The forex market is one of the most volatile markets that traders could trade. It could move up and down and all around without regard for your trading position. It oscillates erratically on the price chart with seemingly no direction at all. Some call it a “Random Walk”, like a drunk man whose steps you could never predict.

To make money out of the forex market, traders should make sense out of what seems to be a “Random Walk”. Traders should learn to anticipate what the market might be doing next with a relatively high degree of certainty. Traders will never be 100% certain of a trade, but traders could tilt probabilities in their favor.

Trend Sniper Reversal Forex Trading Strategy allows traders to trade with a positive expectancy on their trades. Trend and market bias are measured using a reliable custom indicator and exact entry points could be identified using a custom signal indicator combined with a knowledge on high probability candlestick patterns.

Binary Trend Sniper

Binary Trend Sniper is a custom technical indicator which helps traders identify the general market bias.

It makes use of historic price movements to calculate the general trend direction and market sentiment. It then displays bars to indicate the direction of the trend. Bearish markets are indicated by maroon bars, while bullish markets on the other hand are indicated by green bars.

This indicator is intended for binary trading but also works well for forex trading. It is also considered binary because the market bias is identified only as bullish or bearish. It does not measure for strength or provide any dynamic figures.

BB Alert Arrows

BB Alert Arrows is a custom signal indicator that provides trade signals indicating probable reversal points.

The BB Alert Arrows signals are based on fractals. Major fractal points usually constitute a swing point, either a swing high or a swing low. These could be used as a high probability momentum reversal signal which could indicate that price might reverse on the short-term.

The signals of the BB Alert Arrows indicator also consider price rejections based on extreme points of the Bollinger Bands. It typically produces signals on fractals occurring on the outer bands of the Bollinger Bands or its midline.

Bollinger Bands

The Bollinger Bands is usually considered as a momentum or trend indicator. However, this indicator is very versatile, it has other applications that could also be very profitable.

Its midline is basically a Simple Moving Average (SMA) line, typically set at 20-periods. This line could be used to identify trend direction as a typical moving average line is used.

It also has outer lines or bands which are based on a standard deviation from the midline. It is typically set at 1 or 2 standard deviations from the SMA line. This line could mark overbought or oversold price points.

The characteristics of the bands could also be used to identify momentum. A Bollinger Band that is contracted indicates that the market is in a market contraction phase, while an expanding Bollinger Band indicates a market expansion phase and increased volatility.

Trading Strategy

This strategy combines all the information coming from the three indicators in order to pinpoint high probability entry signals. On top of that, trade signals are filtered based on candlestick patterns.

Trade direction is filtered based on the market bias indicated by the Binary Trend Sniper indicator.

We then wait for price to visit critical areas on the Bollinger Bands and observe how price reacts to these areas. These areas are the outer bands or the midline of the Bollinger Bands. The midline is usually considered only when the market tends to be trending.

We then wait for the BB Alert Arrows indicator to produce a signal by plotting an arrow pointing the direction of the trade. The trade signal should coincide with either a pin bar or engulfing candlestick pattern.

Indicators:

- BBalert_Arrows (default setting)

- Bollinger Bands

- Deviations: 2

- BinaryTrendSniper (default setting)

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

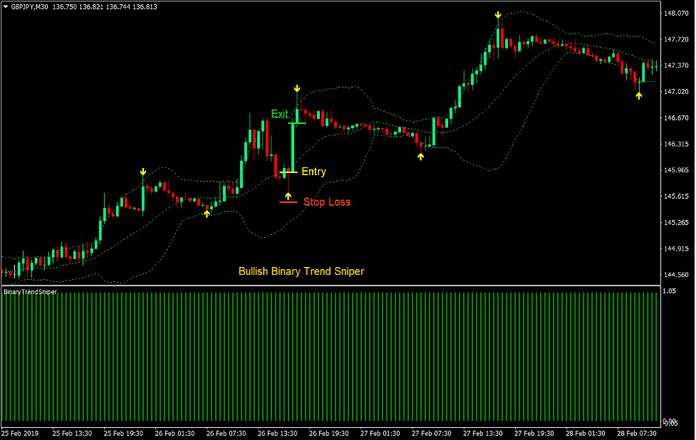

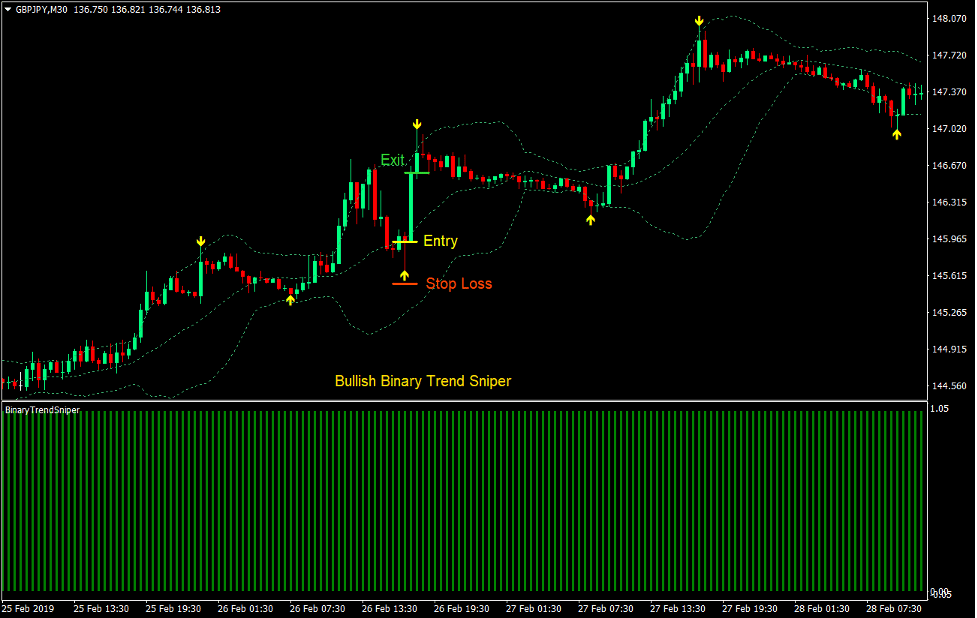

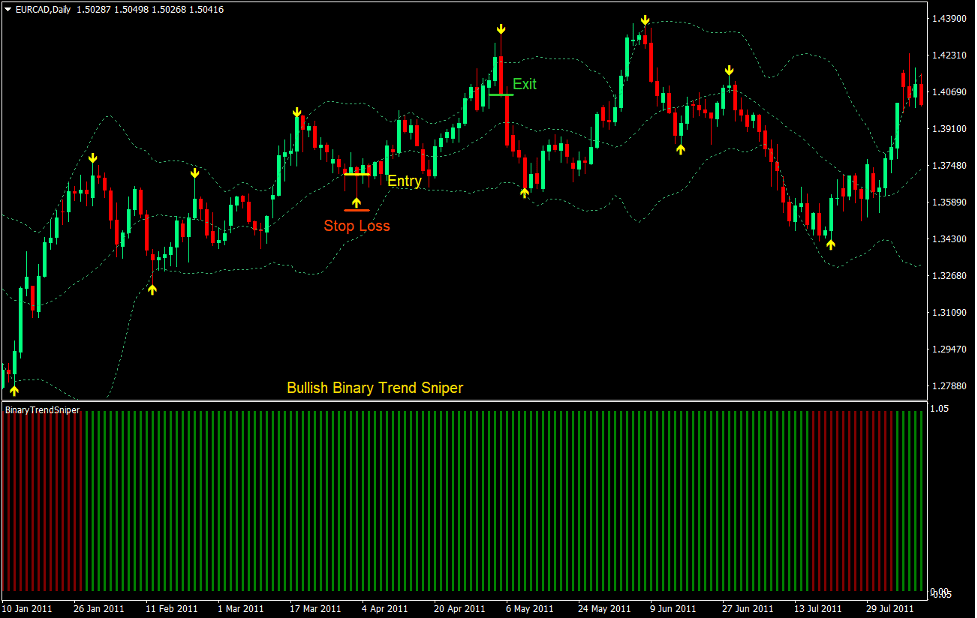

Buy Trade Setup

Entry

- The Binary Trend Sniper bars should be green.

- Price should show signs of price rejection of the midline or lower line of the Bollinger Bands.

- The BB Alert Arrows indicator should plot an arrow pointing up.

- The trade signal should coincide with either a bullish pin bar or engulfing pattern.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the BB Alert Arrows indicator plots another arrow pointing down.

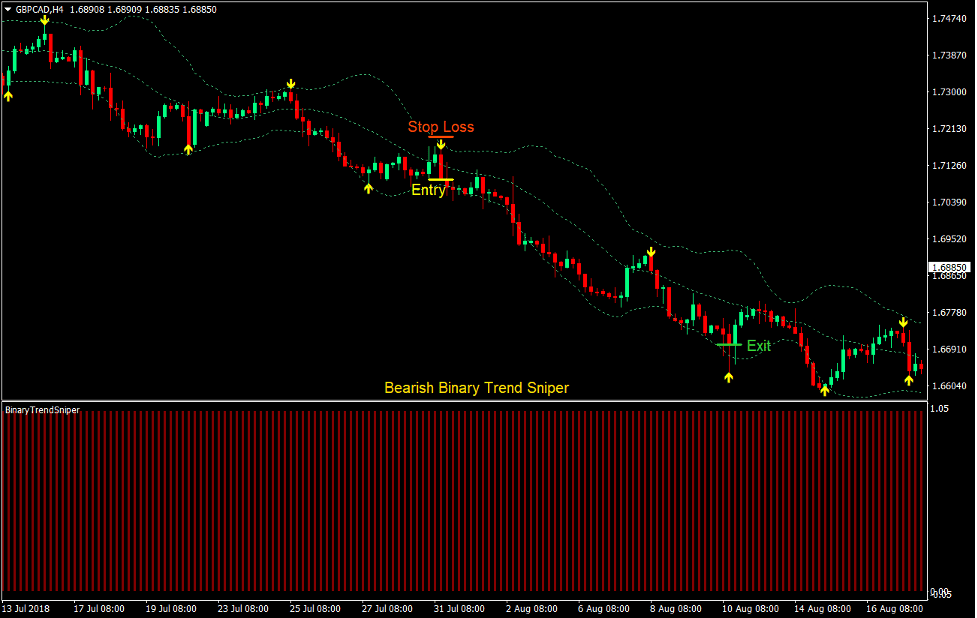

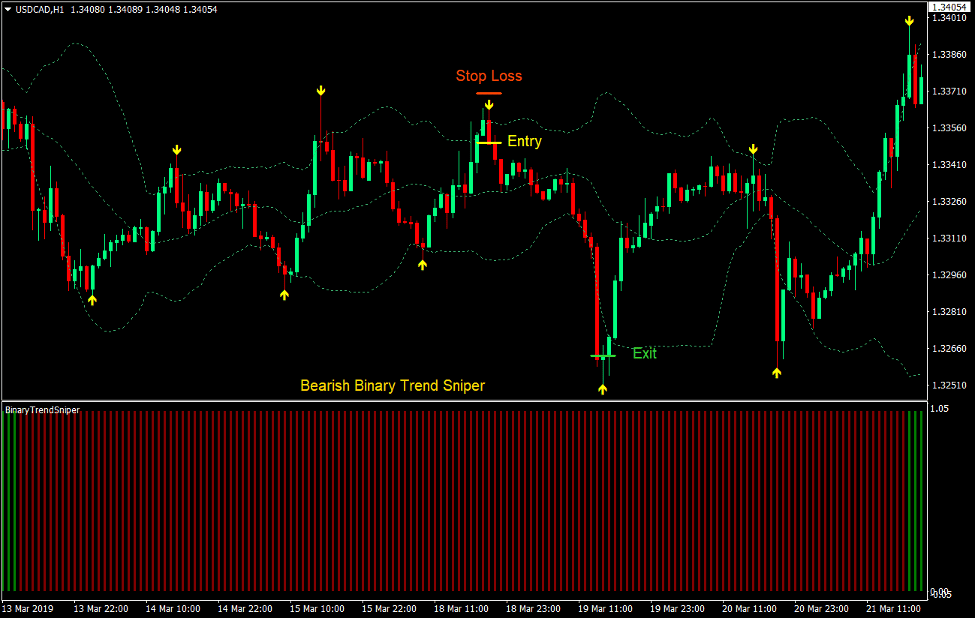

Sell Trade Setup

Entry

- The Binary Trend Sniper bars should be maroon.

- Price should show signs of price rejection of the midline or upper line of the Bollinger Bands.

- The BB Alert Arrows indicator should plot an arrow pointing down.

- The trade signal should coincide with either a bearish pin bar or engulfing pattern.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the BB Alert Arrows indicator plots another arrow pointing up.

Conclusion

This strategy is a high probability trading strategy that could work well for most market conditions. It usually works best on a slowly trending market with a clear market bias.

There are many traders who trade solely based on rejection patterns of the Bollinger Bands who have been profiting well. This strategy takes it a step further by filtering trades based on market bias and providing an exact entry signal.

Traders could opt to lock in profits as price touches the outer lines of the Bollinger Bands, however this could limit potential yields because there are cases when momentum would build up and price would tend to hug the outer bands closely until momentum fizzles out. Either way works. It is up to the trader to decide which works best for him or her.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: