Pivot Point is one of the tools that professional traders use to objectively identify potential trading opportunities. It would be a good learning experience for retail traders to learn how to trade based on Pivot Point levels.

There are many ways to trade based on the Pivot Point levels. This strategy just shows one of the many ways to trade it based on a mean reversal trading opportunity.

Pivot Points

The Pivot Point Indicator is a technical analysis tool which is used to determine the overall trend direction or bias of the market as well as the various potential support and resistance levels based on the previous period’s key price levels. For example, a daily pivot point is computed based on the previous day’s price levels, while a weekly pivot point is computed based on the previous week’s key price levels, and so on and so forth.

The Pivot Point Indicator typically plots the main Pivot Point (PP), three Support Levels (S1, S2, and S3), and three Resistance Levels (R1, R2, and R3). Some variations calculate for four support and resistance levels, while others are limited to only two. This version of the Pivot Points used in this strategy plots three support and resistance lines each.

The main Pivot Point (PP) is calculated as the average of the high, low, and close of the prior period. The various support and resistance levels have varying formulas derived from the main Pivot Point line. Below are the various formulas for the support and resistance levels.

- PP = (High + Low + Close) / 3

- R1 = (PP x 2) – Low

- R2 = PP + (High – Low)

- S1 = (PP x 2) – High

- S2 = PP – (High – Low)

Note that the “High” refers to the highest high of the prior period, and the “Low” refers to the lowest low of the prior period. In a Weekly Pivot Point, that would be the highest high and lowest low of the previous week.

The main trend direction or bias is usually based on where price action is in relation to the main Pivot Point line.

However, the farther price action is from the main Pivot Point line, the higher the probability that price would reverse back to its mean, which is the main Pivot Point line, and even swing to the opposite end of the range.

As the name suggests, the Support levels (S1, S2, and S3) may act as support levels where price may reverse from. On the other hand, the Resistance levels (R1, R2, and R3) may also act as resistance levels where bearish reversal signals may develop. However, these levels can also be broken through by strong momentum during momentum breakout scenarios.

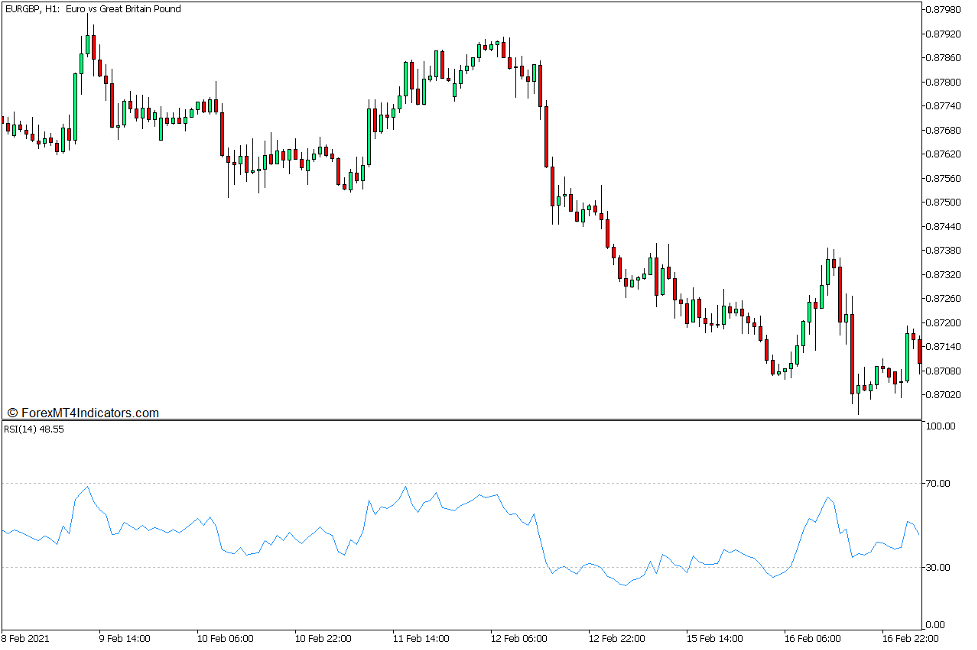

Relative Strength Index

The Relative Strength Index (RSI) is a versatile momentum oscillator which is often used to determine overbought and oversold markets, and its subsequent mean reversal signals. At times, it can also be used to determine trending markets and its trend direction, as well as potential momentum breakouts.

The RSI plots a line which oscillates within the range of zero to 100. This line is derived from the movement of price action. As such, the line it plots also mimics the movements of price action and is characteristically very jagged due to the sudden oscillations of price.

The range of the RSI typically has markers at levels 30 and 70, which are used to determine oversold and overbought markets. An RSI line which is below 30 is indicative of an oversold market, while an RSI line which is above 70 is indicative of an overbought market. Both scenarios are prime conditions for a potential mean reversal.

As mentioned earlier, the RSI can also be used to determine trend and momentum. However, for the purpose of this strategy, we will not delve into these techniques for now.

Trading Strategy Concept

This strategy is a mean reversal strategy which trades on the confluence of a reversal from a Weekly Pivot Point support or resistance level and a mean reversal signal from the RSI.

First, we would have to set the Pivot Point Indicator to identify the Weekly Pivot Point levels. This can be modified within the inputs tab of the indicator settings.

Then, we would be trading this strategy on the 1-hour chart. Timeframes such as the 30-minute and 4-hour chart may also work well.

We then observe price action as it nears a Support or Resistance level based on the Weekly Pivot Points.

At the same time, we should also confirm whether the RSI is overbought or oversold.

If so, we could then trade a mean reversal setup based on the confluence of price action and the RSI line curling back within the 30 to 70 range.

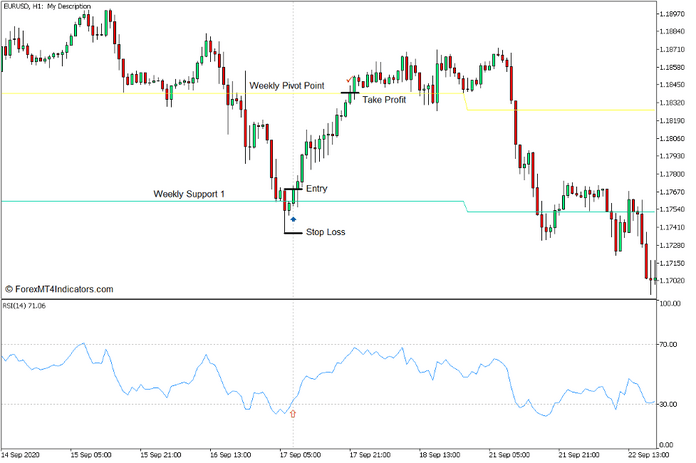

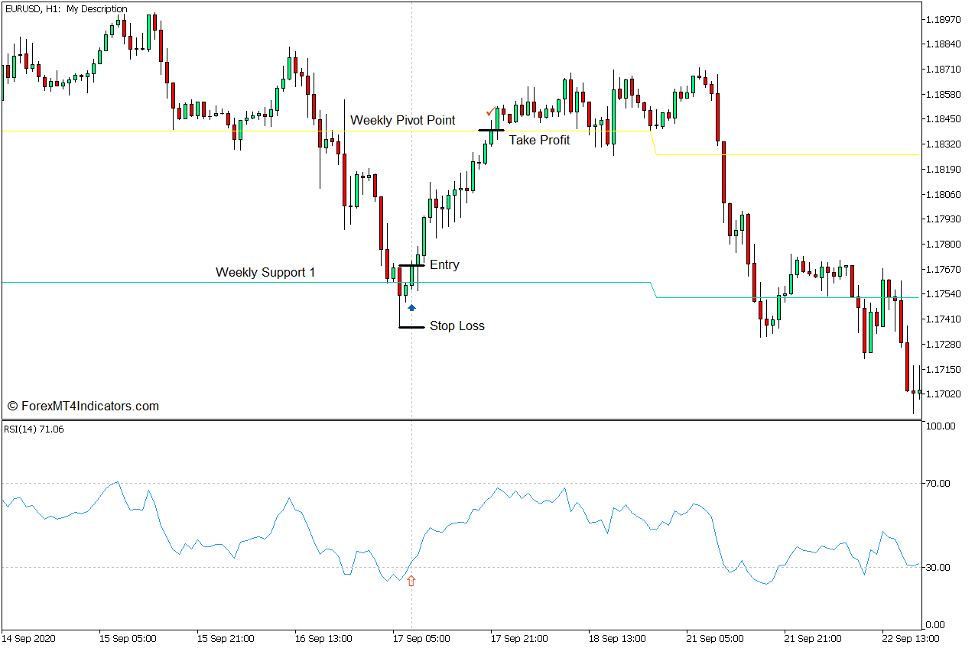

Buy Trade Setup

Entry

- Price should touch a Weekly Pivot Point Support level (S1, S2, or S3).

- The RSI line should be below 30.

- Price action should show signs of a bullish reversal.

- The RSI line should breach back above 30.

- Open a buy order on the confluence of these mean reversal signals.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Set the take profit at the next Weekly Pivot Point level above the entry candle.

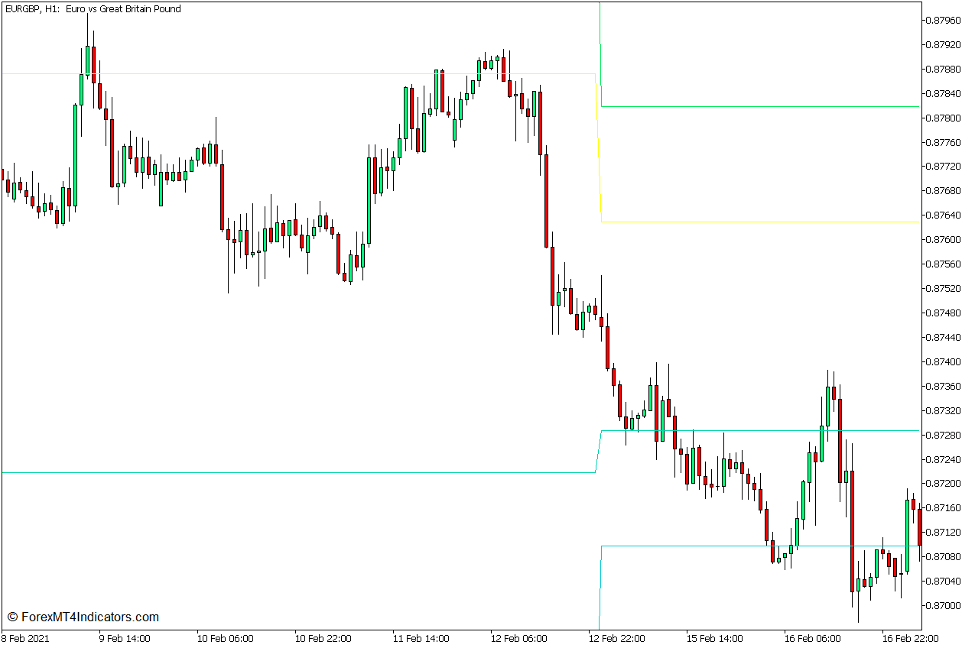

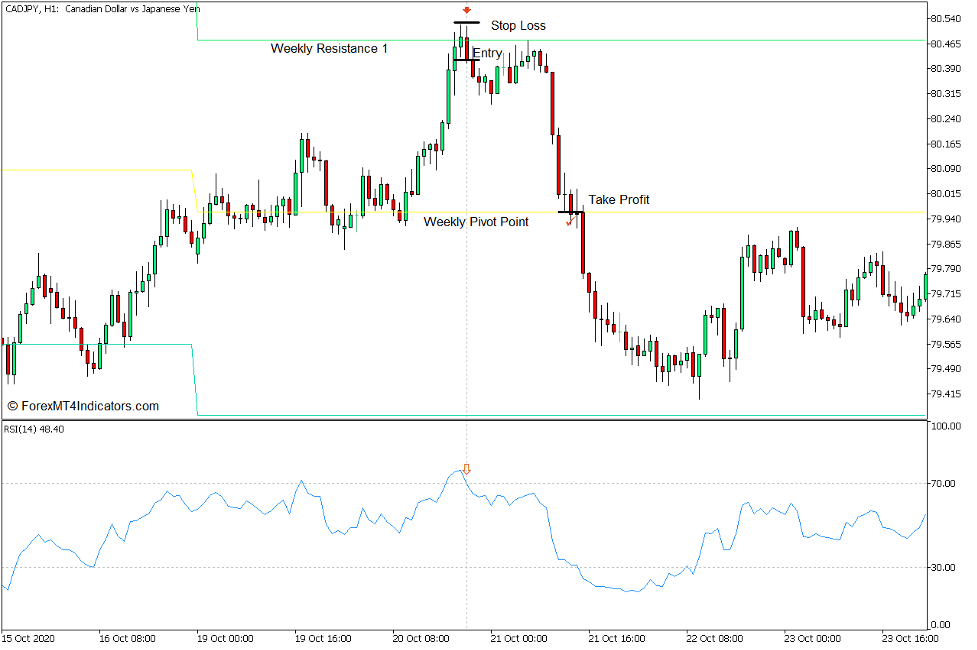

Sell Trade Setup

Entry

- Price should touch a Weekly Pivot Point Resistance level (R1, R2, or R3).

- The RSI line should be above 70.

- Price action should show signs of a bearish reversal.

- The RSI line should drop back below 70.

- Open a sell order on the confluence of these mean reversal signals.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Set the take profit at the next Weekly Pivot Point level below the entry candle.

Conclusion

This trading strategy can be an effective mean reversal strategy. In fact, there are many seasoned traders who trade reversal signals that develop on the Pivot Point support and resistance levels. Trading mean reversals coming from a price spike based on the RSI is also a valid trading strategy, especially when traded in confluence with price action and other technical indications. This strategy simply trades on the confluence of these methods.

Trade setups using this strategy do not come too often. However, they do present viable trading opportunities that has the potential to produce high yields relative to the risk whenever they develop.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: