Aggressive Momentum Scalp Forex Trading Strategy

One of the most lucrative type of trading is probably scalping. With scalping, a trader is able to get in and out of the market in a very short period of time, making money within a few minutes, sometimes even less. Imagine having the opportunity to incrementally grow your account several times every day. This may be just a few dollars, but by doing several times, a trader would have the ability to accumulate a substantial amount at the end of the day.

But scalping is not that easy. Many traders also try to avoid scalping knowing the higher degree of risk that it brings with it. Often, a trader has less time to analyze the thesis of a trade setup when scalping as compared to day trading or swing trading. Add to it the fact that due to the minute moves that price makes on the lower timeframes, it is even harder to overcome spreads, commissions, and other costs of a transaction.

To successfully scalp the forex market, you would need a strategy that addresses these two hurdles. You would need a simple trading setup that is very easy to analyze and a strategy that allows you to earn as much pips as possible for the least risk placed on the market. There are several strategies that does this, but momentum trading is one of the best types of strategies to do this.

Momentum Candle

So, what is a momentum candle? Before we get there, let us first define what a momentum is. Science would tell us that momentum is the result of velocity and mass. In trading, this means that price moved up or down with a considerable distance, in a very short period of time, and with volume behind it.

How about momentum candles? Basically, it is a candle that represents strength. It is strong enough to either cause a slow-moving market to breakout on a trend, reverse a current trend, or carry a currently trending market further. It is identified by one characteristic – size. Momentum candles are big and long, full-bodied candles. Anytime we see this type of candle appearing out of nowhere, we should brace ourselves for the action that might follow it.

Trading Strategy Concept

This strategy is hinged on trading around a momentum candle.

Coming from a relatively slow moving or normal market, once a momentum candle appears, which is substantially bigger than the preceding candles, we ready ourselves for the price action that might follow.

How big a candle are we looking for? This is not a hard and fast rule because different currency pairs and markets have different ranges. But for example, on a market where price moves 1.5 to 3 pips within a given 1-minute candle, a candle that is 10 pips long and is full-bodied could be considered a momentum candle.

The momentum move could also be a few candles long, two, three, even five candles long, as long as the candles are characterized as momentum candles.

After such thrust with momentum candles, we will be observing for price to retrace for a few candles. It should be short and shallow, not 10 candles of retracement and should be just less than 30% of the momentum thrust. After the retracement phase, we wait for price to roll back over signaling a probable resumption of the momentum. Then we could setup our trade using stop orders.

Timeframe: 1-minute or 5-minute chart

Currency Pair: major pairs and some volatile crosses

Trading Session: whenever the market of the currency being traded is open

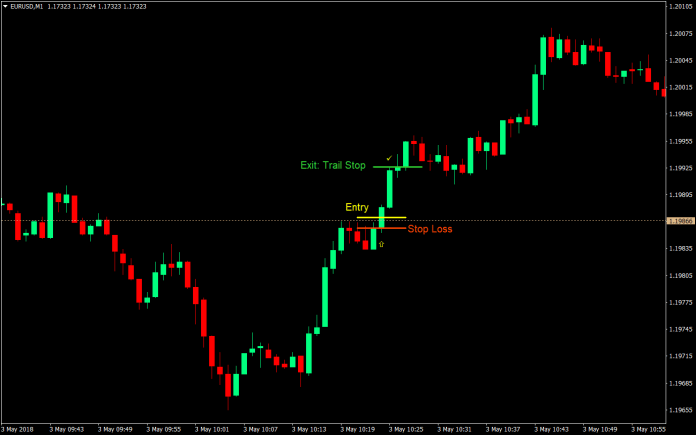

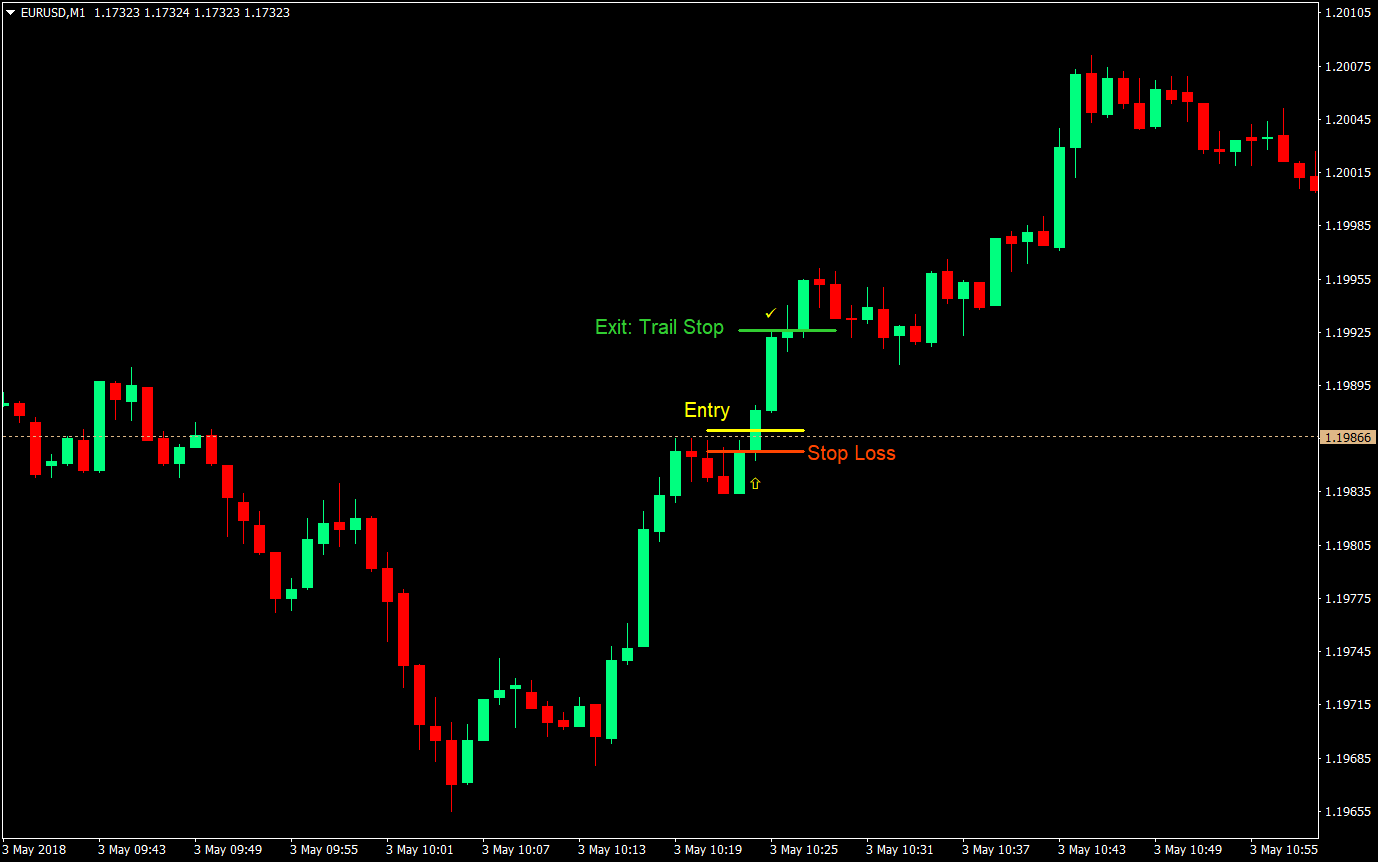

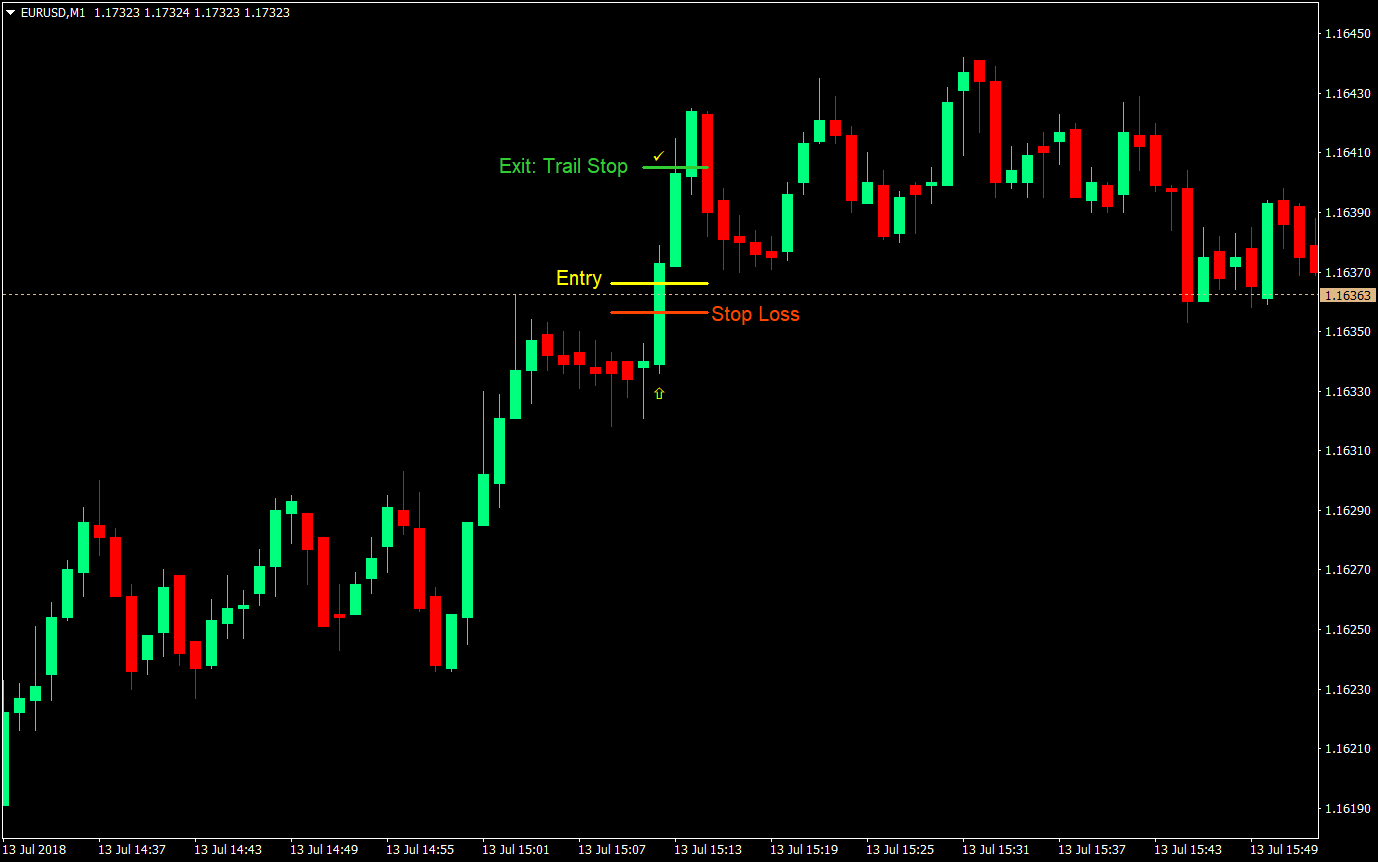

Buy (Long) Trade Setup

Entry:

- A bullish momentum candle or thrust should appear should appear approximately around 3 to 5 times the size of preceding candles

- Wait for price to retrace with small bearish candles

- Price should not retrace more than 30% of the thrust

- Wait for some signs of price resuming the trend

- As soon as some small bullish candles appear place a buy stop entry order a few pips above the swing high

Stop Loss

- Set the stop loss just a few pips below the swing high

Exit

If price makes another strong thrust on the resumption of the momentum, trail the stop loss by approximately the same distance as the initial stop loss

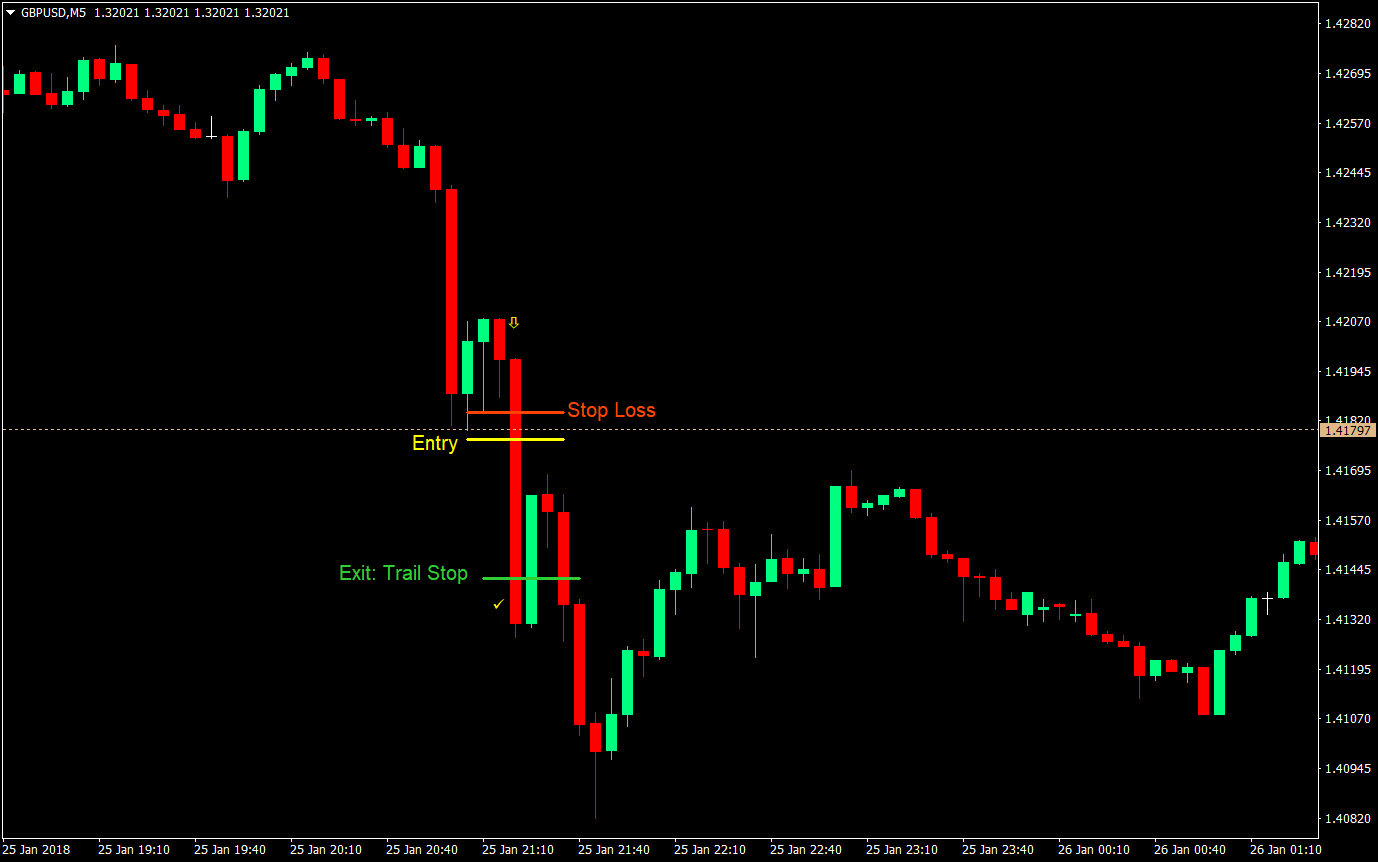

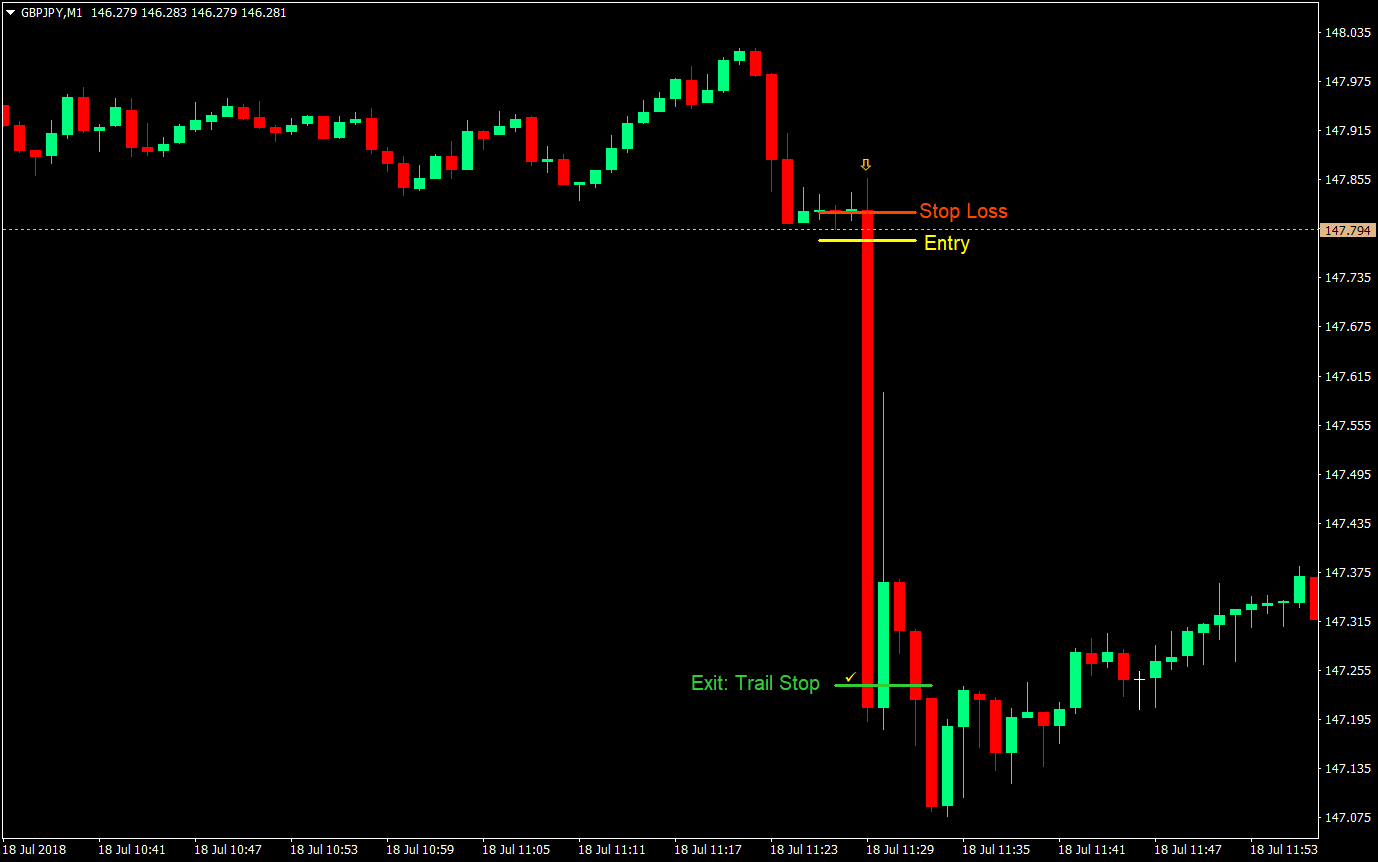

Sell (Short) Trade Setup

Entry:

- A bearish momentum candle or thrust should appear should appear approximately around 3 to 5 times the size of preceding candles

- Wait for price to retrace with small bullish candles

- Price should not retrace more than 30% of the thrust

- Wait for some signs of price resuming the trend

- As soon as some small bearish candles appear place a sell stop entry order a few pips below the swing low

Stop Loss

- Set the stop loss just a few pips above the swing low

Exit

- If price makes another strong thrust on the resumption of the momentum, trail the stop loss by approximately the same distance as the initial stop loss

Conclusion

This strategy is a commonly used momentum strategy utilized by many scalpers and day traders. However, this same concept could also be applied on some swing trading strategies.

Some variations of this strategy involve taking a market order at the close of the candle. Some also utilize a stop loss on the fractal made by the retracement. Other traders also set a fixed take profit target based on a previous support or resistance level.

This variation of momentum trading however is a very aggressive type, with tight stop losses and exiting trades by trailing the stop loss. Some would even go as far as manually closing the trade as price stalls. But that depends on you, whichever you prefer.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: