Tokyo Daybreak Forex Trading Strategy

One of the better ways to earn from the forex market is to understand the currency pairs market cycle in relation to its main markets. This is because, by understanding the currency pairs market cycle, cycle stages may present inefficiencies due to the cycle itself, which we could capitalize on.

There are many ways to identify and predict a market cycle. Some may take more of a long-term view of the market and see market cycles as seasonal, annual, or to some extreme, decades. They would see booms and busts based on patterns exhibited by the past. Others take more of a short-term view and observe market cycles on an intra-day basis. They would observe market cycles based on the time of the day and what the market is probably doing during those times. Whether it may be a market opening, or a lunchbreak lull, or end-of-day winding down and squaring up of positions.

While long-term market cycles have so much credible studies, observations, and analyses behind it, I tend to shun from it. For one, it is quite harder to predict because of the fact that many things could happen in a longer period of time, which may affect the direction of the market. On the other hand, shorter market cycles tend to be easier to assess since there are lesser possible unforeseeable market disruptions that could occur in shorter periods of time. The shorter the market cycle we are looking at, the easier it should be to assess.

Now, take note I don’t use the word predict. This is because although many claim to be able to predict the market direction, it seems that even predicting direction alone is hard enough on itself, let alone adding the complexity of predicting the timing of the market movements. What I’d rather do is assess at what stage of the market cycle the current market movement is at the moment. Some would assess it by looking at boom, peaks, busts, and troughs. While this is very much applicable in other types of markets, I don’t think this is applicable to the forex market because there are at least two major markets pulling at each currency, having their market cycles. I propose though that the simpler method of contraction and expansion cycles is more appropriate to the forex market. It is easier to predict the cycle of volatility rather that which market could pull the pair stronger.

Knowing that we could assess market contractions and expansions on the intra-day level easier, let us explore one of the inefficiencies of the USD/JPY pair on this level.

Market cycles are dependent on the time of day the main markets of the pair are on. For this currency pair, the US and Tokyo market are the ones we will be looking at, and their cycle goes with the rising and setting of the sun in both markets. Because of this, a constant inefficiency presents itself. This inefficiency is during the time when both markets are close. During this time, it is very predictable that the market would go into a contraction phase. As the usual market cycle, the next phase would be a rapid and violent expansion. As the next major market of the pair opens for business, this rapid expansion phase kicks in quick, which would usually cause strong momentum.

After the New York market closes, there is a three-hour window when no major market is open for the USD/JPY pair. During this time, the market enters into a contraction phase. Then, as the Tokyo market opens, a rapid market expansion occurs.

This is further amplified by market moves caused by fundamentals. This is because both currencies are safe havens. If one is in jeopardy, investors flock to the other for safety. This could cause strong market moves which we could make money from

The Setup

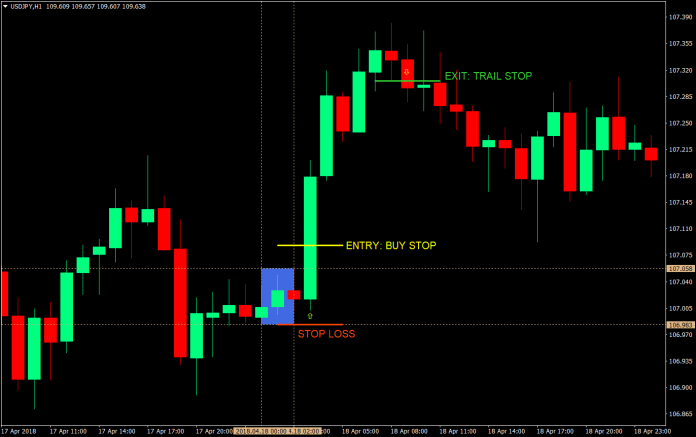

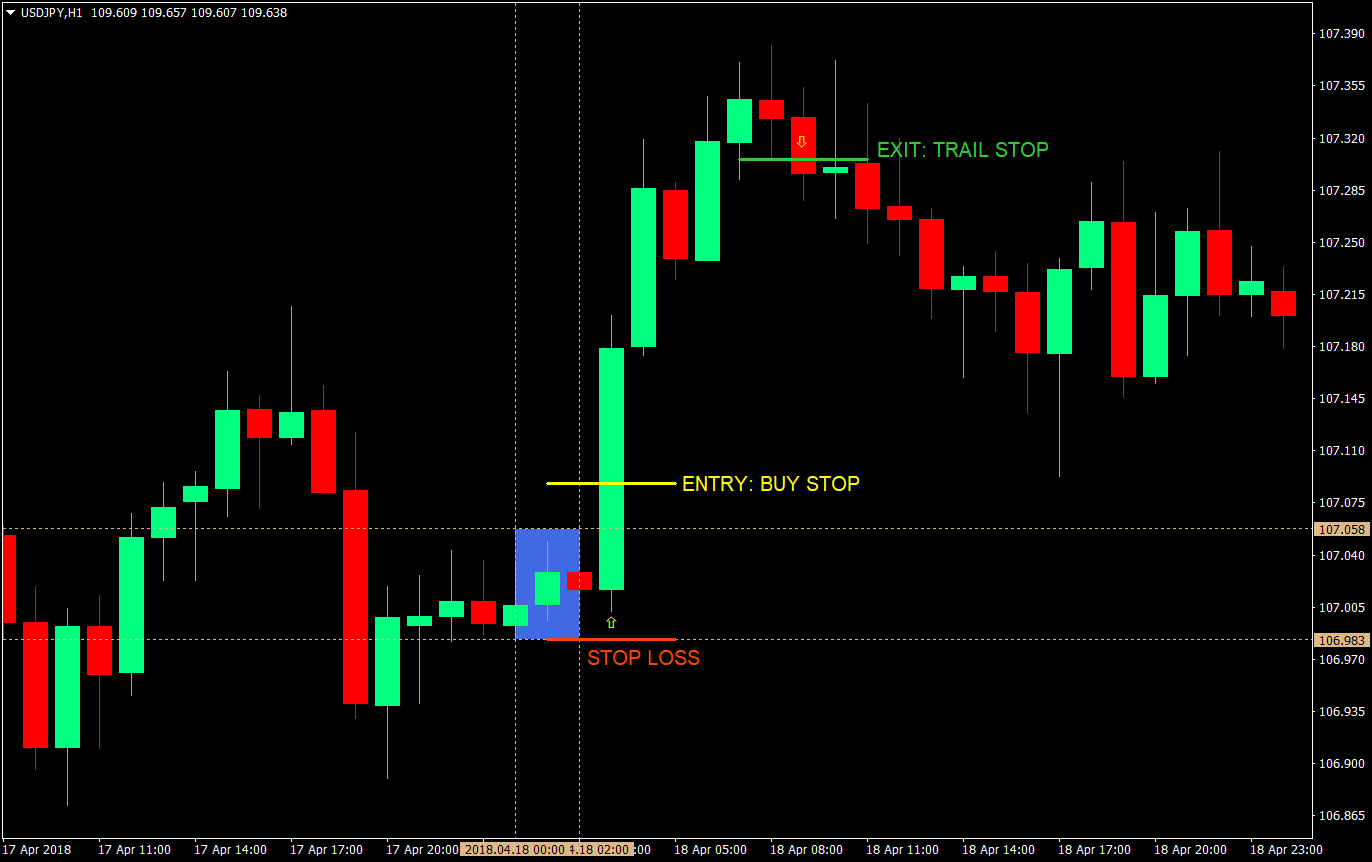

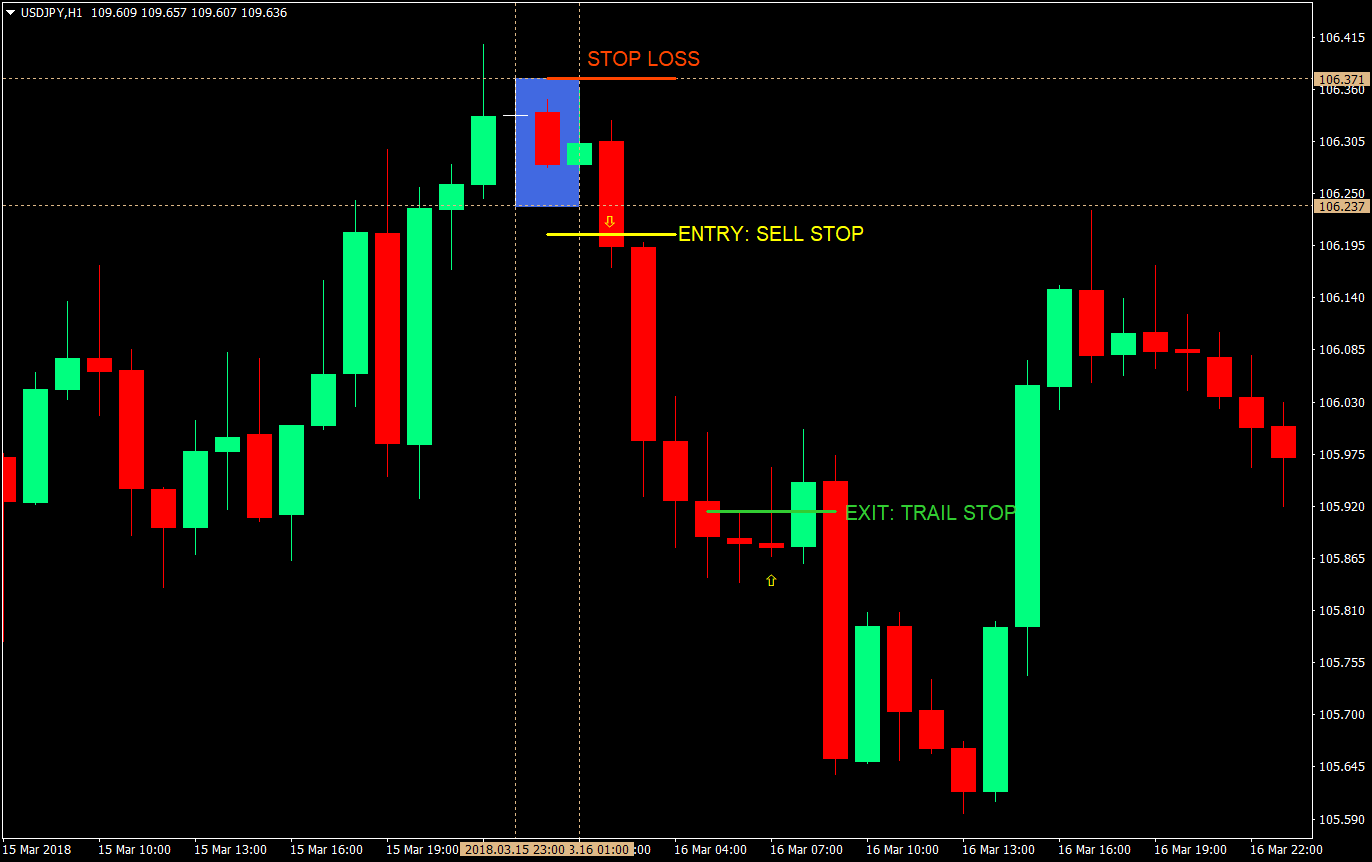

To do this strategy correctly, you would have to identify the time of the correct 1-hour candle that represents the first hour of the Tokyo session. This varies from broker to broker. Then, mark the three candles prior to this candle. These candles represent the time after the close of the New York session but prior to the Tokyo session. Bracket the high and low of the three candles to represent our range. The breakout of this range would be our market direction.

Currency Pair: USD/JPY only

Timeframe: 1-hour chart

Entry Setup:

- Bracket the high and the low of the market on the three hours prior to the Tokyo open

- Set a buy stop order three (3) pips above the high

- Set a sell stop order three (3) pips below the low

Stop Loss: Set the stop loss at the opposite end of the range

- For the buy stop order, set the stop loss at the low of the range

- For the sell stop order, set the stop loss at the high of the range

Exit: Trail the stop loss as the market moves in the direction of the trade until stopped out

- For buy trades, trail the stop loss at the low of every 1-hour candle at candle close

- For sell trades, trail the stop loss at the high of every 1-hour candle at candle close

Buy Trade Sample

Sell Trade Sample

Conclusion

This is a simple mechanical strategy that exploits the clear market contraction phase caused by the closing of the USD/JPY’s main markets.

While this strategy has the potential to bring in big pips if the market explodes with strong momentum during the first hour, this will not be the case on a day-to-day basis. There will be some days when the market would reverse after the first hour candle touches the stop entry order. There will also be cases when the market would remain in a tight range. These types of market will definitely lose you some money using this strategy.

But if you could filter out these types of market and find the common denominator of momentum shifting first hour candles, then that would definitely improve this strategy further.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: