Trading may seem complicated most of the time. If we would open up a random chart and look at what the market is doing, chances are we would not know what the market is up to. That is because we are looking at things on the micro level. We are too zoomed in to what is happening on the short-term, we forget looking at the bigger picture.

If you would zoom out your trading chart you might be seeing a different picture. You would most likely notice that the market is moving in waves. You would notice how the market is oscillating in the direction of the trend. You would see the big picture and notice long-term trend lines. However, all this comes with experience. It takes time and practice in order to train your eyes to see things that other traders could not see.

Although it may seem difficult for new traders to anticipate what the market is doing, there are ways around this. There are tools that could help traders identify the trend and the general direction of the oscillations of price. There are tools that could help traders anticipate where trends may reverse and start a new trend.

Elliott Wave Forex Trading Strategy is a strategy that makes use of reliable indicators in order to identify trend direction and reversals. These indicators are based on trusted and proven theories that could help traders trade with the trend.

Elliott Wave Oscillator

The Elliott Wave Oscillator is a momentum indicator that helps identify trend direction. The idea behind this indicator is to create a simple oscillating indicator that could help identify trend waves just as naked chart price action traders would identify waves based on the Elliott Wave Theory.

The Elliott Wave Theory proposes that trends in the market are based on the psychology of market participants and the shifting of their sentiments. As such, because psychology could somehow be predicted although vaguely, price movements could also be predicted.

Price movements form waves and these waves would usually follow recurring patterns. Traders who understand this phenomenon would trade according to the flow of these patterns.

Elliott Wave Oscillator attempts to identify trend and wave direction by identifying the difference between a 5-period Simple Moving Average (SMA) and a 34-period Simple Moving Average (SMA). The results are then plotted as histogram bars. Positive bars indicate a positive trend while negative bars indicate a negative trend.

SMMA Crossover Signal

SMMA Crossover Signal is a trend following indicator based on a pair of Smoothed Moving Averages (SMMA).

The SMMA is a moving average which aims to reduce noise rather than lag. It assigns lesser weight on older historical prices in order to reduce its effect on the moving average line. This results in a moving average line that is less susceptible to noise.

The SMMA Crossover Signal indicator provides trade signals based on the crossover of two short-term moving average lines. It indicates buy signals by placing an arrow on the price chart that is pointing up. On the other hand, it indicates sell signals by placing arrows that are pointing down.

Trading Strategy

This strategy provides trade signals based on the confluence of trade signals coming from the Elliott Wave Oscillator and the SMMA Crossover Signal. Because the two indicators are based on a crossover of moving averages, in effect this strategy trades on a confluence of trend reversal signals coming from crossovers.

Trades should be taken if there are signals coming from the two indicators that occur quite closely. However, not all trade signals with confluences should be taken. Trades should only be taken if the trade signal produced is in confluence with a momentum candle. This ensures that momentum is behind the trend reversal, which increases the likelihood of a profitable trade setup.

Indicators:

- SMMA-Crossover_Signal (default setting)

- Elliott Wave Oscillator (default setting)

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

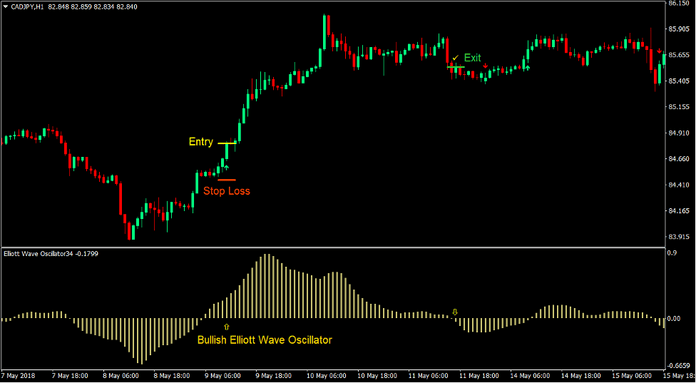

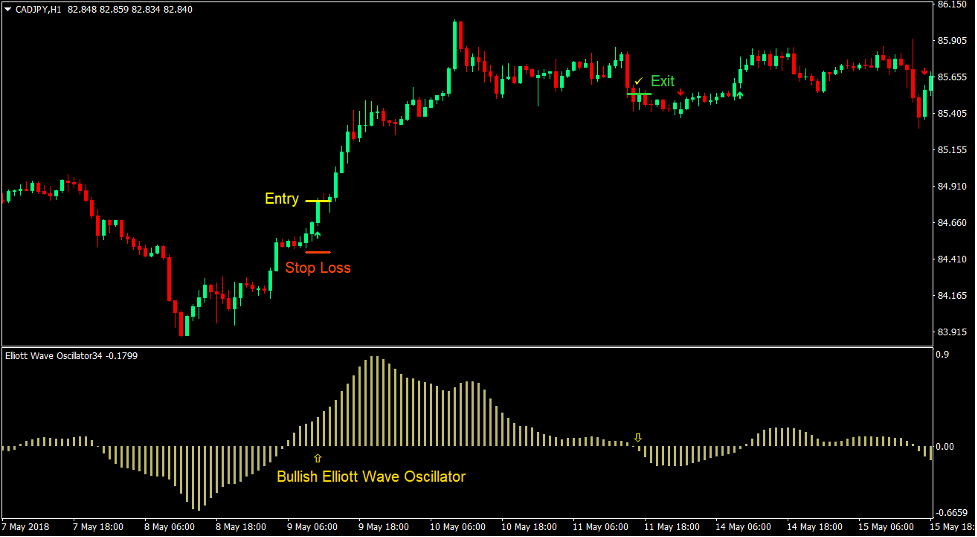

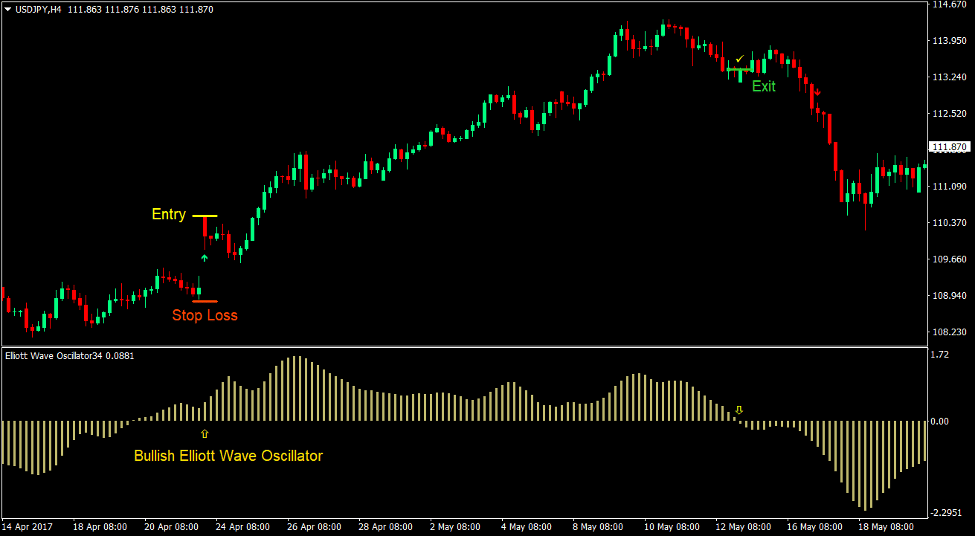

Buy Trade Setup

Entry

- The Elliott Wave Oscillator should start printing positive bars.

- The SMMA Crossover Signal indicator should print an arrow pointing up.

- These signals should be closely aligned.

- The buy signal should be in confluence with a bullish momentum candle.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Elliott Wave Oscillator prints a negative bar.

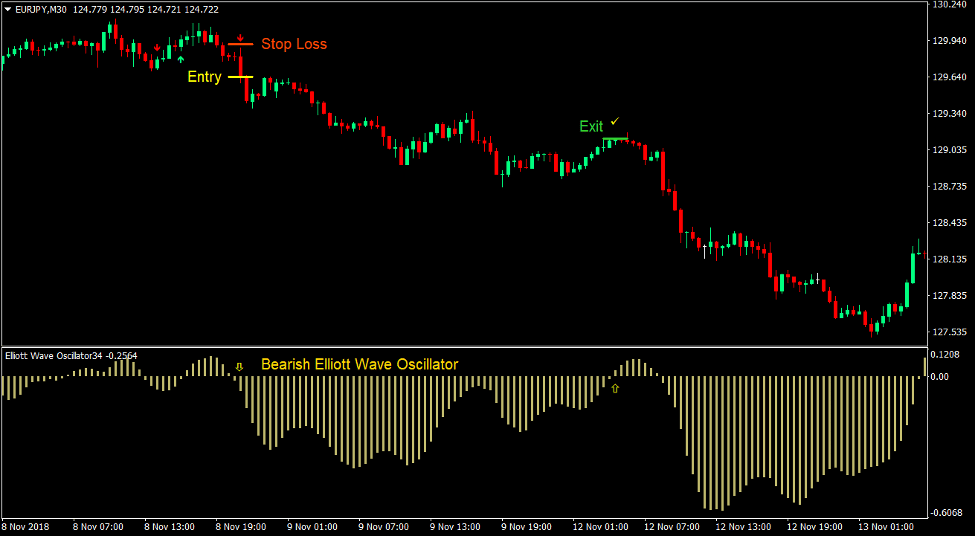

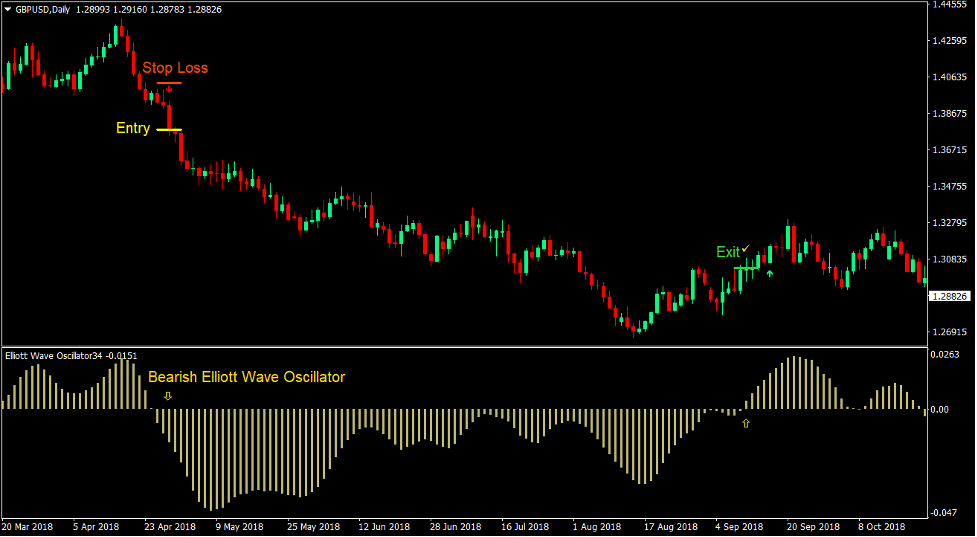

Sell Trade Setup

Entry

- The Elliott Wave Oscillator should start printing negative bars.

- The SMMA Crossover Signal indicator should print an arrow pointing down.

- These signals should be closely aligned.

- The sell signal should be in confluence with a bearish momentum candle.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Elliott Wave Oscillator prints a positive bar.

Conclusion

This strategy is a classic trend reversal strategy. However, instead of using the traditional moving average lines to identify crossover trend reversal signals, this strategy simplifies the process by using indicators.

Like most trend reversal strategies, this strategy banks on high yielding trades to earn profits. It also aims to take high probability trade setups by trading only signals that are in confluence with a momentum candle. This results in a high yield trading strategy with a relatively higher win rate compared to regular crossover strategies.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: