Ortalama tersine çevirmeler, tüccarların forex piyasasından kar elde etmek için kullandıkları en temel ticaret stratejileri türlerinden biridir. Bununla birlikte, bir fiyat dalgalanmasının zirvelerini ve dip noktalarını belirlemek, yeni tüccarlar için genellikle çok göz korkutucu olabilir. Osilatörler gibi bazı teknik göstergeler, tacirlere ortalamanın tersine dönmesi için bir ön koşul olan aşırı satım ve aşırı alım piyasalarını belirlemede nesnel bir temel sağladığı için yardımcı olabilir.

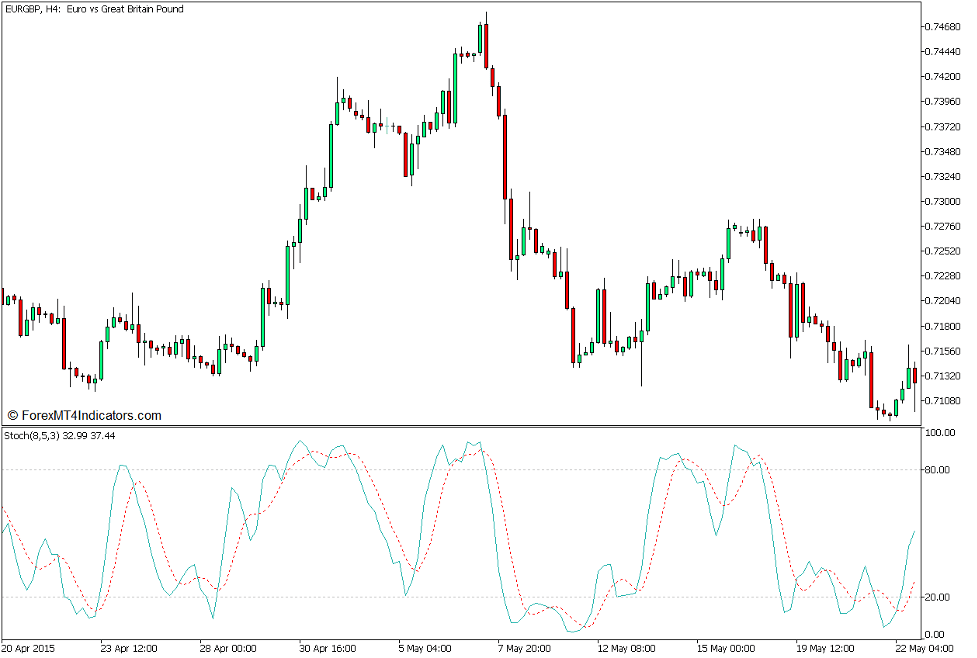

Stokastik Osilatör

Stokastik Osilatör, tüccarlar için mevcut olan en temel göstergelerden biridir. Aslında, bu, yeni tüccarlara ticaret hakkında öğrenmeye başladıklarında genellikle öğretilen ilk birkaç göstergeden biridir. Ancak temel bir gösterge olmasına rağmen yine de çok etkili bir teknik göstergedir.

Stokastik Osilatör, bir osilatör çizerek piyasanın olası yönünü sunan bir momentum göstergesidir. Bunu, ticareti yapılabilir bir enstrümanın kapanış fiyatını ortalama tarihsel fiyat aralığı ile karşılaştırarak yapar. Ardından, temel formülüne göre iki çizgi çizer. Çizdiği çizgilerin değerleri 0 ile 100 arasında sabit bir aralıkta salınır. 80'in üzerindeki değerler aşırı alım, 20'nin altındaki değerler ise aşırı satım olarak kabul edilir. Çoğu tacir, her iki uç noktanın da momentumun tersine dönmesine neden olma olasılığının olduğu konusunda hemfikirdir.

Momentum yönü, iki osilatör hattının nasıl etkileşime girdiğine bağlı olarak da tanımlanabilir. Daha hızlı osilatör çizgisi daha yavaş osilatör çizgisinin üzerinde olduğunda momentum yükseliş olarak kabul edilir. Öte yandan, daha hızlı osilatör çizgisi daha yavaş osilatör çizgisinin altında olduğunda, momentum düşüş eğilimi olarak kabul edilir. Aşırı satım veya aşırı alım olarak kabul edilen alanlarda meydana gelen geçişler, yüksek olasılıklı ters sinyaller olarak kabul edilir.

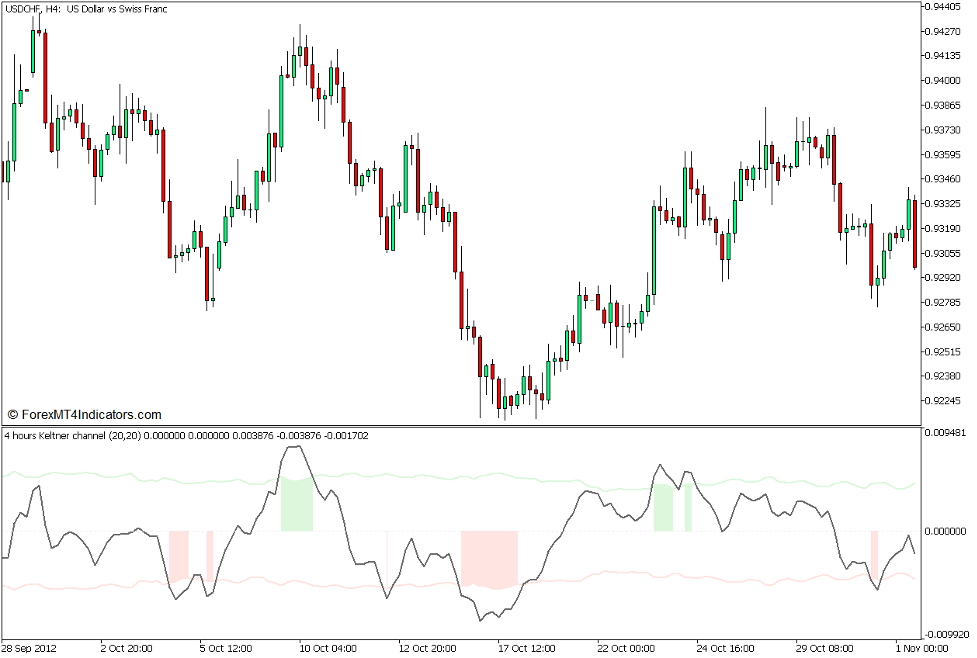

Keltner Kanal Osilatörü

Keltner Kanalı Osilatörü, Keltner Kanalından türetilen özel bir teknik göstergedir.

Orijinal Keltner Kanalı, Üstel Hareketli Ortalama (EMA) ve Ortalama Gerçek Aralık (ATR) değerlerini kullanarak oynaklığı ve eğilimi tanımlayan bir bant tipi göstergedir. Ortalama fiyatı hesaplamak için 20 barlık bir EMA kullanır ve bunu orta çizgisi olarak çizer. Ardından, ATR değerini çıkararak ve ekleyerek 20 EMA çizgisinin üstünde ve altında yer değiştiren iki çizgiyi çizer.

Keltner Kanal Osilatörü de aynı konsepte dayanmaktadır. Ancak değerleri fiyat tablosunda çizmek yerine kendi gösterge penceresini oluşturarak volatilite ve trendi bir osilatör olarak sunar. Sıfır olan bir orta çizgi etrafında salınan bir çizgi çizer. Bu, 20 EMA ile her çubuğun kapanış fiyatı arasındaki farkı temsil eder. Ayrıca sıfır civarında bir kanal oluşturan bir çift çizgi çizer. Bu çizgiler temel olarak pozitif ve negatif değerler olarak sunulan ATR'nin bir katıdır.

Gösterge ayrıca, ana osilatör hattı ATR'ye dayalı olarak kanalının aralığını ihlal ettiğinde sıfır ile üst veya alt çizgiler arasındaki alanı da gölgeler. Bu, her ikisi de olası bir ortalamanın tersine çevrilmesi için ana senaryolar olan aşırı satım veya aşırı alım piyasasına işaret eder.

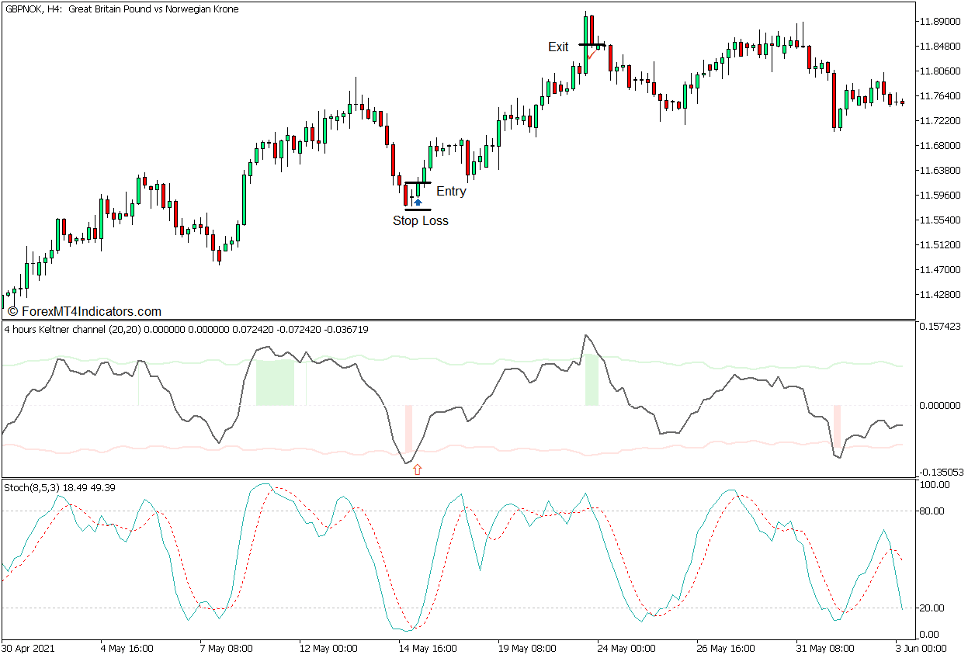

Ticaret Stratejisi Kavramı

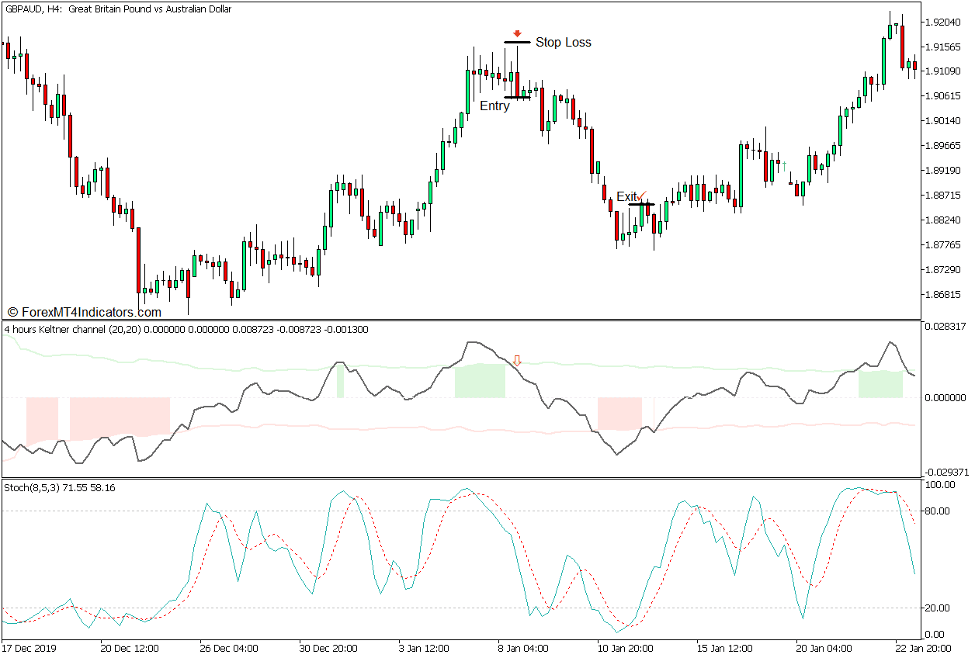

Keltner Kanal Osilatörü MT5 için Ortalama Tersine Çevirme Forex Ticaret Stratejisi, Stokastik Osilatör ile Keltner Kanal Osilatörü arasındaki kesişmelere dayalı olarak aşırı alım ve aşırı satım piyasa koşullarını tanımlayan bir ortalama tersine ticaret stratejisidir.

Stokastik Osilatör, aşırı satım ve aşırı alım piyasalarını tanımlayan bir gösterge olarak yaygın olarak kullanılır ve kabul edilir. Bununla birlikte, tanımladığı sinyaller çoğunlukla kısa vadeli ufuktadır. Keltner Kanal Osilatörü ise daha uzun vadeli ufku temel alan aşırı alım ve satım piyasalarını sunar. İki gösterge arasındaki çakışmalar, aşırı satım veya aşırı alım piyasasından gelen güçlü bir ortalama tersine dönme olasılığını önemli ölçüde artırır.

Stokastik Osilatörde, tüccarlar, osilatör çizgilerinin 20 ila 80 aralığını ihlal edip etmediğine bağlı olarak aşırı fiyat koşullarını belirleyebilirler. Ters dönüşler, iki çizginin kesişmesi olarak tanımlanır ve 20 ila 80 aralığında geri dönmeye başlar.

Keltner Kanalı Osilatörü, ATR kanalı tarafından oluşturulan aralığı aşan osilatör hattına dayalı olarak fiyat uç noktalarını tanımlar. Ortalama ters sinyaller, kanal alanı içinde geriye doğru kesişen osilatör hattına dayalı olarak tanımlanır.

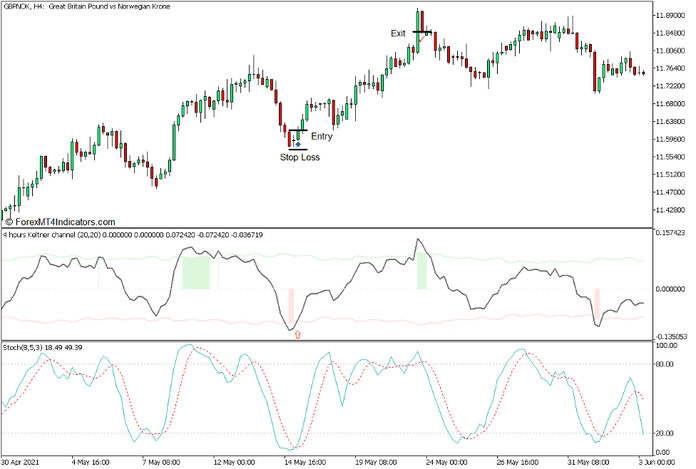

Ticaret Kurulumu Satın Al

Girdi

- Stokastik Osilatör çizgileri 20'nin altına düşmelidir.

- Keltner Kanalı Osilatörü çizgisi, ATR aralığının alt çizgisinin altına düşmelidir.

- Daha hızlı Stokastik Osilatör çizgisi, daha yavaş olan çizginin üzerinden geçmeli ve 20'nin üzerindeki alana doğru hareket etmelidir.

- Keltner Kanalı Osilatörü çizgisi, ATR aralığının alt çizgisinin üzerinde geçmelidir.

- Bu sinyallerin birleştiği noktada bir satın alma emri açın.

Zarar Durdur

- Stop Loss'u giriş mumundan önceki düşük salınımın altına ayarlayın.

Çıkış

- Fiyat hareketi olası bir düşüş eğilimi belirtileri gösterir göstermez işlemi kapatın.

Ticaret Kurulumu Sat

Girdi

- Stokastik Osilatör çizgileri 80'in üzerine çıkmalıdır.

- Keltner Kanalı Osilatörü çizgisi, ATR aralığının üst çizgisinin üzerine çıkmalıdır.

- Daha hızlı Stokastik Osilatör çizgisi, daha yavaş olan çizginin altından geçmeli ve 80'in altındaki alana doğru hareket etmelidir.

- Keltner Kanalı Osilatörü çizgisi, ATR aralığının üst çizgisinin altından geçmelidir.

- Bu sinyallerin birleştiği noktada bir satış emri açın.

Zarar Durdur

- Stop Loss'u giriş mumundan önceki yüksek salınımın üzerine ayarlayın.

Çıkış

- Fiyat hareketi olası bir yükseliş tersine dönüş belirtileri gösterir göstermez ticareti kapatın.

Sonuç

Ayrı ayrı bu iki gösterge, aşırı satım ve aşırı alım piyasalarından gelen olası ortalama tersine dönüşleri belirlemek için halihazırda mükemmel göstergelerdir. Birlikte kullanıldığında, üretilen sinyaller daha güvenilir olma eğilimindedir. Bu ticaret stratejisi, bu izdiham nedeniyle çok etkili bir ortalama tersine ticaret stratejisi olabilir. Sinyallerden sonra meydana gelen fiyat dalgalanmaları, işlem başına daha yüksek getiri sağlayan daha geniş olma eğilimindedir.

Bu stratejiyi kullanan tacirler, fiyat hareketini ve şamdan modellerini kullanarak piyasayı nasıl okuyacaklarını da öğrenmelidir çünkü bu aynı zamanda piyasanın tersine dönüp dönmeyeceği hakkında bir fikir verebilir.

Doğru kullanıldığında, bu birleşmeler, aşırı bir fiyattan hemen sonra fiyat ters yöne dönme eğiliminde olduğundan, tacirlerin piyasadan kar elde etmelerine yardımcı olabilir.

Önerilen MT5 Komisyoncuları

XM Broker

- Ücretsiz $ 50 Anında Ticarete Başlamak için! (Çekilebilir Kar)

- Para Yatırma Bonusu $5,000

- Sınırsız Sadakat Programı

- Ödüllü Forex Brokerı

- Ek Özel Bonuslar Yıl boyunca

>> XM Broker Hesabına buradan kaydolun <

FBS Aracısı

- Ticaret 100 Bonus: Ticaret yolculuğunuza başlamak için ücretsiz 100$!

- 100% Depozito: Yatırdığınız parayı 10,000$'a kadar ikiye katlayın ve artırılmış sermayeyle işlem yapın.

- 1'e kadar kaldıraç: 3000: Mevcut en yüksek kaldıraç seçeneklerinden biriyle potansiyel kârı en üst düzeye çıkarmak.

- 'Asya'nın En İyi Müşteri Hizmetleri Komisyoncusu' Ödülü: Müşteri desteği ve hizmetinde tanınan mükemmellik.

- Mevsimsel Promosyonlar: Tüm yıl boyunca çeşitli özel bonusların ve promosyon tekliflerinin keyfini çıkarın.

>> FBS Broker Hesabına buradan kaydolun <

İndirmek için aşağıya tıklayın: