Double Whammy Forex Trading Strategy

What comes up must come down. This is mean reversion strategy in a nutshell. The idea behind mean reversion strategies is that price, when overextended, would usually go back to its mean or its average. If price, rallies so fast, the tendency is that there would be too much pressure for it to go back to its average price.

Have you seen one of those exercises they train athletes with where a strong elastic band would be put around their waist and they would try to run? If we would try it, chances are after going a certain distance, we would be pulled back by the band. The same thing is happening with price whenever it is overextended. As it tries to run or rally, the pressure of the pull going back to its mean becomes stronger. As price loses strength and momentum, it becomes overcome by the reversal pressure, bringing price back to its mean, or worse, making it reverse.

Today, we will be exploring a simple indicator used to indicate if price is overextended enough to warrant it being ready to reverse to its mean – the Relative Strength Indicator (RSI).

The Setup – Double Whammy Strategy

As with other indicators, the RSI has already been backtested with its normal settings, taking trades whenever price is overextended and exiting a trade whenever price has reached the other extreme of the RSI range. Chances are, like most other indicators, the results would be lackluster.

With this strategy, we will try to look for RSI to reach a certain level which is overextended more than its usual settings. Then, we will be entering the trade at a confirmation of the reversal, still based on the RSI. Lastly, we will be setting a cap on our profit target to avoid closing the trade when price has reversed.

We will be setting the RSI at its usual 14 period parameter. However, aside from the usual 30-70 levels, we will add the 20-80 level. We will be using the 20-80 level to determine oversold and overbought market conditions, then use the 30-70 levels as confirmation of the reversal. This is why we are calling it double whammy, because of the double confirmation of the RSI.

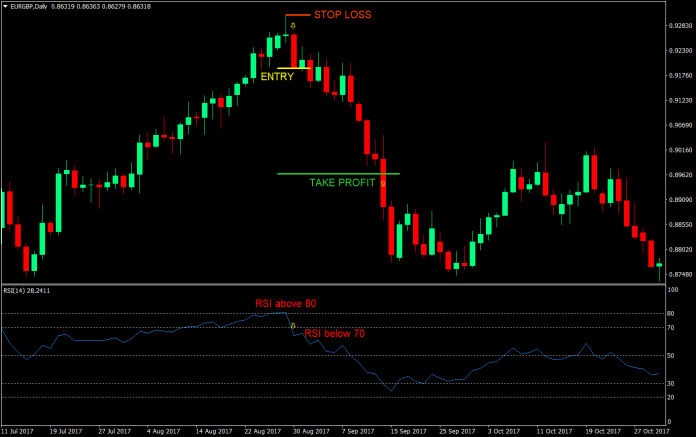

Buy Entry:

- Look for RSI to go below 20

- From below 20, wait for RSI to go back above 30 but still below 50

- Enter a buy market order at the close of the candle corresponding the RSI being above 30

Stop Loss: Set the stop loss at the swing low formed by the bullish price thrust

Take Profit: Set the take profit at 2x the stop loss risk

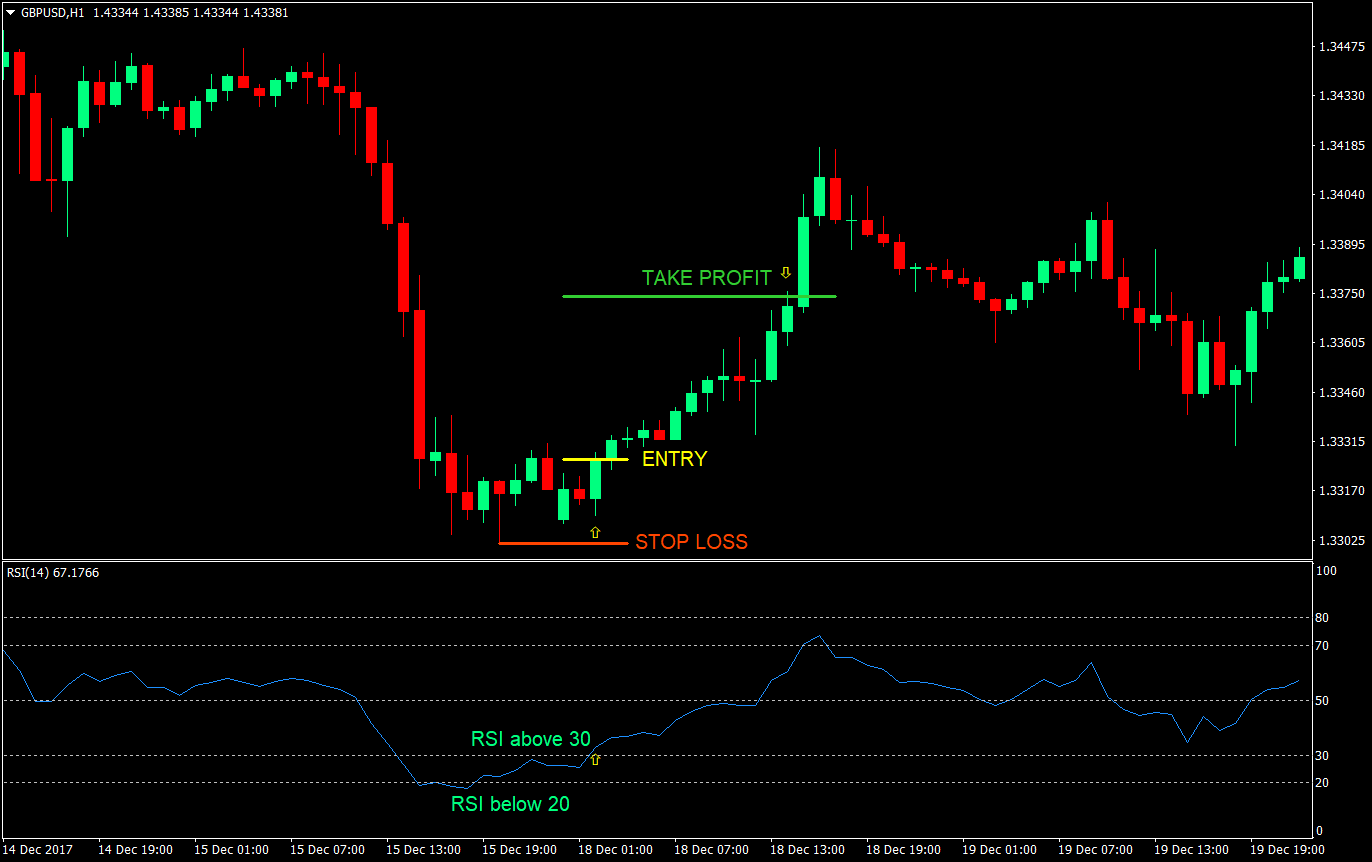

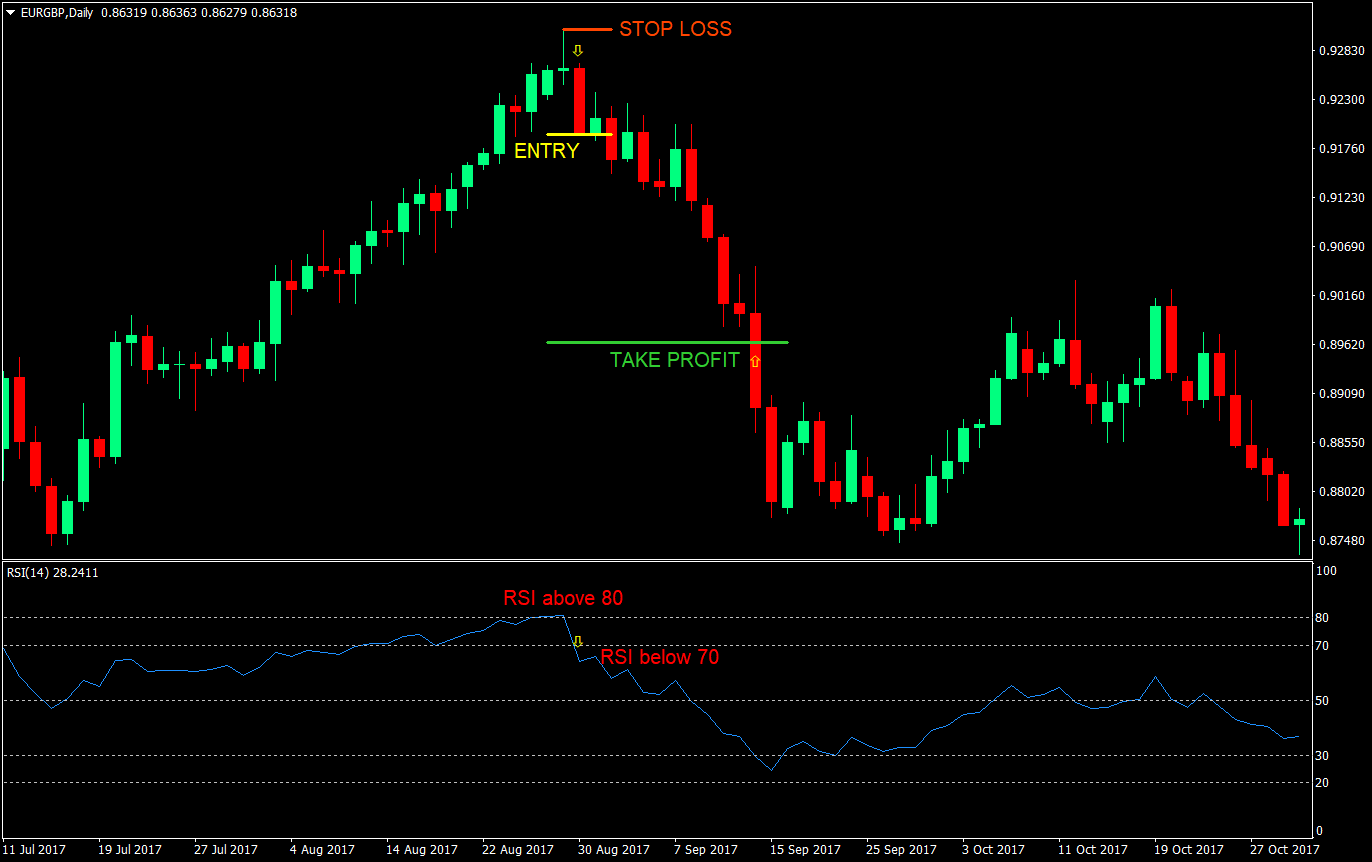

Sell Entry:

- Look for RSI to go above 80

- From above 80, wait for RSI to go back below 70 but still above 50

- Enter a sell market order at the close of the candle corresponding the RSI being below 70

Stop Loss: Set the stop loss at the swing high formed by the bearish price thrust

Take Profit: Set the take profit at 2x the stop loss risk

Conclusion

This mean reversion strategy is quite restrictive because the RSI seldom goes above 80 or below 20. However, this restrictiveness allows for higher probability trades. Another advantage of this strategy is that it has a fixed 2:1 reward-risk ratio, which ensures that the reward-risk ratio would always be positive. It is somehow an all or nothing type of strategy. Given a positive reward risk ratio and an improved win ratio due to the restrictiveness of the parameters, this could make a trader profitable.

The only downside is that due to its restrictiveness, trades don’t come too often. This could lead to boredom for most traders and could then cause traders to bend the rules. Also, this strategy might also be a little inferior to other strategies which allow for more trades, even if they have lower reward-risk and win ratios. This is because of the higher number of possible winning trades that they could have.

If you would also notice, there is quite a big chunk of possible profits that were left on the table. Aggressive traders could opt to increase the take profit multiple. This would bring the reward-risk ratio higher, yet might also affect the win ratio adversely.

Even though this strategy is quite good, there are also a number of times when even if all the rules were ticked, the trade still results to a loss. This would usually happen in a trending market environment, which is also usually the type of environment when the RSI could pierce below 20 or above 80.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: