Momentum trading is one of the best ways to trade. Many traders make money trading momentum strategies and so could you.

Trading momentum strategies is usually much easier compared to other strategies because the flow of the market is usually behind the trade setups. Momentum pushes it along causing price to move in favor of a trade setup that is based on a momentum strategy.

Now, although trading momentum strategies is usually much easier and tends to work better for many traders, it is not the Holy Grail of trading. There are instances where traders could get trapped in a losing trade or whipsawed into a loss. This is because many momentum traders are guilty of chasing price. Momentum traders would sometimes hit the buy button at the high or hit the sell button at the low.

How do we avoid this and make money trading momentum strategies? The key is in understanding how to find strong momentum trade setups.

There are many ways to identify momentum. Some traders use channels and Bollinger Bands, others use price action and candlestick patterns, while others use momentum technical indicators.

Smoothed RSI Momentum Forex Trading Strategy is a strategy that makes use of reliable technical indicators that could help traders identify strong momentum. This strategy combines an element of price action and trading with technical indicators giving it an edge over the market.

Smoothed RSI Inverse Fisher

The Smoothed RSI Inverse Fisher is an oscillating indicator that identifies momentum and trend direction.

This indicator is based on the Relative Strength Index (RSI), which is another oscillating indicator that helps identify momentum. The RSI is based on historical prices and mimics the movement of price action quite closely.

The Smoothed RSI Inverse Fisher indicator is basically an Inverse Fisher Transform computation applied on the Relative Strength Index (RSI).

Inverse Fisher Transform is used to alter the probability distribution function of an indicator. The resulting indicator is a smoothened-out oscillator which provides clearer signals.

Trend and momentum direction are based on whether the Smoothed RSI Inverse Fisher line is above or below 50.

SMMA Crossover Signal

SMMA Crossover Signal is a trend-following indicator which provides trade entry signals based on a pair of Smoothed Moving Averages (SMMA).

The basic Simple Moving Average (SMA) tends to provide lagging signals and are susceptible to noise. Different traders would try to address either of the two in order to have an indicator that would fit their trading style best.

The Smoothed Moving Average (SMMA) is geared towards reducing noise and lag at the same time. It does this by decreasing the weight of older historical prices in order to lessen its effect on the moving average line. The result is a much smoother moving average line which also tends to respond quick enough to price changes.

The SMMA Crossover Signal indicator provides trade signals based on a crossover of a pair of Smoothed Moving Average lines. In this setup, the periods used are both short-term moving averages. This provides trade signals that are timelier and more relevant to the current price action and tends to have a reduced lag.

This indicator provides trade signals by conveniently plotting arrows on the price chart to point where price might reverse and the direction of the signal.

Trading Strategy

This trading strategy provides trade signals based on a confluence of the two indicators above and a momentum candle.

The Smoothed RSI Inverse Fisher indicator will serve as the main momentum direction filter. Trades should be taken in the direction of the momentum as indicated by the Smoothed RSI Inverse Fisher. This will be based on whether the oscillator line is above 50 or below 50. A line that is above 50 indicates a bullish momentum while a line that is below 50 indicates a bearish momentum.

The SMMA Crossover Signal will serve as our entry signal based on the arrows it plots. These arrows should agree with the momentum direction indicated by the Smoothed RSI Inverse Fisher indicator. It should also be in confluence with a momentum candle, which would be a long big bodied candle with small wicks.

Indicators:

- SMMA-Crossover_Signal (default setting)

- SmoothedRSIInverseFisher (default setting)

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

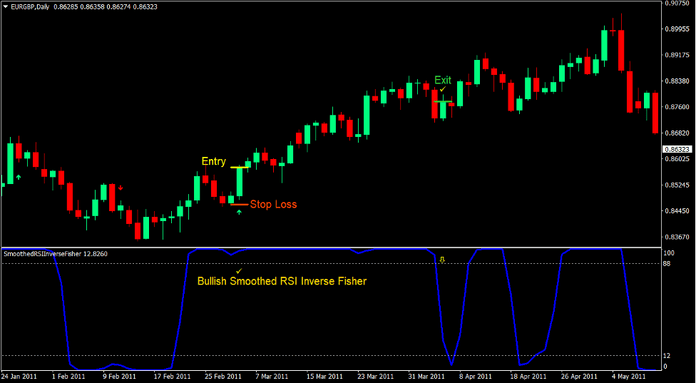

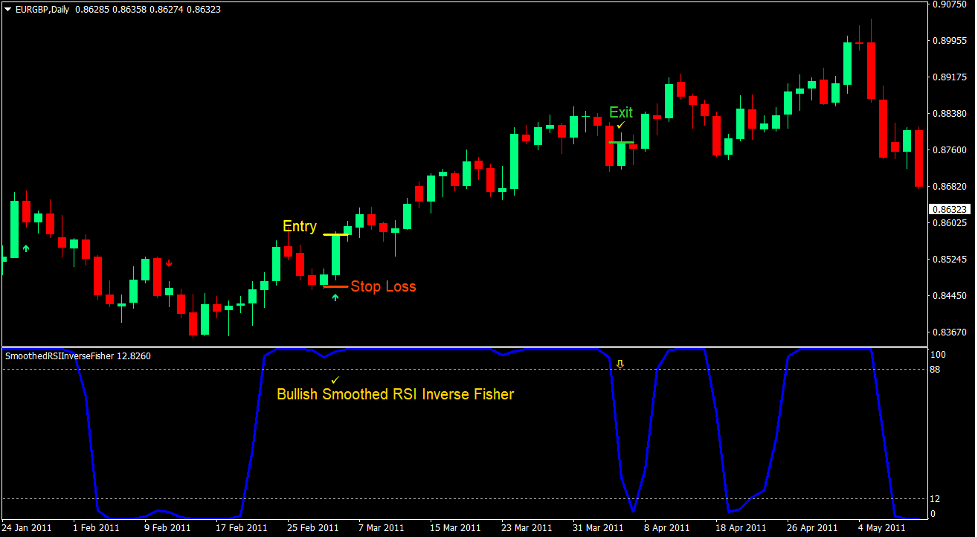

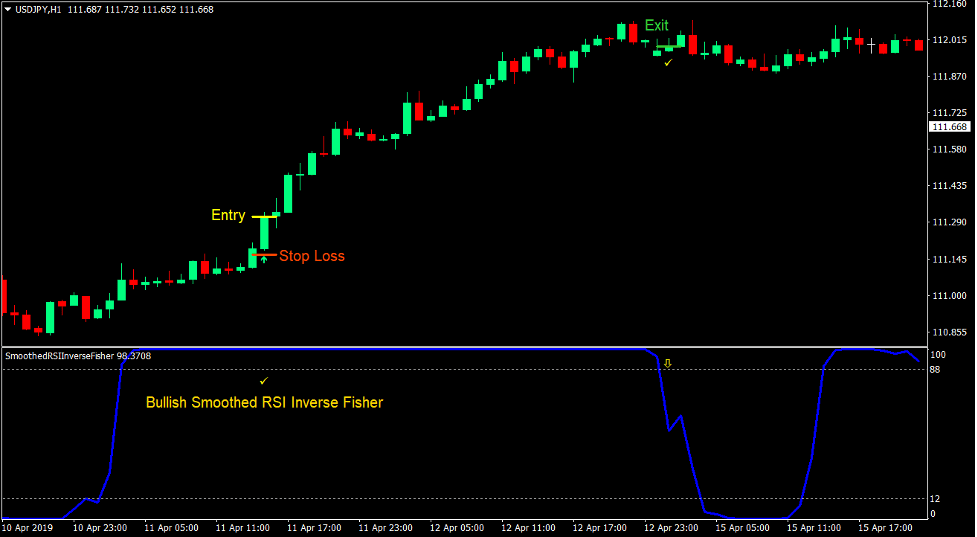

Buy Trade Setup

Entry

- The Smoothed RSI Inverse Fisher line should be above 50.

- The SMMA Crossover Signal indicator should print an arrow pointing up.

- The buy signal should be in confluence with a bullish momentum candle.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss a few pips below the entry candle.

Exit

- Close the trade as soon as the Smoothed RSI Inverse Fisher line falls below 88.

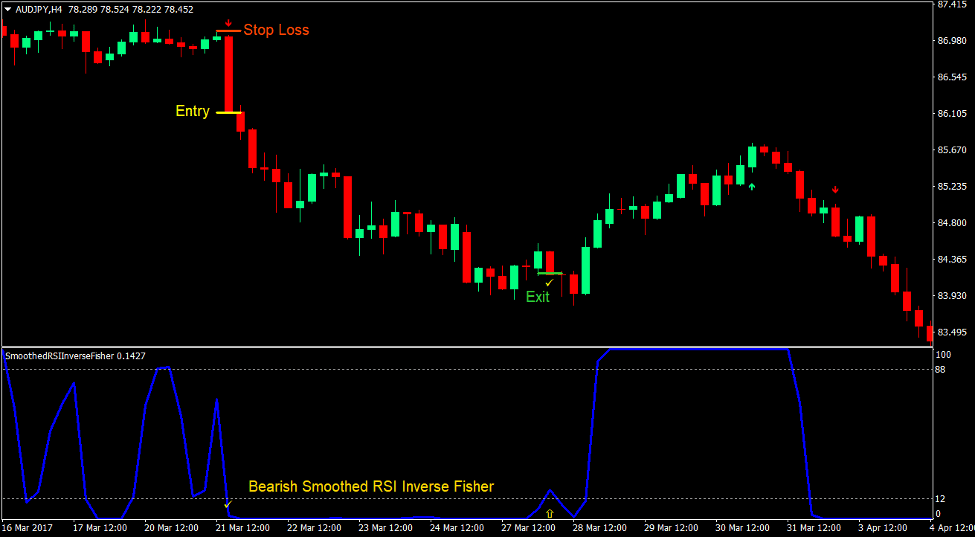

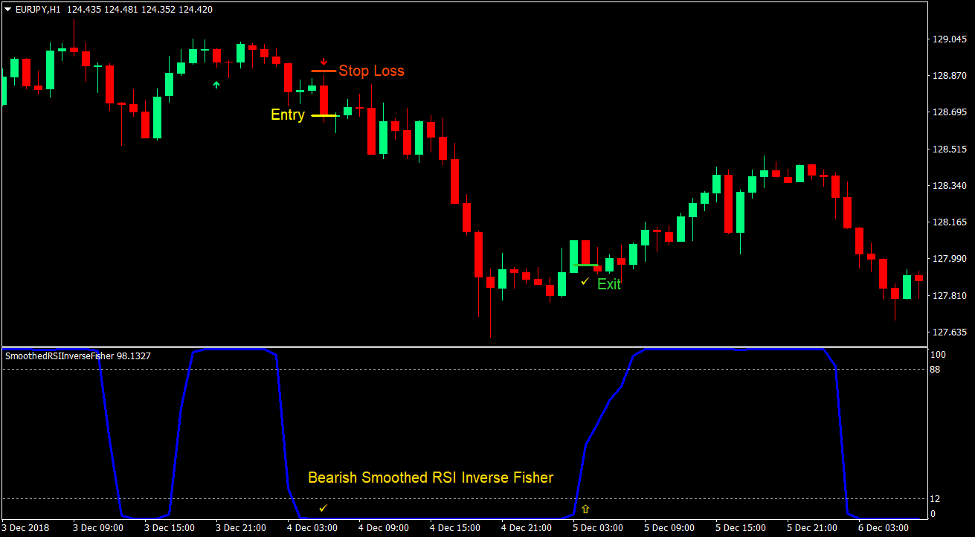

Sell Trade Setup

Entry

- The Smoothed RSI Inverse Fisher line should be below 50.

- The SMMA Crossover Signal indicator should print an arrow pointing down.

- The sell signal should be in confluence with a bearish momentum candle.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss a few pips above the entry candle.

Exit

- Close the trade as soon as the Smoothed RSI Inverse Fisher line rises above 12.

Conclusion

This momentum trading strategy works best when combined with price action technical analysis.

Price usually moves a bit further towards the direction of the momentum move after a momentum candle that is confirmed by both indicators. This is what makes this strategy profitable.

Also, since momentum trades do not usually last too long, traders should be ready to exit the market as soon as they could identify probable signs of a reversal. Stop loss should also be moved to breakeven as soon as possible in order to protect profits.

As always, trade wisely.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: