Traders often look for accurate trading strategies. Traders would easily be attracted to trading strategies that would claim “90% win rate” traded on any market condition. You would see this advertised by “gurus” in Youtube. However, although it is not impossible to trade with 90% accuracy, it could also entail having huge losses whenever such errant trades come along. This is because many traders who claim such high accuracy tend to never close a trade until it is in profit. They are willing to risk huge losses to gain just a bit.

Instead of being too caught up with those grand win rates posted online, many successful retail traders opt to think in terms of probabilities. Instead of aiming for the 90% win rate or that perfect trading strategy that seems to do no wrong, they are willing to accept strategies that have a good mix between a decent win rate and risk-reward ratio.

Trading strategies tend to have different probability mixes depending on the type of market condition being traded. Trend reversal traders tend to have lower win rates with higher risk-reward ratios. Mean reversal traders tend to have higher win rates with lower risk-reward ratios. Trend following traders tend to have a good mix between a decent win rate and a decent risk-reward ratio.

Kijun Tenkan Plus Forex Trading Strategy is a trend following strategy that provides a good mix between the two factors. It makes use of technical indicators that help filter out trade setups that are occurring on a non-trending market, as well as provide precise entry signals based on short-term momentum. It also uses price action as well as support and resistances to provide a better grasp on what the market is doing.

Kijun Tenkan+

Kijun Tenkan+ indicator is a trend following indicator based on the Ichimoku Kinko Hyo or Ichimoku Cloud indicator. Ichimoku Kinko Hyo is a complete trend following indicator which provides information regarding the long-term, mid-term and short-term trends and momentum shifts. It also provides information regarding the short-term price action movements which should help traders avoid errant trades.

While the Ichimoku Kinko Hyo indicator provides a more complete information, the Kijun Tenkan+ indicator provides information regarding the mid-term trend, which is the main entry and exit triggers of the Ichimoku Kinko Hyo indicator.

Kijun Tenkan+ is composed of two lines, which are the Kijun-sen and the Tenkan-sen.

Kijun-sen, also known as the Base Line, is the longer-term line between the two. It is computed based on the midpoint between the high and the low of the past 26 periods.

Tenkan-sen, also known as the Conversion Line, is the shorter-term line. It is computed as the midpoint between the high and low of the last 9 periods.

Trend direction is based on how the two lines are stacked. Having the Tenkan-sen above the Kijun-sen indicates a bullish trend bias, while having it inverse indicates a bearish trend bias. Crossovers between the two lines indicate a possible trend reversal.

Octopus 1 Indicator

Octopus 1 is a trend bias indicator. It is a simple indicator developed to help traders identify the general trend direction and trade according to it.

The Octopus 1 indicator is a simple indicator which produces bars that change colors to indicate trend direction. Green bars indicate a bullish trend bias, while red bars indicate a bearish trend bias.

This indicator is mainly used as a trend bias filter. Traders could identify the direction of the trend using this indicator and filter out trades that go against the direction of the trend.

It could also be used as an entry and exit trigger. Traders could use the changing of the color of the bars to indicate a possible trend reversal. Traders could then enter and exit trades using this information.

Trading Strategy

This trading strategy is a trend following strategy that uses a moving average, the Kijun Tenka+ indicator, the Octopus 1 indicator, and support and resistance lines to identify possible trend following entries.

To identify the direction of the trend, we will be using the Octopus 1 indicator and a 50-period Exponential Moving Average (EMA). Trend direction will be based on the location of price in relation to the 50 EMA line, as well as the slope of the 50 EMA line. Price action should also signify a trending market condition based on its swing highs and swing lows. The Octopus 1 indicator would serve as a confirmation of the trend based on the color of the bars.

As soon as we identify trend direction, we could then look for possible trade setups by plotting support and resistance lines where price could breakout from if the trend continues. We then wait for price to break the trend lines. Entries are then confirmed by the crossing over of the Kijun-sen and Tenkan-sen lines.

Indicators:

- 50 EMA

- KijunTenkan+

- Octopus_1

Preferred Time Frames: 15-minute, 30-minute and 1-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

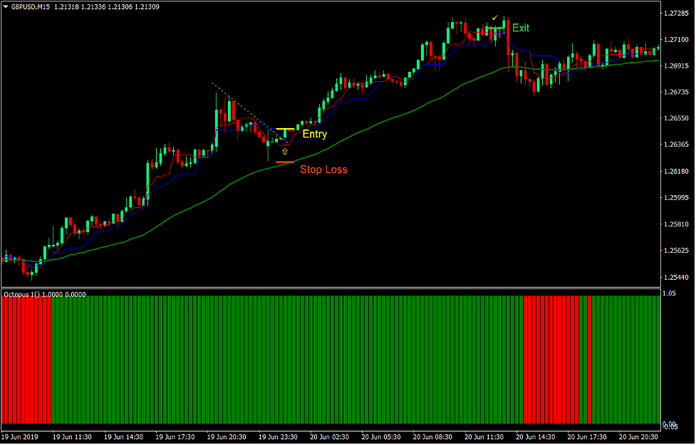

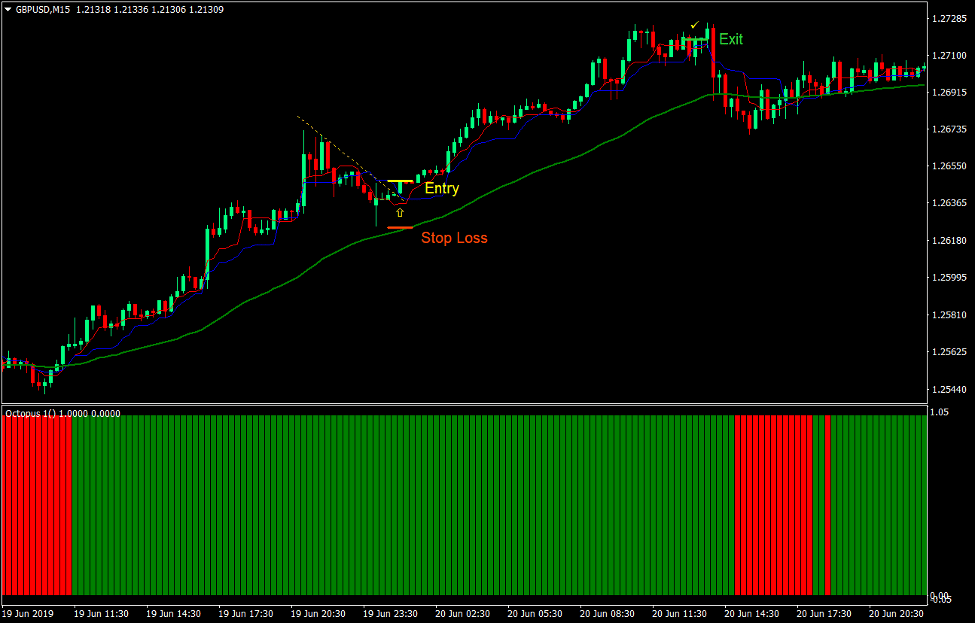

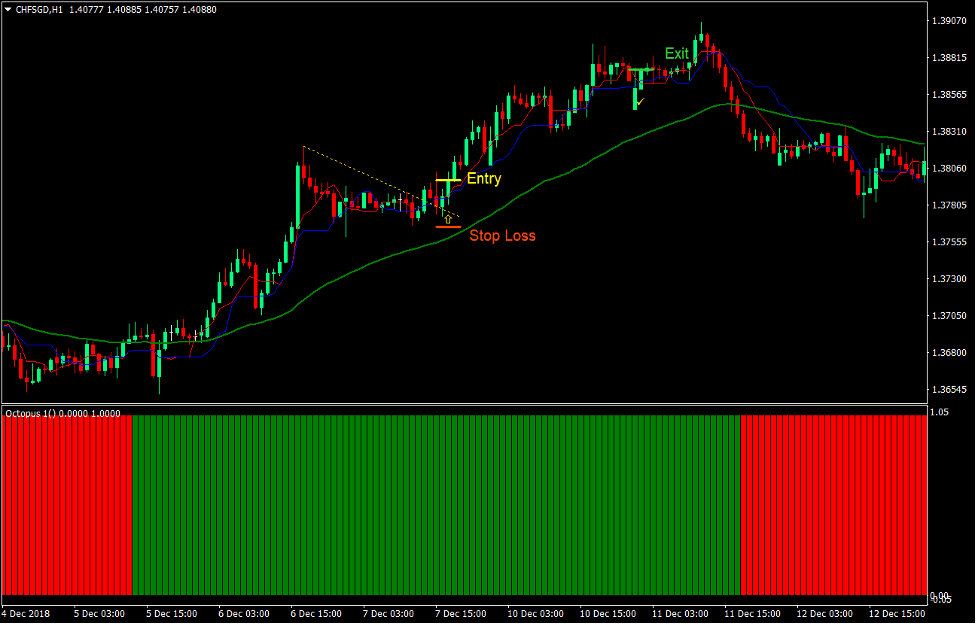

Buy Trade Setup

Entry

- Price action should be above the 50 EMA line.

- The 50 EMA line should be sloping up.

- Price action should be making higher swing highs and swing lows.

- The Octopus 1 bars should be green.

- A resistance line should be observable.

- Price should break above the resistance line.

- The Tenkan-sen line should cross above the Kijun-sen line.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the swing low below the entry candle.

Exit

- Close the trade as soon as the Tenkan-sen line crosses below the Kijun-sen line.

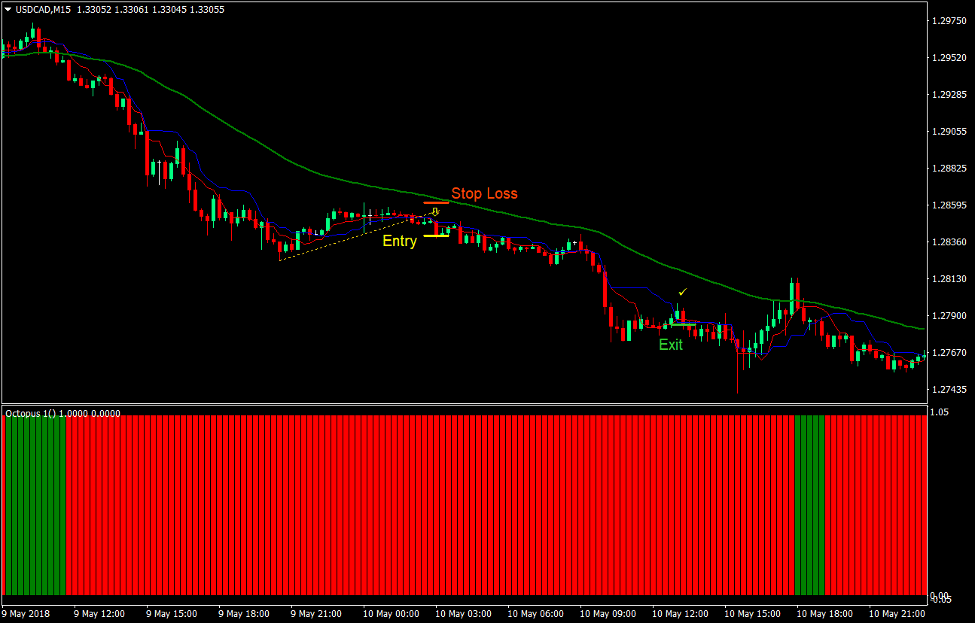

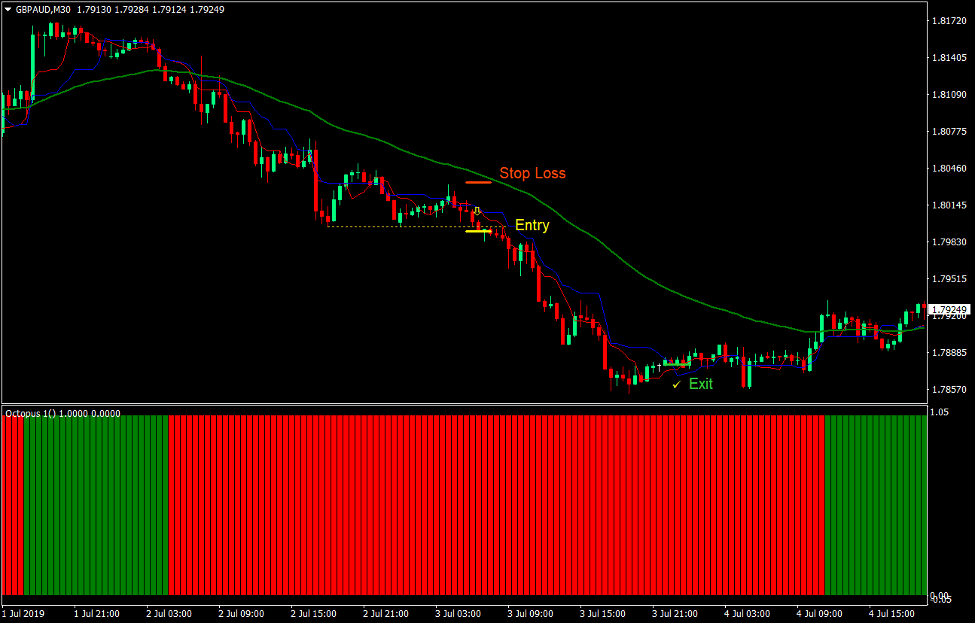

Sell Trade Setup

Entry

- Price action should be below the 50 EMA line.

- The 50 EMA line should be sloping down.

- Price action should be making lower swing highs and swing lows.

- The Octopus 1 bars should be red.

- A support line should be observable.

- Price should break below the support line.

- The Tenkan-sen line should cross below the Kijun-sen line.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the swing high above the entry candle.

Exit

- Close the trade as soon as the Tenkan-sen line crosses above the Kijun-sen line.

Conclusion

This type of trend following strategy is a widely used trading strategy. It is common to see traders use the 50 EMA line as a basis for trend following strategies trading on retracements. It is also common practice to use support and resistance line breakouts to trigger trades.

However, traders would sometimes make the mistake of trading on the wrong support or resistance line or taking trades too early while the retracement is not yet completed.

Using the Kijun Tenkan+ indicator allows us to filter out trades that have not yet completely reversed. This is because we could only plot the support or resistance line when the Kijun Tenkan+ lines have temporarily reversed.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: