Many people think that trading is very complicated and that it should be left to the math geeks, programmers and financial analysts. While many institutional traders and analysts have this kind of background, it is not necessarily true that trading should be exclusively for these types of people. This is because trading does not necessarily have to be complicated in order to be profitable. In fact, not all geniuses could succeed in trading, while there are many drop outs who have done well as a retail trader. Trading strategies could be complex yet ineffective and they could also be simple yet effective.

The Kaufman Envelopes Forex Trading Strategy is a simple yet effective trading strategy suitable for any retail trader, whether you are a beginner or have already been trading for many years. It is an indicator-based and rule-based trading strategy, which makes it very easy to follow. It makes use of a simple crossover of two powerful indicators and a confirmation of an oscillating indicator, in which the setups it produces have a good probability of resulting in a high yielding trade setup.

Kaufman’s Adaptive Moving Average

The Kaufman’s Adaptive Moving Average (KAMA), developed by Perry Kaufman, is a moving average designed to address the issue of market noise and volatility. It is common to moving averages perform poorly in indicating a trend during choppy market conditions. Although the KAMA indicator does not perfectly eliminate noise, it does however perform much better than most moving averages when it comes to adjusting for noise. The KAMA indicator tends to hug price action quite close during conditions where market noise is quite low. However, during choppy markets, the KAMA indicator tends to stay relatively flat. This gives traders an indication that the market is in an indecisive phase and allows traders to stay away for a while. Staying relatively flat as a moving average also produces lesser trade signals for moving average crossover traders. This means less false signals for them.

The KAMA smoothens out moving averages by making use of an Efficiency Ratio. This basically attempts to account for volatility by computing for the change in price for a certain preset period. The Efficiency Ratio is then used to compute for the Smoothing Constant. Lastly, the indicator computes for the current KAMA, while including the Smoothing Constant in the equation.

Kijun-sen and Envelopes

The Kijun-sen and Envelopes indicator is custom momentum indicator use to aid traders in identifying trend direction. As the name suggests, this indicator is an envelope type of indicator but is based on the Kijun-sen. It has midline, an upper band and a lower band, much like the usual Envelopes indicator. However, the midline is based on the Kijun-sen, which is a reliable modified moving average used in the Ichimoku Cloud indicator.

5-34-5 Oscillator

The 5-34-5 indicator is a custom indicator used to identify momentum. It is an oscillating indicator which resembles the Moving Average Convergence and Divergence (MACD). It is also an unbounded oscillator much like the MACD. However, due to its parameter setting, its lines tend to be smoother compared to other oscillating indicators. Trade signals could be generated based on the crossing over of its two lines if it is considerably away from the midline. This is because crossovers that are overbought or oversold tend to work better than crossovers that are closer to the mean. However, having both lines crossover the midline could also be another type of trade signal. Having both lines cross over the midline typically indicates a change trend direction.

Trading Strategy

This strategy produces trade signals based on the crossing over of the KAMA indicator and the Kijun-sen and Envelopes indicator. Trade signals are generated whenever the blue line of the KAMA indicator crosses over the dodger blue midline of the Kijun-sen and Envelopes indicator.

Trade entries are also filtered based on the 5-34-5 oscillating indicator. Both lines should have crossed over the midline indicating that the trend has already shifted. The faster red line of the 5-34-5 indicator should also be leading going the direction of the trend as indicated by the crossover of the KAMA indicator and Kijun-sen and Envelopes indicator.

Indicators:

- kijun_sen_and_envelope

- KAMA

- 5_34_5

Timeframe: preferably 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

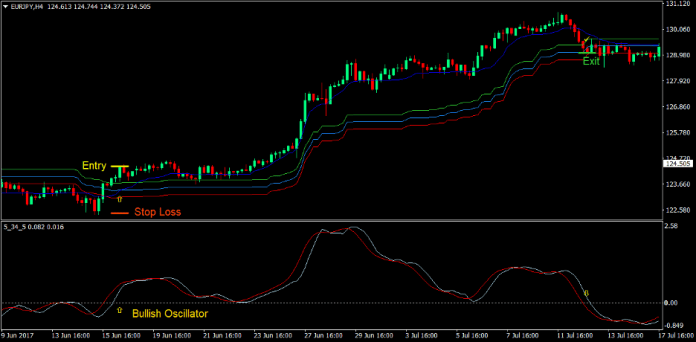

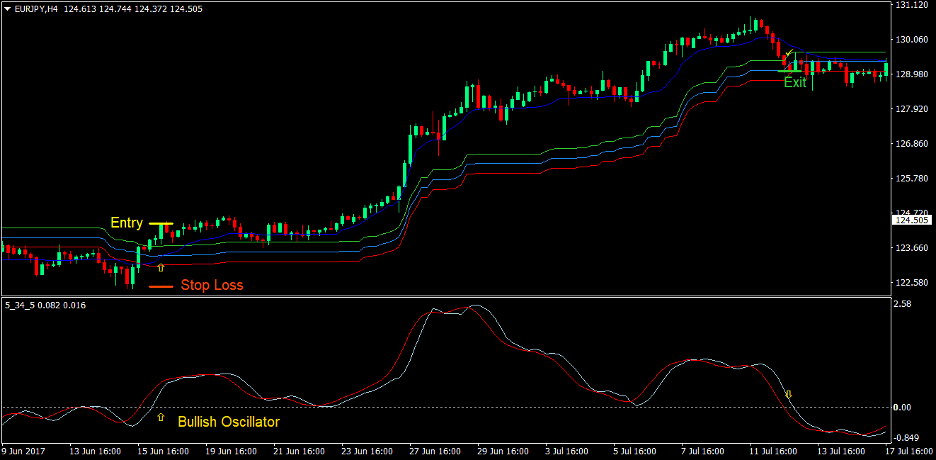

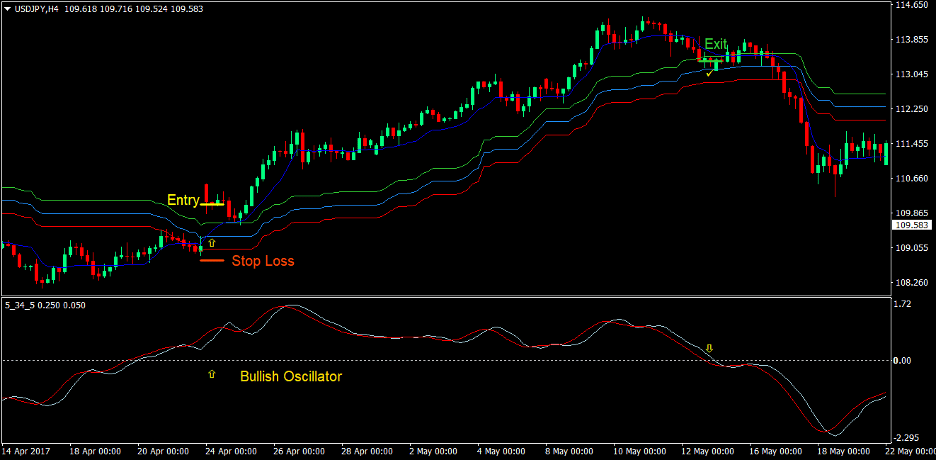

Buy Trade Setup

Entry

- The 5-34-5 oscillator lines should cross above the midline indicating a bullish trend

- The red line should be above the light blue line indicating an ongoing bullish short-term trend

- The blue KAMA line should cross above the dodger blue midline of the Kijun-sen and Envelopes indicator indicating a bullish trend reversal

- These bullish signals should be somewhat aligned

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Close the trade as soon as the red line of the 5-34-5 oscillator crosses below the midline

- Close the trade as soon as a candle closes below the dodger blue line of the Kijun-sen and Envelopes indicator

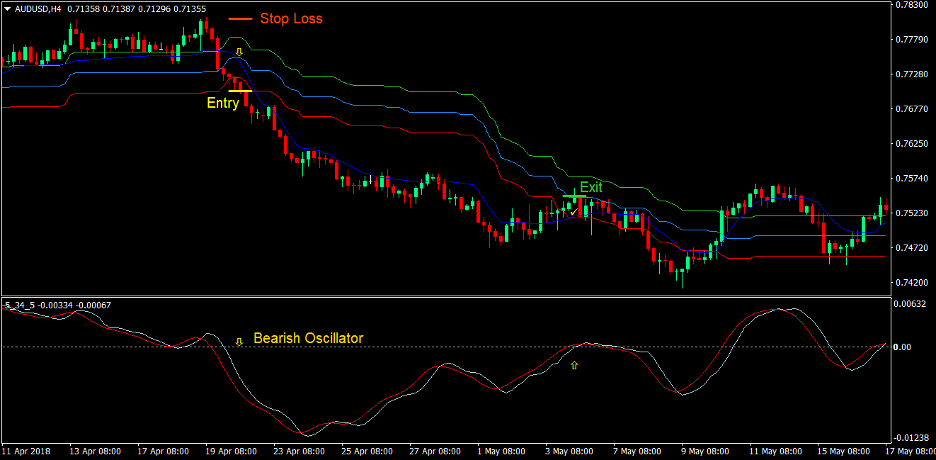

Sell Trade Setup

Entry

- The 5-34-5 oscillator lines should cross below the midline indicating a bearish trend

- The red line should be below the light blue line indicating an ongoing bearish short-term trend

- The blue KAMA line should cross below the dodger blue midline of the Kijun-sen and Envelopes indicator indicating a bearish trend reversal

- These bearish signals should be somewhat aligned

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as the red line of the 5-34-5 oscillator crosses above the midline

- Close the trade as soon as a candle closes above the dodger blue line of the Kijun-sen and Envelopes indicator

Conclusion

This trading strategy is a simple crossover strategy using the KAMA indicator and the Kijun-sen and Envelopes indicator. Both these modified moving average lines are good indications of trend direction. Using these two lines together work well in determining possible trend reversal setups that could trend quite long.

This strategy allows for high yield trades to take place from time to time, while having a pretty consistent win rate. However, there will be some losses and drawdown periods. This strategy keeps the drawdowns to a minimum since the strategy calls for traders to close the trade if ever the market reverses prematurely. It is also best to trail the stop loss to breakeven whenever possible to reduce the risk of market reversals.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: