Most traders trade strategies that aim to catch big trends. This is what most traders hope for, catching one of those big trending moves that could add a huge chunk of profits to the account. Traders would often experience catching a big trend a few times, however, this would happen just a few times in a period. But why is it that there are traders who could catch more trends than others? Are they just lucky or do they know something that other traders don’t?

One of the better ways to catch huge trends is by trading entries that have momentum behind it. This is because momentum-based entries usually have a higher probability to continue its direction and develop into a trend. Also, most momentum trade setups are developed because it is either institutional traders who initiated these moves or there are fundamental news releases that caused it. Big banks and institutions, as well as fundamental news releases, have the capacity to move markets. Whenever retail traders see these big players make a move, they would try to trade in the direction that the big guys are trading. If a big chunk of the market would follow, then a trend could develop.

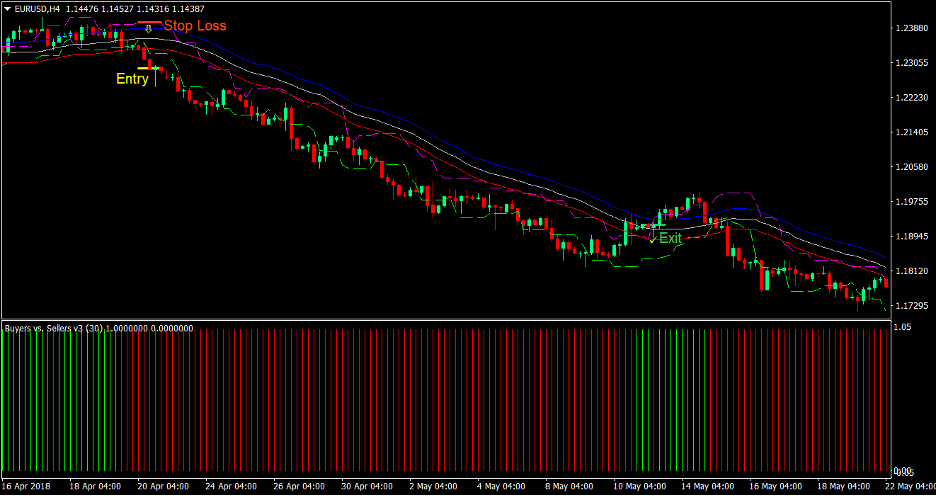

This strategy allows traders to identify probable momentum shifts that could result in big trending moves. This allows traders to catch big trends that could significantly impact their trading accounts.

Candle Stop Indicator

The Candle Stop indicator is a custom indicator developed to allow traders to identify trend direction based on a channel. It does this by drawing two dashed lines near price action. Price action would tend to hug one side of the line whenever the market is trending. There are also instances when price would be breaching these lines. These scenarios could be interpreted as a momentum candle breaking out of the channel. Candles with enough momentum behind it could often result in a trend.

Envelopes Indicator

The Envelopes indicator is another type of indicator which is used to determine the trading range of a market. It also draws a channel around price action which are used by different traders in various ways.

Mean reversion traders would often use the Envelopes indicator as a means to identify overbought and oversold prices. They would often take sell trades when price goes over the upper line, and buy trades when price goes below the lower line.

On the other hand, momentum traders interpret the breaching of the envelopes differently. Momentum traders would look at the breaching of the upper or lower lines as a momentum candle breaking out of a channel. Thus, they would often take a trade in the direction of the breakout.

Buyers vs Sellers

The BvS indicator stands for Buyers versus Sellers. It is a custom indicator which helps traders objectively identify trend direction. It does this by printing lines that change colors. It paints lime lines whenever it detects a bullish a market condition and red lines when it detects a bearish market condition.

This feature of the BvS indicator makes it an excellent trend filter as it allows traders to easily filter out trade signals that goes against the direction of the trend.

Trading Strategy

This trading strategy is a momentum-based trading strategy that takes trades based on the momentum shifts indicated by the Candle Stop indicator and the Envelopes indicator.

To trade this strategy, traders should be looking for conditions wherein the Candle Stop indicator line would breakout of the Envelopes indicator line. For example, if the upper line of the Candle Stop indicator breaks above the upper line of the Envelopes indicator, this would be considered a bullish momentum entry signal. On the other hand, a bearish momentum entry signal would be the Candle Stop’s lower line breaking below the lower line of the Envelopes indicator. These signals would usually coincide with price going beyond both lines.

The entry signals discussed above will then be filtered based on the trend direction of the BvS indicator. Buy signals are considered only when the BvS indicator is printing lime lines, and sell signals are only considered when the BvS indicator is printing red lines.

Indicators:

- CandleStop

- Trail Periods: 5

- Envelopes

- Period: 28

- Shift: 6

- BvS v3

- BvS Period: 30

Timeframe: 4-hour chart only

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

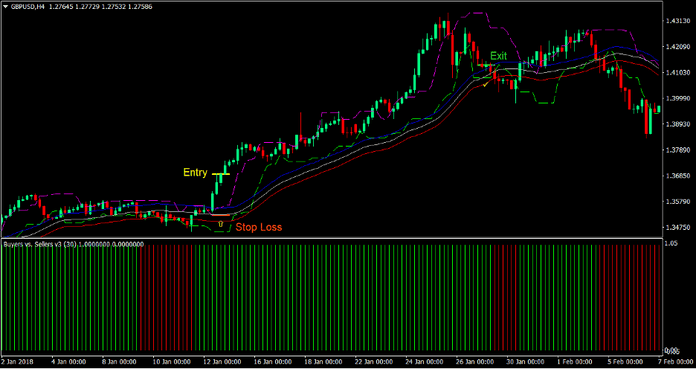

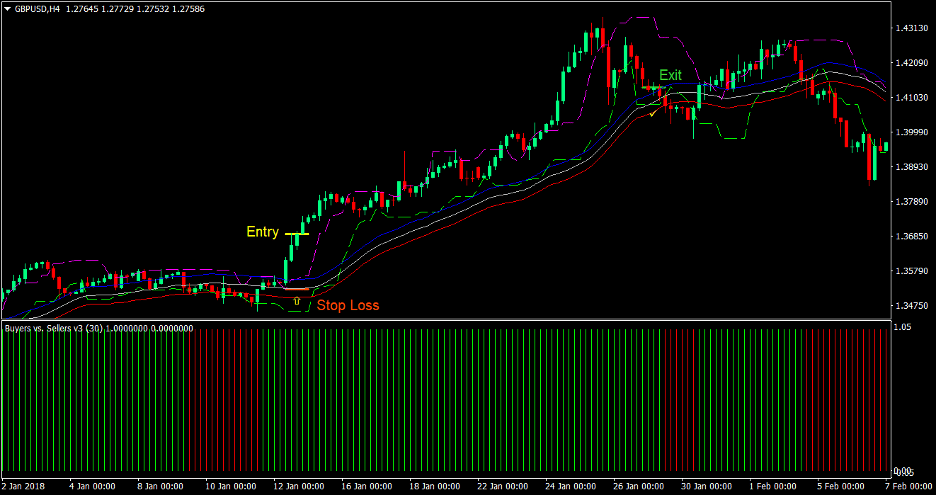

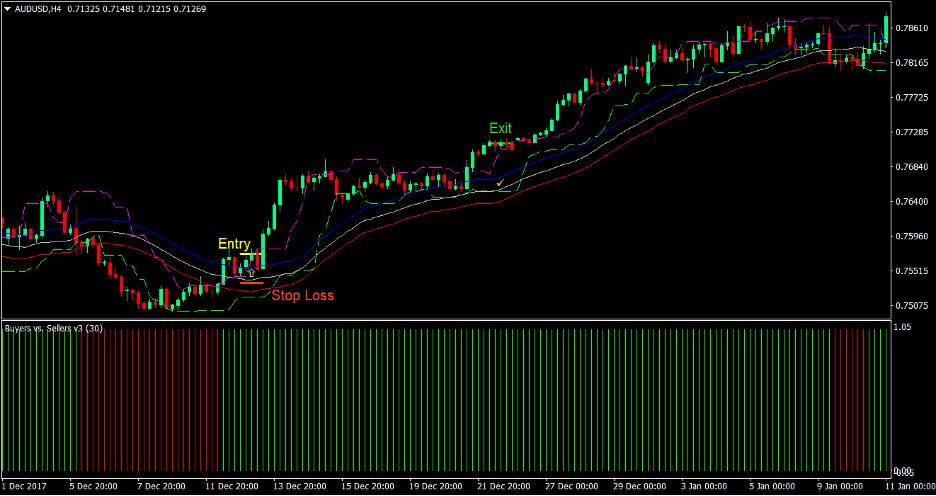

Buy Trade Setup

Entry

- The BvS indicator should be printing lime lines indicating a bullish market condition

- The broken magenta line of the Candle Stop indicator should cross above the solid blue line of the Envelopes indicator indicating a bullish momentum signal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Close the trade as soon as broken lime line of the Candle Stop indicator crosses below the midline of the Envelopes indicator

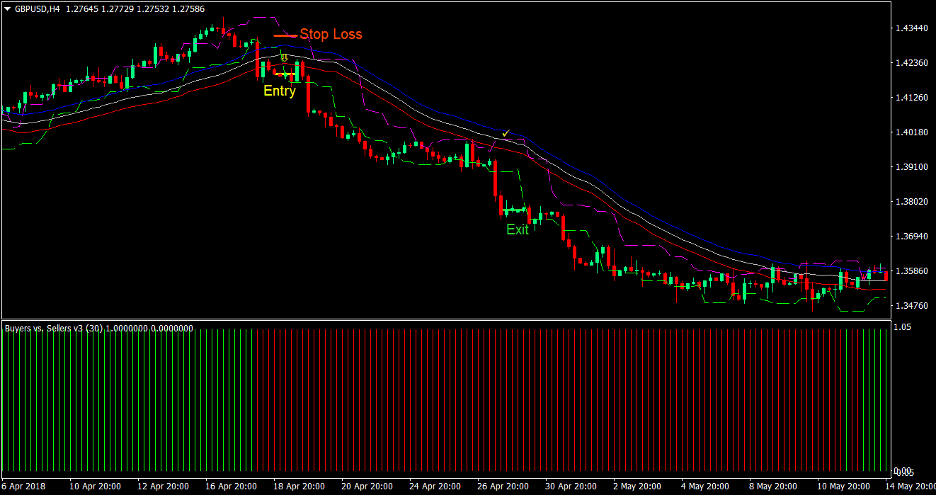

Sell Trade Setup

Entry

- The BvS indicator should be printing red lines indicating a bearish market condition

- The broken lime line of the Candle Stop indicator should cross below the solid red line of the Envelopes indicator indicating a bearish momentum signal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as broken magenta line of the Candle Stop indicator crosses above the midline of the Envelopes indicator

Conclusion

This trading strategy is a good momentum type strategy. The breaching of the dashed lines beyond the solid lines would usually coincide with long momentum candles prior to the breach. This signifies that there is indeed momentum behind the trade.

This strategy also allows traders to catch big trending moves since many of the momentum entries generated by this strategy have a high probability of developing into a trend.

The exit strategy of this setup is somehow conservative. It is aimed at protecting profits, thus the exit is based on the crossing of the broken line over the midline of the Envelopes indicator. This signifies that the trend could be ending, however there will be instances when the exit is a bit premature. On this instances you would find that the trend could still continue further and could have resulted in better profits.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: