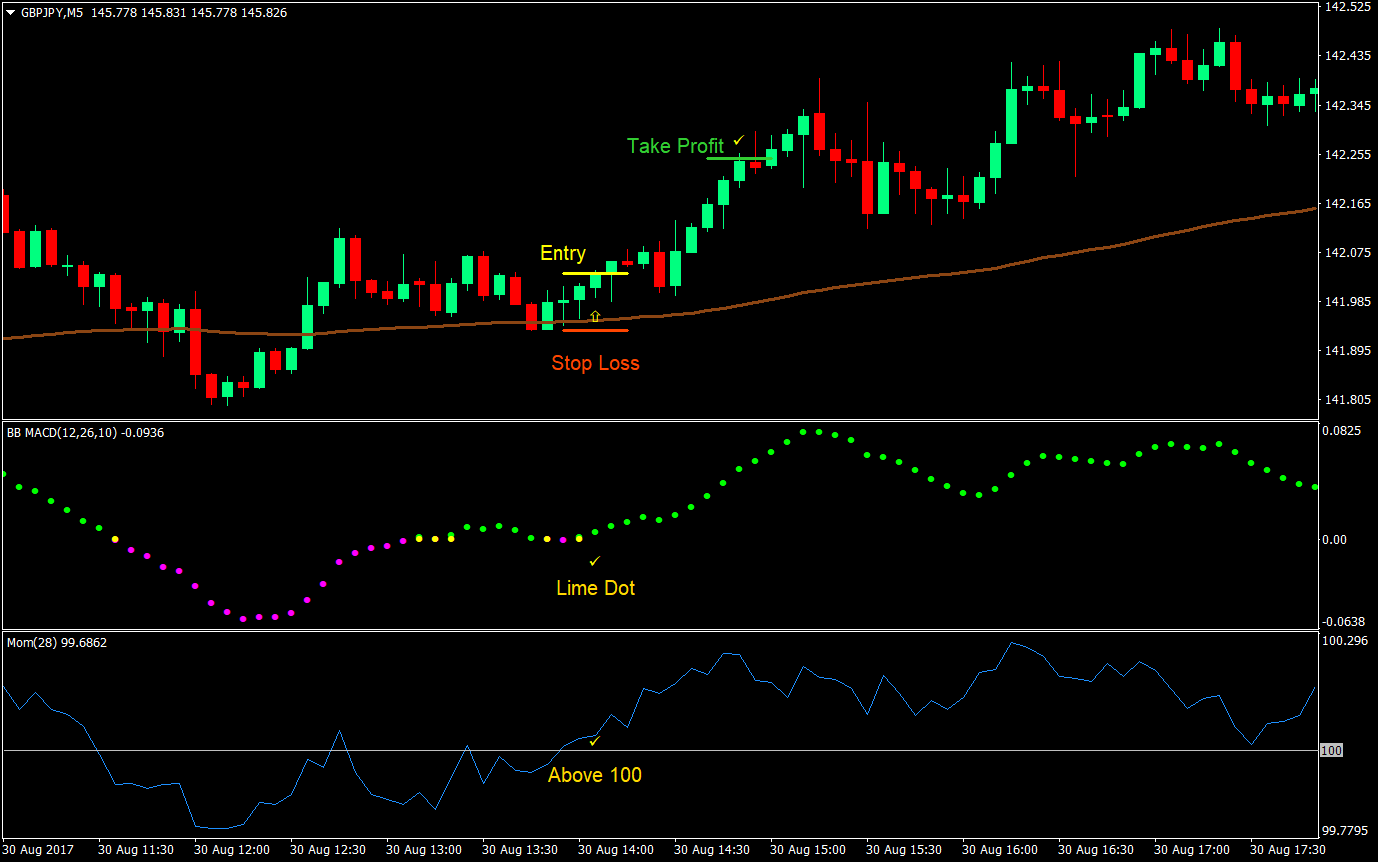

Buy (Long) Trading Setup Rules

Entry

- Price should be above the 100 EMA

- BB MACD should print a lime dot

- Momentum indicator should be above 100

- Enter a buy market order at the confluence of the above rules

Stop Loss

- Set the stop loss at the swing low support below the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

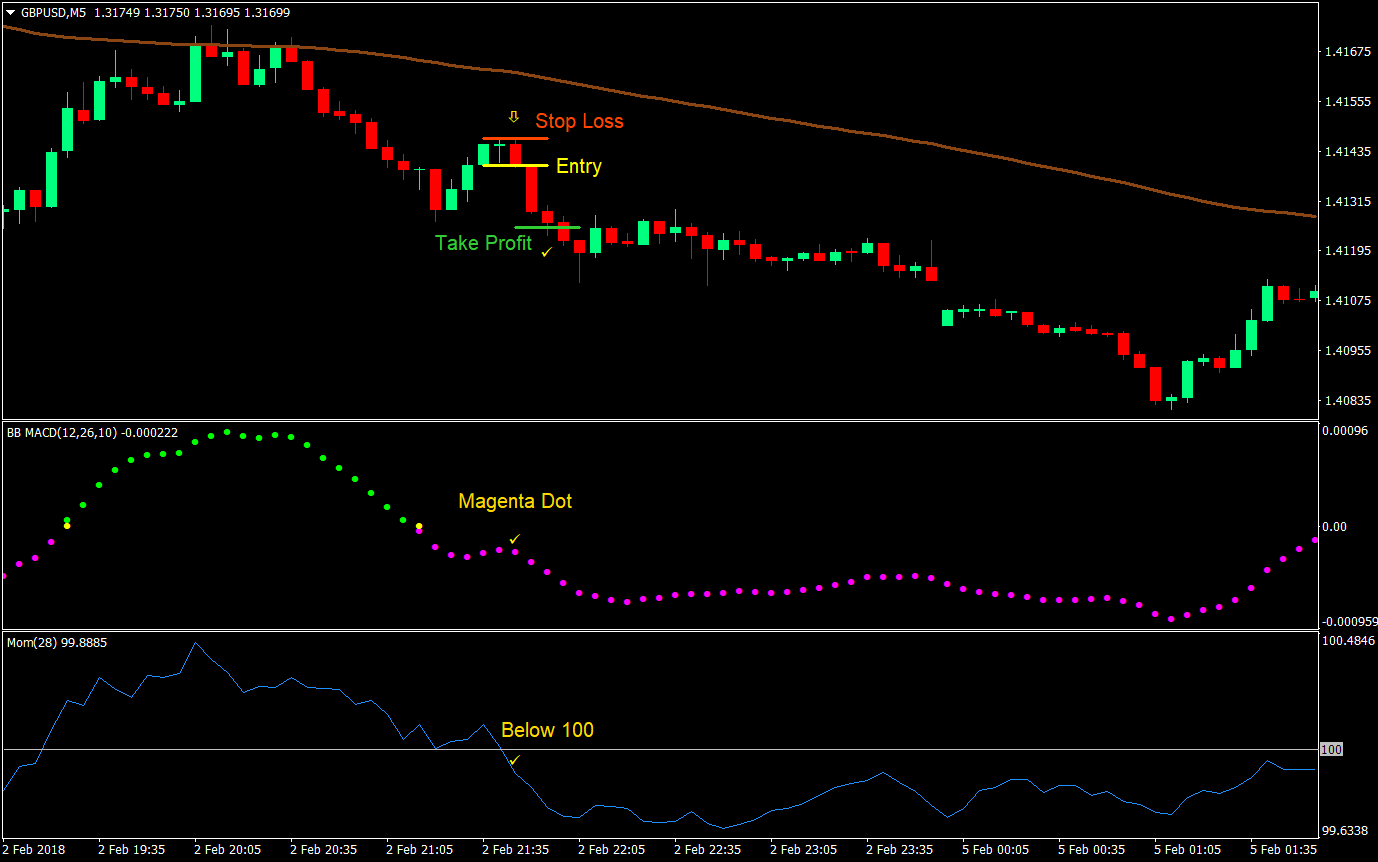

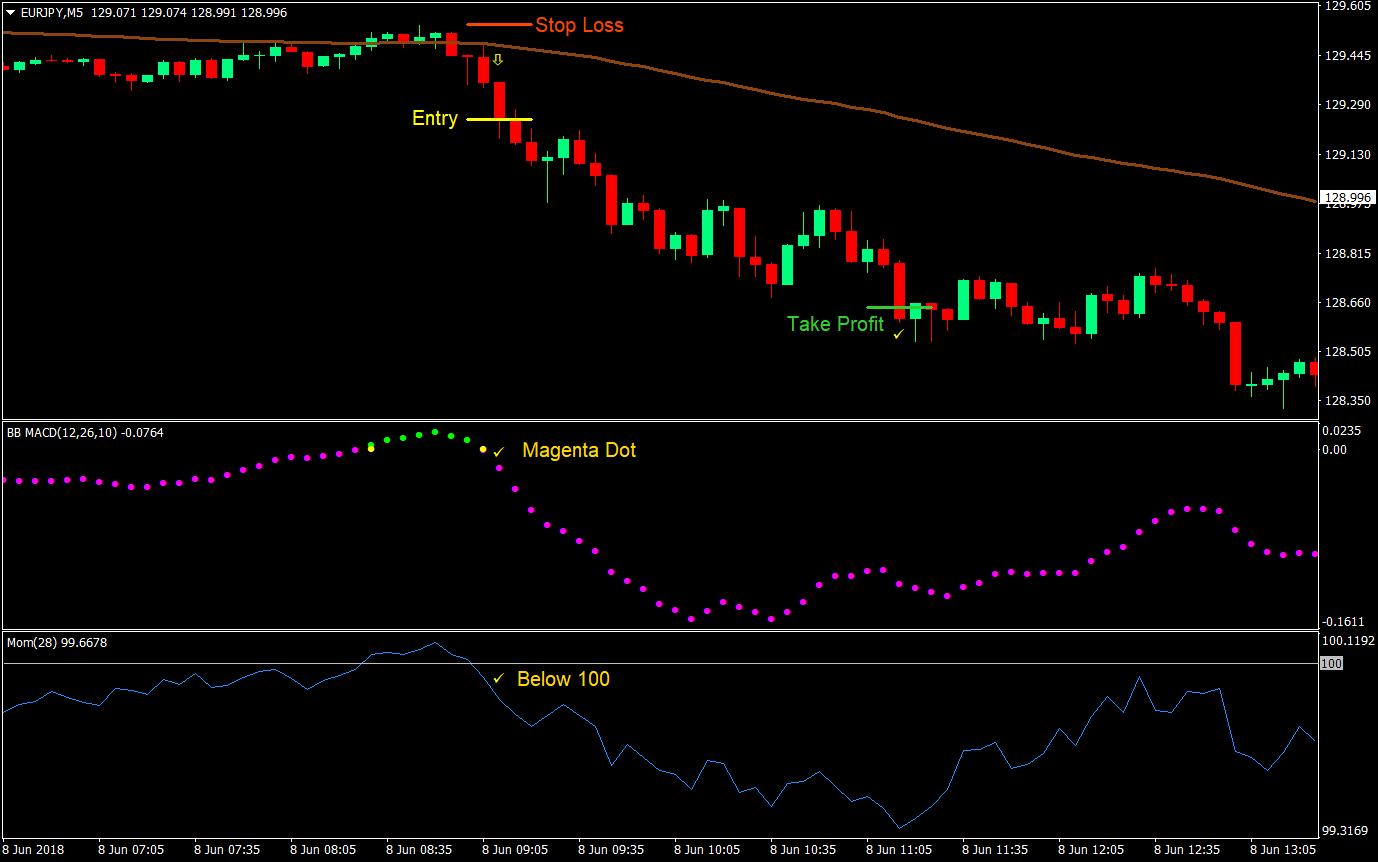

Sell (Short) Trading Setup Rules

Entry

- Price should be below the 100 EMA

- BB MACD should print a magenta dot

- Momentum indicator should be below 100

- Enter a sell market order at the confluence of the above rules

Stop Loss

- Set the stop loss at the swing high resistance above the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

Conclusion

This is a simple momentum-based strategy that is based on the confluence of a couple of working custom indicators. It Being that this strategy is based on custom indicators that work, it tends to have a higher probability combining both together. However, it is important to note that it is still not perfect. It is just that you would get entries that have a higher chance of making huge moves.

Given that our exit strategy is based on a multiple of the risk, it is good to avoid entries that have extremely large risk because this will cause our take profit target to be too far from our entry price. This will give us a lower probability of having a profitable trade because of the sheer distance price have to travel to reach our target.

Another option would be to explore take profits that are based on previous swing points. However, since this is a momentum strategy, there would be many instances where swing point-based targets would not be available on the recent chart because the market could already be in an established trend.

For those who prefer not using a risk multiple as a basis for the target and couldn’t find the swing point target on the chart because of an established trending market, exploring trailing stop loss strategies would also be great as this could maximize profits.

Lastly, you could also manually close a trade if any of the entry rules have been voided. However, this could also cause an exit that is too late, diminishing much of the profits, or cause a premature closing of the trade due to some noise in the market.

Discover which fits best for you and your style of trading.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: