Reversal trades are some of the most difficult trades to correctly time. This is because reversal trades are often trades taken against an established trend or momentum direction. One way to increase the likelihood of timing a reversal trade correctly is by trading on a confluence of reversal signals.

This strategy is a simple trading strategy which trades on a confluence of momentum and trend reversal indications.

HL Cross for WPR Indicator

The HL Cross for WPR Indicator is a custom trend following strategy which is derived from the Williams Percentage Range (WPR) Indicator and the Heiken Ashi Indicator.

The Williams Percentage Range Indicator is an oscillator type of technical indicator which is used to indicate overbought and oversold price levels as well as its corresponding mean reversals. It calculates for the Williams Percentage Range line based on the difference between the highest high of price and the close of price divided by the difference between the highest high of price and the lowest low of price. This is set over n periods which is usually at 14 periods. This creates a line which oscillates within the range of -100 and 0 with markers at levels -80 and -20. WPR lines breaching above -20 indicates an overbought market, while WPR lines dropping below -80 indicates an oversold market. The HL Cross for WPR derives its trend reversal signals based on the crossing of the WPR line over the -50 threshold. A cross above -50 indicates a bullish trend reversal, while a cross below -50 indicates a bearish trend reversal.

The second indicator which this indicator is derived from is the Heiken Ashi Indicator. The Heiken Ashi Indicator modifies the open and close of the traditional Japanese Candlesticks based on the average price movements.

The HL Cross for WPR Indicator identifies trend reversals based on the confluence of the two indicators above.

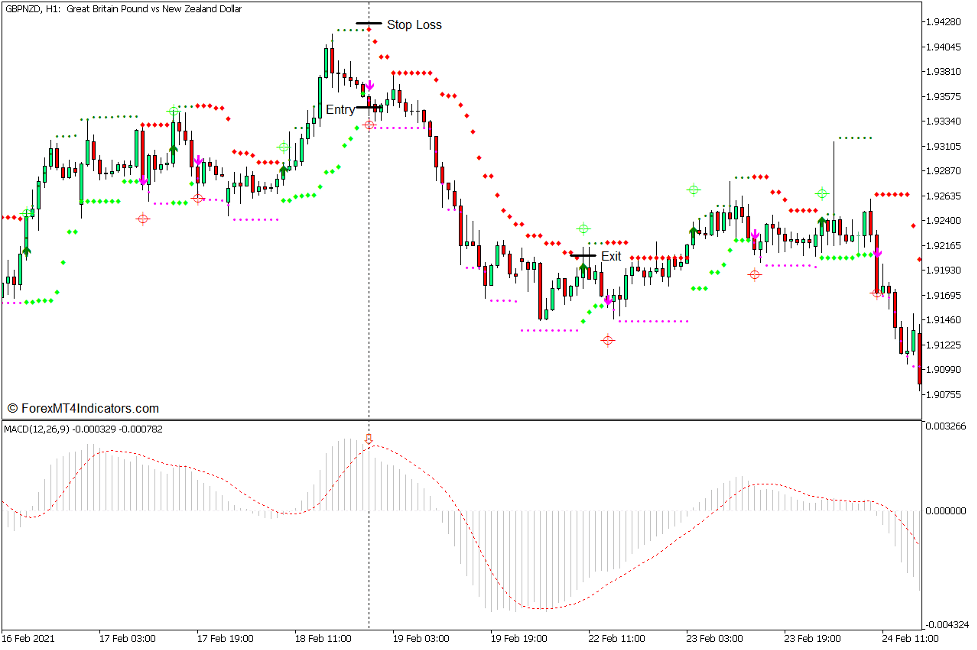

The HL Cross for WPR Indicator plots diamonds and arrows to indicate the trend direction. This indicator plots an arrow pointing up to indicate a bullish trend reversal and then plots lime diamonds to indicate the ideal stop loss levels for a buy trade. Inversely, it also plots an arrow pointing down to indicate a bearish trend reversal and then plots red diamonds to indicate the ideal stop loss levels for a sell trade.

Traders can use the arrows as a trend reversal entry signal and the diamonds as a trailing stop loss placement.

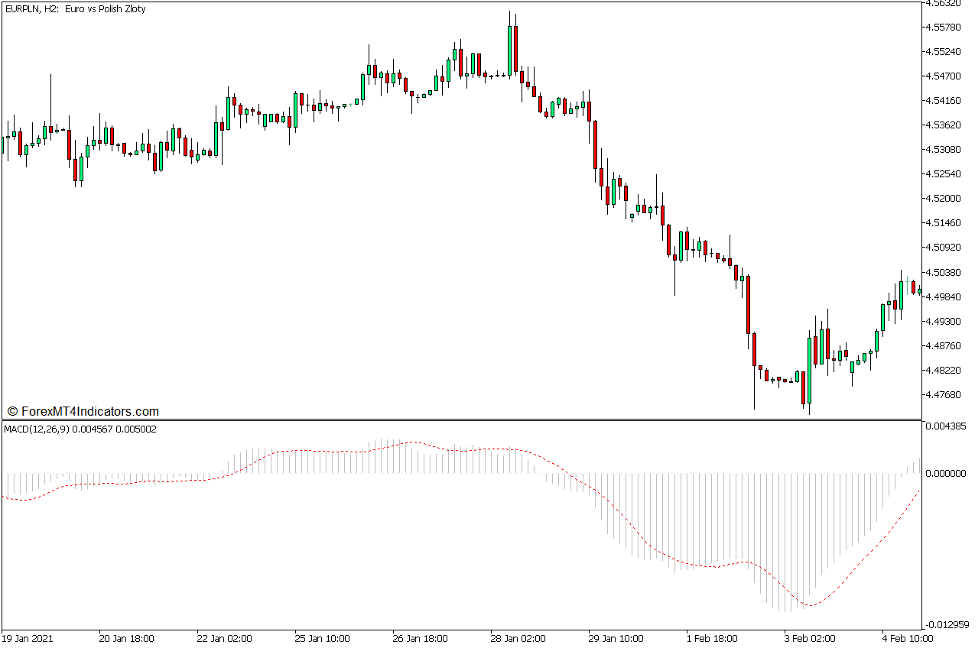

Moving Average Convergence and Divergence

The Moving Average Convergence and Divergence Indicator, more popularly known as the MACD, is a classic momentum oscillator which is based on the crossing over of moving averages.

The MACD calculates for the difference between a fast moving Exponential Moving Average (EMA) and slow moving EMA. It then plots the difference as histogram bars called the MACD bars. It also plots a signal line which is derived from the MACD bars. The signal line is basically a Simple Moving Average (SMA) line calculated from the MACD bars.

The fast moving EMA line is usually set at a 12-bar period, while the slow EMA line is usually set as a 26-bar period. The signal line on the other hand is usually set on a 9 period calculation. However, these variables can be modified to suit the trader’s strategy.

Positive MACD bars typically indicate a bullish trend direction, while negative MACD bars indicate a bearish trend direction. However, MACD bars that are extremely overextended from its midpoint, which is zero has a very high probability for a reversal. Crossovers between the MACD bars and the signal line indicate a momentum reversal. MACD bars crossing above the signal line indicate a bullish momentum reversal, while MACD bars crossing below the signal line indicate a bearish momentum reversal. Crossovers from an overextended level tend to be a high probability reversal signal.

Aside from being a trend and momentum indicator, the MACD can also be used as a basis for identifying divergences. Divergences between price action and the MACD tend to be a high probability reversal indication.

Trading Strategy Concept

This trading strategy is a simple reversal trading strategy which combines the HL Cross for WPR trend reversal signal with the MACD momentum reversal signals.

On the HL Cross for WPR Indicator, the appearance of the arrows will be used as the entry signal, while the diamond markers will be used as a trailing stop loss level.

On the MACD, crossovers between the MACD bars and the signal line coming from opposite of the midpoint, which is zero, would be used as the momentum reversal signal.

Confluences between these two reversal signals would be used as the reversal trade setup.

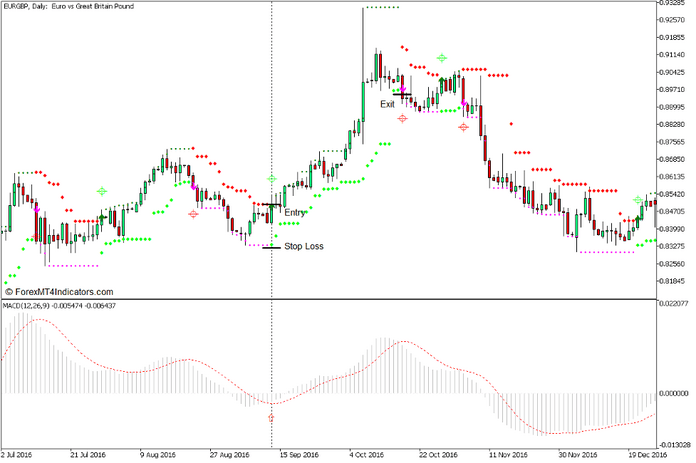

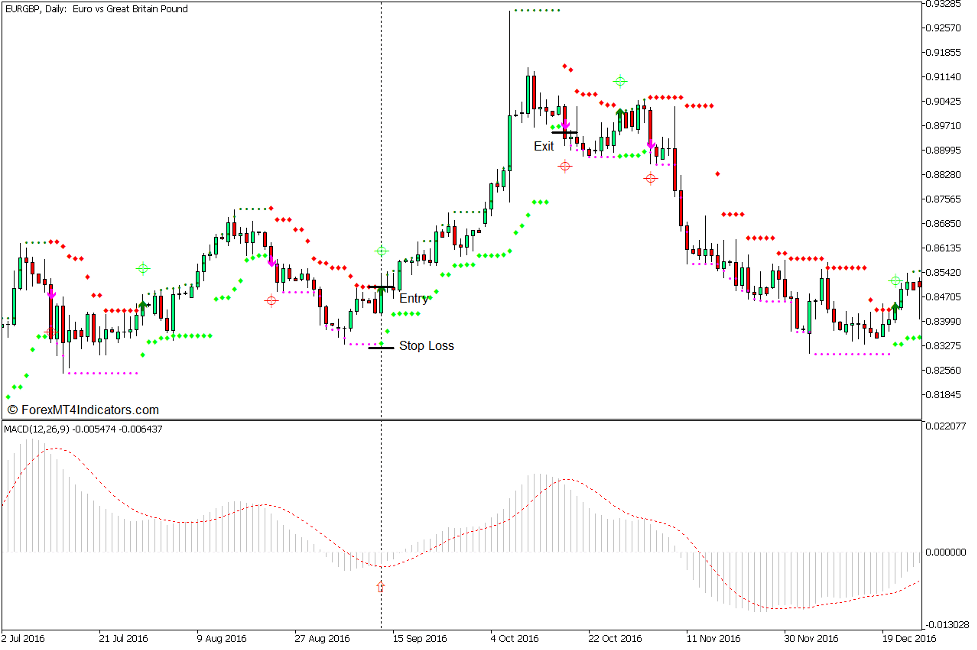

Buy Trade Setup

Entry

- The MACD bars should start from below zero.

- The MACD bars should cross above the signal line indicating a bullish momentum reversal.

- The HL Cross for WPR Indicator should plot an arrow pointing up indicating a bullish trend reversal.

- Open a buy order on the confluence of these bullish reversal signals.

Stop Loss

- Set the stop loss below the lime diamond symbol.

Exit

- Trail the stop loss below the lime diamond symbols formed until stopped out in profit.

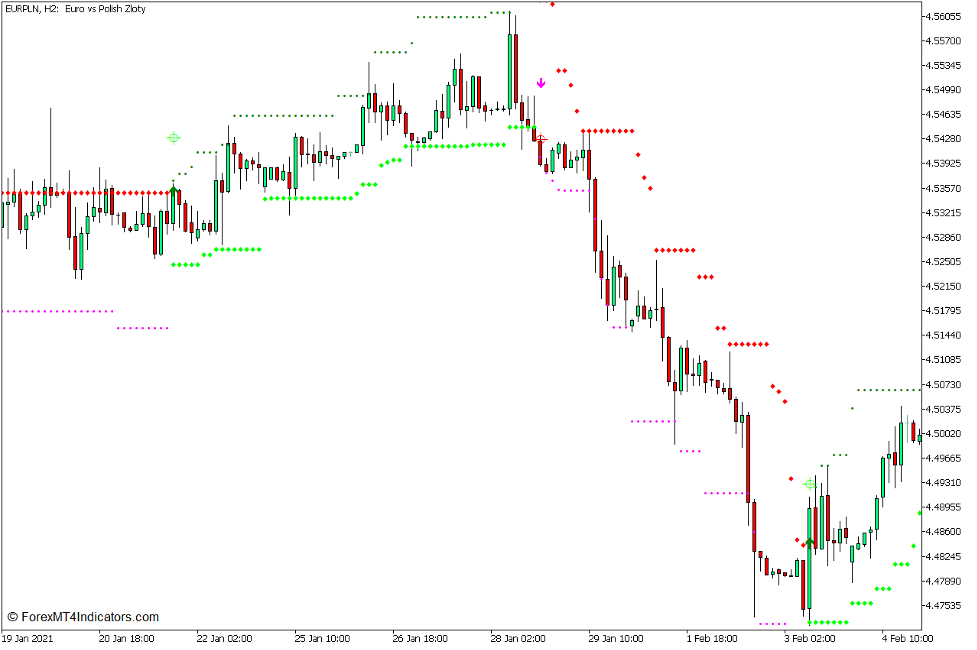

Sell Trade Setup

Entry

- The MACD bars should start from above zero.

- The MACD bars should cross below the signal line indicating a bearish momentum reversal.

- The HL Cross for WPR Indicator should plot an arrow pointing down indicating a bearish trend reversal.

- Open a sell order on the confluence of these bearish reversal signals.

Stop Loss

- Set the stop loss above the red diamond symbol.

Exit

- Trail the stop loss above the red diamond symbols formed until stopped out in profit.

Conclusion

This trading strategy is a decent reversal trading strategy with the potential to produce trades with positive risk reward ratios based on the risk placed on the stop loss. However, this strategy does not work well in choppy ranging market conditions. It is best to use this strategy in a market scenario which has the potential to move with strong momentum. This can be scenarios which are in confluence with a possible momentum breakout or a reversal from a major support or resistance level.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: