Trend scalping involves exploiting short-term price fluctuations within an established trend. Traders aim to capture a few pips (the minimum price movement) per trade, accumulating profits through sheer volume. This strategy thrives on high liquidity and market volatility, making major forex pairs like EUR/USD prime candidates.

Why Use MT5 for Trend Scalping?

MT5 caters perfectly to the fast-paced nature of trend scalping. Its customizable interface allows for efficient chart analysis, while one-click trading facilitates the swift execution of orders. Additionally, the platform’s stability and reliability ensure smooth operation during critical trading moments.

Understanding The Trend Scalp Indicator

The Trend Scalp Indicator, often attributed to the work of Mladen Rafajlović (better known as “mladen” in the trading community), is a custom indicator for the MT5 platform. Let’s delve deeper into its functionalities:

Components Of The Trend Scalp Indicator

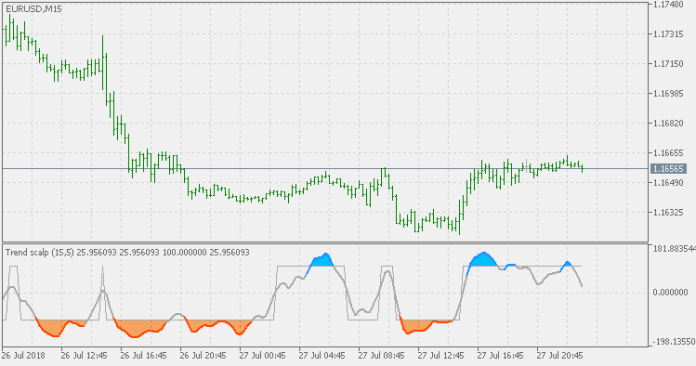

At its core, the Trend Scalp Indicator utilizes a combination of elements to generate buy and sell signals:

- Moving Average Convergence Divergence (MACD): This popular indicator gauges momentum by measuring the difference between two moving averages.

- Overbought/Oversold Levels: The indicator often incorporates horizontal lines to represent potential overbought and oversold zones, aiding in identifying potential trend reversals.

Combining the Indicator with Other Strategies

While the Trend Scalp Indicator offers buy and sell suggestions, it shouldn’t be your sole decision-making tool. Consider incorporating additional technical analysis tools like support and resistance levels or price action confirmation to add context to the indicator’s signals. Remember, successful scalping often hinges on a confluence of factors.

Backtesting and Paper Trading Before Going Live

Before risking real capital, utilize MT5’s backtesting capabilities to evaluate the Trend Scalp Indicator’s performance on historical data. This allows you to assess its effectiveness in different market conditions and refine your trading strategy. Additionally, practice your scalping approach using a demo account (paper trading) to gain experience and build confidence before venturing into live markets.

Advantages and Limitations of the Trend Scalp Indicator

Like any trading tool, the Trend Scalp Indicator has its pros and cons:

Potential Benefits Of Using The Trend Scalp Indicator

- Provides Clear Visual Cues: The indicator simplifies trend identification and potential reversal points through its straightforward presentation.

- Offers Automation: It automates the analysis of potentially relevant technical factors, saving traders valuable time during fast-paced scalping sessions.

- Can Enhance Scalping Strategies: When used in conjunction with other strategies and proper risk management, the Trend Scalp Indicator can potentially bolster a trader’s scalping approach.

Drawbacks and Limitations to Consider

- Prone to False Signals: Market noise and volatility can generate misleading signals, leading to unprofitable trades.

- Overreliance on Indicator: Solely relying on the indicator can hinder the development of a well-rounded trading strategy based on fundamental and technical analysis.

- Requires Skillful Interpretation: Understanding the underlying logic behind the indicator’s signals and interpreting them in the context of the broader market is crucial for successful utilization.

How to Trade with Trend Scalp Indicator

Buy Entry

- Look for the orange line (potentially representing the MACD line) to cross above the zero line.

- Ensure the orange line remains below the overbought level.

- Possible Stop-Loss: Place a stop-loss order below the recent swing low before the buy signal.

- Possible Take-Profit: Consider a take-profit target that aligns with the nearest resistance level or a predetermined profit percentage (e.g., 10 pips).

Sell Entry

- Look for the orange line to cross below the zero line.

- Ensure the orange line remains above the oversold level.

- Possible Stop-Loss: Place a stop-loss order above the recent swing high before the sell signal.

- Possible Take-Profit: Consider a take-profit target that aligns with the nearest support level or a predetermined profit percentage (e.g., 10 pips).

Conclusion

Trend Scalp Indicator can be a valuable tool for active MT5 traders, particularly those interested in exploring trend scalping strategies. However, it’s crucial to understand its limitations and integrate it within a broader trading framework that incorporates risk management, confirmation from other technical indicators, and an awareness of fundamental factors.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: