Trading is not an easy endeavor. Imagine anticipating price movements of a tradeable security when in fact it is dependent on a variety of factors and the whims of thousands of traders around the world. Forex trading in particular is even more difficult. The sheer size of the market means that there are more market participants who have varying expectations and outlooks. This often causes the price of forex currency pairs to fluctuate erratically. Add to it the fact that forex pairs are composed of two currencies, which are themselves individual tradeable commodities with different supply and demand structures.

Although forex trading is not easy, traders who master it have the opportunity to make unlimited money from the forex market. The same volatility that can cause some traders to lose some money is the same reason why there is so much opportunity in trading the forex market.

Professional traders make money from trading the forex market because they have an edge. A trading edge is an advantage that traders have that should allow them to have higher win percentages or higher risk-reward ratios or a combination of both, which should result in a consistently profitable trading statistic.

One of the best sources of a trading edge are technical indicators. Not all technical indicators are made the same. Some are better than others. Technical indicators generally help traders identify opportunities in the market which have a high win probability. However, they should not be used as the only basis to make a trade. Traders should find confluences based on different rationales, whether it be from price action or confluences with other technical indicators.

Carter MA

Carter MA is a simple trend following technical indicator which is based on a set of modified moving averages.

In fact, the Carter MA is a set of moving averages used to help traders clearly identify trend direction. What is unique about the Carter MA is that it considers the long-term trend, mid-term trend, short-term trend and the immediate momentum impulses of price action.

The Carter MA is composed of five moving average lines with varying period lengths to account for the short-term trend up to the long-term trend.

Trend direction is identified based on how the moving average lines are stacked. In a bullish trending market, the short-term moving average lines are generally stacked above the long-term moving average lines. Inversely, in a bearish trend, the short-term moving average lines are generally stacked below the long-term moving average lines.

Moving average lines that are not stacked neatly could indicate a range-bound market.

Trend strength can also be assessed based on the fanning out of the moving average lines.

Crossovers between the moving average lines can also be indicative of a probable trend reversal.

The areas between the moving average lines can also be considered as a dynamic area of support or resistance.

Qualitative Quantitative Estimation

Qualitative Quantitative Estimation (QQE) is one of the few technical indicators which can claim to provide a significant boost in a trader’s edge if used properly. Although it is not the “Holy Grail” among technical indicators, it does produce relatively high probably trade setups compared to most technical indicators.

The QQE is an oscillator type of technical indicator. It plots two lines which oscillate around zero. The solid blue line is the main QQE line, while the dotted line is a signal line. Positive lines generally indicate a bullish trend bias, while negative lines indicate a bearish trend bias.

Momentum can also be identified based on how the two lines overlap. The solid blue line above the dotted line indicates a bullish momentum, while having the solid blue line below the dotted line indicates a bearish momentum. Crossovers between the two lines indicate a probable short-term trend or momentum reversal.

Trading Strategy

Carter Quantitative Estimation Forex Trading Strategy is a simple trend following strategy which adheres with the long-term trend, while at the same time provides trade setups based on short-term momentum reversals.

Trend direction is identified based on how the Carter MA lines are stacked. It is also confirmed based on where price action is generally located in relation to the long-term moving average lines, as well as the direction of the slope of the long-term moving average lines. Trades are taken only in the direction that adheres with the long-term trend.

Price action would always retrace even on trending markets. This would often cause the short-term moving average lines to draw nearer to the middle lines and sometimes intersect with it. As long as the lines do not touch the longer-term moving average lines, the market could still be considered as a trending market.

Retracements should also cause the QQE lines to temporarily reverse. Trade setups are triggered as soon as a crossover between the two QQE lines occur in the direction indicated by the Carter MA trend.

Indicators:

- Carter_MA

- QQE

- Smoothing: 8

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

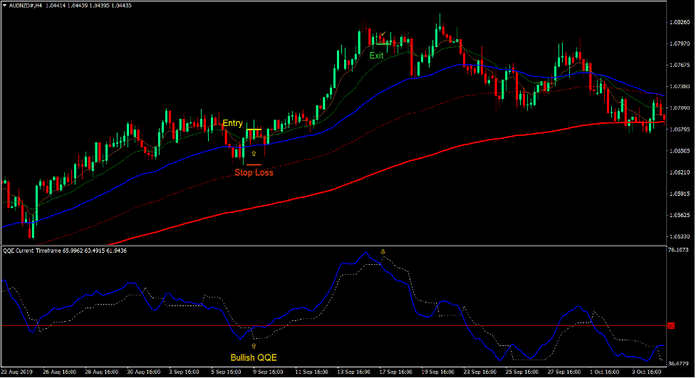

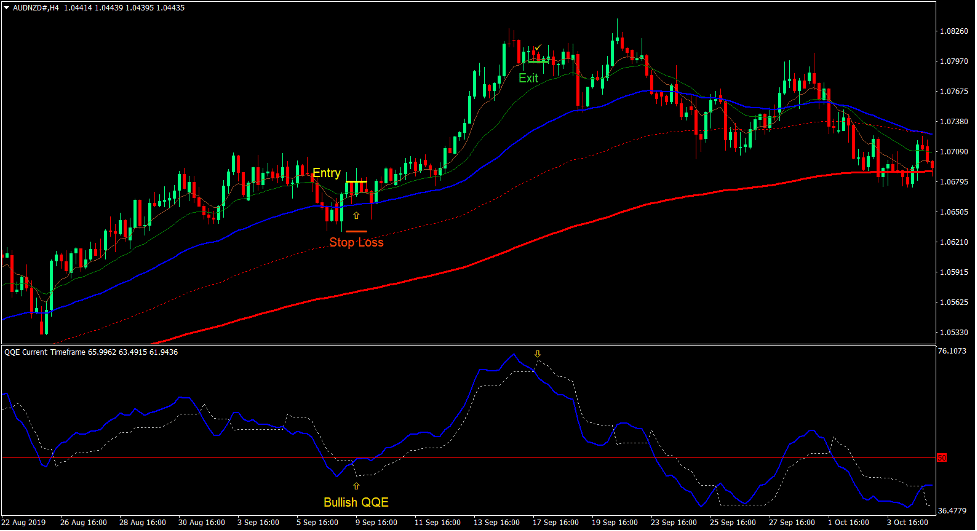

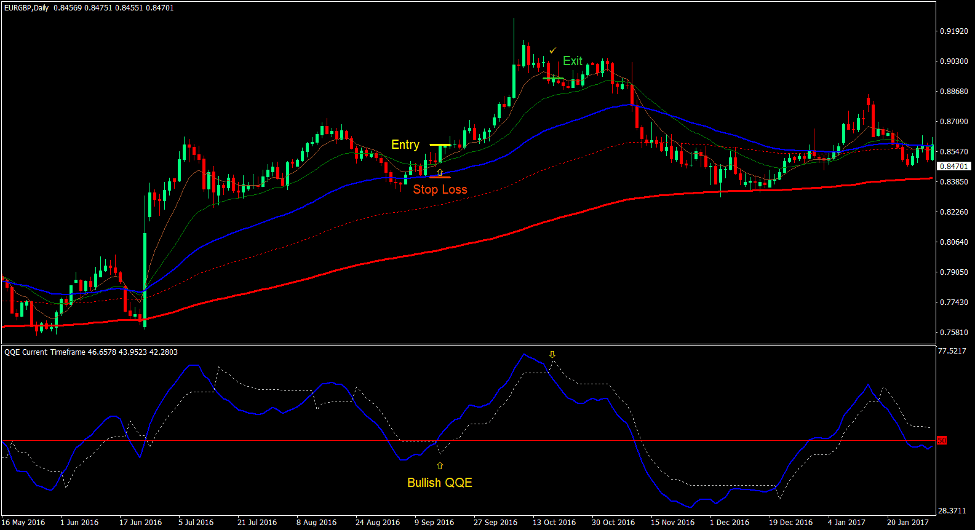

Buy Trade Setup

Entry

- The Carter MA lines should be fanning up with the short-term moving average lines generally above the long-term moving average lines.

- Price should retrace towards the area of the blue line.

- Price action should show signs of bouncing off from the blue line.

- The solid blue line of the QQE indicator should cross above the dotted line.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on a support below the entry candle.

Exit

- Close the trade as soon as solid blue QQE line crosses below the dotted line.

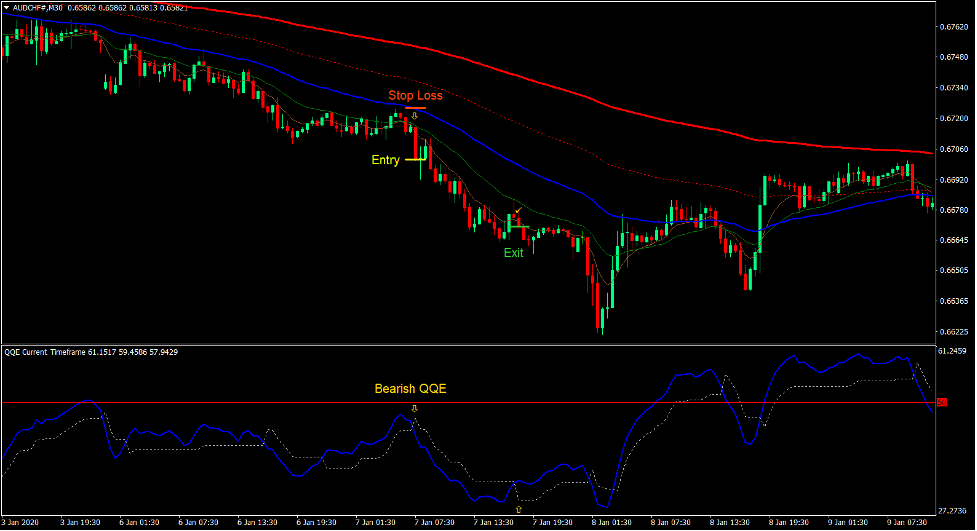

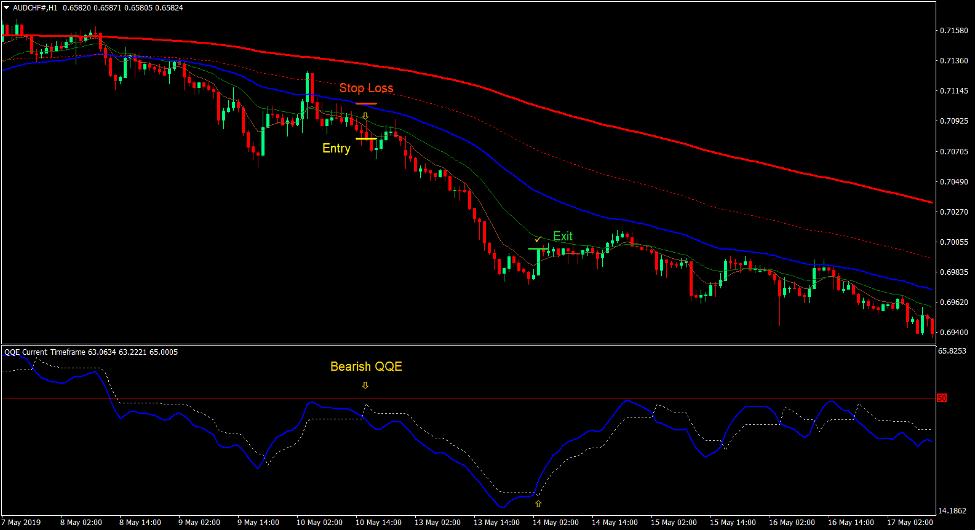

Sell Trade Setup

Entry

- The Carter MA lines should be fanning down with the short-term moving average lines generally below the long-term moving average lines.

- Price should retrace towards the area of the blue line.

- Price action should show signs of bouncing off from the blue line.

- The solid blue line of the QQE indicator should cross below the dotted line.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on a resistance above the entry candle.

Exit

- Close the trade as soon as solid blue QQE line crosses above the dotted line.

Conclusion

This simple trading strategy is an effective trading strategy which can be very profitable when used correctly.

Reversal signals indicated by the QQE crossover tend to be very effective. When traded in the direction of the main trend, the results even become more impressive.

This trading strategy when used correctly with the confluence of price action indications can result in a very profitable trade setup.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: