Traders often look for strategies that are highly accurate. As traders, we would want to be making money in most of our trades. If possible, we would even want a strategy that would allow us to make money in all our trades. While there are trading strategies that allow for an extremely high win rate, it also usually follows that the reward-risk ratio would suffer a bit in exchange for the high win rate.

However, there are traders who take the different approach. They are fine with a slightly worse win rate as long as they have great reward-risk ratios. In fact, most traders trade like this. Most traders would make money less than 50% of the time, but when they do profit from a trade, they would earn two or three times than what they usually lose.

Breakout strategies are often the kind of strategies that allow for an extremely high reward-risk ratio. This is because breakout strategies imply that after breaking out a level of support or resistance, there is little resistance left to hinder the progress of the trade.

CMO Heiken Ashi Breakout Forex Trading Strategy is a type of breakout strategy that allows for great reward-risk ratios. It allows trades to profit around three times more than the risk place on the stop loss. It uses two technical indicators to identify and confirm a breakout which has caused momentum to shift.

Heiken Ashi Candlesticks

Traditional Japanese candlesticks have become the norm. It is probably the most popularly used type of charting used among traders. This is because Japanese candlesticks simplify everything. It allows traders to see the whole picture based on the bars.

Heiken Ashi Candlesticks is another form of charting developed by the Japanese. Heiken Ashi simply means “average bars” in Japanese. It still creates candlesticks to represent the movement of price, however it also takes into account the average movement of price.

The Heiken Ashi Candlesticks is an indicator that modifies the open and close of the bar in order to represent the average movement of price. The highs and lows of the candle remain the same. This creates a candlestick that allows traders to see price action based on the highs and lows of each candle while at the same time causing the color of the candlestick to change only when the average price movement has reversed.

CMO Indicator

CMO or Chande Momentum Oscillator is a technical momentum indicator developed to identify the direction or movement of price.

It is calculated by looking for the difference between the sum of all recent higher closes and the sum of all the recent lower closes. The difference is then divided by the sum of all price movement over a given period. The result is then multiplied by 100 to normalize the figures within the range of -100 to 100.

The CMO is displayed as an oscillator plotted in its own indicator window. It is plotted as a line that moves within the range of -100 to 100. It also has markers at -50, 0 and 50. CMO lines piercing beyond -50 and 50 could indicate an overextended market price, which may imply a possible trend reversal. Positive CMO lines generally indicate a bullish trend bias, while negative CMO lines generally indicate a bearish trend bias.

Trading Strategy

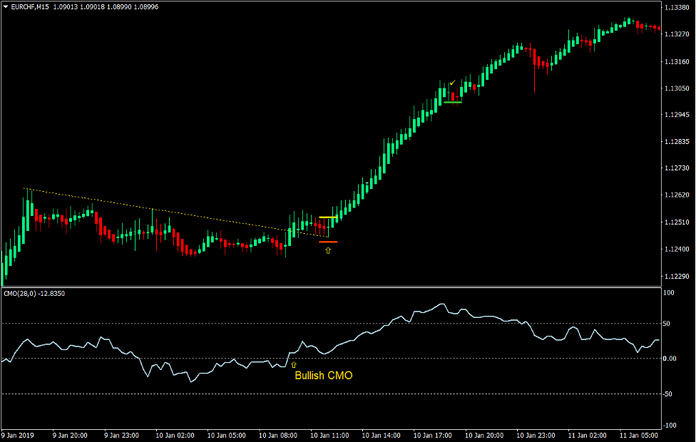

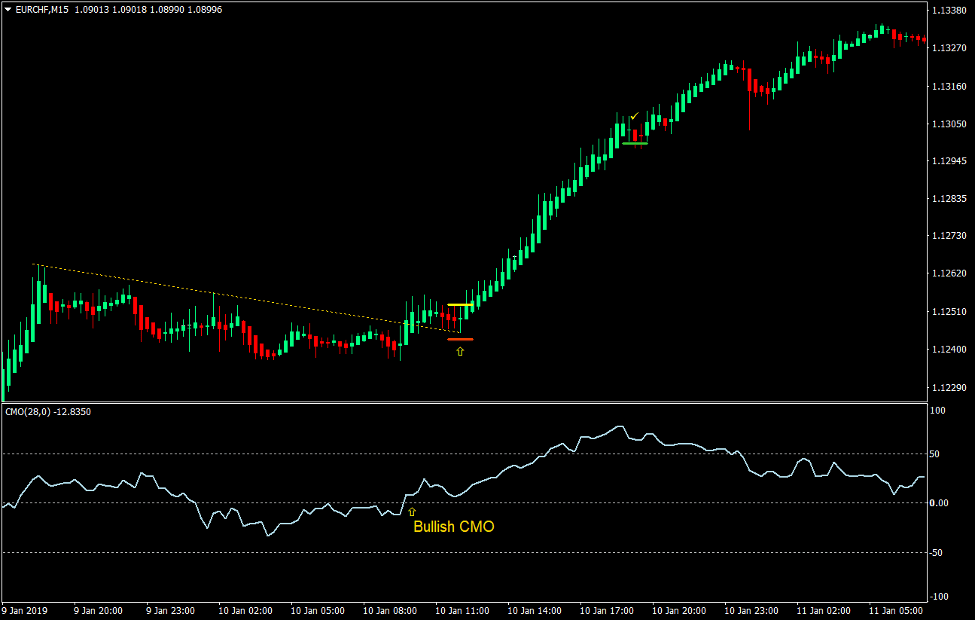

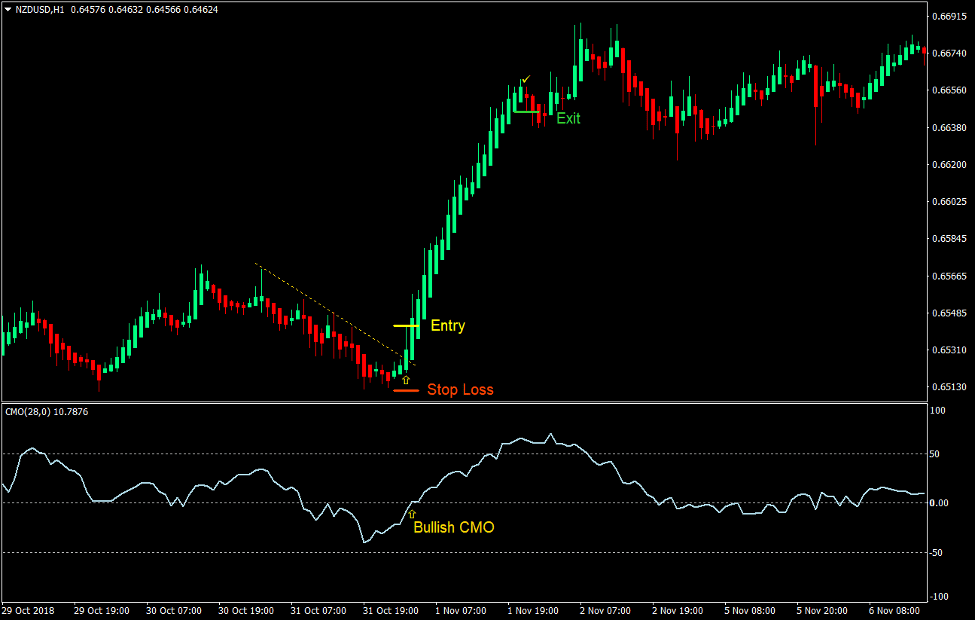

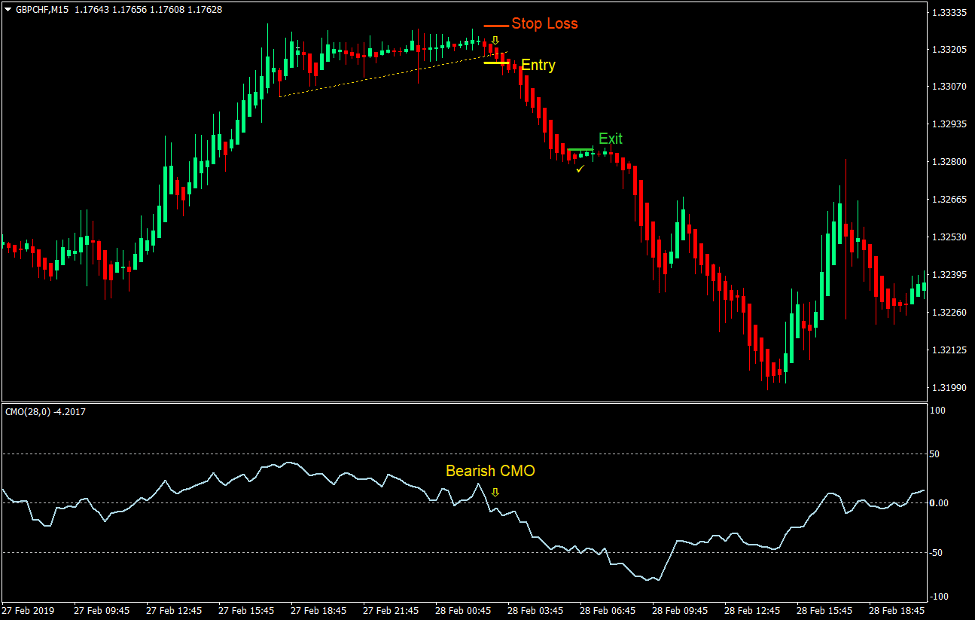

This breakout strategy trades on breakouts coming from diagonal supports and resistances. It uses the Heiken Ashi Candlesticks and the CMO indicator to confirm the momentum of the breakout.

To trade this strategy, traders should first identify a diagonal support or resistance line in a market contraction phase. We then wait for price to breakout of the support or resistance line with strong momentum.

The CMO indicator should then confirm the momentum shift based on the crossing over of the CMO line over its midline.

The Heiken Ashi Candlesticks should confirm the breakout based on the color of the breakout candle.

Then, we place a stop entry order on the high or low of the Heiken Ashi Candlestick on the breakout pattern. Momentum is confirmed by price breaking the high or low of the Heiken Ashi Candlestick. By then, the stop entry order would have been triggered.

Indicators:

- Heiken Ashi

- CMO_v1

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

Entry

- A diagonal resistance line should be identified.

- Price should break above the diagonal resistance line.

- The Heiken Ashi Candlestick should be spring green.

- The CMO line should cross above zero.

- Place a buy stop order on the high of the Heiken Ashi Candlestick

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Trail the stop loss two Heiken Ashi Candlestick behind the current bar until stopped out in profit.

- Close the trade as soon as the Heiken Ashi Candlestick changes to red.

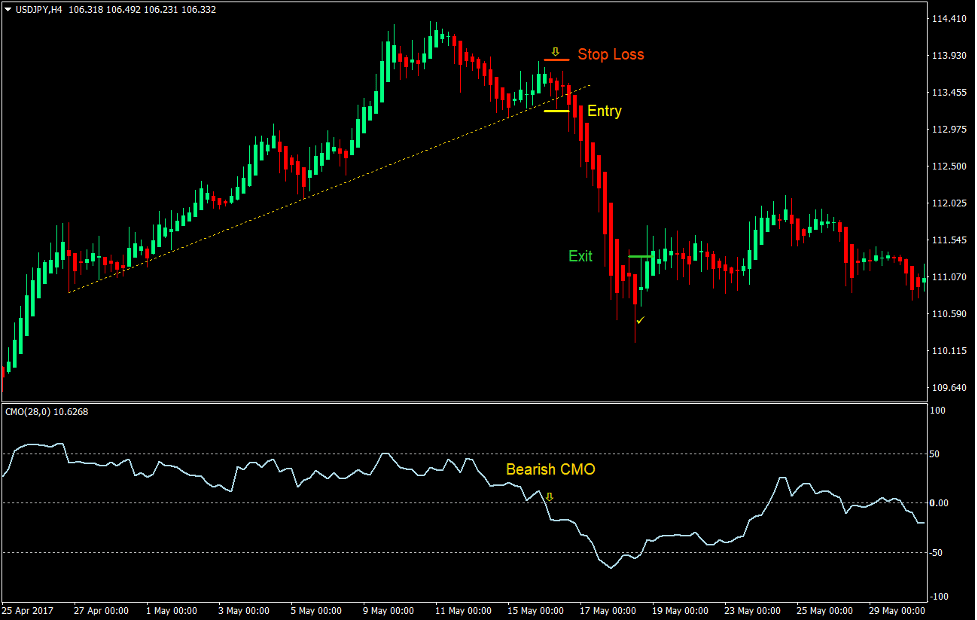

Sell Trade Setup

Entry

- A diagonal support line should be identified.

- Price should break below the diagonal support line.

- The Heiken Ashi Candlestick should be red.

- The CMO line should cross below zero.

- Place a sell stop order on the low of the Heiken Ashi Candlestick

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Trail the stop loss two Heiken Ashi Candlestick behind the current bar until stopped out in profit.

- Close the trade as soon as the Heiken Ashi Candlestick changes to spring green.

Conclusion

This trading strategy is an excellent breakout trading strategy. This is because it confirms the momentum shift coming from the breakout.

The good thing about this strategy is that it could be used in conjunction with pattern trading. It could be used on breakouts from a flag pattern, reversals from wedge patterns, and breakouts from a box market congestion.

Traders who could identify high probability support and resistances would benefit greatly from this strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: