There are many ways to trade the forex markets. Some methods work while others do not. Some traders develop a new way to trade the forex markets, while others use a strategy that has been tested and proven by time.

Price patterns are probably one of the most basic type of trading strategy and have been used by traders for a very long time. In fact, if you would learn trading from a traditional technical trader, you would probably be taught some price pattern setups. You would probably come across head and shoulders, triangle patterns, double or triple tops or bottoms, or other mainstream price patterns.

There are many traders who trade price patterns profitably and there are also traders who find trading price patterns very difficult. This is because price patterns are very subjective. What may be a clear trading pattern for one trader might just be a nonsensical chart to another. Price pattern trading usually works for those who are great at intuitively seeing visual patterns. There are traders who are naturally inclined to price patterns and there are traders who would do better off using another type of system.

If you would want to learn price patterns, it is best that you learn some of the most basic and easiest patterns to trade. The flag or pennant patterns are probably one of the easiest patterns to trade. It is a trend continuation pattern which is a result of a market expansion phase followed by a retracement with a strong potential for another momentum expansion. The “pole” of the flag is formed by the expansion phase, while the body of the flag is formed by the retracement or contraction. What usually follows after such a contraction or retracement is another expansion phase in the direction of the previous trend.

Super Trend Flag Forex Trading Strategy is a systematic trading strategy which allows traders to identify trend direction and visually identify key areas where flag patterns may form using a couple of technical indicators.

Super Trend

Super Trend is a trend following technical indicator which is based on the average movement range of price.

One of the ways traders identify trends and trend reversals is by looking at how price is moving during retracements compared to the average movement range of price. For the most part during a trend, price would move in the direction of the trend. However, there are also minor reversals or retracements that occur within a trend. If the reversals are short, then the trend is still in place. However, if price reverses significantly longer compared to its average range, then the trend might already be reversing.

This is the same concept behind the Super Trend indicator. It marks a line on the price chart which shadows the movement of price action. This line is based on the average movement range of price. The line is also plotted opposite the direction of the trend. If price reverses back towards the line and closes on the opposite side of the line, the Super Trend indicator will detect a trend reversal and shift the line to the opposite side of price action.

This shifting of the Super Trend line and the changing of its color could be used as a trend reversal signal. The Super Trend line can also be used as a trend direction filter wherein traders would only take trades in the direction of the trend as indicated by the Super Trend line.

Awesome Oscillator

The Awesome Oscillator (AO) is a trend following indicator used to identify trend direction using market momentum.

The AO is computed as the difference between a 5-period Simple Moving Average (SMA) and a 34-period Simple Moving Average (SMA). However, unlike most moving averages, the SMAs used for computing the AO bars is based on the median of each bar within a given period.

Looking at how the AO is computed, one could say that is based on the crossover of a modified moving average. The difference is that the AO is an oscillator which indicates trend direction and trend strength.

The AO is displayed as histogram bars that oscillate around zero and change colors depending on the strength of the trend. A positive green bar indicates a strengthening bullish trend, while a positive red bar indicates a weakening bullish trend. On the flip side, a negative red bar indicates a strengthening bearish trend, while a negative green bar indicates a weakening bearish trend.

Trading Strategy

This trading strategy is a basic flag pattern trading strategy. The difference is that it uses the Super Trend indicator and Awesome Oscillator to identify trend direction and make it easier for us to identify flag patterns moving in the direction of the trend.

On the Awesome Oscillator, trend direction will be based on whether the bars are generally positive or negative.

On the Super Trend indicator, trend direction will simply be based on the color of the Super Trend line and the location of price action in relation to the Super Trend line.

As soon as we identify the trend direction, we could start observing for flag patterns to form. Flag patterns would usually form as a retracement towards the Super Trend line right after a strong momentum move in the direction of the trend.

Trades are taken as soon as price breaks out of the body of the flag pattern in the direction of the trend.

Indicators:

- Non_Repainting_SuperTrend

- Awesome

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

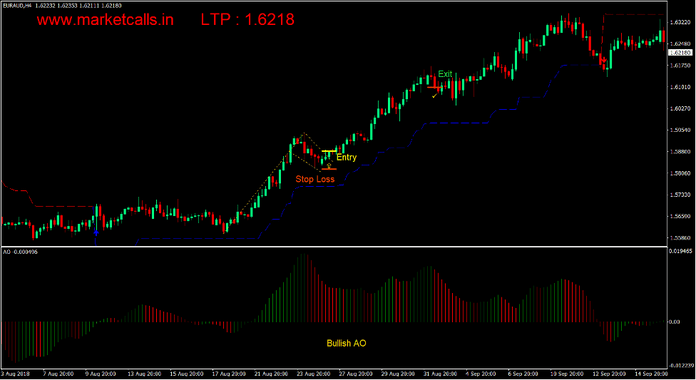

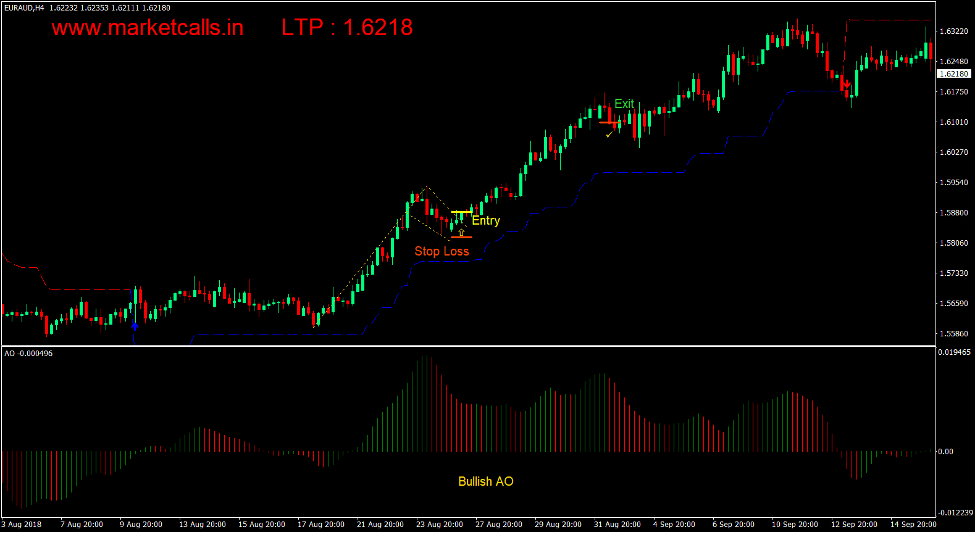

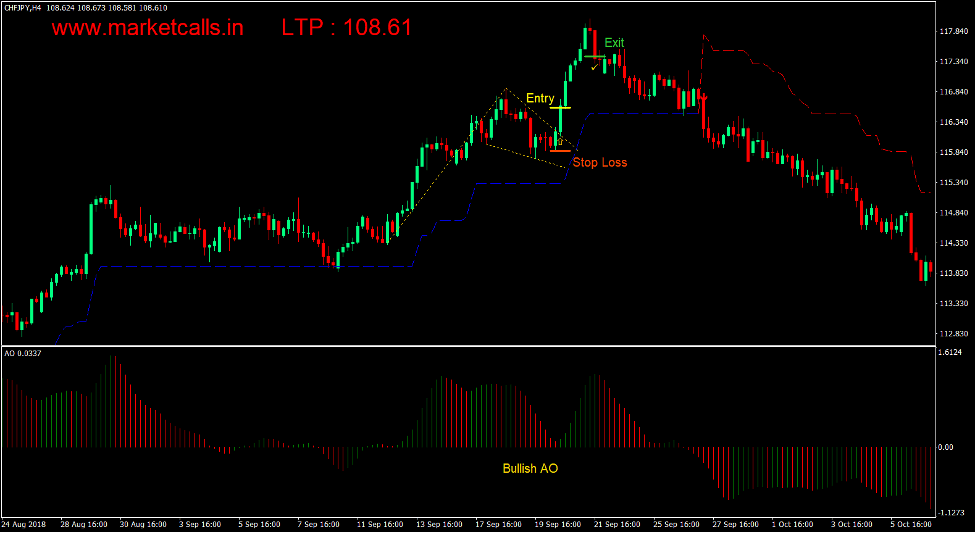

Buy Trade Setup

Entry

- The Awesome Oscillator bars should be positive.

- The Super Trend line should form below price action and should be blue.

- A bullish flag or pennant pattern should be observable.

- Enter a buy order as soon as price breaks above the body of the flag pattern.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as price action shows signs of reversing.

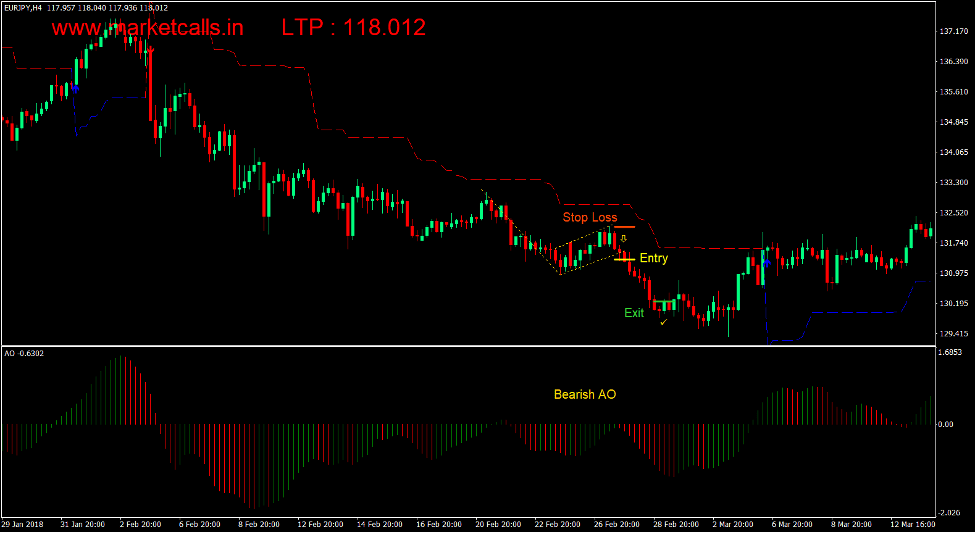

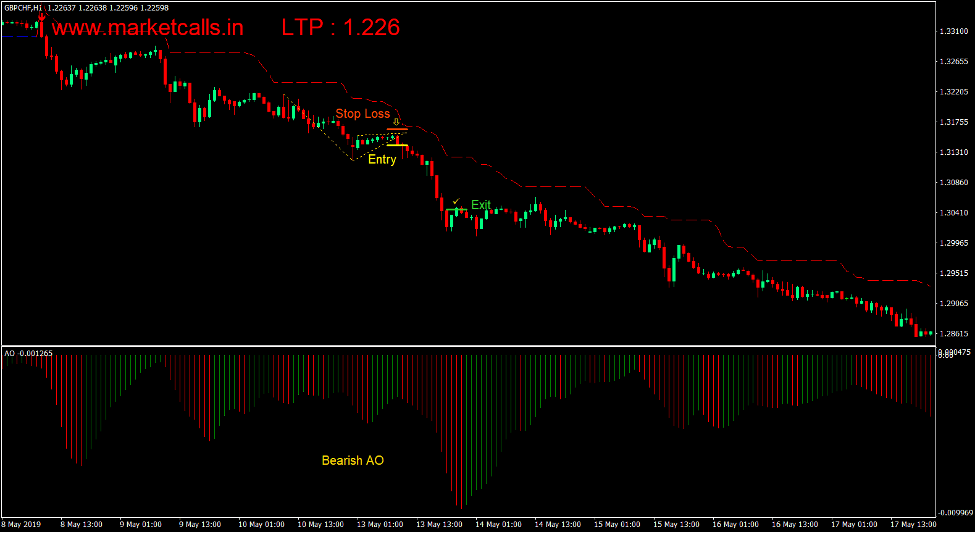

Sell Trade Setup

Entry

- The Awesome Oscillator bars should be negative.

- The Super Trend line should form above price action and should be red.

- A bearish flag or pennant pattern should be observable.

- Enter a sell order as soon as price breaks below the body of the flag pattern.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as price action shows signs of reversing.

Conclusion

This strategy is a working trading strategy. Traders can easily make profits consistently using this strategy.

The key to trading this strategy well is with the trading psychology of the trader. This is because price action is very subjective. Traders who are too greedy would often hold to a trade even if there is already clear reversal pattern hoping that the trade would produce more profits. On the other hand, traders who are too fearful would exit the trade too early even though there is still a potential for more profits based on price action. Traders who can master reading price action and avoid making wrong judgements due to fear and greed can easily profit using this strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: