Traders often drool whenever they see that the market has trended. As traders, we often experience thinking to ourselves, “If I only saw that trend coming.” If only we knew that a market would trend and could move for several hundred pips. If there is one thing we cannot do in trading, that is thinking in hindsight and regretting our decisions. That would only hurt our psyche and our future trades.

Some would rather forgo hunting for those big trending market moves. They would rather settle for small consistent wins, rather chase for something that is quite difficult to catch. There is nothing wrong about that. After all, consistency is what makes a trader profitable.

However, there are also traders who prefer to take the chance and go after these big trending moves. They would aim for several hundreds of pips swing trading and hope they could catch the next big one.

One of the better ways to enter a trade prior to a trend is by trading based on momentum. This is because momentum is often the small push needed by the market in order to start a trend. Think of it as a tugboat pulling a tanker. If a tugboat pulls on the tanker hard enough and get out of the way, chances are that the tanker would continue to move for quite some time. The same is true with the market. One momentum candle or signal could initiate a trend that could last for several days.

Momentum Wave Forex Trading Strategy is a strategy that is initiated by momentum and aims to catch big trends by staying with the trade until the trend stops. It makes use of two momentum indicators that could help us identify the exact entry points prior to the big trending move.

RSI Filter

The RSI Filter is a momentum indicator based on the Relative Strength Index (RSI).

The classic RSI is an oscillating indicator which also helps identify trend, overbought or oversold prices, and momentum.

The classic RSI plots a line that oscillates from 0 to 100. It also has markers at level 70, 50 and 30. If the RSI line stays above 50, the market is in an uptrend, while if the RSI line stays below 50, then the market is in a downtrend. Momentum is identified based on the breaching of the RSI line above 70 or below 30. If the RSI line breaches above 70, then the market is gaining a bullish momentum. If the RSI line drops below 30, then the market is gaining bearish momentum.

The RSI Filter is based on this concept. It plots a positive bar whenever the RSI line breaches above 70 and continues plotting positive bars until the RSI line drops below 50. On the other hand, it would plot a negative bar whenever the RSI line drops below 30 and continues plotting negative bars until the RSI line crosses above 50.

MA Angle Indicator

MA Angle is a trend following technical indicator displayed as an oscillator. It identifies trend direction based on the slope of a moving average line.

One theory for identifying trend direction is by looking at the slope of a moving average line. If the line is sloping up, then the market is in an uptrend. If the line is sloping down, then the market is in a downtrend.

The MA Angle indicator is based on this concept. It identifies the slope of the underlying moving average line by duplicating a moving average line and shifting the duplicate forward. It then computes for the difference between the two moving average lines. If the result is a significant positive number, then it will plot a lime green bar indicating a bullish trend bias. If the result is a significant negative number, it will plot a fire brick bar indicating a bearish trend bias. If the result is insignificant, it will plot a yellow bar indicating a non-trending market.

Trading Strategy

Momentum Wave Forex Trading Strategy anticipates trending market moves initiated by a momentum signal using the confluence of the RSI Filter and the MA Angle.

The MA Angle indicator is used to identify the trend direction bias. Trend bias will be based on whether the bars it plots are lime green or fire brick.

The RSI Filter is used to identify the momentum signal. This will be based on the shifting of the bars from negative to positive or vice versa. Proper signals will be based on the shifting of the bars and not the resumption of prior bars. This is because the shifting of the bars indicate that the RSI line has breached above 70 or dropped below 30.

Trades are taken based on the confluence of the reversal signals coming from the two complementary indicators.

Indicators:

- RSIFilter (default setting)

- MAAngle (default setting)

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

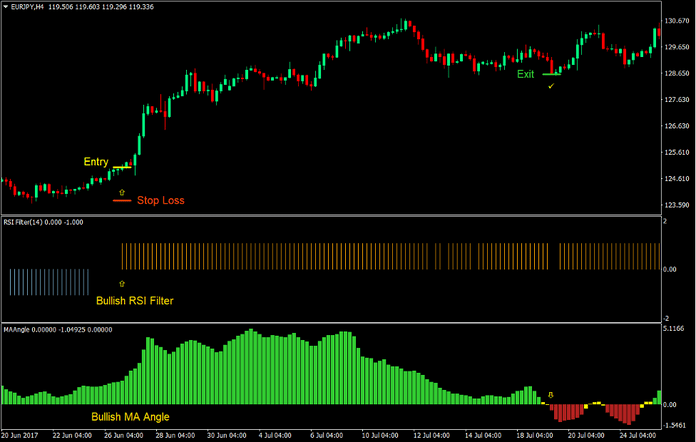

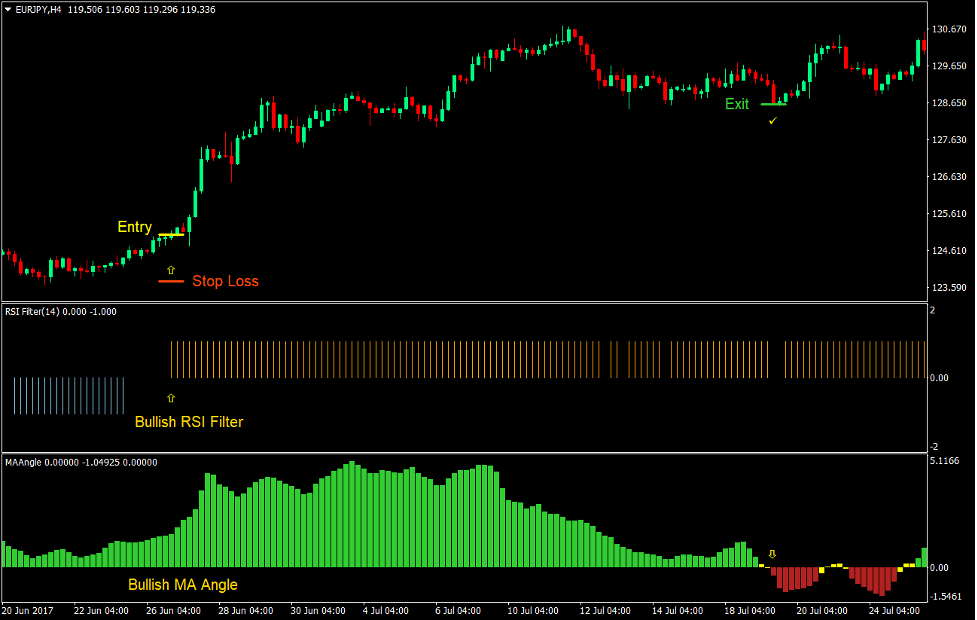

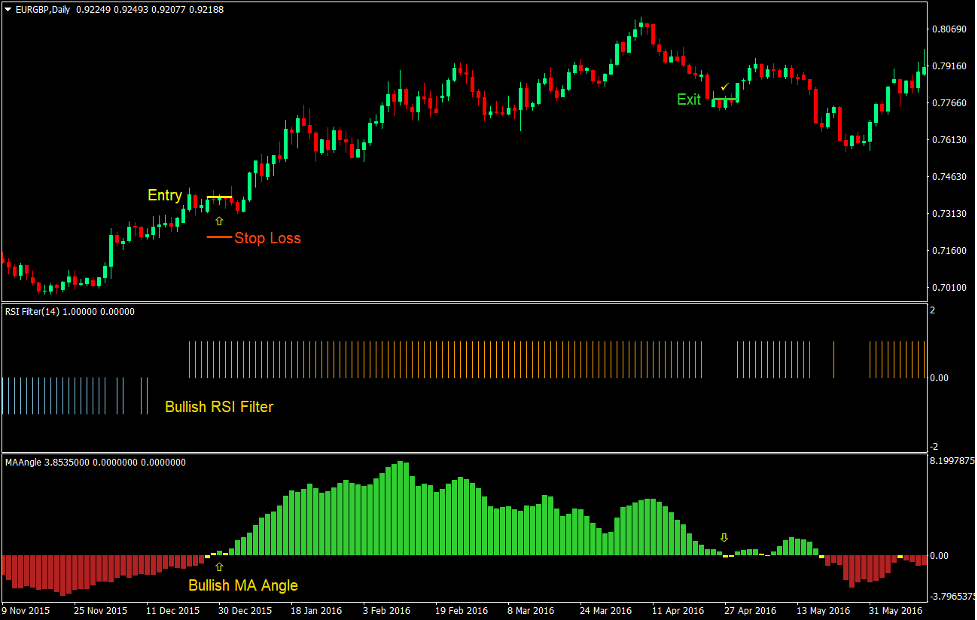

Buy Trade Setup

Entry

- The MA Angle indicator should start to print lime green bars.

- The RSI Filter indicator should print a positive bar.

- Price action should breach above the previous highs.

- Enter a buy order on the confluence of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the MA Angle indicator prints a negative bar.

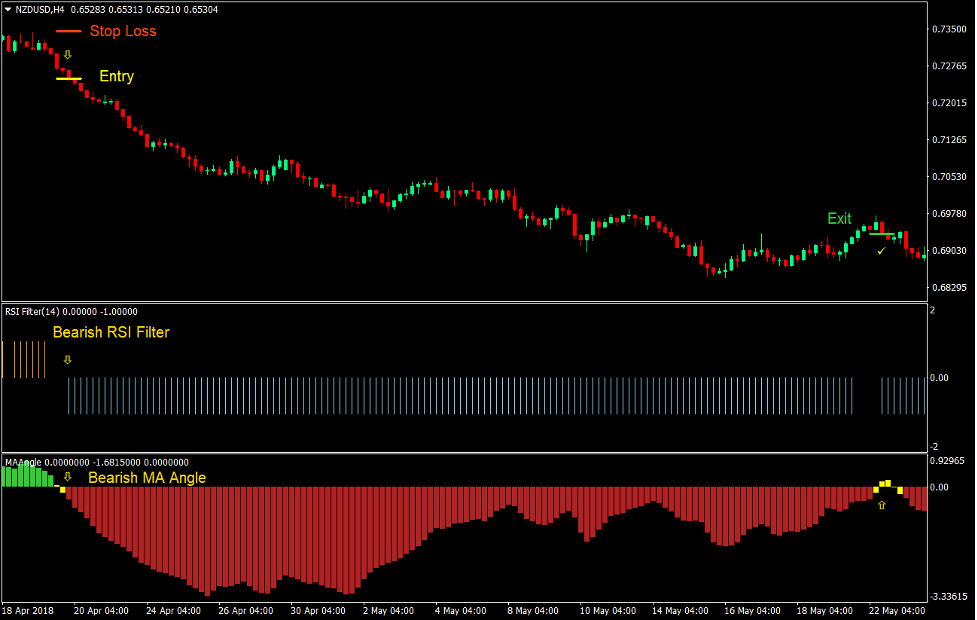

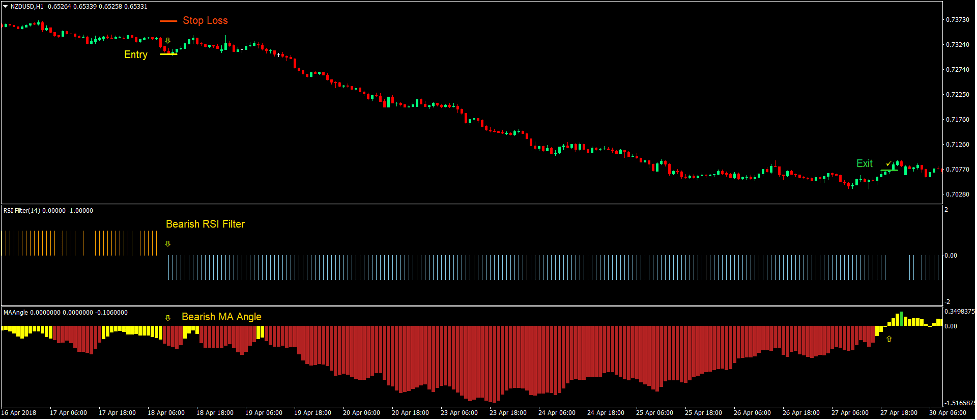

Sell Trade Setup

Entry

- The MA Angle indicator should start to print fire brick bars.

- The RSI Filter indicator should print a negative bar.

- Price action should drop below the previous lows.

- Enter a sell order on the confluence of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the MA Angle indicator prints a positive bar.

Conclusion

This trading strategy works well for traders who are aiming for big yields. However, this strategy is also a high risk and high reward strategy. Trade setups would not always be big winners. There will be small wins and losses every now and then. However, there will also be trades that would produce huge yields. These are the type of trades that would make traders very profitable using this strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: