Many traders are preoccupied with finding the perfect point and predicting the correct reversal points. While all this should be theoretically sound, it is quite difficult if not impossible to execute. The perfect entry point is assumed to be the exact spot where price reverses. While I have experienced predicting the right entry points using limit entry orders several times, it is hardly accurate. Often, price would move against my position for several pips before it goes in my direction. Predicting the exact reversal point is like predicting the thoughts of thousands of traders. Not only are you guessing which direction they are taking, you are also predicting the exact figure where most traders would take the trade. Impossible, isn’t it?

Instead of guessing the exact reversal point, traders can more easily decipher the direction which the market is heading to. This is very evident in a trending market condition. It would be very easy to see that price is either trending up or trending down. Instead of fighting against the crowd and anticipating where the trend would reverse, it would be best to go with the flow of the market instead.

Wisdom of the crowd is basically the collective opinion of a group rather than a single expert. In the case of trading, instead of trying to be the “expert”, it is best to just go with the wisdom of the crowd, which is the market itself.

Heiken Ashi Smoothed

Heiken Ashi Smoothed is a trend following technical indicator which is based on the combination of the Heiken Ashi Candlesticks and moving averages.

The Japanese candlesticks have been the gold standard for charting price action for quite some time now. However, another clever innovation has been developed yet again by Japanese traders. The Heiken Ashi Candlesticks is a technical indicator which plots a different type of candlestick. It retains the same highs and lows plotted by the Japanese candlesticks. However, it also modifies the open and close of each candle based on the average of each candle. This creates candlesticks which change colors only when the short-term trend or momentum has shifted.

The Heiken Ashi Smoothed indicator on the other hand is much like the Heiken Ashi Candlesticks because it also plots bars on the price chart. These bars also indicate the direction of the trend by changing its color. Lime bars indicate a bullish trend, while red bars indicate a bearish trend. However, its similarities end there. This is because the Heiken Ashi Smoothed indicator behaves more like the Exponential Moving Average (EMA). It plots bars which follow price action quite closely. This allows traders to see the actual price action more clearly based on the candlestick patterns, while at the same time identify the direction of the trend based on the color of the bars.

The Heiken Ashi Smoothed indicator is a very reliable trend following indicator. It changes color only when the mid-term trend has clearly shifted directions and is not as susceptible to false signals much like other technical indicators. This makes it a very reliable trend reversal signal indicator.

Just like moving averages, the Heiken Ashi Smoothed indicator can also act as a dynamic area of support or resistance. During a trending market, price would often bounce off its area after a retracement.

TSR Execute Line

The TSR Execute Line is a custom technical indicator which is an excellent momentum indicator.

It identifies short-term trends or momentum based on a modified short-term moving average line. It then plots a line which identifies the movement of price action and indicates the direction of the short-term trend or momentum based on the color of the its line.

A yellow TSR Execute Line indicates a bullish short-term momentum, while a magenta line indicates a bearish short-term momentum.

As the name suggests, the TSR Execute Line can be used as a trade execution or entry trigger signal. Traders can identify or confirm trade entries based on the changing of the color of its line.

Trading Strategy

Wisdom of the Crowd Forex Trading Strategy is a trend following trading strategy which combines the direction of the mid-term trend and short-term momentum to confirm an excellent trade setup.

The 50 EMA line and the Heiken Ashi Smoothed indicator is used to identify the direction of the trend. This is based on the location of the Heiken Ashi Smoothed bars in relation to the 50 EMA line, as well as the color of the Heiken Ashi Smoothed bars. Trends should also be visually confirmed by the trader based on the behavior of price action.

Price should then retrace or contract towards the area of the Heiken Ashi Smoothed bars. Then, price should create a momentum candle as price bounces off the area of the bars.

The TSR Execute Line should then confirm the momentum shift after the retracement based on the changing of the color of its line.

Indicators:

- (T_S_R)-Execute Line

- Heiken_Ashi_Smoothed

- 50 EMA

Preferred Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

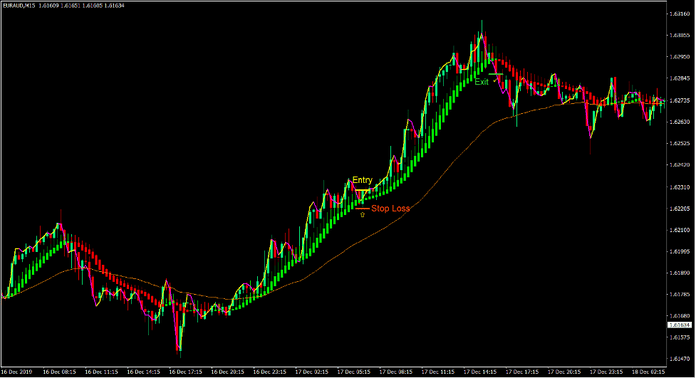

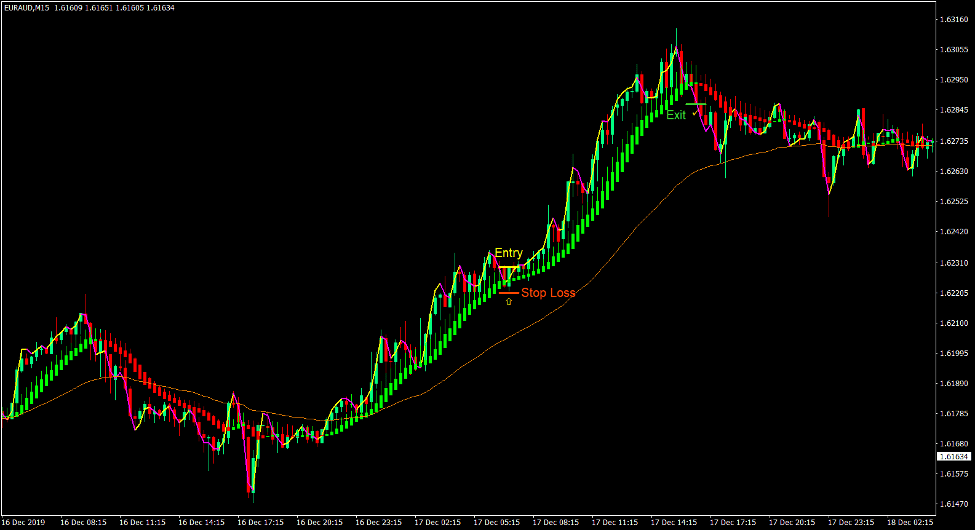

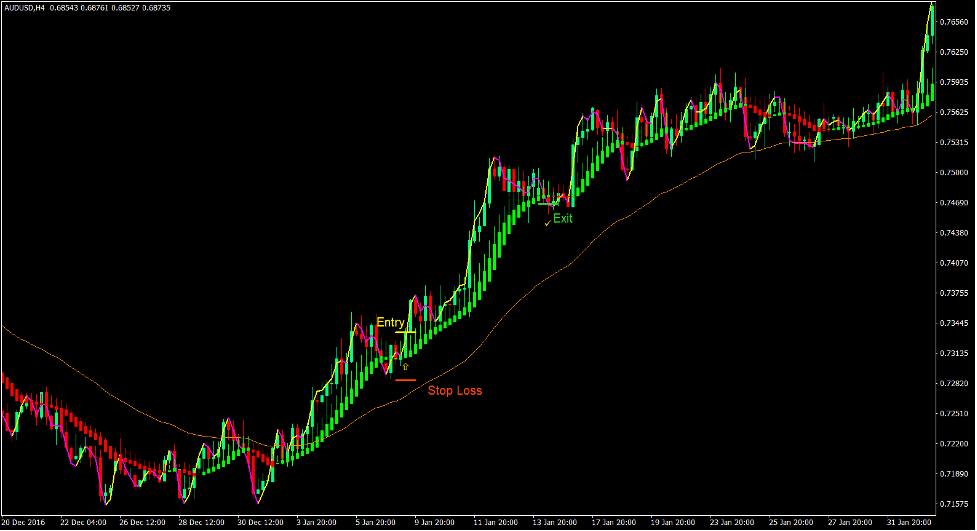

Buy Trade Setup

Entry

- Price action should be trending up.

- The Heiken Ashi Smoothed bars should be above the 50 EMA line.

- The Heiken Ashi Smoothed bars should be lime.

- Price should retrace or contract towards the area of the Heiken Ashi Smoothed bars.

- A bullish momentum candle should be formed.

- The TSR Execute Line should change to yellow.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as a candle closes below the Heiken Ashi Smoothed bars.

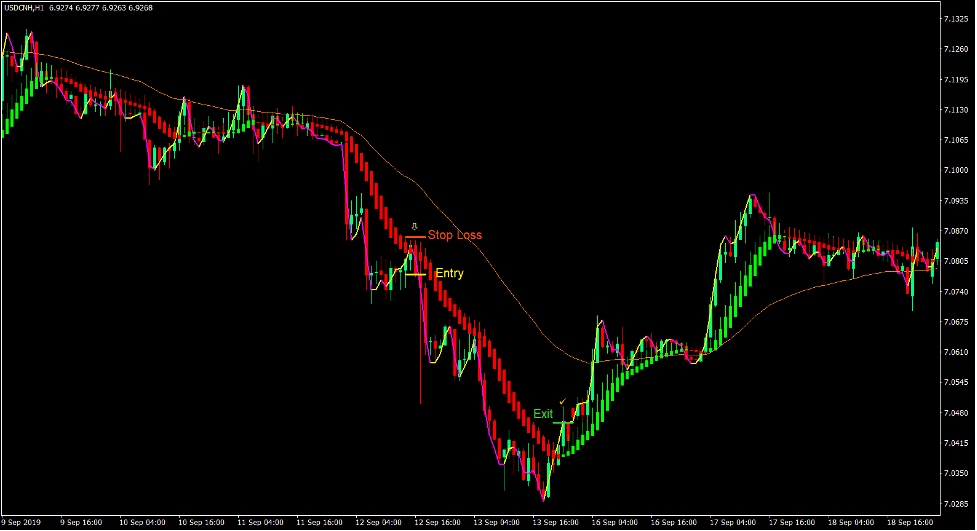

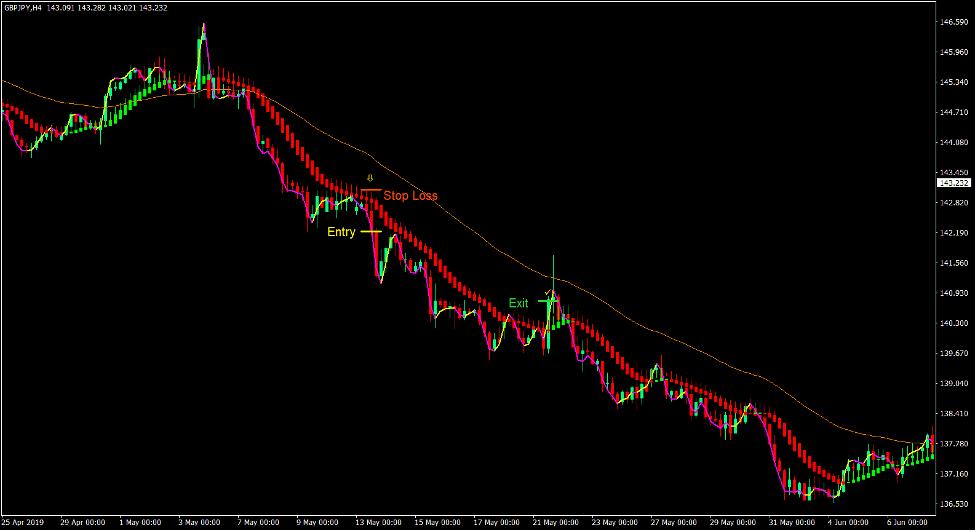

Sell Trade Setup

Entry

- Price action should be trending down.

- The Heiken Ashi Smoothed bars should be below the 50 EMA line.

- The Heiken Ashi Smoothed bars should be red.

- Price should retrace or contract towards the area of the Heiken Ashi Smoothed bars.

- A bearish momentum candle should be formed.

- The TSR Execute Line should change to magenta.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as a candle closes above the Heiken Ashi Smoothed bars.

Conclusion

This trend following strategy is a highly reliable trading strategy that could help traders propel their trading accounts to huge profits. However, this strategy only works in a market that is clearly trending on the mid-term horizon.

The key to trading this strategy profitably is in correctly identifying the right trending market. In the right trending market, this strategy could produce two to three good trading opportunities. Some trends can allow for more good trade setups, however the likelihood of the market reversing also increases as the trend extends longer.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: