3 Simple Moving Average Crossover Forex Trading Strategy

Forex Strategies need not be complicated to be effective. You don’t need a list of 20 rules to check to be accurate in the forex market. You don’t need to buy all the expensive indicators to make money. Even the simplest tools preset on the MT4 is enough to make a ton of pips. Simple is effective. In fact, simplicity gives a valuable advantage because it allows traders to decide quickly and with less stress.

Crossover strategies are one of the simplest types of forex trading strategies to employ. Its simplicity often causes many new traders to doubt its effectiveness, and as a result miss the opportunity of making profits out of the forex market.

So, what is a crossover type of strategy? A crossover strategy is one in which the trigger to enter the trade is when a crossover happens. For example, price crossing over a moving average. Or a fast line indicator crossing over a slow line indicator. The list goes on.

The Simple Moving Average (SMA) Advantage

One type of crossover strategy that may be used is a crossover of moving averages. With this strategy, trades are triggered when a faster moving average crosses over a slower moving average.

Many traders who use this type of strategy may argue what type of moving average is best, simple or exponential moving average. My take on this is that it would depend on what type of trades you would want to take as each has its own strengths and weaknesses.

The exponential moving average uses a formula that gives more weight on the most recent prices. Because of this the exponential moving average tends to respond quicker than the simple moving average, plotting a more reactive line. This responsiveness, although a strength, could also be considered as a weakness. Due to its reactiveness to recent price changes, price tends to whipsaw this moving average, causing confusion to some traders.

The simple moving average on the other hand is more straight forward between the two. Since it is a straight forward averaging of price, it tends to be smoother than the exponential moving average. Because of this, whipsaws tend to be less occurring when using the simple moving average.

Traders who focus mainly on short term trends and swings usually prefer the exponential moving average’s responsiveness. However, if a trader’s objective is to ride out the trend, the simple moving average might offer an advantage. Because the simple moving average has lesser whipsaws, traders will be shaken off the trade less often compared to those who use the exponential moving average.

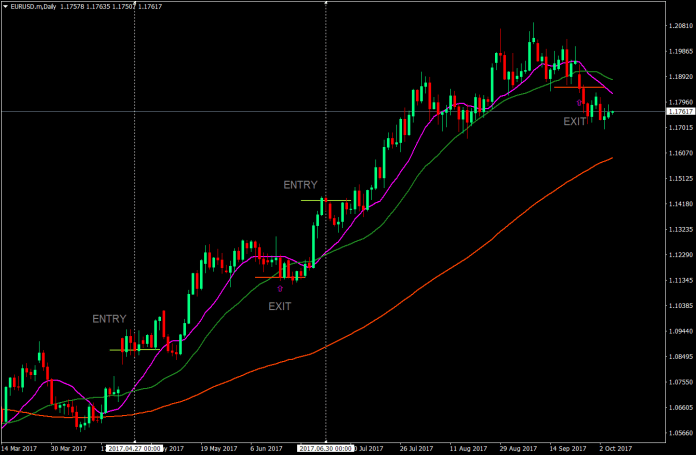

The 3 SMAs

For this strategy, we will be using three simple moving averages represented by the following colors:

- 13 SMA – Magenta

- 26 SMA – Forest Green

- 100 SMA – Orange Red

The 13 SMA represents the fast-moving average, while the 26 SMA represents the slow-moving average. Crossovers between the two moving averages would be our trigger for a trade.

The 100 SMA however will represent the main intermediate trend. All the trades taken should be in the direction of the trend. At times, it is the crossover of the 26 SMA over the 100 SMA that occurs last, which would also be a trigger.

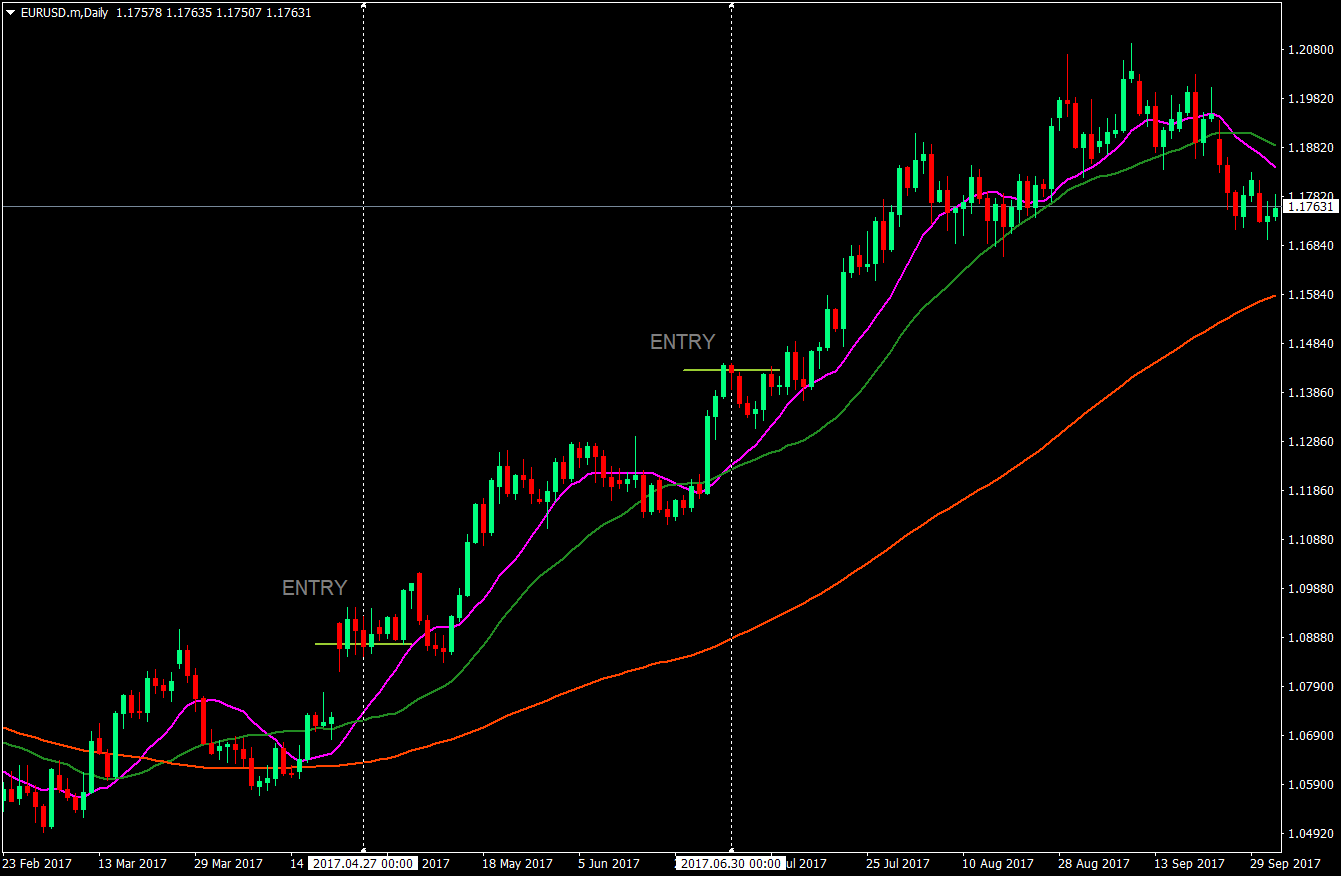

The Buy Setup – Entry & Exit

For a buy trade to be considered, the following rules should apply:

- Price should be above the 100 SMA

- Both the 13 & 26 SMA are above the 100 SMA

- The 13 SMA has crossed above the 26 SMA

These rules should show a neatly layered moving averages with the 13 SMA being at the top, the 26 SMA at the middle, and the 100 SMA at the bottom.

Notice how the three SMAs are neatly layered on top of each other, with price plotting a clear uptrend.

For this strategy, we will not be using a hard stop loss. Instead, we will be closing the trade when price closes below the 26 SMA. This will allow us to ride the trend up until it shows a tendency to reverse.

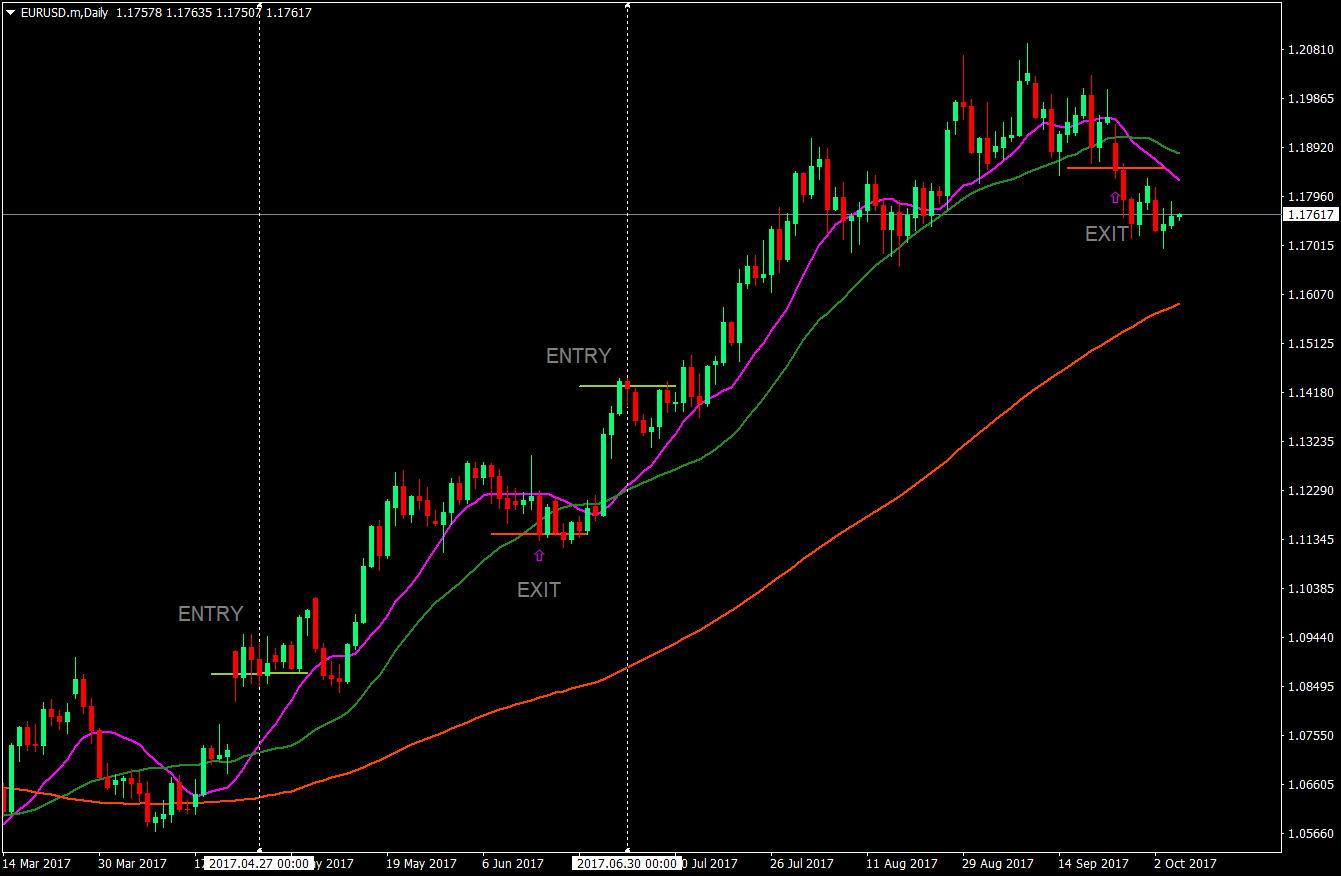

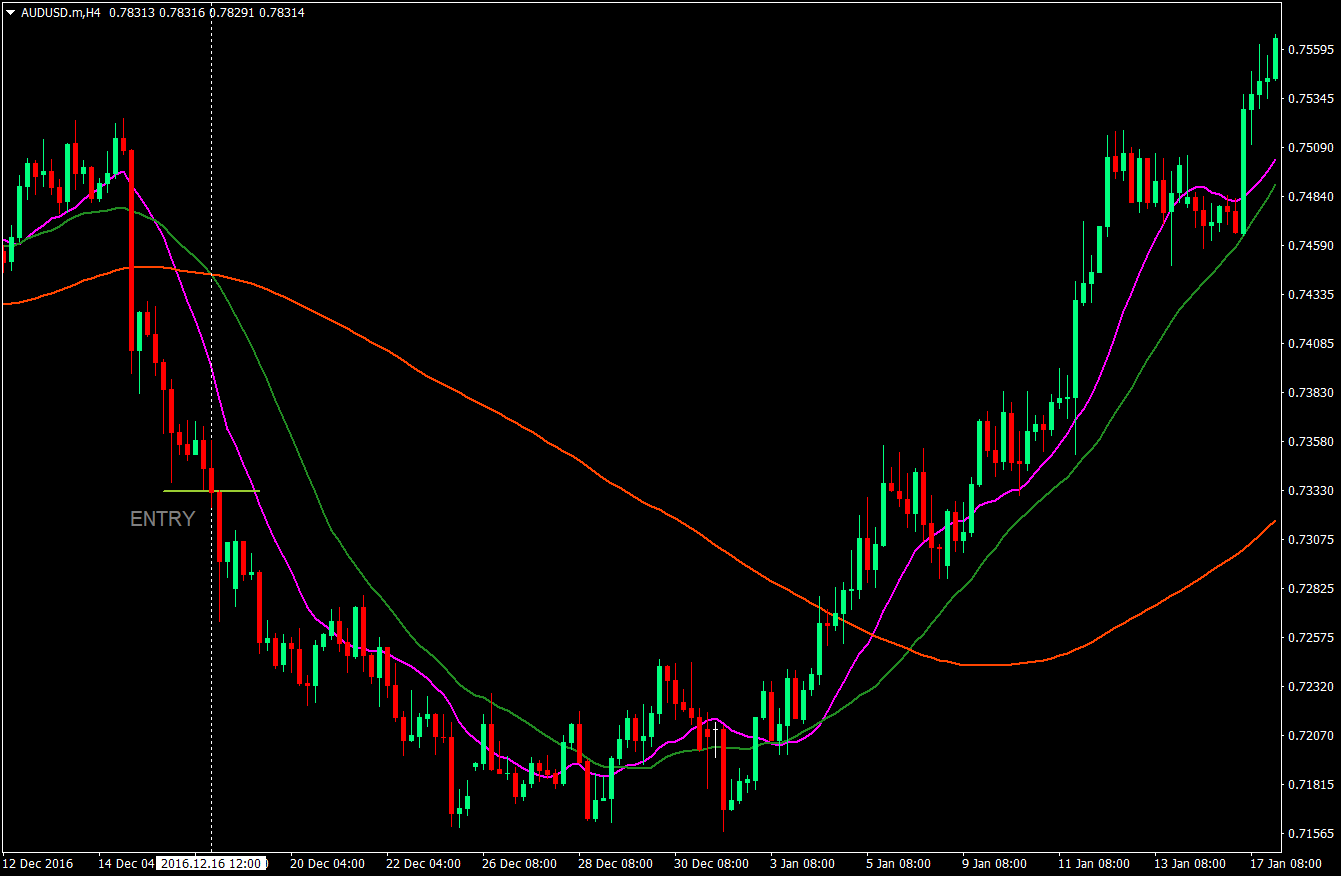

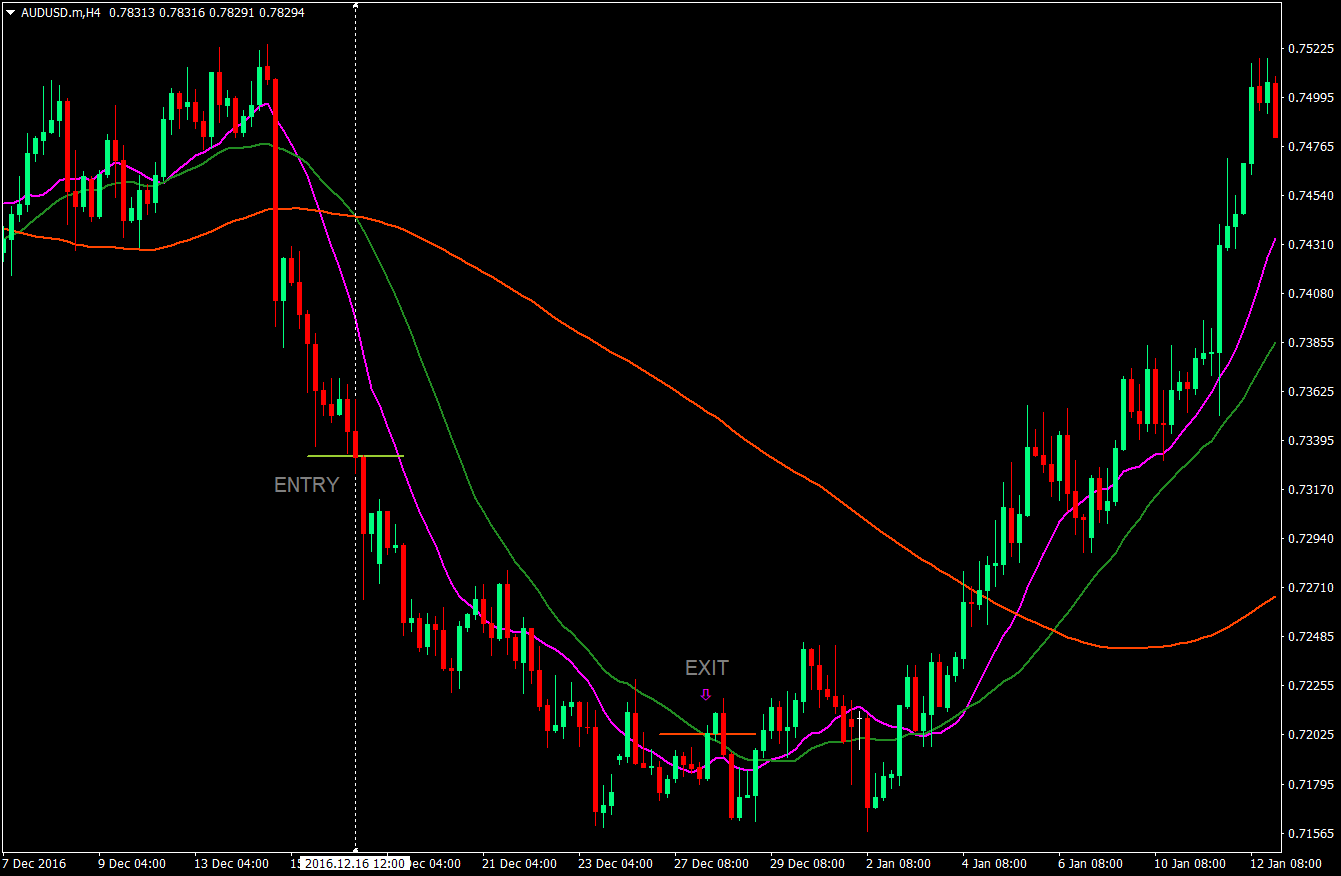

The Sell Setup – Entry & Exit

For a sell trade, what we will be looking for will be the following:

- Price should be below the 100 SMA

- Both the 13 & 26 SMA are below the 100 SMA

- The 13 SMA has crossed below the 26 SMA

This should result to a reversely stacked moving averages. The 100 SMA at the top, 26 SMA at the middle, and the 13 SMA at the bottom.

Again, a layered 13, 26, and 100 SMA, but this time on reverse.

The stop loss would again be based on the 26 SMA. Candles closing above the 26 SMA will be a trigger to close the trade.

Conclusion

This strategy is a bit conservative. Since the 100 SMA differs greatly from the 13 & 26 SMA, trades take a bit longer to confirm. However, this lessens the possibility of entries that are potential whipsaws. The setback is that sometimes, the entry might be late and we might be gaining less pips than if we entered a tad earlier.

Although this strategy is very simple, but it could be very profitable. Its long rallies allow traders to gain more pips on their setups, especially that traders might be able to ride along almost the whole trend. The drawback though is the possible late entries and whipsaws.

Another drawback is that since the strategy doesn’t use a hard stop loss, the risk-reward ratio might be harder to assess. What you can do however is set the entry to a fixed volume, which is considerably minimal compared to your account. A position wherein, if ever the trader would need to close the trade at a loss, it would be just a small percentage of the trader’s account.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: