One of the criteria that define a professional trader is consistency. Professional traders make money out of trading as their main source of income. Many traders dream to just that. However, not all traders can do this because most traders are not consistent enough to pin their hopes of a monthly income coming from trading. Professional traders on the other hand are very consistent when it comes to their trading. Sure, there will be a few periods here and there wherein they could be on the red. However, for the most part professional traders are usually on the green. It does not mean that all their trades are profitable. It just means that on a period to period basis, professional traders are mostly on the green, which allows them to expect income from trading which they can live with.

Consistency in trading comes from a systematic way of trading the market, which allows traders to repeat the same process again and again as long as a trade setup fits their criteria. With the right trade setup, traders can significantly decrease trades that have a low probability of resulting in a win and trade high probability setups most of the time.

One of the best types of trade setups that traders can use in order to trade with a relatively high win probability is a trend following or trend continuation setup. This is because trend continuation setups are traded in the direction of the main trend, which significantly increases the likelihood of a winning trade.

Alligator

Bill William’s Alligator indicator is a popular on-chart trend following technical indicator which was developed in order to aid traders in identifying trends.

This indicator is based on a set of modified moving averages, specifically a smoothed moving average. The long-term moving average line is called the Jaw line, the mid-term moving average line is the Teeth, and the short-term moving average line is called the lips.

Trend direction is based on how the lines overlap. If the short-term line is above the other two lines, the market in considered bullish. However, the market is considered bearish if the short-term line is below the other two lines. If the lines are not stacked properly, then that market could be in a ranging condition. Crossovers between the lines indicates a probable trend reversal.

The market is considered to be in a strengthening trend phase whenever the three moving average lines start to expand. However, if the three lines would start to contract towards each other, then the market is considered to be in a market contraction phase. It is prudent for traders to trade only when the market is beginning to strengthen its trend direction and exit trades as the market starts to cool down.

CCI on Step Channel

The CCI on Step Channel is a custom technical indicator which is just as its name suggests. It is based on the Commodity Channel Index (CCI) yet is modified based on the Step Channel indicator.

The classic CCI indicator is a momentum-based oscillator used to help traders identify the cyclical movements of price action, including overbought and oversold conditions, which often lead to a mean reversal. The CCI is an oscillator which is derived from a moving average of a Typical Price.

The Step Channel indicator on the other hand is a trend following technical indicator is an on-chart indicator which plots a channel like structure based on the volatility of price action.

The CCI on Step Channel indicator combines both concepts into one. It plots a CCI oscillator just like the basic CCI. However, instead of using Typical Price as its basis, it computes using the median of the Step Channel indicator.

This indicator plots bars that could oscillate from positive to negative or vice versa. Positive bars indicate a bullish momentum bias, while negative bars indicate a bearish momentum bias. It also has markers at levels +/-80. Bars breaching beyond this range could indicate a strengthening trend or momentum.

PPO Indicator

The PPO indicator, also known as the Percentage Price Oscillator, is a technical momentum indicator which is also part of the oscillator family of indicators. It is also very similar to the popular MACD oscillator.

Like the MACD, this indicator is based on the relationship between two moving averages, which is computed in percentage form. It also has a signal line which is also derived from the original PPO line. What makes it unique is that it is based on Exponential Moving Average (EMA) lines, which makes it very responsive to price movements.

This indicator plots two lines which oscillate around zero. Trend bias can be identified based on whether the lines are positive or negative. Reversal signals can also be generated based on the crossing over of the main PPO line and the signal line.

Trading Strategy

Alligator CCI Step Forex Trading Strategy is a trend following strategy which trades on confluences of trend continuation signals coming from the CCI on Step Channel indicator and the PPO indicator.

Trend direction is identified based on the Alligator indicator. This is based on how the three modified moving average lines are stacked.

During such trends, market contraction phases and retracements do occur. This would often cause the CCI on Step Channel to indicate a weakening trend and the PPO indicator to show temporary signs of reversal.

Trade setups are deemed valid as soon as the CCI on Step Channel indicator indicates a resumption of trend strength or momentum, and the PPO indicator shows signs of a possible trend continuation based on the crossing over of the two lines.

Indicators:

- Alligator

- Cci_

- PPO

Preferred Time Frames:15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

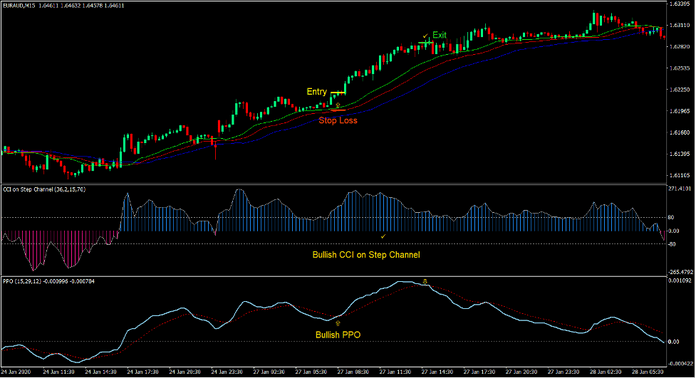

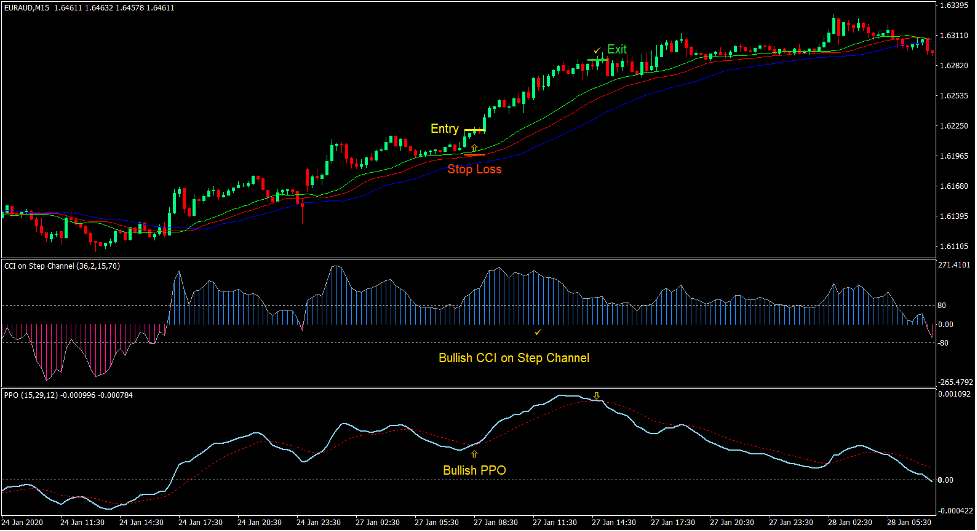

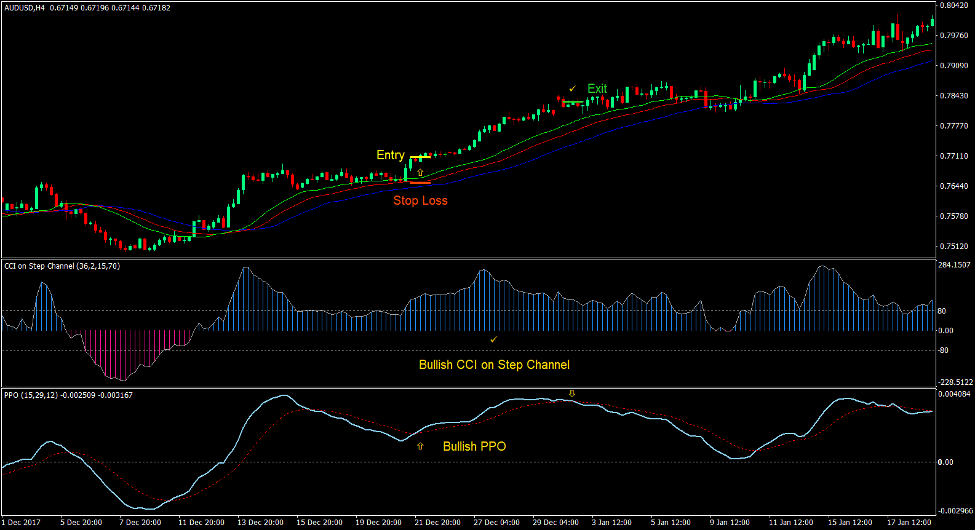

Buy Trade Setup

Entry

- The Alligator lines should be stacked in the following order:

- Lips: top

- Teeth: middle

- Jaw: bottom

- The CCI on Step Channel bars should be positive.

- The PPO lines should be positive.

- Price should retrace towards the Alligator lines causing the CCI on Step Channel bars to drop below 80 and the PPO line to cross below the signal line.

- The CCI on Step Channel bars should cross above 80.

- The PPO line should cross above the signal line.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on a support below the entry candle.

Exit

- Close the trade as soon as the PPO line crosses below the signal line.

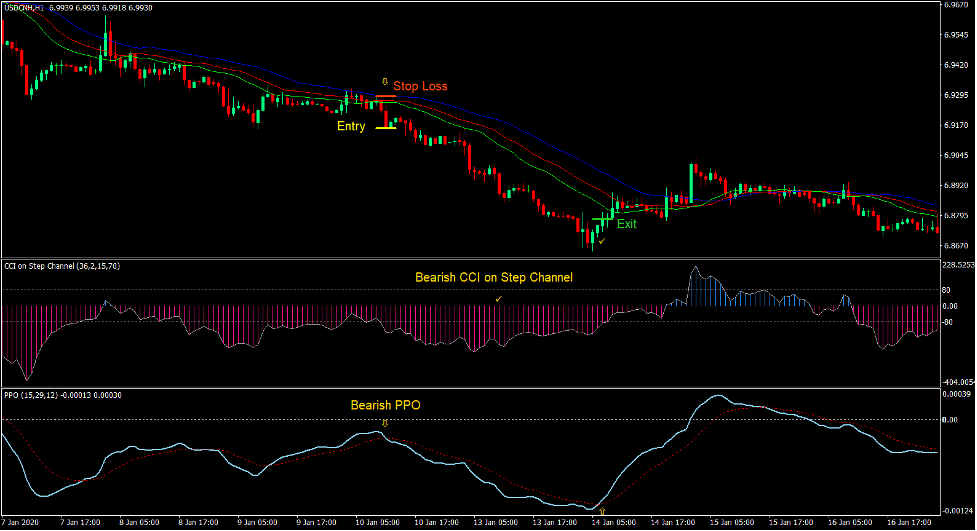

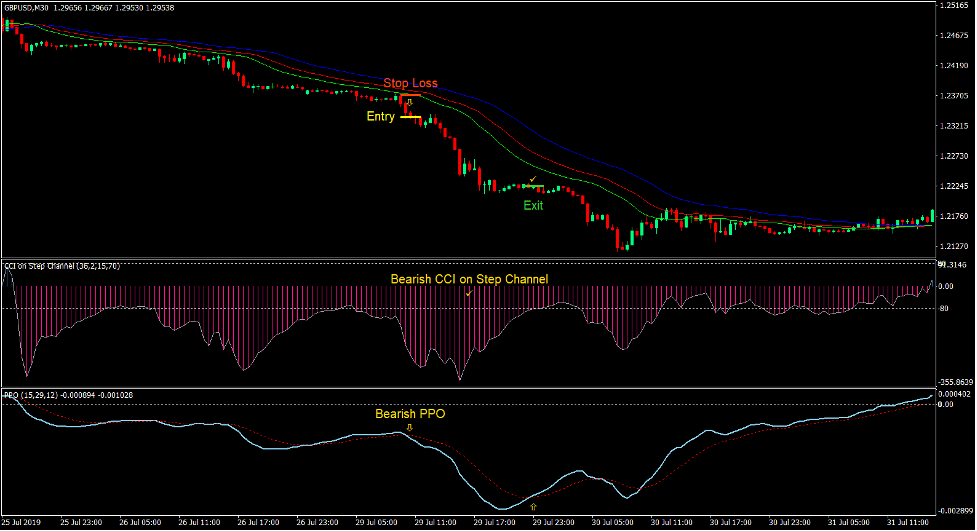

Sell Trade Setup

Entry

- The Alligator lines should be stacked in the following order:

- Lips: bottom

- Teeth: middle

- Jaw: top

- The CCI on Step Channel bars should be negative.

- The PPO lines should be negative.

- Price should retrace towards the Alligator lines causing the CCI on Step Channel bars to breach above -80 and the PPO line to cross above the signal line.

- The CCI on Step Channel bars should cross below -80.

- The PPO line should cross below the signal line.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on a resistance above the entry candle.

Exit

- Close the trade as soon as the PPO line crosses above the signal line.

Conclusion

This trading strategy is a simple trend following strategy which is based on confluences of high probability custom technical indicators.

The setups that could be produced by this strategy tend to result in high win percentages provided that the strategy is used in the correct market environment.

As such, this strategy is best used only during clearly trending market conditions as it provides traders with a systematic way of entering a trending market in the direction of the trend.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: