Nothing is sure when it comes to trading. Anything can happen. The market could move in any direction anytime and at any point on the price chart. However, despite the uncertainty that is inherent in trading, traders could also increase their confidence level that they could profit in the long run. This is because trading is about probabilities. This means that although the market can do anything it wants, if we have a setup that produces good results often, then we could still profit over the long run by allowing the law of large numbers to work in our favor.

One way to increase the probability of a trade setup is by looking for confluences. Confluences are basically points on the price chart where there are two or more indications that price would move in a certain direction. It would be like having two road signs pointing the direction of a certain route.

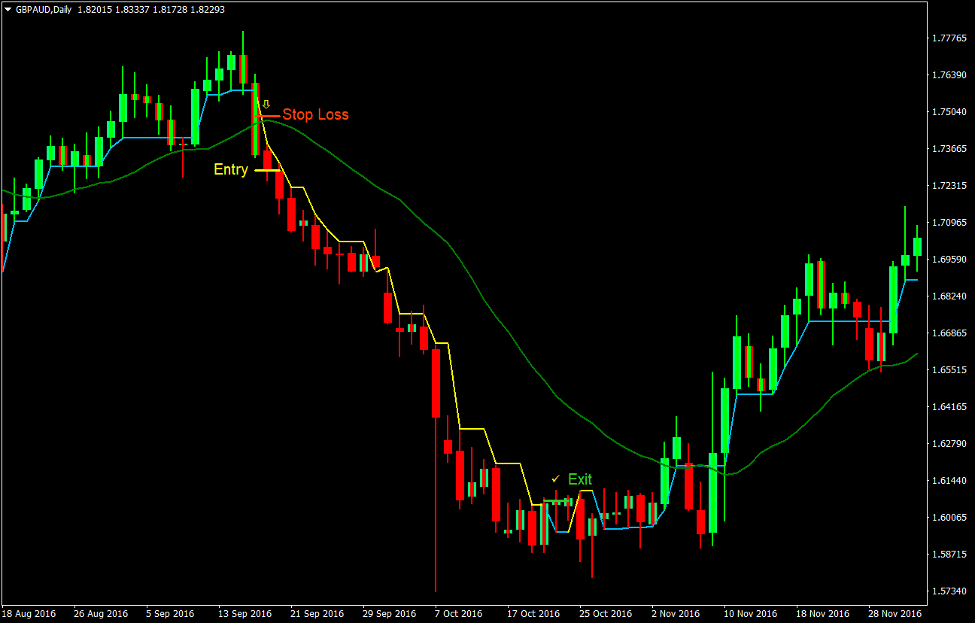

ADX Super Trend Forex Trading Strategy is a trend following strategy that makes use of trend reversal confluences in order to identify potential trade setups. It identifies trend direction by looking at the short-term momentum, the mid-term trend and the long-term trend. Having all perspectives aligned increases the likelihood that price would move in a certain direction thereby increasing the probability of a profitable trade.

Super Trend Indicator

Super Trend indicator is a trend following indicator developed to help traders identify the direction of a currency pair’s momentum. It is derived from the Commodity Channel Index (CCI).

The Super Trend indicates trend direction by plotting a line on the price char. This line would change color depending on the direction of the trend. Deep Sky Blue lines indicate a bullish trend direction while yellow lines indicate a bearish trend direction.

The Super Trend indicator is used either as a trend filter or a trend reversal signal. As a trend reversal signal, traders simply take trades based on the shifting of the lines and the changing of the color of the lines.

As a trend filter indicator, traders could use the indicator to avoid trades that are going against the trend. Traders could use a different entry signal indicator to confirm the trade setup while aligning the trade with the Super Trend indicator.

ADX Candles Indicator

The ADX indicator or the Average Directional Index is a technical indicator used to determine if the market is trending with strong momentum or not.

The classic ADX indicator is used to quantify the strength of a trend. It is computed based on the price range expansion of moving averages over a given period. It is also usually plotted with three lines, the ADX line, the DMI+ line and the DMI- line. DMI stands for Directional Movement Index. If the DMI+ is above the DMI- line, then the market is said to be bullish. If it is stacked inversely, then the market is considered bearish. The ADX line simply measures the strength of the trend by plotting an oscillating line. If the line is above 30, then the trend strength is strong.

The ADX Candles indicator simplifies this process by overlaying bars on the candlestick that change colors indicating the direction of the trend. Lime bars indicate a bullish trend, dark green bars indicate a neutral trend and red bars indicate a bearish trend.

Trading Strategy

This trading strategy simply trades on confluences based on moving averages, the Super Trend indicator and the ADX Candles indicator.

The moving average indicator is set as a 20 bar Exponential Moving Average (EMA). It is used as a crossover indicator. Trade signals are considered whenever price would crossover the 20 EMA line with strong momentum.

The Super Trend indicator is used as a trend reversal signal indicator. Trade setups are considered whenever the Super Trend line changes color indicating a probable trend reversal.

The ADX Candles indicator is also used as a momentum reversal indicator. Trade setups are considered whenever the ADX Candles change color indicating a strong trend reversal.

Although individually, these trend reversal signals could produce valid setups, this strategy would wait for confluences between the three signals in order to have a strong probability of a profitable trade. Signals should also be closely aligned.

Indicators:

- Super Trend

- ADX Candles

- 20 EMA

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

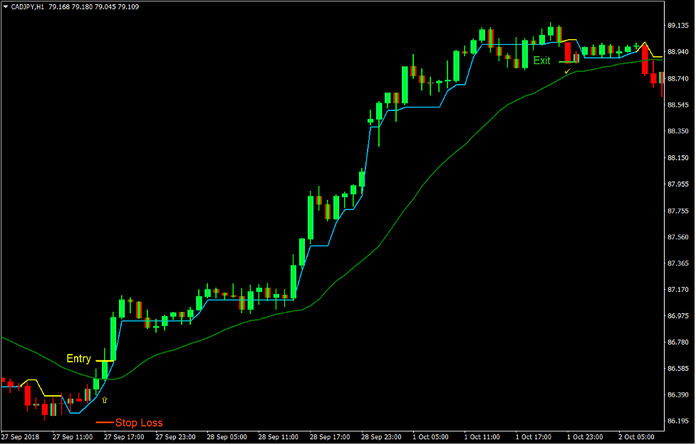

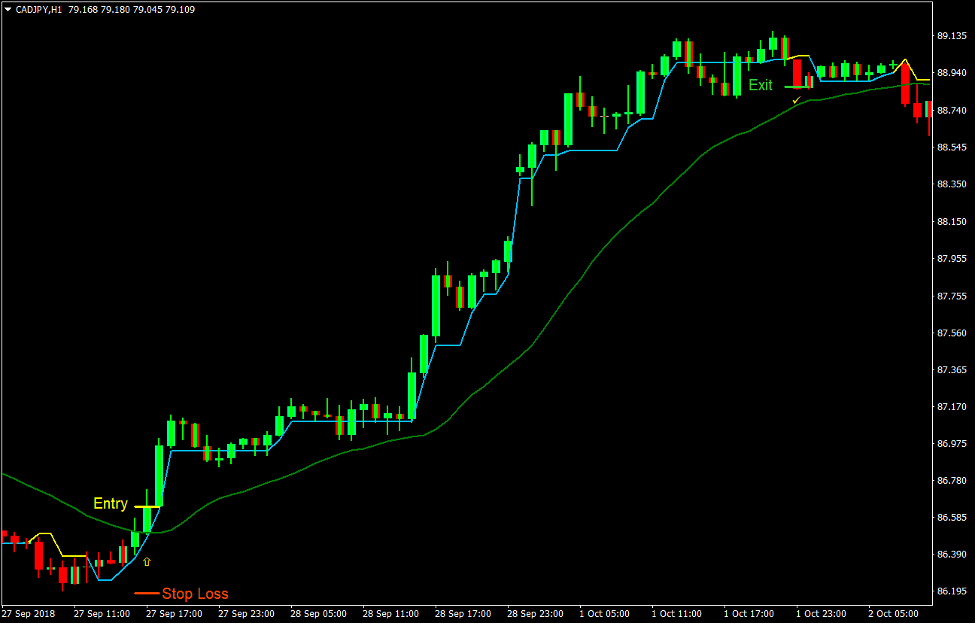

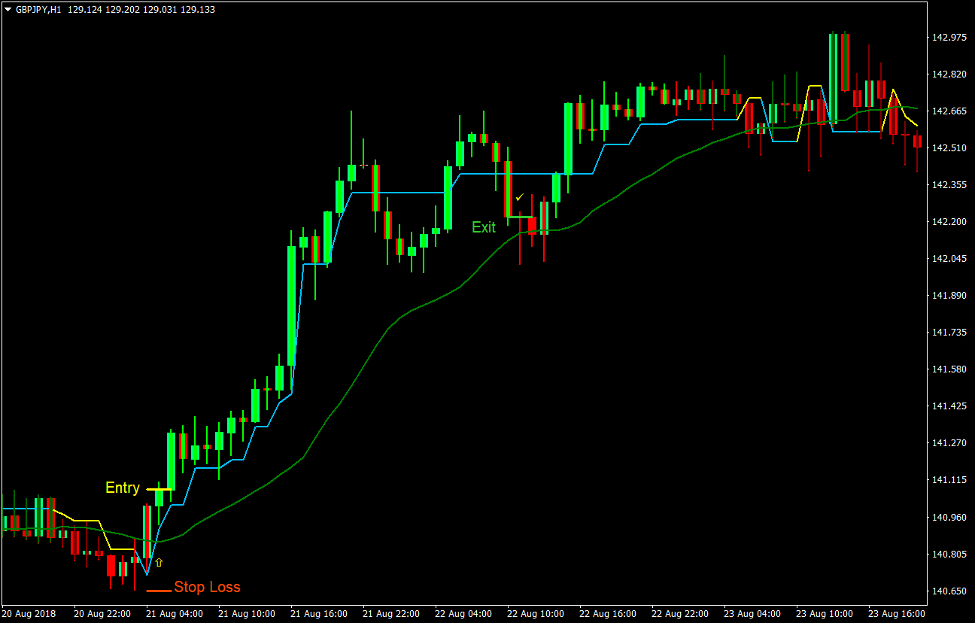

Buy Trade Setup

Entry

- Price should cross above the 20 EMA line with strong momentum.

- The Super Trend line should change to deep sky blue.

- The ADX Candles should be lime.

- Enter a buy order on the confluence of the bullish signals above.

Stop Loss

- Set the stop loss on the support level below the entry candle.

- Option 2: Set the stop loss on the 20 EMA line.

Exit

- Close the trade as soon as the ADX Candles change red.

- Close the trade as soon as the Super Trend line changes to yellow.

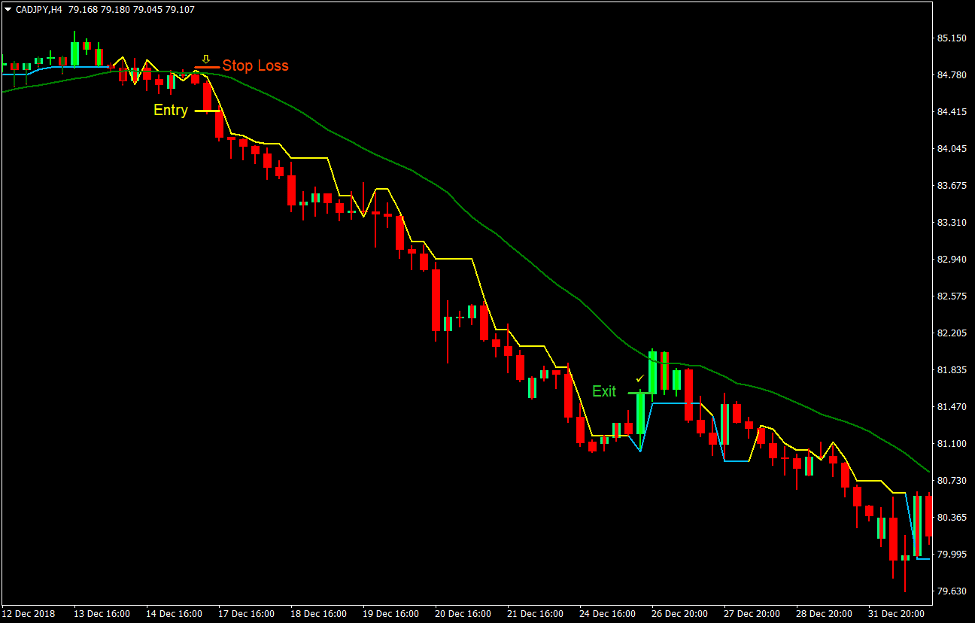

Sell Trade Setup

Entry

- Price should cross below the 20 EMA line with strong momentum.

- The Super Trend line should change to yellow.

- The ADX Candles should be red.

- Enter a sell order on the confluence of the bullish signals above.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

- Option 2: Set the stop loss on the 20 EMA line.

Exit

- Close the trade as soon as the ADX Candles change lime.

- Close the trade as soon as the Super Trend line changes to deep sky blue.

Conclusion

This trend reversal strategy relies heavily on confluences of technical indicator signals. Although these signals do produce high probability setups even as individual indicators, traders should not use it as the sole basis for a trade entry.

This strategy works best when used in conjunction with price action and support or resistance reversals. Traders could also use candlestick patterns to confirm a trade setup. This would allow traders to trade signals with greater confidence and with an even better probability.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: