Lazy Trade Forex Trading Strategy – Version 1

Many people want to dip their feet into trading. However, due to different circumstances, many are hindered to do so. Some are hindered due to time constraints. They may have a full-time job and would just want to do trading on the side. Some still don’t have enough experience and screen time under their belt to be confident enough to start trading. Others just can’t wrap their minds around the art of reading charts and price action.

You may be one of the above. It is not something to be ashamed of. Everybody starts at this level.

However, even though you are still at this level, there are strategies that you could start with that are simple, easy to follow, and doesn’t take up much of your time to do the analysis of all the charts you are trading. This strategy is designed for those who want to trade but don’t have all the time to spend analyzing charts.

To start with, we will be using only two indicators for this strategy. One is the 200 Exponential Moving Average (EMA). The 200 EMA is used by many traders to indicate the long-term trend and directional bias of the market. It is the last line of defense and is usually one of the most respected moving averages in the market. May traders consider this as a strong barrier which price would usually find a bit tougher and longer to breakthrough. With this said, it would be quite foolish to be trading against it. Yes, there are traders who make money trading mean reversions when price is away from the 200 EMA, but you can’t expect the same amount of room for price to run through as with trades that are traded with the trend. This will be our directional filter. We will only take buy trades if price is above the 200 EMA and sell trades if price is below it.

Another indicator that we will be using will be the Heiken Ashi Smoothed indicator. It is a candlestick indicator that points out if the short-term trend direction is about to change. If you are familiar with the classic Heiken Ashi candles, kindly clear all your thoughts about Heiken Ashi candles. The Heiken Ashi Smoothed indicator is far different from the classic Heiken Ashi candles. While the classic Heiken Ashi candles are candlesticks that show highs and lows and indicate trend through their color, Heiken Ashi Smoothed is actually based on EMAs of the high, low, and close of the candles. It doesn’t show the actual price, the high, low, or close. It doesn’t show price action. All it gives you is a clear short-term trend bias indication. The only similarity it has with the classic Heiken Ashi candles is that they both use color to indicate trend.

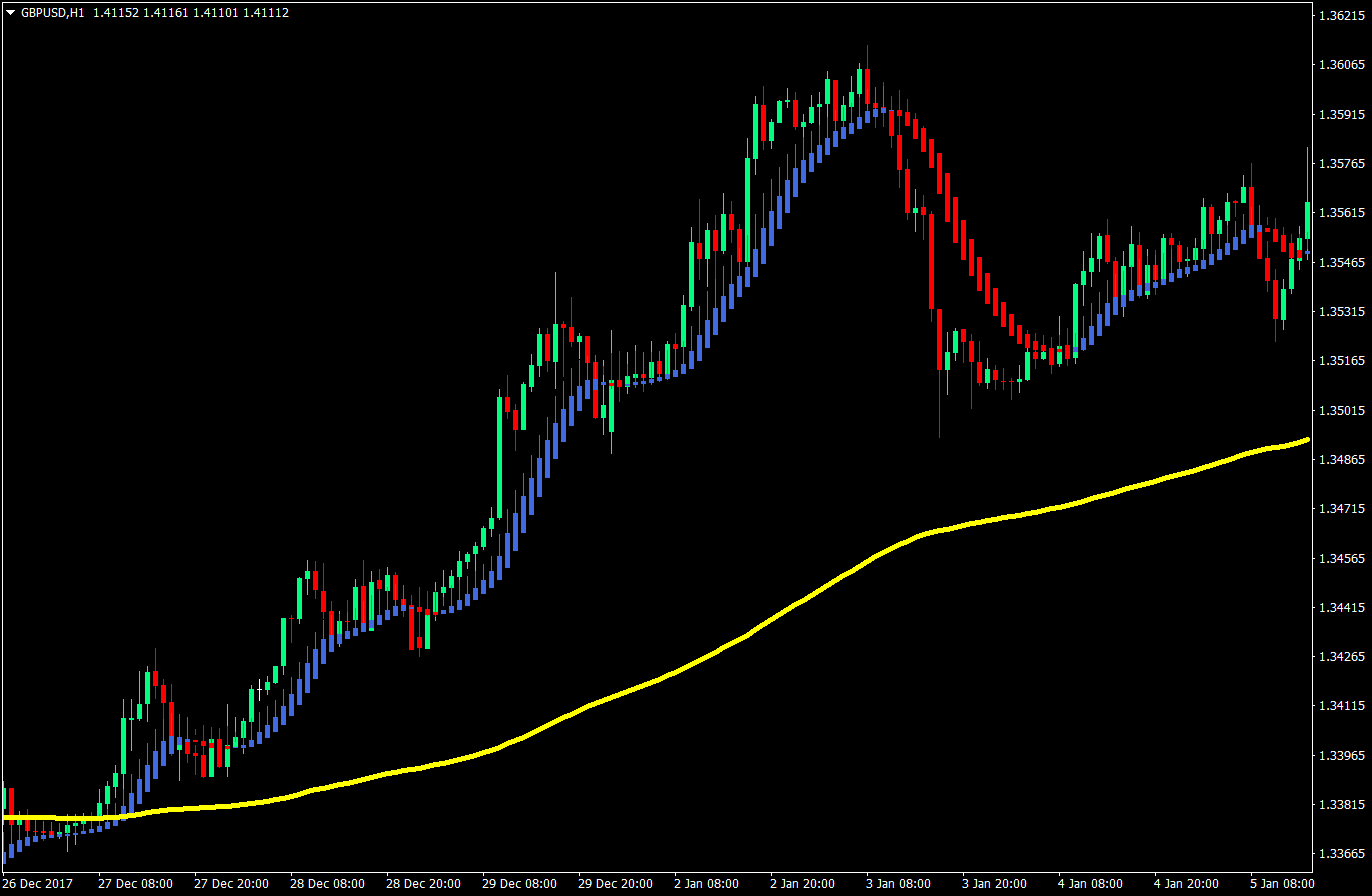

Let me show you how your chart would look like with the 200 EMA and the Heiken Ashi Smoothed on it.

The yellow line represents our 200 EMA.

On the Heiken Ashi Smoothed indicator, blue candles represent a short-term bullish trend bias. Red candles on the other hand represent a short-term bearish trend bias.

Those who have trading experience might be drooling right now seeing how clear the trend is with the Heiken Ashi Smoothed. This clarity of trend direction will be our bread and butter.

The Setup: The Lazy Trade Ver. 1 Setup

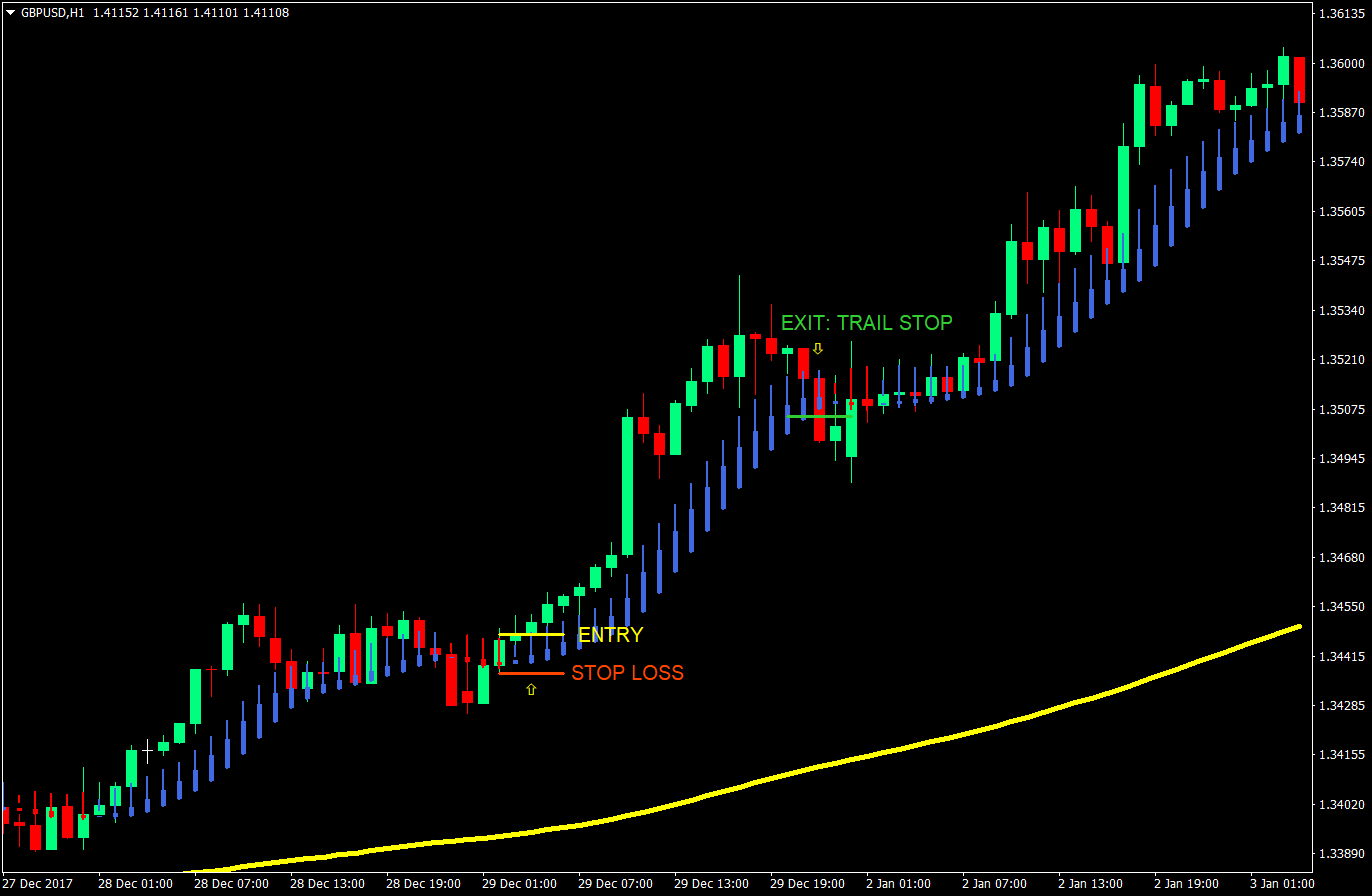

Buy Entry:

- Price should be above the 200 EMA

- Enter the trade on the close of the candle corresponding to the first blue Heiken Ashi Smoothed candle. This will also correspond to the open of the second blue Heiken Ashi Smoothed candle.

Stop Loss: Stop loss should be a few pips below the Heiken Ashi Smoothed candle.

Exit:

- Trail the stop loss a few pips below the Heiken Ashi Smoothed indicator.

- Or close the trade as soon as the Heiken Ashi Smoothed candle turns red.

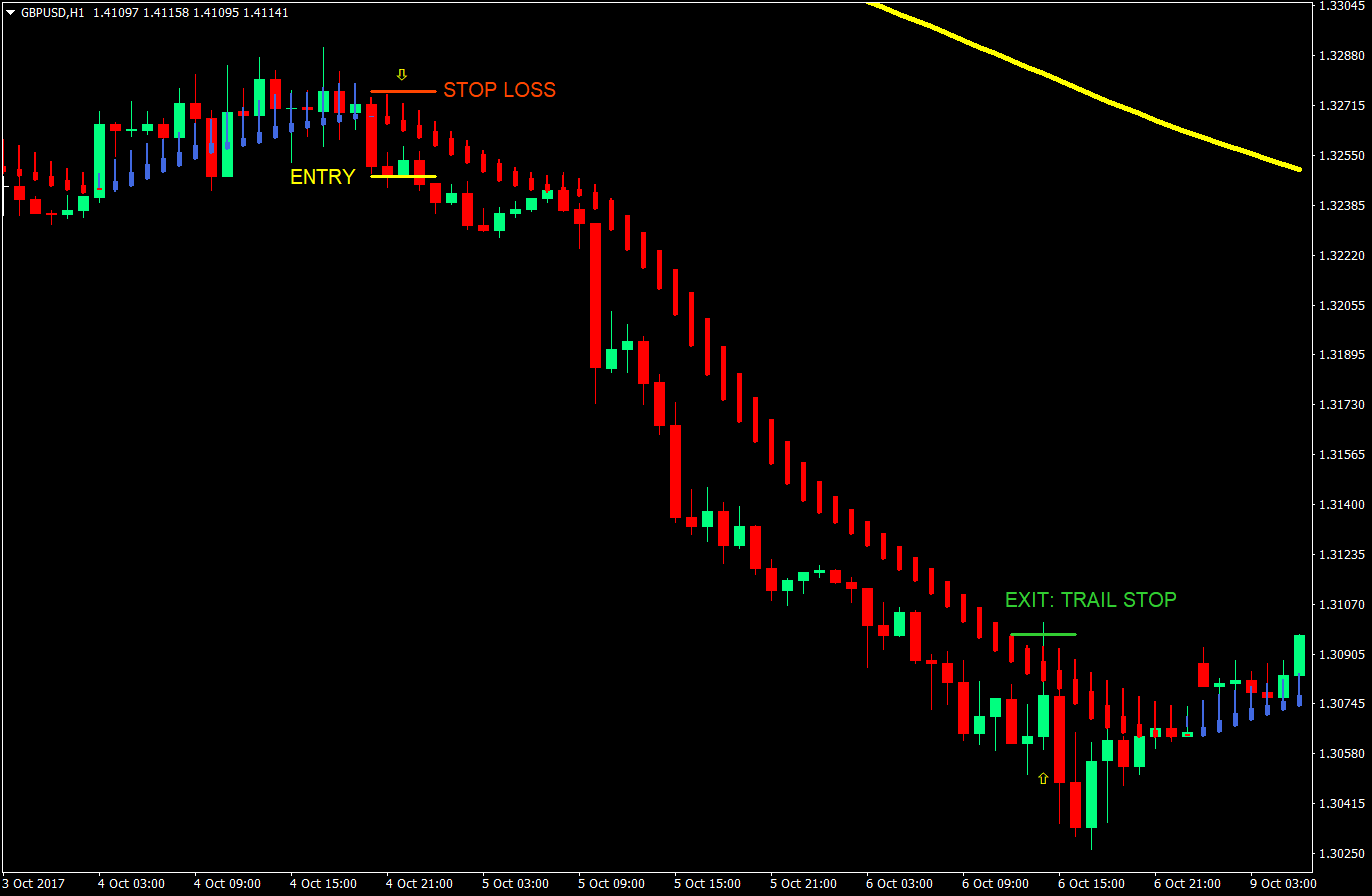

Sell Entry:

- Price should be below the 200 EMA

- Enter the trade on the close of the candle corresponding to the first red Heiken Ashi Smoothed candle. This will also correspond to the open of the second red Heiken Ashi Smoothed candle.

Stop Loss: Stop loss should be a few pips above the Heiken Ashi Smoothed candle.

Exit:

- Trail the stop loss a few pips above the Heiken Ashi Smoothed indicator.

- Or close the trade as soon as the Heiken Ashi Smoothed candle turns blue.

Conclusion

This strategy is an excellent strategy that you could use if you’d want a simple, no fuss, indicator-based strategy.

This excels in catching trends as they begin, and not just catching a trend, but a big chunk of the trend. It also allows traders to re-enter a trend if they get shaken off a trade due to premature hitting of a stop loss or out of fear due to some minor retracements.

Given that the Heiken Ashi Smoothed indicator is based on exponential moving averages, you could also consider this strategy a short-term moving average crossover strategy based on EMAs. But this one has an advantage over the regular crossover strategies, since EMAs are usually smoother than SMAs, thus making the trend clearer. On top of that, the 200 EMA filter also filters out entries that are going against the long-term trend.

This strategy works well in a trending environment, or a market that has just begun to trend. However, it could also cause losses on markets that are overbought or oversold. It also wouldn’t work in markets that are choppy or is in a range.

Overall, this simple strategy could bring you profits if used wisely on trending markets.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: