DASR EMA Forex Trading Strategy

Alright, so what about the coded strategy name? There is nothing special about it. Just for Dynamic Area of Support and Resistance (DASR).

The Dynamic Area of Support and Resistance (DASR)

You may be asking, “what is it about the dynamic area of support and resistance?”

Before we go onto what DASR is, let us first discuss one of the characteristics of its main component, the moving average.

One of the characteristics of moving averages is that price tend to bounce off them, especially the more popular ones and especially if there is a clear trend. This is what I’d like to call a dynamic support or resistance. It is dynamic because it is never fixed. It weaves up and down the chart, shadowing where price goes. But as price touches a commonly used moving average, there is that probability that price would bounce off it.

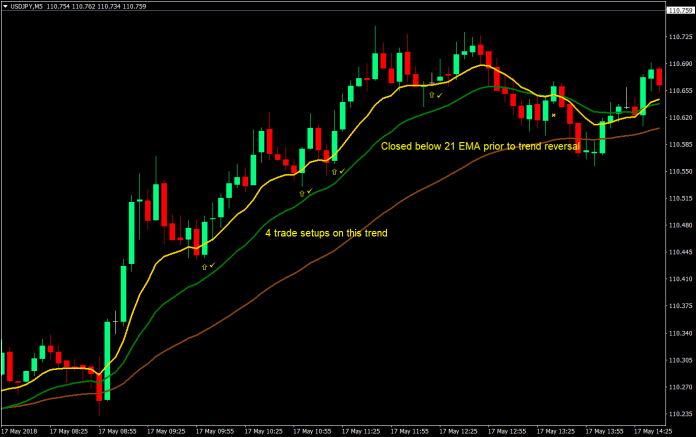

The chart below shows a sample of price consistently bouncing off a popular moving average.

This is a good example of how moving averages tend to act as dynamic supports. However, you would also notice that in some cases, price would stall a bit prior to bouncing off. In some cases even, price would probe below the moving average for several candles.

This is where the brilliance of the word “area” comes into play.

The market consists of a large number of trading participants. All of whom have a different take on the market. All of whom use different strategies, moving averages, and setups. Because of this, supports and resistances are never precise. They could go over a support or resistance at times, or pierce moving averages for a few pips prior to bouncing off.

To alleviate this problem, we bring in a second moving average. The function of this moving average is to mark the area in between our main moving average and this new moving average as an area of support and resistance.

We could then say that price could bounce off the area in between the two moving averages, and we would only conclude that price has bounced off it if the candle closes outside this area going the direction of the trend. And that my friend is a Dynamic Area of Support and Resistance (DASR).

Trade Concept

Now that we have an understanding of what a Dynamic Area of Support and Resistance is, we could then go on to discuss the specific parameters of the moving averages that we would be using for this particular strategy. Take note though that there are several combinations of moving averages that could make a DASR.

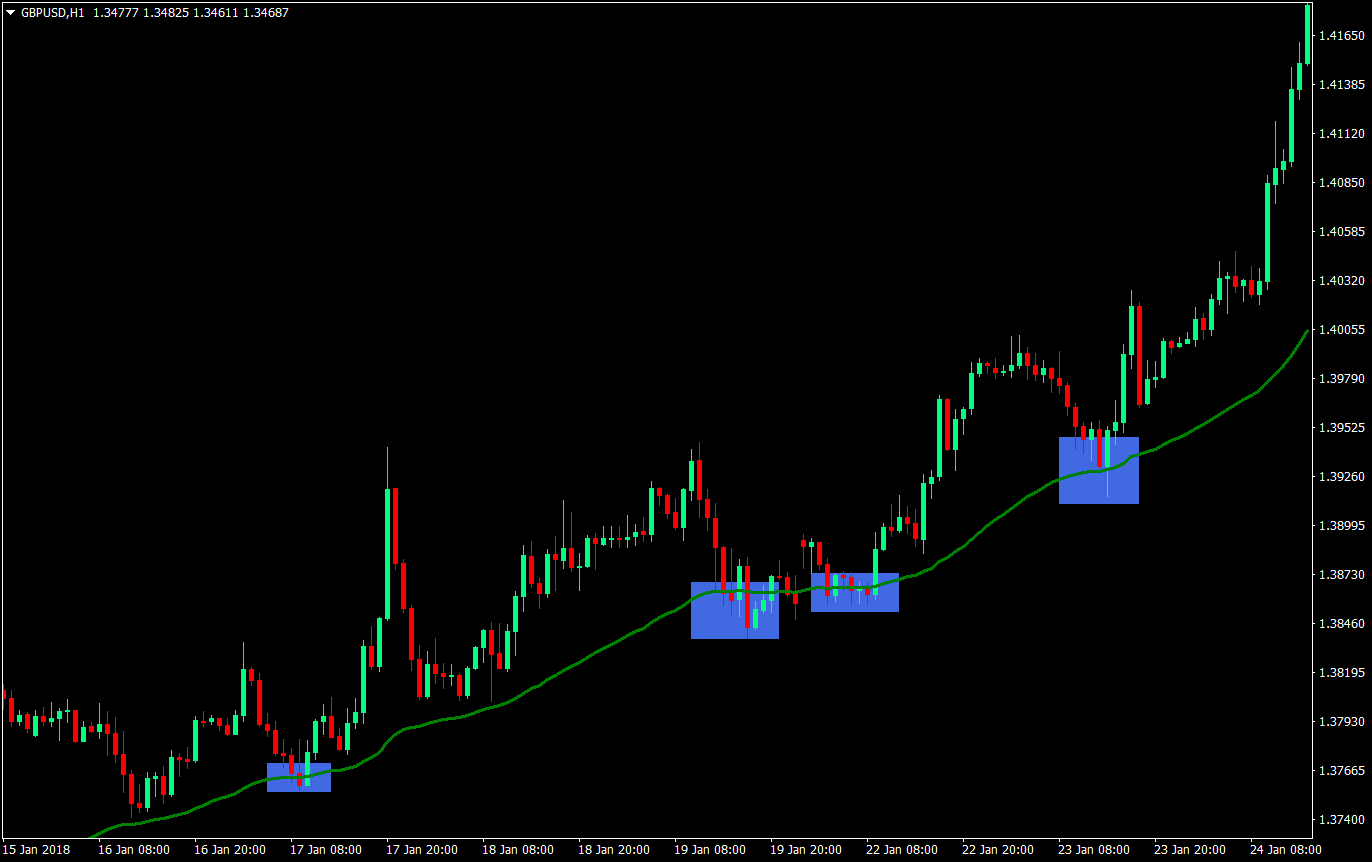

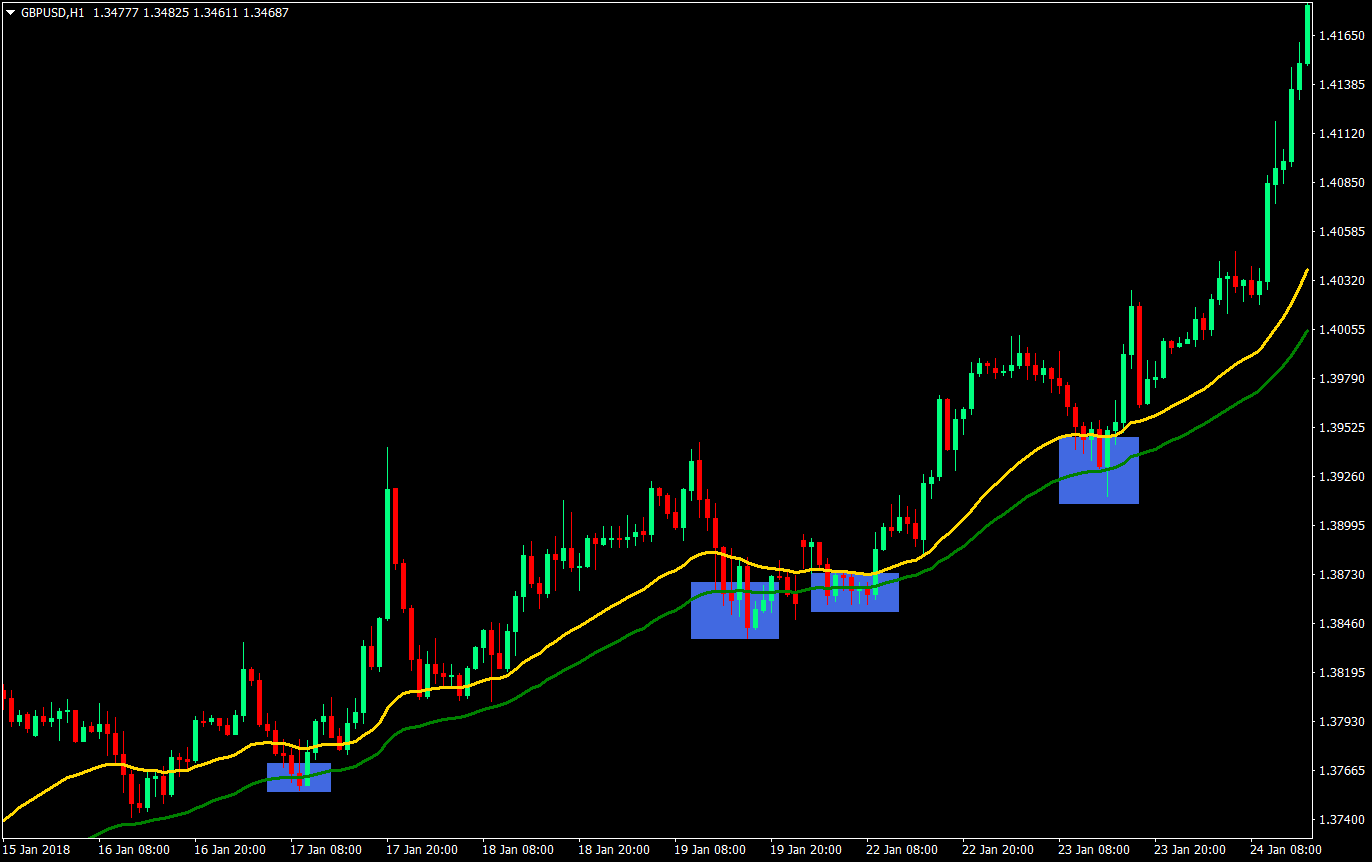

For this particular strategy, we will be using the 10 & 21 Exponential Moving Averages (EMA) as our DASR. However, we will also be adding another moving average to serve as our trade direction filter. We will be using the 50 EMA as our trade direction filter. Your chart should look somewhat like the one below.

Timeframe: 5-minute chart and above

Currency Pair: any major pair

Session: if day trading, trade on the session of one of the currencies (Ex: GBPUSD – London and New York session)

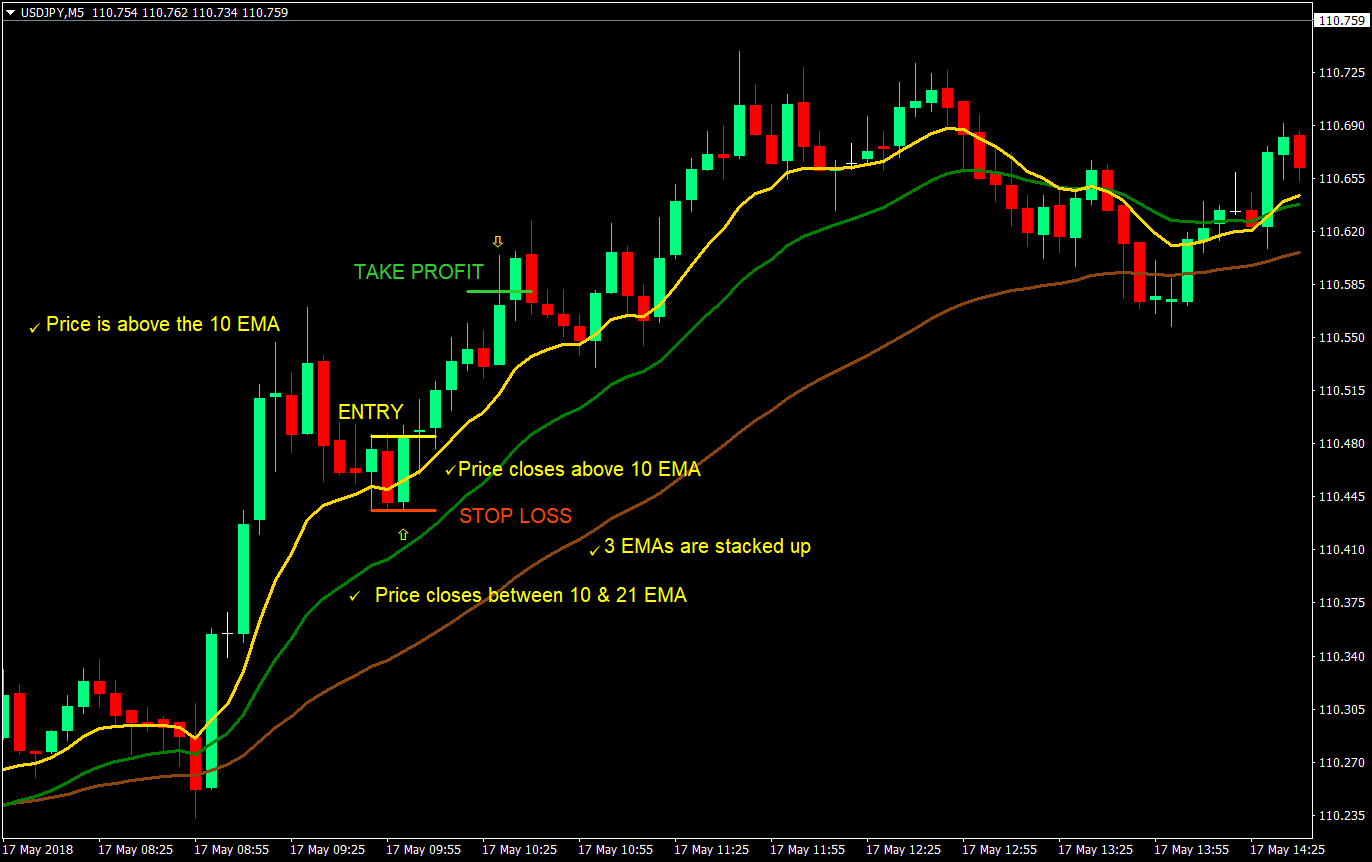

Buy Setup

Entry

- The three EMAs should be stacked up

- 50 EMA (brown): bottom

- 21 EMA (green): middle

- 10 EMA (gold): top

- Price should come from above the 10 EMA

- Price should retrace towards the DASR – 10 & 21 EMA

- Price should close inside the DASR

- Price should close back above the 10 EMA

- Enter a buy market order at the close of the candle

Stop Loss

- Set the stop loss at the swing low below the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

This is one of the buy trade setups on this bullish trend, however there are several trade setups on this chart that could have worked.

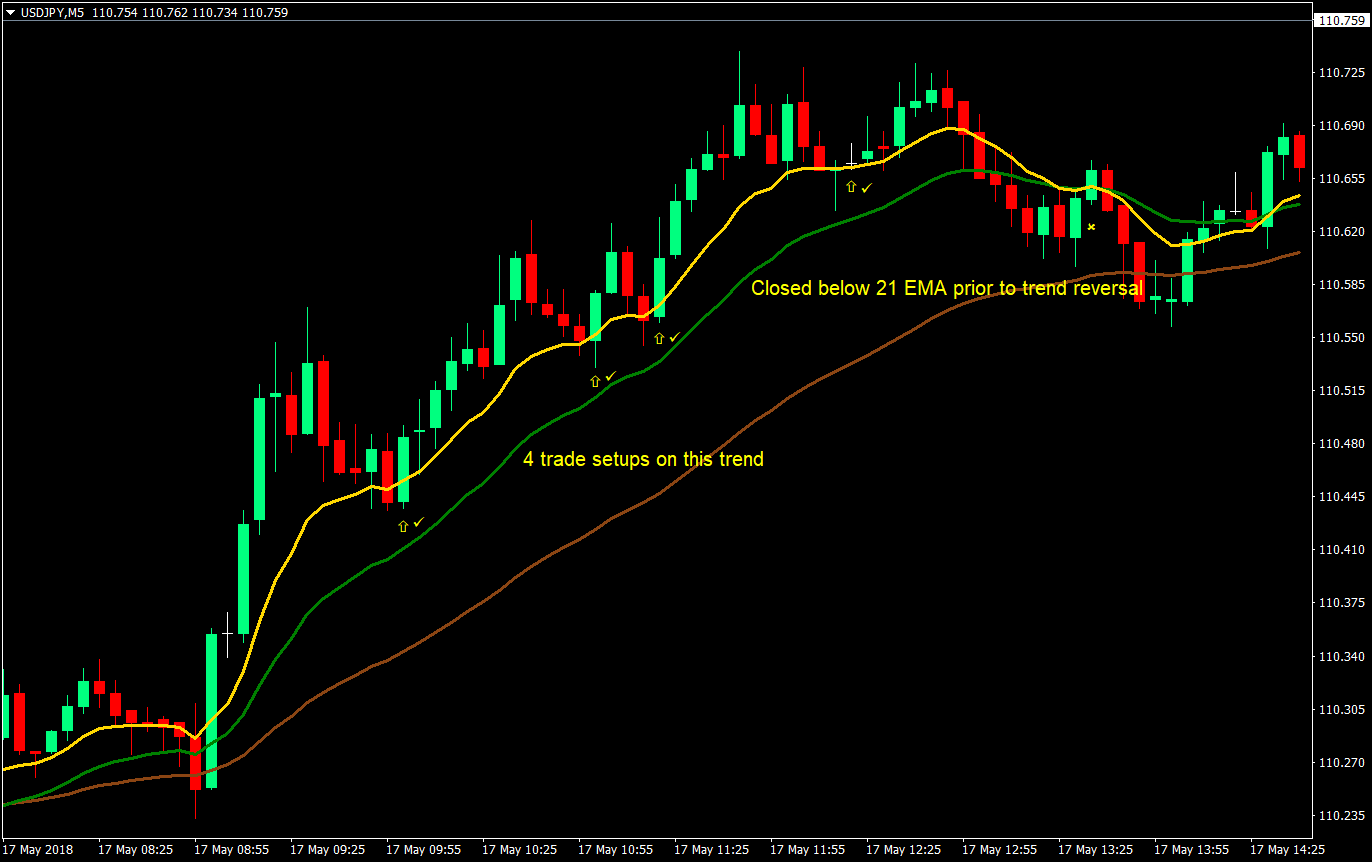

On this particular trend there are four setups that could have worked. The last one though just barely made it. Towards the end of the chart price started closing below the DASR although above the 50 EMA. Still, this would be considered a risky trade because this is a signal of a reversal. Price action traders would also see that it has formed a lower low on that area, a precursor of a reversal.

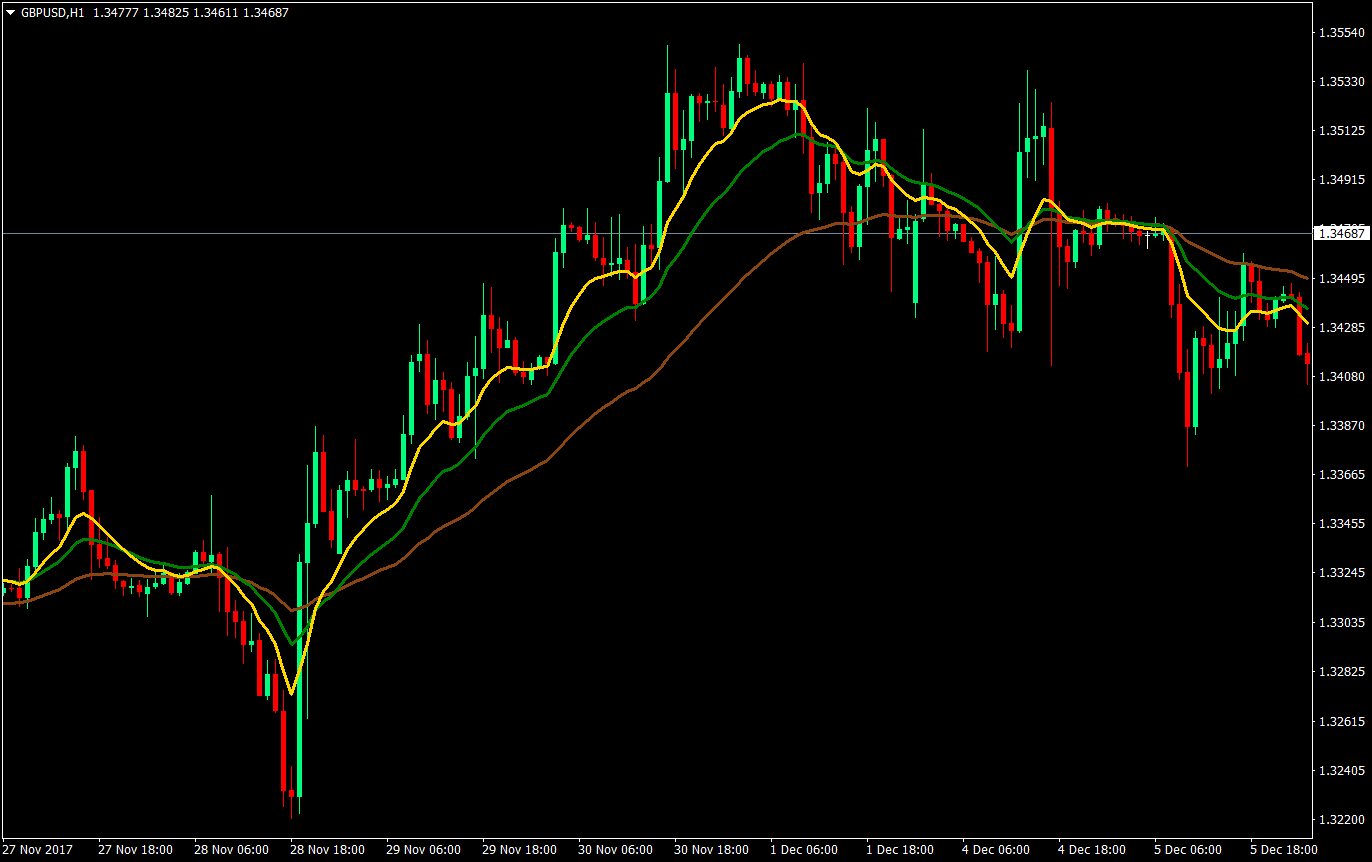

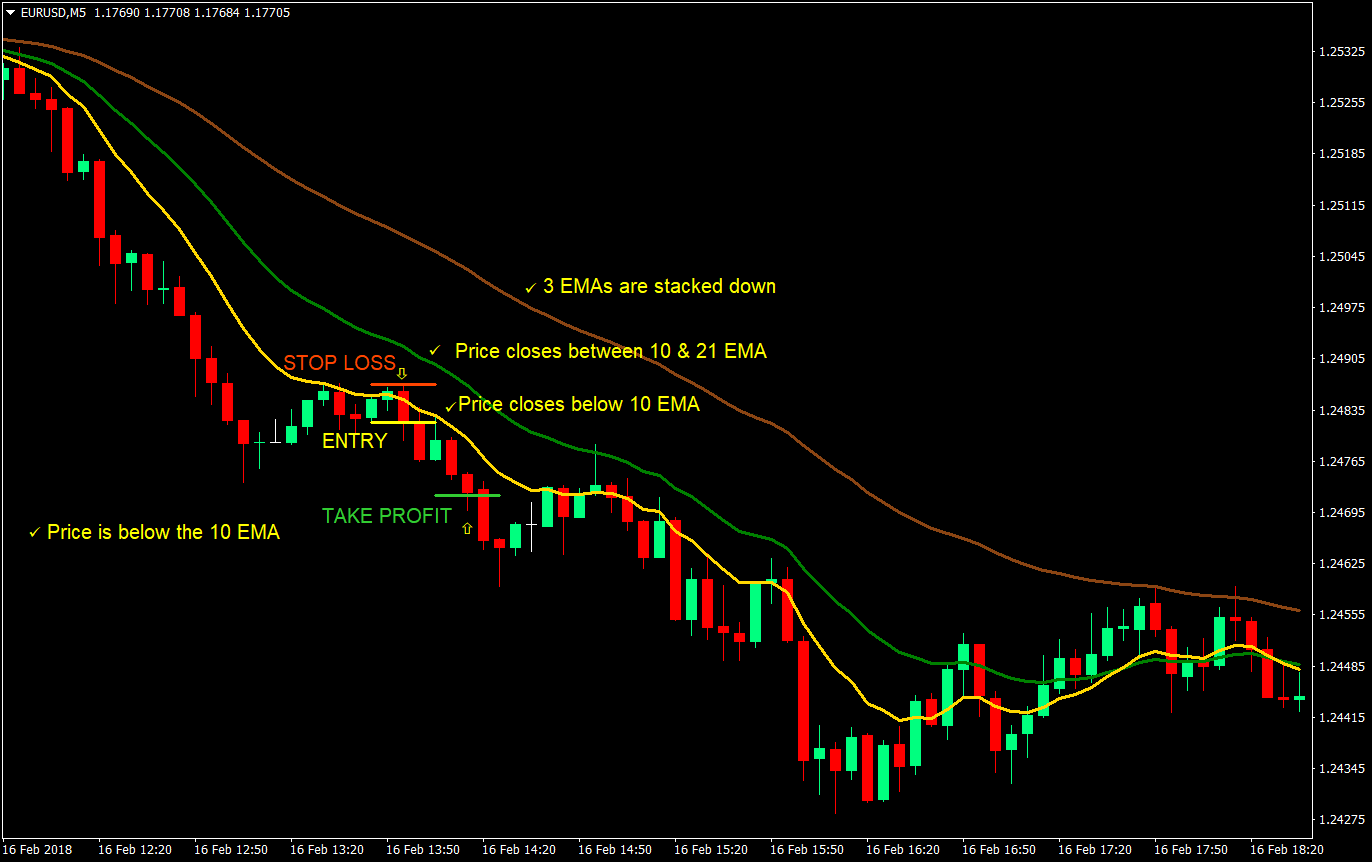

Buy Setup

Entry

- The three EMAs should be stacked down

- 50 EMA (brown): top

- 21 EMA (green): middle

- 10 EMA (gold): bottom

- Price should come from below the 10 EMA

- Price should retrace towards the DASR – 10 & 21 EMA

- Price should close inside the DASR

- Price should close back below the 10 EMA

- Enter a sell market order at the close of the candle

Stop Loss

- Set the stop loss at the swing high above the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

This is how a successful sell trade setup would look like. But if you’d look closely, there are also other trade setups available here, most of which would have been profitable.

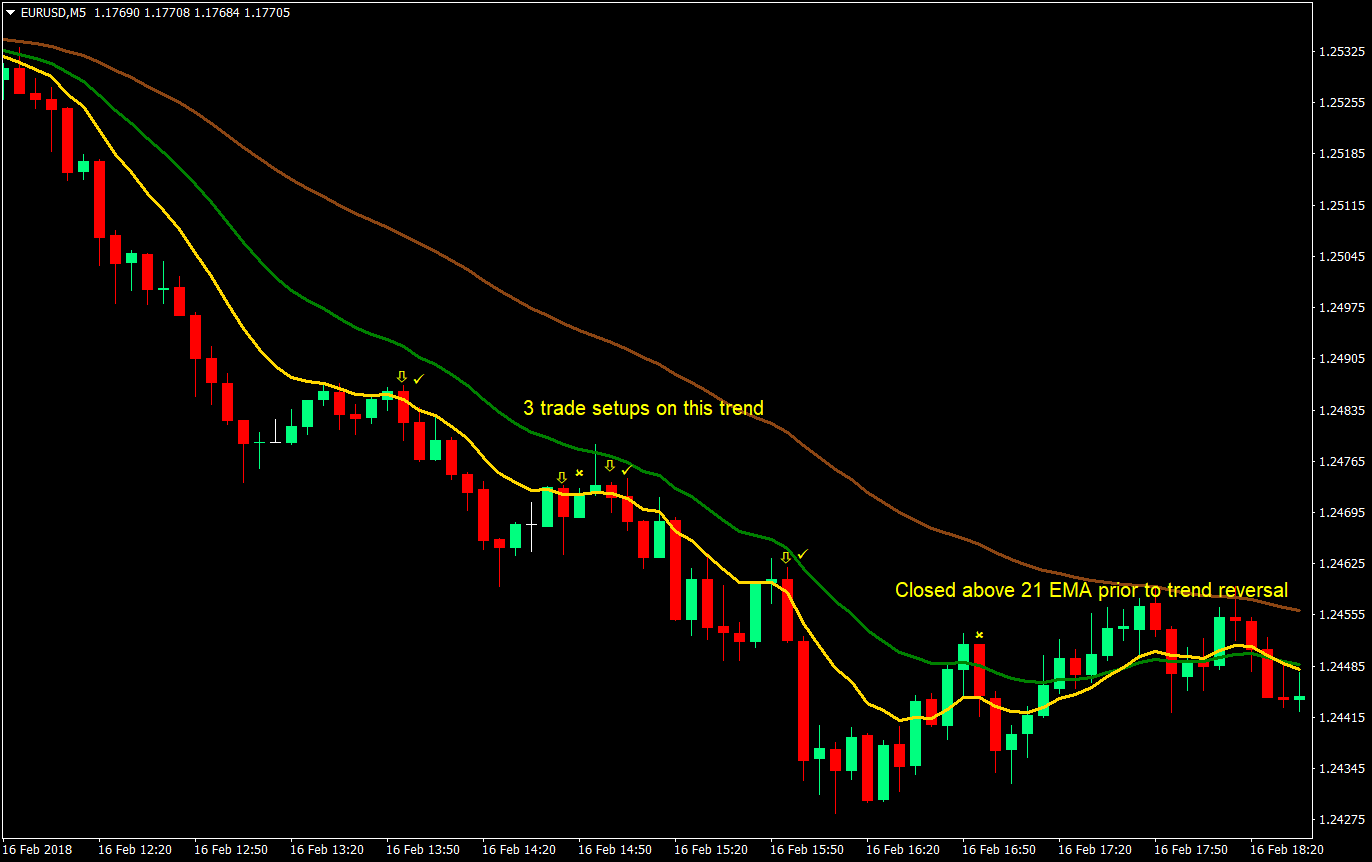

There are four trade setups in total on this bearish trend. Three would have been profitable, while one would have been for a loss. That is still a 75%-win rate. Towards the end of the chart, the market started to reverse. First, a candle closed above 21 EMA, then it showed signs of a bounce. However, this was already a start of a reversal.

Conclusion

Dynamic Areas of Supports and Resistances are great. They provide areas where you could snipe for your next trade. However, the problem is in looking for the right moving average parameters. This setup though works because many traders use moving averages between these numbers. If you would search the internet, you would find trend traders taking trades as price retraces on a fast moving average. It may be a 10, 15, or 20-period moving average. Because our DASR has these popular numbers covered, we could ride in on whichever moving average price did bounce off at that time.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: