Gap and Go Momentum Forex Ticaret Stratejisi

Bir ticaret seansının sadece ilk saatinde veya buna yakın bir zamanda ticaret yaptıklarını iddia eden tüccarlar var ve ticarete bu kadar az zaman ayırsalar bile, aynı stratejiyi tekrar tekrar uygulayarak hala çok para kazanıyorlar. Bunun imkansız olduğunu düşündüm. Kârınız çabalarınızla orantılı olmalı, değil mi? Yanlış! Ticarette bu temel kural değildir. Ticaretin ihtiyacı olan şey, sağlam ve kârlı bir ticaret stratejisi ve kurallara sadık kalabilecek ve fırsatlar ortaya çıktığında kendini hazırlayabilecek yeterli disipline sahip bir tüccardır.

Soru şu ki, ne tür bir strateji bunu yapmanıza, her seansta sadece bir saat işlem yapmanıza ve yine de para kazanmanıza izin verebilir? Kesin bir cevap olmasa da bulduğum uygulanabilir stratejilerden biri momentum stratejileridir. Bu, bir işlem seansının açılışındaki boşluklar aranarak yapılır.

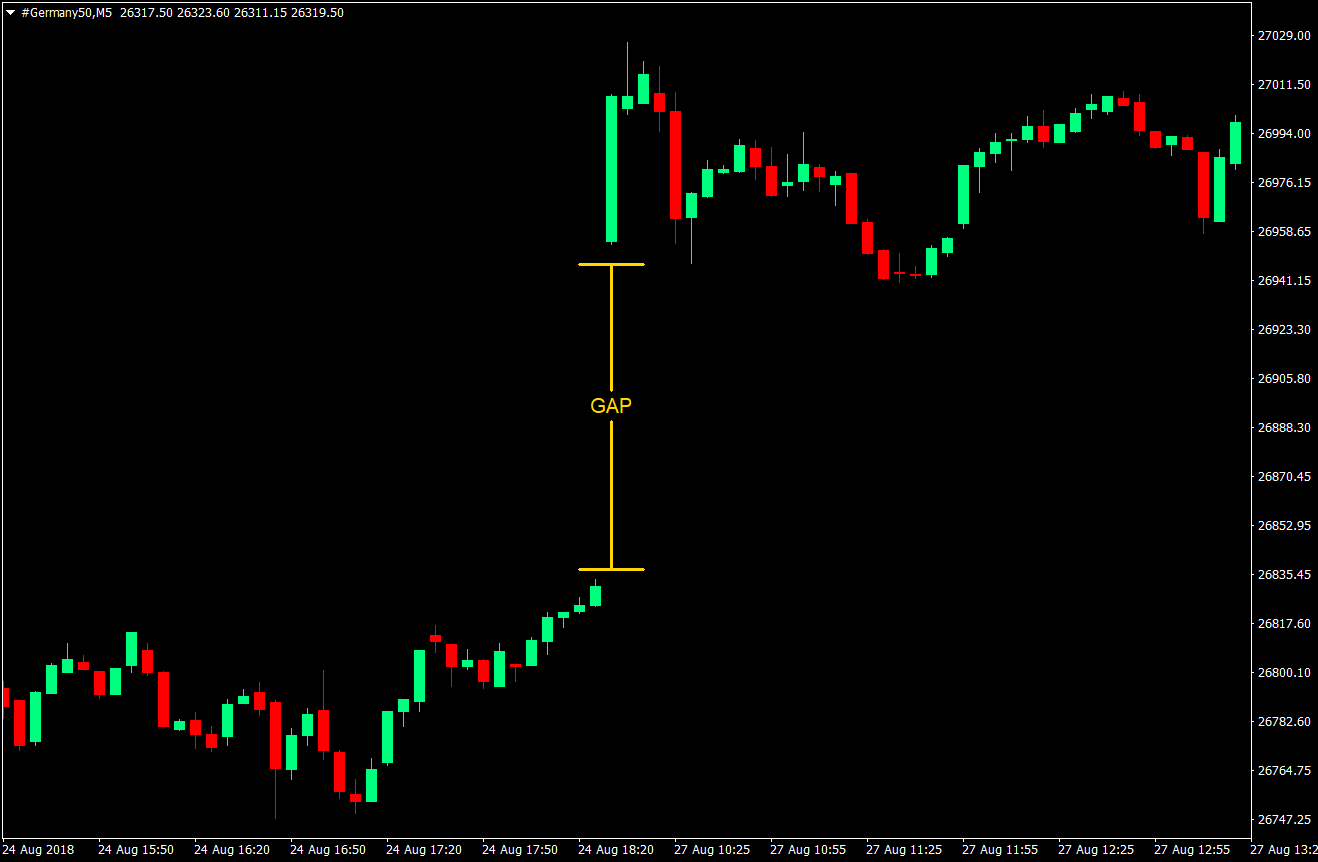

Momentum Olarak Boşluklar

Boşluklar nelerdir? Boşluklar temel olarak bir piyasanın kapanışından bir sonraki açılışına kadar fiyatta meydana gelen sıçramalardır. Örneğin forex piyasası her hafta sonu kapanır ve bir sonraki hafta ilk piyasa seansı açıldığında yeniden açılır. Borsa ve bazı endeksler gibi bazı piyasalar her gün açılıp kapanır. Bazen piyasa açıldığında, bir önceki seansın kapanışı ile bir sonraki seansın açılışı arasında büyük bir fark olur. Bu bir boşluktur.

Peki boşluklar nasıl oluşur? Piyasaların planlı bir kapanış ve açılış periyodu olduğu doğru olsa da piyasa katılımcıları piyasanın değerini değerlendirmeyi bırakmıyor. Belki gece boyunca belli bir piyasayı veya para birimini etkileyebilecek temel bir haber yayınlandı. Bir sonraki seansın açılışından önce bu haberi öğrenen trader'lar, fiyatın ne olması gerektiği konusunda kendi değerlendirmelerini yapacaklardı. Bazıları komisyoncularına talimat bile bırakabilir. Hatta bazıları, piyasa kapalıyken bile belirli hisse senetleri üzerinde işlem yapmanın yollarını bile bulabilir. Bu değerlendirmeler ve eylemler fiyatı etkiler. Ertesi gün piyasa açıldığında, tüccarlar farklı bir fiyat noktasında işlem yapmaya başlayacakları ve kapanıştan önce diğer tüccarlar tarafından bırakılan ve önceki kapanış fiyatından çok uzakta olan tekliflere veya tekliflere ulaşacakları için fiyat aniden sıçrayacaktır.

Şimdi, eğer bir boşluğun arkasındaki anatomiye ve mantığa bakarsanız, bu aslında piyasa hala yakınken meydana gelen bir ivme veya trend hareketidir ancak planlanabilecek hiçbir işlem resmi olarak tamamlanmadığından grafikte gösterilmemiştir. . Boşluklar momentum veya trend halindeki piyasa hareketleri olduğundan, fiyatın kendisini çok fazla genişletmemesi durumunda biraz daha devam etmesi de kuvvetle muhtemeldir.

Yine de birçok tüccar arasında, fiyatların her zaman ortalamaya geri dönmesi nedeniyle boşlukların her zaman doldurulduğuna dair bir görüş var. Ancak bu her zaman böyle değildir. Boşluklar bazen yeni bir trend olan pazar ortamının başlangıcı olabilir. Boşluklarda iki karşıt kutbun olduğu göz önüne alındığında, boşlukların doldurulup doldurulmayacağına veya momentum nedeniyle bir miktar devam edip etmeyeceğine dair ipuçlarına bakmamız gerekir.

Ticaret Stratejisi Kavramı

Bu strateji, boşlukların piyasa kapalıyken meydana gelen ivme hareketleri olduğu fikrine dayanmaktadır.

Bu stratejiyi uygulamak için işlem seansının açılışındaki boşlukları arayacağız. Her ne kadar büyük temel haber artışları nedeniyle gün içinde de boşluklar oluşabilse de bu nadir görülen bir durumdur. Bir oturumun açılışı sırasında boşlukları bulmak daha kolaydır. Bu nedenle daha fazla fırsat bulmak adına her gün açılıp kapanan piyasalarda bu stratejiyle işlem yapılması tercih edilmektedir. Bu, kesin bir açılış ve kapanışa sahip olan DAX veya diğer endeksler veya yeterli hacim ve volatiliteye sahip belirli hisse senetleri olabilir.

Boşluk 5 dakikalık grafikte açıkça gözlemlenebilir olmalıdır. Piyasada boşluk oluşursa, boşluğu iten uzun fitili olan bir mum ararız. Fitil, oluşmayan boşluk doldurma için pazarın beklenen kısmını temsil eder. Uzun fitili olan bu mumun da ilk iki 5 dakikalık mum içerisinde yer alması gerekmektedir. Bundan sonra bunu geçerli bir ticaret kurulumu olarak değerlendiremedik. Bunun nedeni, fitilin temsil ettiği hafif geri çekilme olmadan boşluğun hemen hareket etmiş olması veya momentumun o kadar güçlü olmaması ve boşluğun dolmaya başlayabilmesidir.

Göstergeler: yok

Döviz Çifti veya Piyasa: tercihen DAX, endeksler ve yüksek volatiliteye sahip hisse senetleri

Zaman aralığı: Yalnızca 5 dakikalık grafik

İşlem Seansı: açık olan herhangi bir piyasa

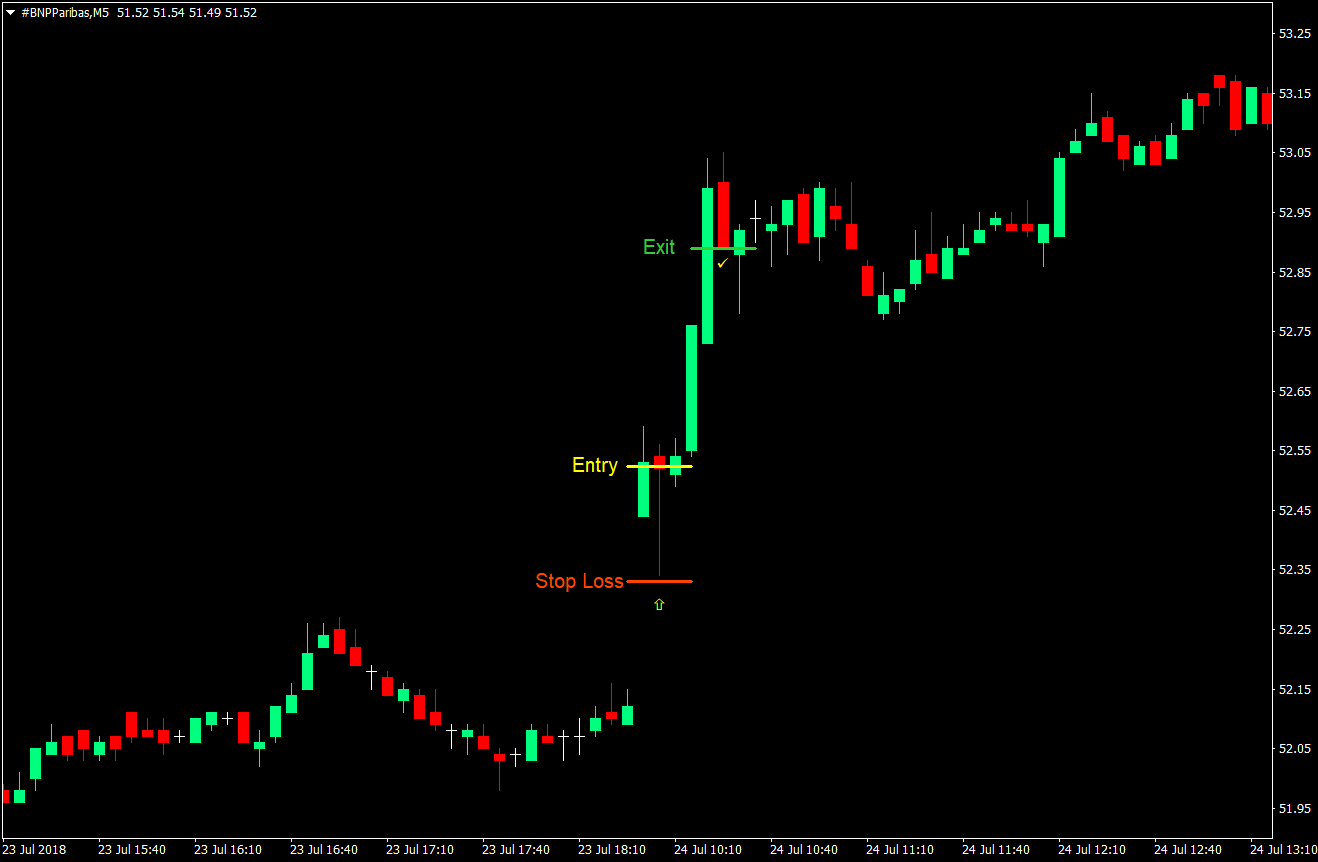

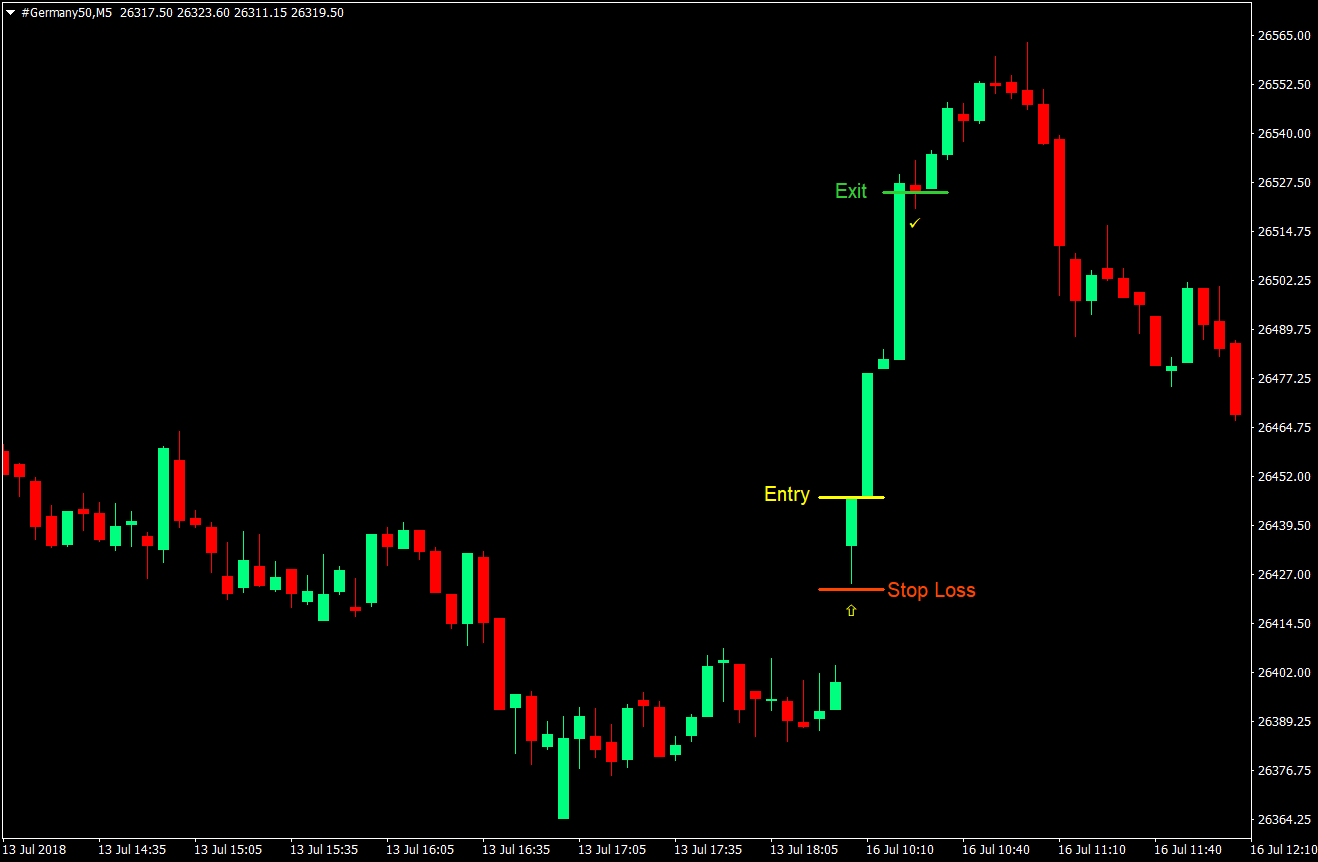

(Uzun) Alım İşlem Kurulumu

Girdi

- Piyasa seansın açılışında boşluk açmalı

- İlk iki 5 dakikalık mum içinde, alt kısmında önemli bir fitili olan ve üst kısmında çok az fitili olan veya hiç fitili olmayan bir mum oluşmalıdır.

- Mumun kapanışında bir satın alma piyasası emri açın

Zarar Durdur

- Zararı durdur emrini mumun fitilinin hemen altına yerleştirin

Çıkış

- İlk düşüş mumunda işlemi kapatın

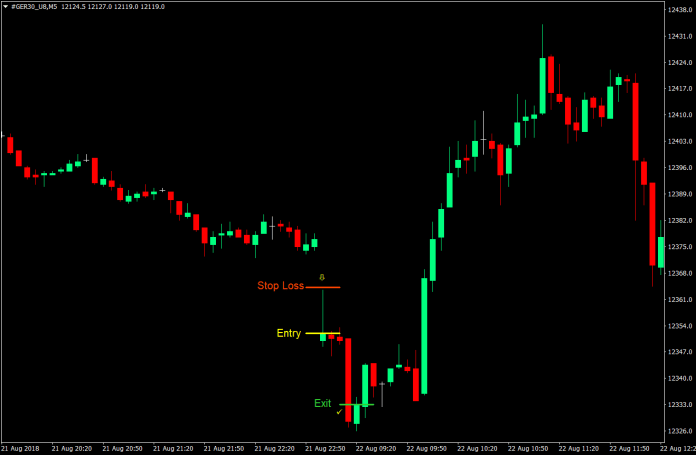

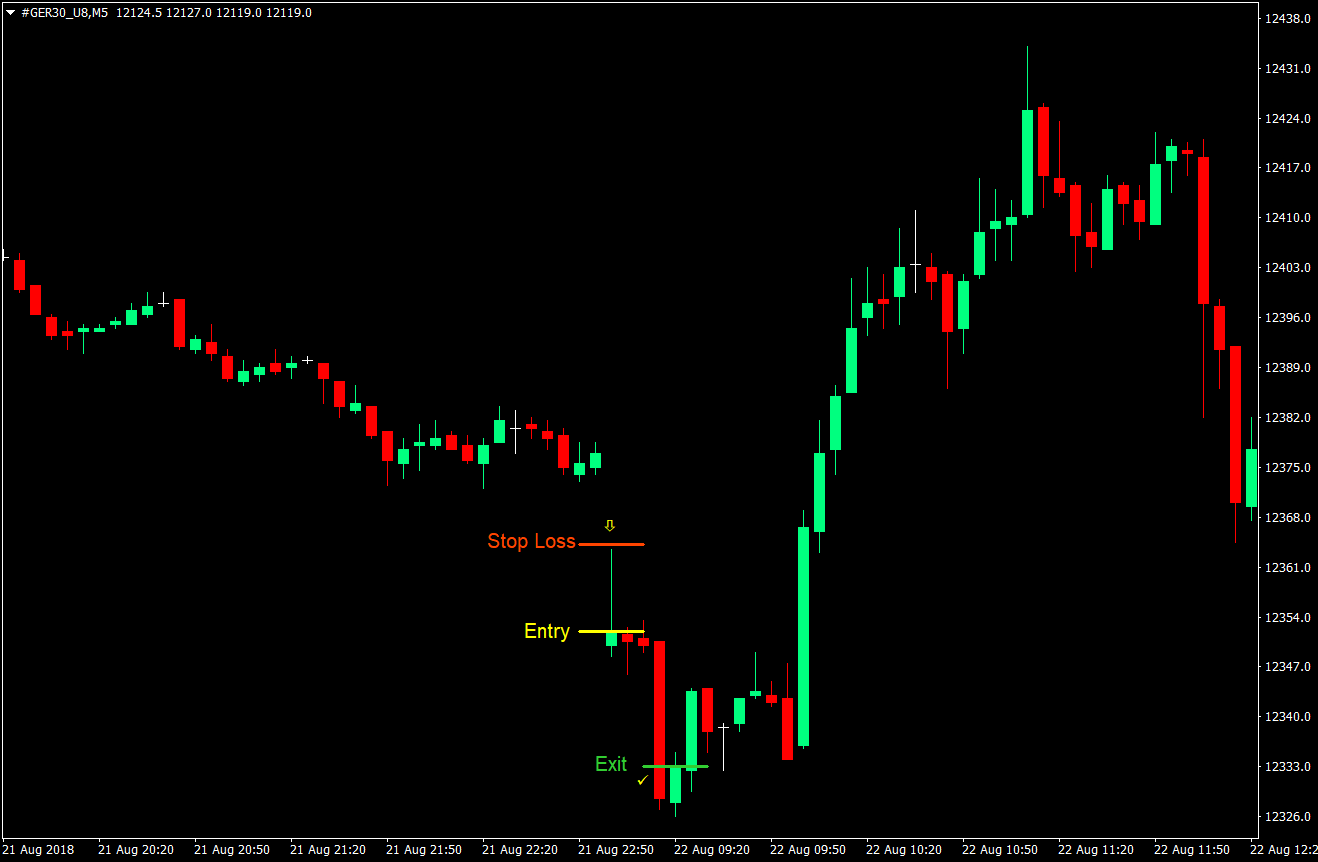

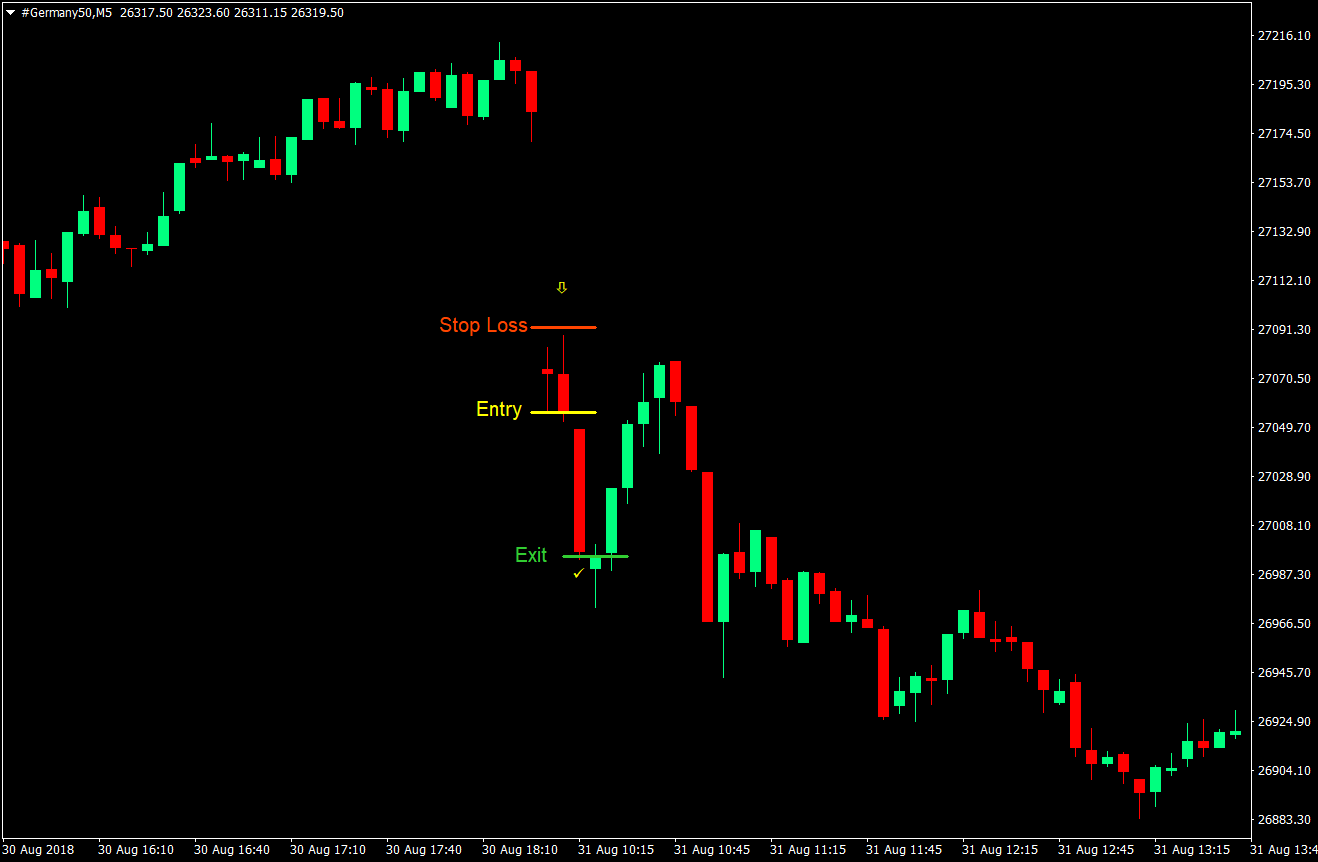

Satış (Kısa) İşlem Kurulumu

Girdi

- Seans açılışında piyasanın boşluğu düşmeli

- İlk iki 5 dakikalık mum içinde, üst kısmında önemli bir fitili olan ve alt kısmında çok az fitili olan veya hiç fitili olmayan bir mum oluşmalıdır.

- Mumun kapanışında bir satış piyasası emri açın

Zarar Durdur

- Zararı durdur emrini mumun fitilinin hemen üstüne yerleştirin

Çıkış

- İlk yükseliş mumunda işlemi kapatın

Sonuç

Bu, 5 dakikalık grafikte yapılan çok kısa vadeli bir günlük ticaret stratejisidir. Aslında işlem seansının ilk saatinde bitirmeniz gerekir.

Bunu akılda tutarak, ticaret mum fiyatına göre mum bazında değerlendirilmelidir. Peşinde olduğumuz şey, boşluktaki ivmeden gelen kısa devam hareketi. İlk karşıt mumun gösterdiği gibi momentumun kısa süreli devamı sona erdiğinde işlemden çıkıyoruz.

Önerilen MT4 Brokerı

- Ücretsiz $ 50 Anında Ticarete Başlamak için! (Çekilebilir Kar)

- Para Yatırma Bonusu $5,000

- Sınırsız Sadakat Programı

- Ödüllü Forex Brokerı

- Ek Özel Bonuslar Yıl boyunca

>> 50$ Bonusunuzu Buradan Talep Edin <

İndirmek için aşağıya tıklayın: