Keltner Scalping

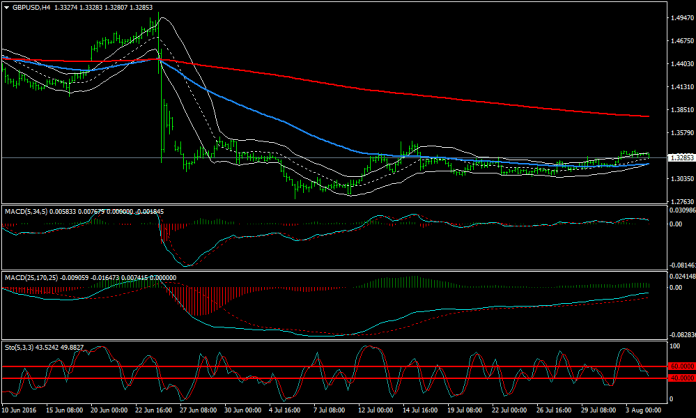

Keltner scalping trading system uses a EURUSD pair with a 1 minute timeframe. The indicators that are used by this system are as follows:

- OHLC bar chart/Candlestick chart

- 89 period SMA (Simple Moving Average)

- Keltner channels sets to 22 period moving average

- MACD histogram with 2 settings: * 5/34/5 and * 25/170/25

- 445 period EMA (Exponential Moving Average)

- Stochastic momentum (5,3) or (5,3,3)

For LONG entry:

- The price must be above or respects the 89 moving average on 1 minute chart.

- Price must be within, closely above or below the keltner Channels. Wait for the next trade if price is below the keltner channel, unless there is a clear positive divergence between the price and the MACD 3/34/5. Price must also test either the moving average 89 or 445. It is still safe to trade if price overlaps the upper keltner channels but just stick to the rules.

- MACD 5/34/5 histogram must be below zero

- Stochastic momentum must be approaching or below -40. Wait for it to go below -40 for highest probability trades but it may not be far enough.

- Period 1 of moving average of the MACD must turn back up in the direction of the trend and crosses the period 5 moving average of the MACD.

Just go LONG when the next bar opens if price is still within above or below or close to the keltner channel and put a maximum stop in one of 3 places.

- One pip outside the lower keltner channel.

- One pip below the 89 or 445 period moving average. If they are below the keltner Channel.

- Twelve pip below the trade entry point. Don’t set stop loss more than 12 pips.

For SHORT entry:

- Price must be below or respects the 89 moving average period.

- Price must be within, closely above or below the Keltner channels. Like the long entry, wait for the next trade if price is above the keltner channels unless there is a clear negative divergence between price and MACD 5/34/5, or if it test moving averages period 89 or 445. It is still safe to enter trades if price overlaps the lower keltner channels but be careful.

- MACD 5/34/5 histogram must be above zero.

- Stochastic momentum is approaching or above +40. Wait for it to go above +40 for high probability trades.

- Moving average period 1 of the MACD must turn back down in the direction of the trend and crosses the moving average period 5 of the MACD. Go short at the opening of the next bar. Just make sure that the price is still within, closely above or below the Keltner channels and enter a maximum stop in one of 3 places.

Set SL: One pipoutside the Keltner channels, One pip above Moving Average 89 or 445, if they are directly above the Keltner Channels, 12 pips above thr trade entry point. Again, do not set SL more than 12 pips.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: