“What comes up, would always come down.” The same law that applies to physics is also true in trading. Trends are great as long as it has momentum behind it, but sooner or later the momentum that drives a trend would die out. Traders who tried to follow the trend but entered the market a bit too late would find themselves in deep waters when the market starts to reverse. This may be a sticky situation for most trend traders, but for those who have learned to navigate these types of conditions could profit from such turbulent trend reversals.

There are many possible reasons why a trend would reverse. It may be a fundamental news release, a trade war, a monetary policy change, a big bank placing a huge position, a support or resistance, etc. Some of the reasons are predictable while many are not. Those that we can’t foresee, we can’t control and make money out of. However, there are some reasons that are predictable via technical analysis, one of which is price rejection. Price rejection is a point wherein price has reached a certain which is either too high or too low and traders start to take notice of it. As soon as the market realizes that price has reached that point, price would find it difficult to break through such point. Then, price would start to stall and reverse. There are many ways to anticipate price rejection, one of which is by determining if price is either overbought or oversold. As soon as price starts to reject an overbought or oversold market condition, price could start reversing.

The Bollinger Trend Reversal Forex Trading Strategy is a strategy that makes use of this knowledge. It anticipates trend reversals by showing traders if the reversal signal it generated started from an overbought or oversold market condition.

Bollinger Bands

The Bollinger Bands is a technical indicator developed by John Bollinger in the 1980s. It determines trend direction, volatility, and overbought or oversold market conditions. As such, the Bollinger Bands is one of the trading indicators which could give traders a ton of information with just one look.

The Bollinger Bands indicate trend direction based on its midline. This is because the midline of the Bollinger Bands is basically a Simple Moving Average (SMA). Like most moving averages, the Bollinger Band’s midline could also be used to determine trend direction. Traders could use the location of price in relation to it or the angle of its slope to determine trend direction. It could also be used to determine trend reversal signals either through a crossover using another moving average or by taking trades as price crosses over it.

It also indicates volatility based on the characteristics of its outer bands. The outer bands are based on a computation of the standard deviation from its midline. During volatile market conditions, the outer bands tend to expand while at times when the market has weak volatility, the outer lines also tend to contract.

Lastly, it also indicates if price is overbought or oversold. The outer bands are usually used as markers of whether price is overbought or oversold. Whenever price starts to reject the area outside the lines, many traders would see it as an indication of price rejection of an overbought or oversold market.

Jurik Moving Average

Jurik Moving Average (JMA) is a modified version of a moving average. It is quite as it is intended to plot a moving average with reduced lag. There are many other moving averages that attempt to lessen lag, one of which is the Exponential Moving Average (EMA). However, when compared to the Jurik Moving Average, the EMA tends to display more lag compared to the JMA.

Klinger Volume Oscillator

The Klinger Volume Oscillator (KVO) is a technical indicator developed by Stephen J. Klinger. It is an oscillating indicator which takes into consideration a volume-based approach to determine trend. It is also quite unique as it attempts to strike a balance between providing short-term trend signals while at the same time being useful at indicating long-term trend directions.

Trading Strategy

This strategy is a trend reversal strategy that provides trade signals on confirmed trend reversals which was initiated by a price rejection. The Bollinger Bands is the focal indicator used in this strategy. The initial stage of the reversal should be a price rejection of the overbought or oversold territory, which are the outer bands.

After observing a price rejection of the outer bands, the trend should start reversing indicated by the crossing of the Jurik Moving Average (JMA) over the midline of the Bollinger Bands.

Lastly, the trend reversal should be confirmed by the Klinger Volume Oscillator (KVO) by showing histogram bars that agree with direction of the crossover.

Indicators:

- Bollinger Bands

- Period: 28

- JMA

- Len: 28

- KVO

- Fast EMA: 84

- Slow EMA: 120

- Singal EMA: 26

Timeframe: 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

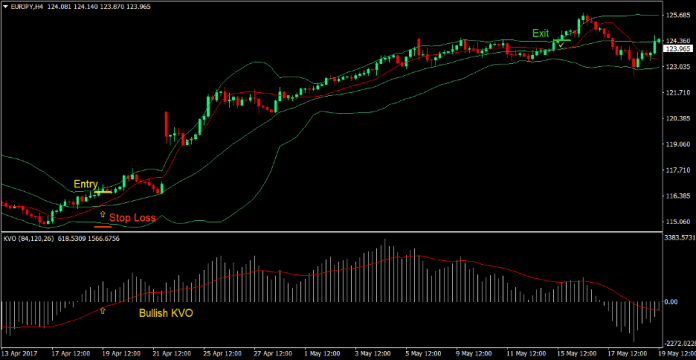

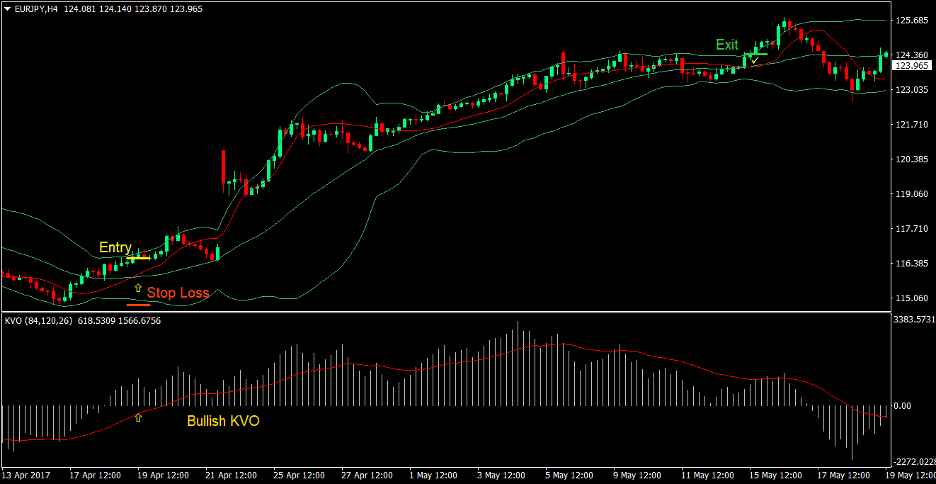

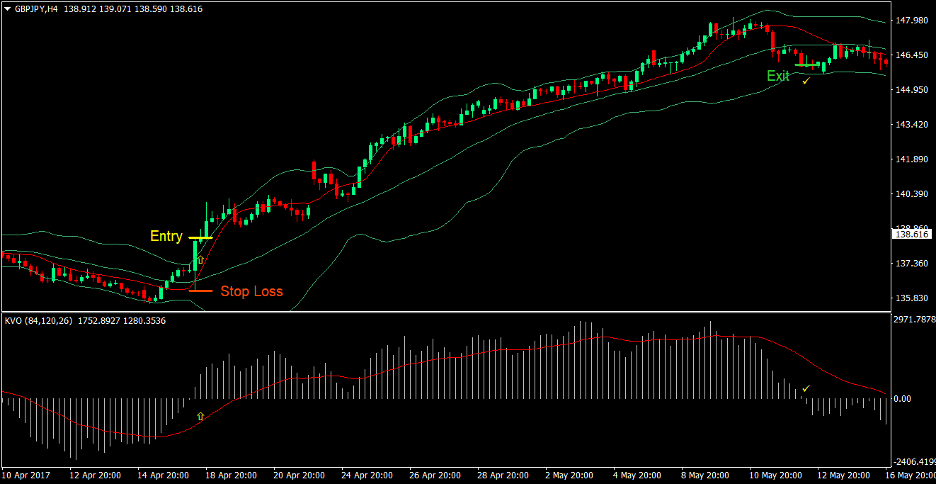

Buy Trade Setup

Entry

- Price action should characterize price rejection of the lower Bollinger Band

- The KVO indicator’s histograms should cross above zero and print positive histograms indicating a bullish trend

- The Jurik Moving Average (JVA) should cross above the midline of the Bollinger Band indicating a bullish trend reversal

- These reversal signals should occur somewhat close to each other

- Enter a buy order at the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Close the trade as soon as the KVO histogram becomes negative

- Close the trade as soon as the JVA line crosses below the midline of the Bollinger Bands

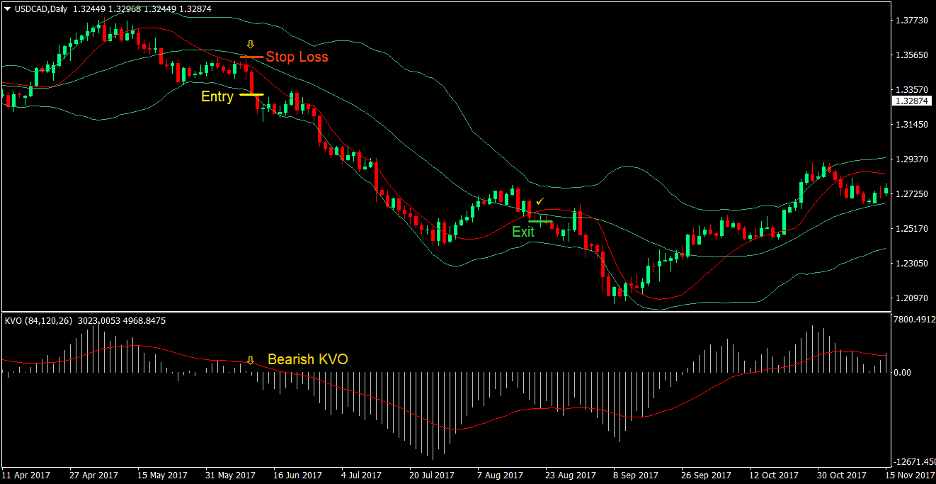

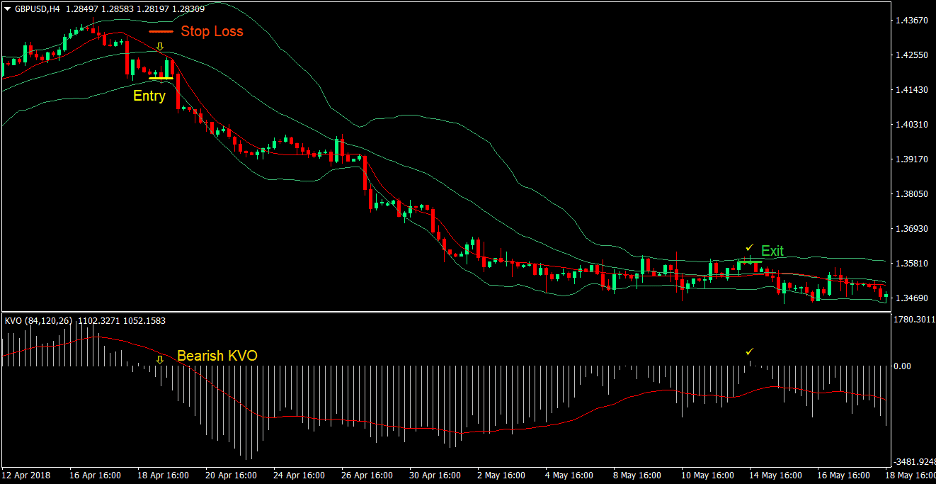

Sell Trade Setup

Entry

- Price action should characterize price rejection of the upper Bollinger Band

- The KVO indicator’s histograms should cross below zero and print negative histograms indicating a bearish trend

- The Jurik Moving Average (JVA) should cross below the midline of the Bollinger Band indicating a bearish trend reversal

- These reversal signals should occur somewhat close to each other

- Enter a sell order at the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as the KVO histogram becomes positive

- Close the trade as soon as the JVA line crosses above the midline of the Bollinger Bands

Conclusion

This trend reversal strategy is one which is based on the price rejection of the Bollinger Bands. There are many traders who trade off the price rejection of the Bollinger Bands’ outer bands. Some trade on the candles that indicate price rejection, while more conservative traders trade on the crossing over of the midline. This strategy however has an improved probability compared to the usual Bollinger Bands reversal strategy as this is confirmed by the trend direction of the Klinger Volume Oscillator (KVO). This indicates that trend reversal initiated by the price rejection has volume behind it, which increases the probability of having an entry signal that could actually result in a trend.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: