20-4 Fake Out Forex Trading Strategy

You’ve probably heard of breakout strategies. It is very common & popular among many traders. If you’re not familiar with what it is, it is basically a strategy that takes trades whenever a support or resistance, or a previous high or low is broken. Now, breakout strategies usually work. However, there are also many instances when this type of strategy just fails completely. And breakout traders are dumbfounded when the market turns against them. Let’s analyze why breakouts work and what could make it not work.

For this strategy, we will be using the concept of previous highs and lows instead of support and resistances with two points connected. This is easier to understand and is easier to spot in a chart. We will then anticipate these highs or lows as our support or resistance areas which price could break out of.

So, what does a high entail and what did cause that high? Highs on a price chart are points where price retreated and started to go down. These means that at that price level, market players think that price is already too high and are more than willing to sell. In short, this is a price point where there are ready sellers. Because these price points are areas where there are ready sellers, if price revisits that area, sell orders should be triggered and should cause price to head back down. However, during a breakout scenario, the up thrust in price is so strong, price would break the previous high. The idea behind breakout strategies is that since price has broken above the previous high, all the ready sellers at that price point should have been exhausted, thus causing more up thrust after the breakout. The opposite is also true on breakouts of previous lows.

However, at times, even when a previous high or low is broken, it doesn’t always follow that price would continue the direction of the breakout. Sometimes, price immediately retreats back and bounces off the high or low. We will call these scenarios as fake-outs.

I don’t believe that a break of the previous high or low immediately means that ready sellers or buyers are exhausted. This is because not all entries are pending orders. Some react a little slower. Some look at higher timeframes. Some trade at the close of the candle. This means that price could still retreat from highs or lows as these traders who are ready sellers or buyers start to enter their trades. Then, we see a candle that creates a new high but fails to close above the previous high.

The Setup: Trading the 20-4 Fake Out Strategy

In this strategy, we will assume that candles creating new 20-period highs or lows, but is more than four periods away from the previous 20-period high or low, are areas where price could bounce off, provided that price failed to close beyond the previous 20-period high or low.

Why 20-period and why four periods away from the previous high or low? Being a 20-period high or low, while being four periods away from the previous, makes the new high or low really defined. It would be easier to spot on a chart, so more traders are looking at it.

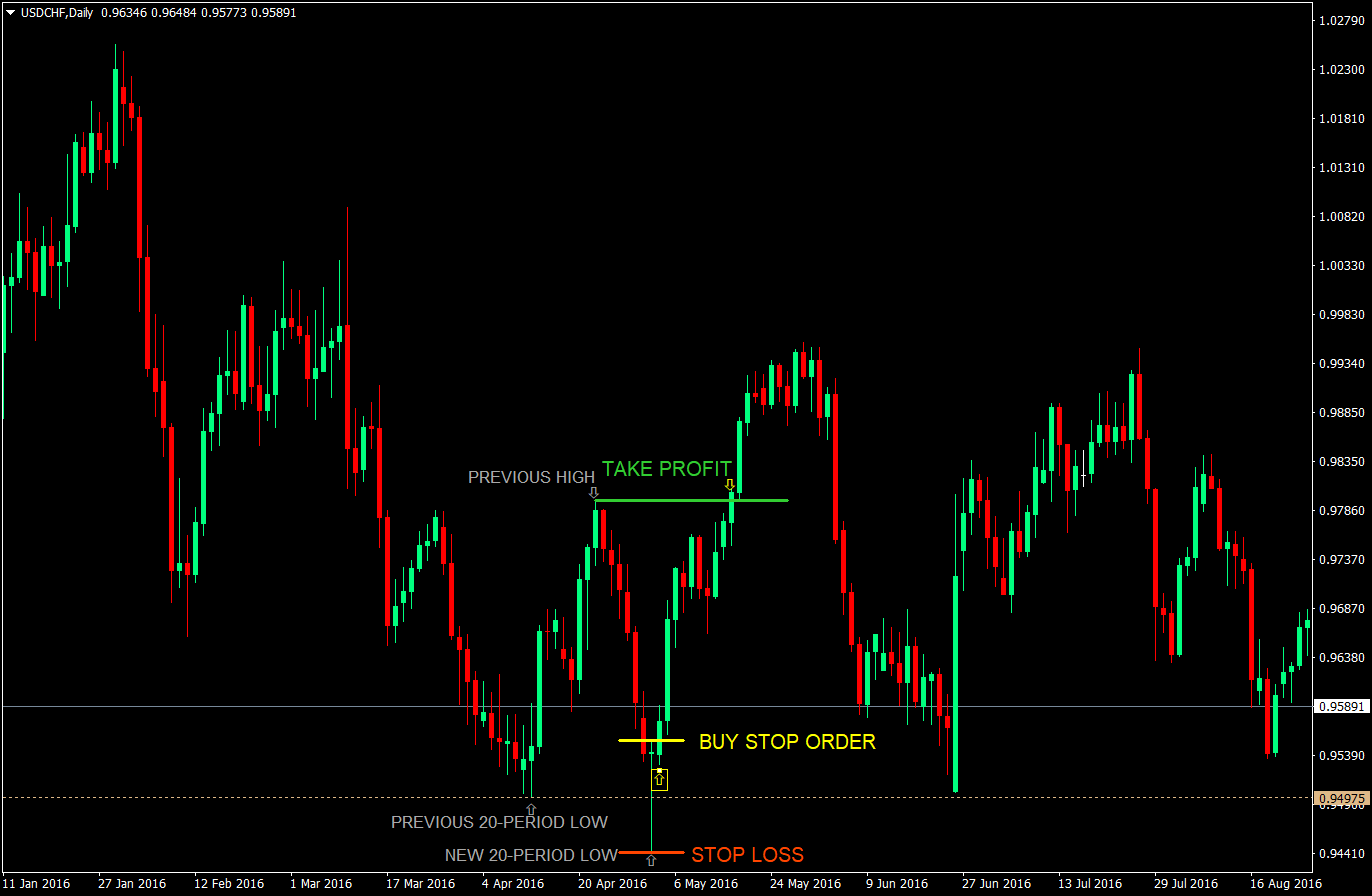

Buy Entry:

- Identify a 20-period low prior to the current candle

- The new candle should form a new 20-period low while not closing below the previous 20-period low

- The two lows should be 4 periods apart

- Set a pending buy stop order on the high of the new candle

- If order is filled on the next candle manage the trade

- If order is not filled on the next candle close the pending order

Stop Loss: Set the stop loss at the low of the entry candle

Take Profit: Set the take profit at the most recent previous high based on price action

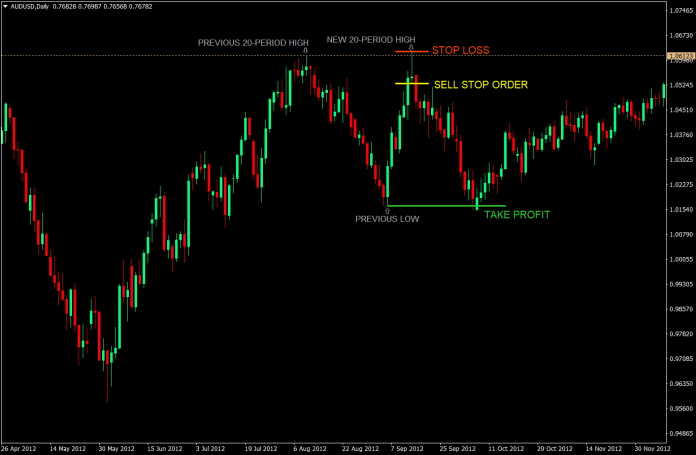

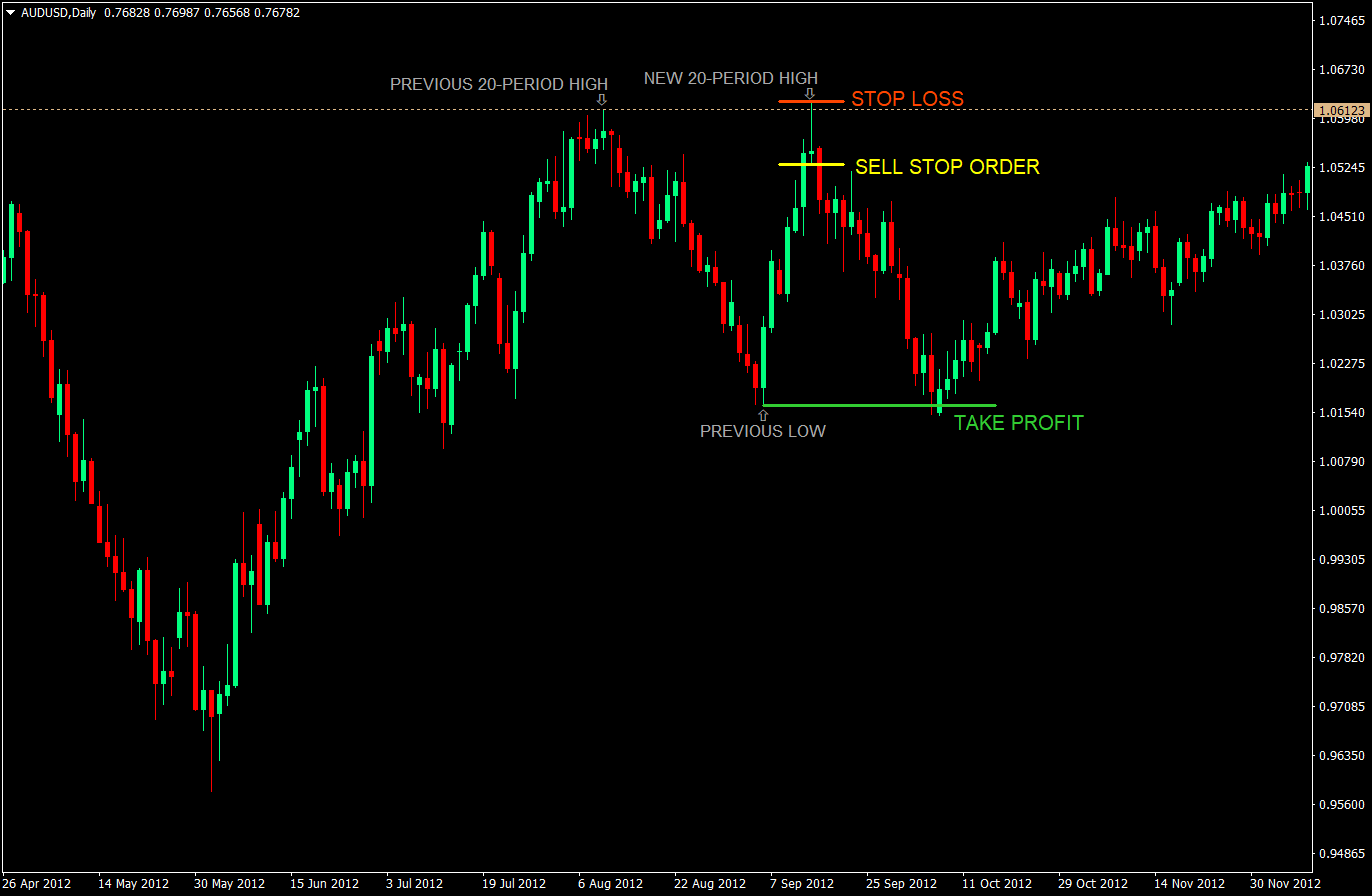

Sell Entry:

- Identify a 20-period high prior to the current candle

- The new candle should form a new 20-period high while not closing above the previous 20-period high

- The two highs should be 4 periods apart

- Set a pending sell stop order on the low of the new candle

- If order is filled on the next candle manage the trade

- If order is not filled on the next candle close the pending order

Stop Loss: Set the stop loss at the high of the entry candle

Take Profit: Set the take profit at the most recent previous low based on price action

Conclusion

Fake-outs are as common as breakouts are. By having this strategy in your arsenal, you have something you could use whenever you see a market structure where other traders are looking for breakouts. But you would have to decide which you prefer, breakouts or fake-outs.

One of the things that you could add to this strategy is a system to manage trailing stop losses. Sometimes price just doesn’t quite reach the target take profit. By having trailing stop losses, you could still end up in profit even though your price target isn’t reached.

Updated: Added MTF High Low Indicator

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: