Technical traders often use a variety of trading indicators in order to implement their strategy. Often traders would be using indicators that determine trend direction and potential trend reversals. However, not all trading indicators are made equal. Some work while some don’t. Some are profitable, some are not. Some indicators are just simply better than others.

The Ichimoku Cloud indicator is one of those indicators that have been proven to be profitable in the long-term even as a standalone indicator. This strategy makes use of the strengths of the Ichimoku Cloud indicator in order to profit from the market consistently.

Tenkan-sen and Kijun-sen

The Ichimoku Cloud indicator is one of the indicators that has been proven to be a profitable standalone indicator even when used in the long-term. This is probably due to the fact that it somehow gives traders a more complete picture with regards to the trend direction.

The Tenkan-sen and Kijun-sen is probably the most important pair of lines in the Ichimoku Cloud indicator. The two indicators represent the short and mid-term trends and are the lines that are mainly used as entry signals.

The Kijun-sen represents the longer-term trend of the two and is often referred to as the signal line. The Tenkan-sen on the other hand represents the short-term trend and is often called the conversion line. Trade signals are generated based on the crossing over of the two indicators. A buy signal is generated whenever the Tenkan-sen crosses above the Kijun-sen, while a sell signal is generated whenever the Tenkan-sen crosses below the Kijun-sen line.

BT1 Indicator

The BT1 indicator is a custom trend indicator that attempts to predict the direction of the short-term trend. It does this by overlaying a line on the candlesticks. These lines change color whenever it detects a trend change on the short-term trend. For this template, we have set the lines to be drawn blue whenever the trend is bullish and yellow if the trend is bearish.

This indicator acts on the short-term trend and responds much like the Gann HiLo and the Heiken-Ashi Candlestick indicators. These types of indicators tend to act as good entry signals for short-term trades and are also good early warnings for short-term trend reversals.

BSTrend Indicator

The BSTrend indicator is a custom indicator which helps traders identify trend direction. It does this by printing bars that changes colors. Bullish bars are printed sky blue while bearish bars are printed violet. This indicator is binary in nature and prints bars that are either +1 or -1. This binary characteristic of the indicator makes it an excellent trend direction filter. This allows traders to objectively determine trend direction without much confusion.

Trading Strategy

This strategy is a crossover strategy based on the Tenkan-sen and Kijun-sen lines of the Ichimoku Cloud indicator. However, we will also be using the BT1 and BSTrend indicators as complimentary indicators that serve different purposes within this strategy.

The BT1 indicator would determine the short-term trend and would act as a confirmation of the trade signal provided by the Tenkan-sen and Kijun-sen lines crossover. Aside from this, the BT1 indicator would also serve as an early short-term trend reversal which would allow us to exit the trade earlier prior to the actual short-term trend reversal.

The BSTrend indicator would serve as the longer-term trend filter. Trade signals that are not in agreement with the BSTrend indicator would not be considered as this would mean that the trends are not aligned. Aside from this, the BSTrend would also be an exit signal as there are instances when the BSTrend would also indicate a trend reversal prior to the crossing over of the Tenkan-sen and Kijun-sen.

Indicators:

- Ichimoku Kinko Hyo

- BT1

- Risk: 3

- BSTrend

- Period: 12

Timeframe: 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

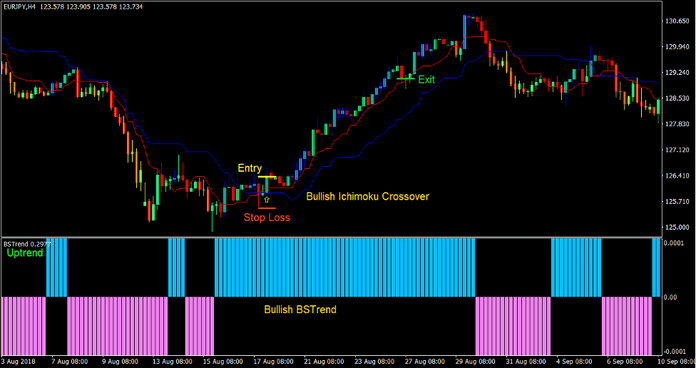

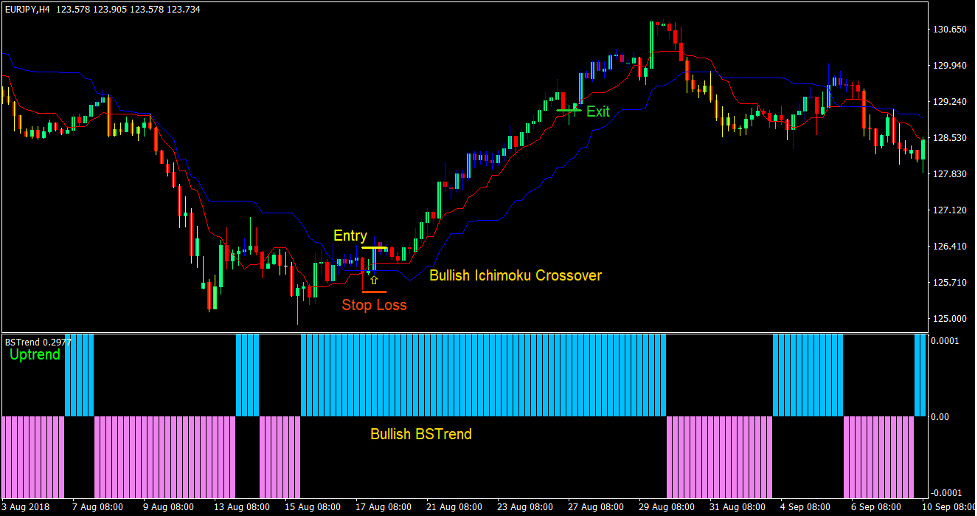

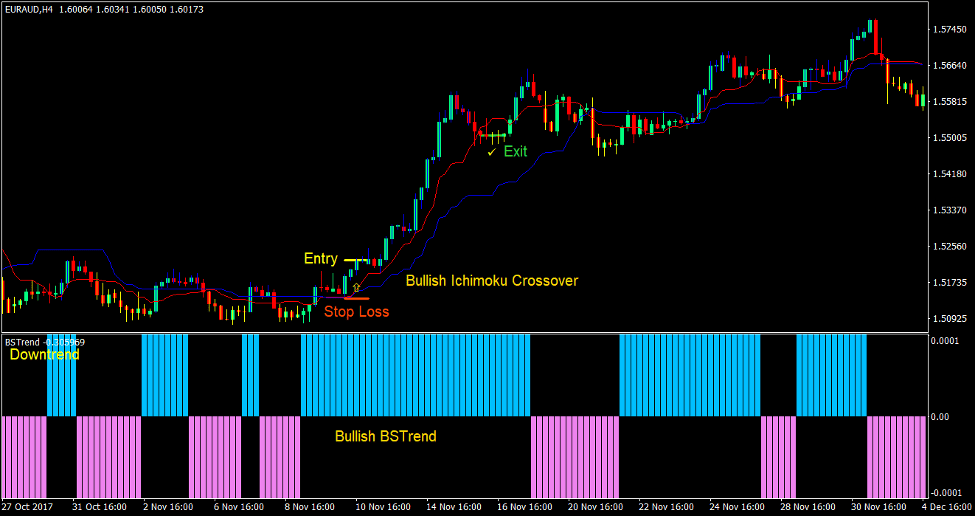

Buy Trade Setup

Entry:

- The BSTrend indicator should be printing sky blue bars indicating a bullish trend

- The BT1 indicator should be printing blue lines on the candlesticks indicating a bullish short-term trend

- The Tenkan-sen line (red) should cross above the Kijun-sen line (blue) indicating a bullish trend reversal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the support level below the entry candle

Exit

- Close the trade as soon as the BT1 indicator draws a yellow line on the candlesticks

- Close the trade as soon as the BSTrend indicator prints a violet bar

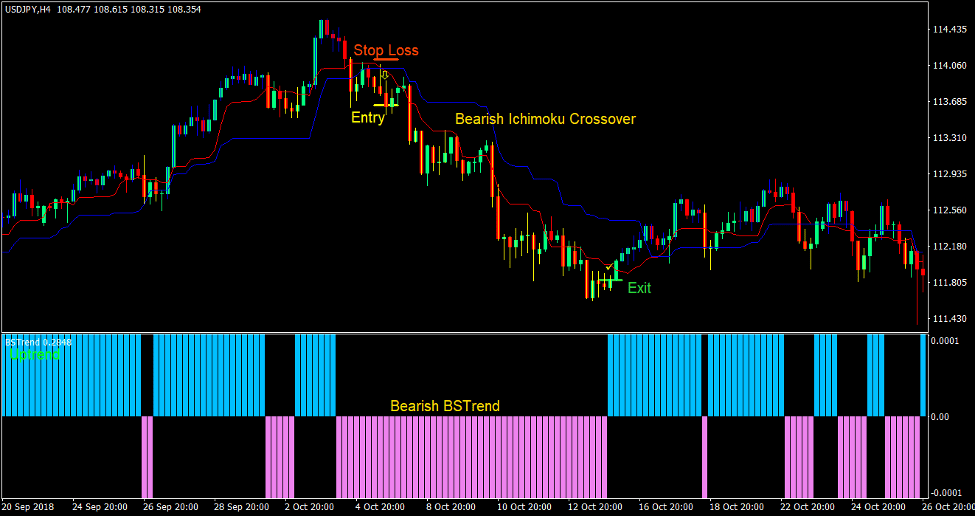

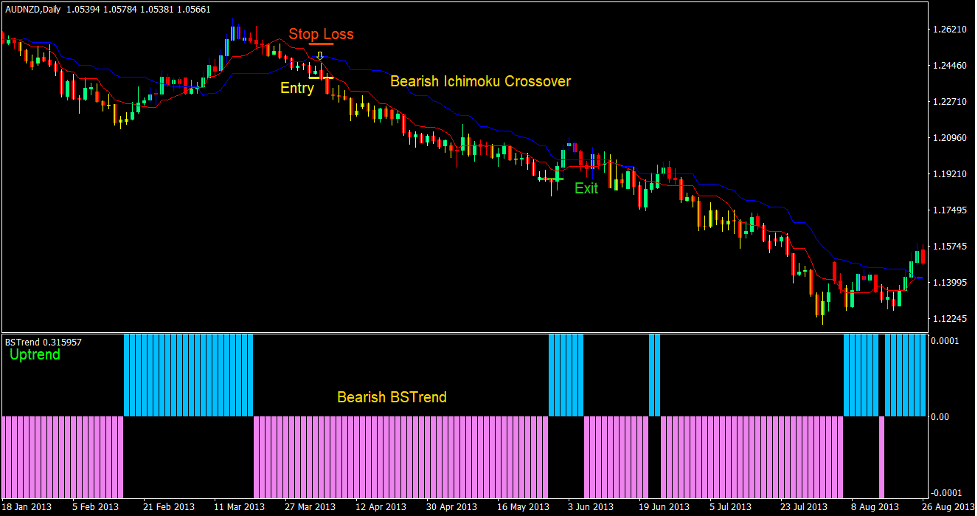

Sell Trade Setup

Entry:

- The BSTrend indicator should be printing violet bars indicating a bearish trend

- The BT1 indicator should be printing yellow lines on the candlesticks indicating a bearish short-term trend

- The Tenkan-sen line (red) should cross below the Kijun-sen line (blue) indicating a bearish trend reversal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss on the resistance level below the entry candle

Exit

- Close the trade as soon as the BT1 indicator draws a blue line on the candlesticks

- Close the trade as soon as the BSTrend indicator prints a sky blue bar

Conclusion

The Ichimoku Cross Forex Trading Strategy is a high probability crossover strategy. Using the Ichimoku Cloud indicator alone is already a profitable trading strategy. Including the BT1 and BSTrend custom indicators as a confirmation increases the probability of a winning trade, due to the alignment of the short-term and long-term trends.

This strategy allows for a relatively higher win rate while at the same time allows winning trades to run longer, which could result in high yielding trades. Trading this strategy with a sound money management system would allow traders to consistently profit from the market over the long-term.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: