Momentum kırılmaları, yatırımcıların iyi ticaret fırsatları bulabileceği başlıca ticaret koşullarıdır. Bunun nedeni, momentumdaki kırılmaların fiyatın genel bir yönde hareket etmesine neden olması ve sıklıkla bir trendle sonuçlanabilmesidir.

Momentum ticareti, yatırımcıların bir trendin gücüne bağlı olarak alınıp satılabilen bir enstrümanı satın aldığı veya sattığı teknik bir ticaret tekniğidir. Temel olarak, momentum stratejileri ticareti yapan tüccarlar, bir fiyat hareketinin arkasında güçlü bir güçle ticaret yapıyorlar. Bu güçlü fiyat hareketleri genellikle fiyatların aynı yönde hareket etmesine neden olur ve çoğu zaman trend halindeki bir pazarla sonuçlanabilir.

Ticaret dışındaki momentum kütle ve hızın bir sonucudur. Ticarette kütle ve hız, hacme ve fiyatın kısa sürede kat ettiği mesafeye göre belirlenebilir.

Güçlü momentumu tanımlamanın bir yolu momentum mumlarını gözlemlemektir. Momentum mumları, çok az fitili olan veya hiç fitili olmayan, uzun, tam gövdeli mumlardır. Bu, fiyatın o mum döneminde tek yönde hareket ettiğini gösterir. Buna genellikle o mum içinde yüksek hacimli ticaret eşlik eder.

Bu stratejide ivmeyi teyit etmek için birkaç teknik gösterge kullanmaya bakacağız.

Dinamik Fiyat Kanalı

Dinamik Fiyat Kanalı, Ortalama Gerçek Aralığı (ATR) temel alan özel bir kanal türü göstergesidir.

ATR temel olarak önceden belirlenmiş bir süre içindeki ortalama fiyat mum aralığıdır.

Dinamik Fiyat Kanalı, trendi, oynaklığı, momentumu ve ortalama dönüşleri belirlemek için ATR'yi hareketli ortalamalarla birleştirir.

Dinamik Fiyat Kanalı, hareketli ortalama çizgisini ana çizgisi olarak çizer ve kesikli sarı çizgiyle temsil edilir. Bu çizgi Basit Hareketli Ortalama (SMA), Üstel Hareketli Ortalama (EMA) veya Düzleştirilmiş Hareketli Ortalama (SMMA) olabilir. Yatırımcılar göstergenin parametreler sekmesindeki seçeneği seçebilirler.

Daha sonra hareketli ortalama çizgisinden altı çizgi yayılır. Üçü yukarıda, üçü aşağıda. Bu çizgiler, ATR faktörüne dayalı olarak hareketli ortalama çizgisi olan orta çizgiden belirli bir mesafede çizilir.

Gösterge volatilite göstergesi olarak kullanılabilir. Yatırımcılar, bantların orta çizgiden uzağa doğru daralmasına ve genişlemesine dayanarak oynaklığı tespit edebilir.

Orta çizginin eğimine ve belirli çizgilerin trend yönünde dinamik destek veya direnç olarak hareket etmesine bağlı olarak trend yönünü belirlemek için de kullanılabilir.

Ayrıca fiyatın dış bantlara nasıl tepki verdiğine bağlı olarak aşırı alım veya aşırı satım piyasalarını da gösterebilir. Fiyat hareketi dış bantlarda fiyat reddi belirtileri gösteriyorsa, piyasa ya aşırı alım ya da aşırı satım durumunda olabilir. Bu koşullar ortalamanın tersine çevrilmesi için temel koşullardır.

Öte yandan, güçlü momentumu belirlemek için aynı dış çizgiler kullanılabilir. Fiyat hareketi dış çizgilere karşı güçlü bir momentum kırılması işaretleri gösteriyorsa, piyasa güçlü bir ivme kazanıyor olabilir ve bu da bir trend oluşturabilir.

Göreceli Güç Endeksi

Göreceli Güç Endeksi (RSI), osilatör gösterge ailesinin bir parçası olan çok yönlü bir teknik göstergedir. Trendleri, momentumu ve aşırı alım veya aşırı satım fiyat koşullarını belirlemek için kullanılabilir.

RSI, 0 ila 100 aralığında salınan bir çizgi çizer. Aynı zamanda tipik olarak orta hat olan 50 düzeyinde işaretleyicilere sahiptir. RSI çizgisi 50'nin üzerindeyse piyasa eğilimi yükseliş yönündedir; çizgi 50'nin altındaysa piyasa eğilimi düşüş yönündedir.

Ayrıca 30 ve 70 seviyesinde işaretleyiciler de vardır. 30'un altına düşen bir RSI çizgisi aşırı satış durumunu gösterebilirken, 70'in üzerindeki bir RSI çizgisi aşırı alım durumunu gösterebilir. Ortalamanın tersine dönmesi için her iki koşul da önceliklidir.

Ancak momentum yatırımcıları 70'in üzerindeki bir kırılmayı yükseliş momentumu göstergesi olarak, 30'un altındaki düşüşü ise düşüş momentumu göstergesi olarak görebilirler. RSI çizgisi bu seviyeleri aştığında fiyat hareketinin nasıl tepki vereceği önemli.

Yatırımcılar ayrıca trend halindeki bir piyasa göstergesini desteklemek için seviye 45 ve 55'i de eklerler. Seviye 45, yükseliş eğilimi gösteren bir piyasada destek seviyesi görevi görürken, seviye 55, düşüş eğilimi gösteren bir piyasada direnç görevi görür.

Ticaret Stratejisi

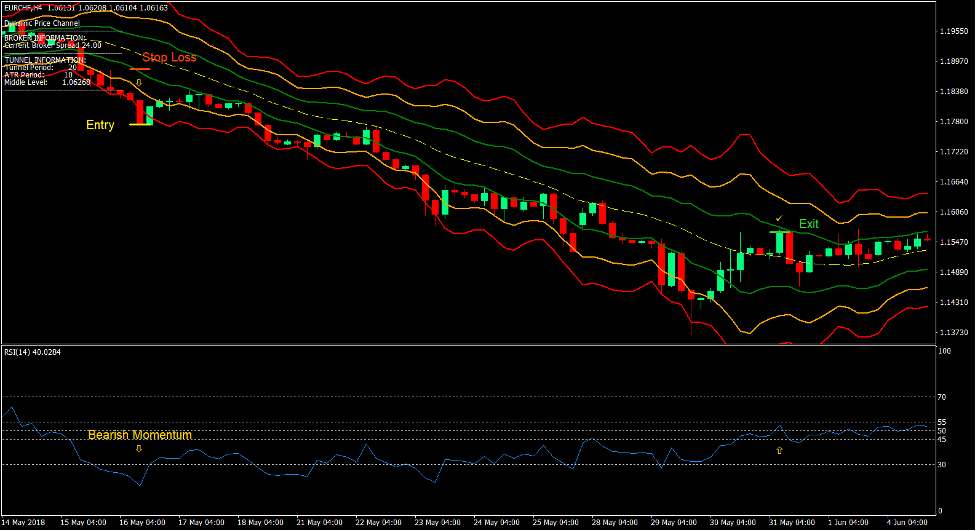

Dinamik Kanal Momentum Kırılma Forex Ticaret Stratejisi, Dinamik Fiyat Kanalı göstergesinden ve RSI'dan gelen momentum kırılma sinyali arasındaki kesişme noktalarında işlem yapan bir momentum kırılma stratejisidir.

Dinamik Fiyat Kanalında momentum, Dinamik Fiyat Kanalının dış çizgilerinin ötesine geçen güçlü bir momentum mumuna dayanarak tanımlanır. Bu, ortadaki sarı çizginin üstündeki ve altındaki kırmızı çizgilerle temsil edilir.

RSI'da momentum, RSI çizgisinin yükseliş momentumu durumunda 70'in üzerinde veya düşüş momentumu durumunda 30'un altında kırılmasıyla doğrulanır.

İki momentum sinyali arasındaki kesişmeler, bir trendle sonuçlanabilecek yüksek olasılıklı momentum sinyalleri olma eğilimindedir.

Göstergeler:

- Dynamic_Price_Channel

- Göreceli Güç Endeksi

Tercih Edilen Zaman Çerçeveleri: 1 saatlik ve 4 saatlik grafikler

Döviz Çifti: FX majörler, minörler ve haçlar

Ticaret Oturumları: Tokyo, Londra ve New York oturumları

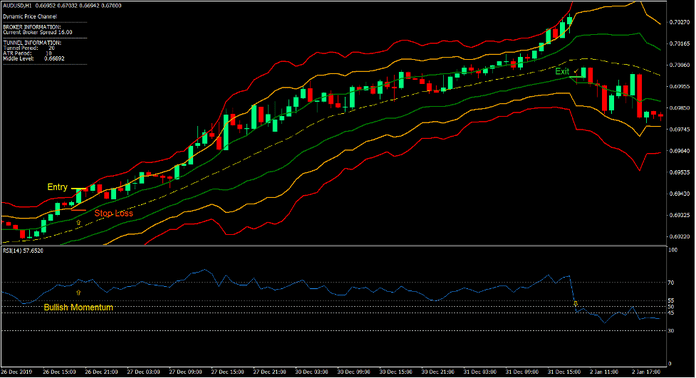

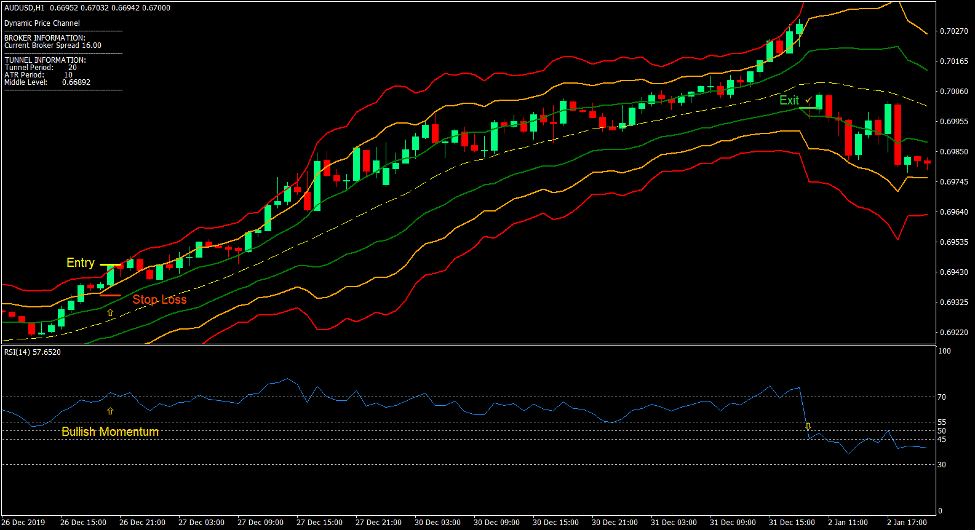

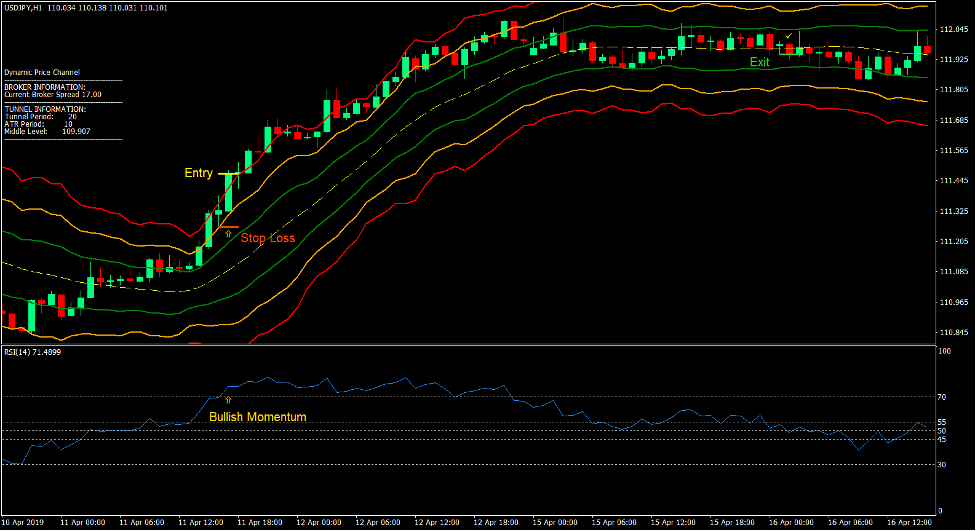

Ticaret Kurulumu Satın Al

Girdi

- Yükseliş momentumu mumu, Dinamik Fiyat Kanalının üst kırmızı çizgisinin üzerine çıkmalıdır.

- RSI çizgisi 70'in üzerine çıkmalıdır.

- Her iki sinyalin kesiştiği noktada bir satın alma emri girin.

Zarar Durdur

- Zararı durdurmayı giriş mumunun biraz altındaki bir destek seviyesine ayarlayın.

Çıkış

- RSI çizgisi 50'nin altına düştüğünde işlemi kapatın.

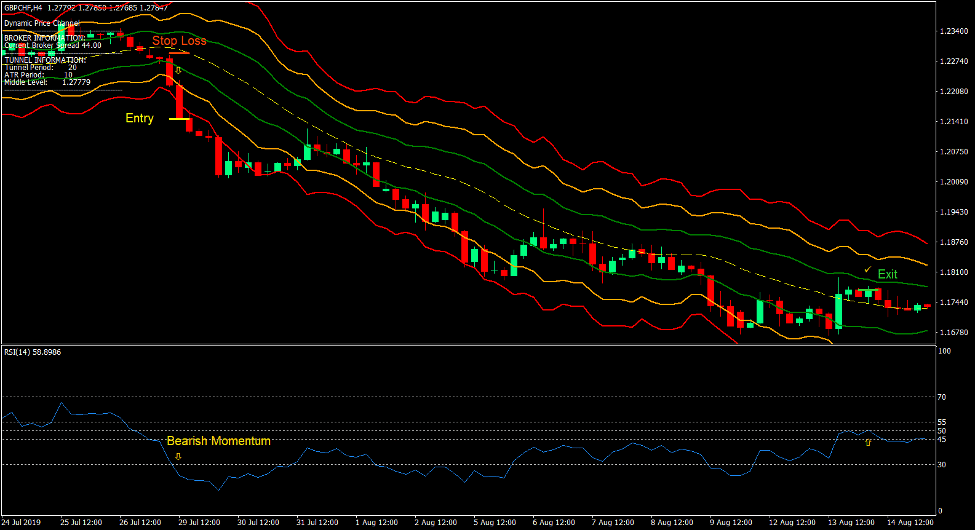

Ticaret Kurulumu Sat

Girdi

- Düşüş momentumu mumu, Dinamik Fiyat Kanalının alt kırmızı çizgisinin altına düşmelidir.

- RSI çizgisi 30'in altına düşmelidir.

- Her iki sinyalin kesiştiği noktada bir satış emri girin.

Zarar Durdur

- Zararı durdurmayı giriş mumunun biraz üzerindeki bir direnç seviyesine ayarlayın.

Çıkış

- RSI çizgisi 50'nin üzerine çıktığı anda işlemi kapatın.

Sonuç

Bu momentum kırma stratejisi, iki yüksek kaliteli momentum sinyaline dayanan momentum ticaret kurulumları üretir.

Bu yöntemi kullanarak değişen parametrelerle ve birden fazla zaman diliminden gelen kesişimlerle ticaret yapan birçok profesyonel tüccar vardır. Ancak bağımsız bir ivme sinyali olarak bu strateji zaten yüksek kaliteli ticaret kurulumları üretebilir.

Bu ticaret kurulumlarının, kırılmalar sıkı bir piyasa sıkışıklığından kaynaklandığında iyi çalışma eğiliminde olduğunu belirtmek de önemlidir.

Yatırımcılar bu stratejiyi birden fazla zaman diliminde kesişen genel momentum stratejisinin bir parçası olarak pratik yapabilirler.

Önerilen MT4 Komisyoncuları

XM Broker

- Ücretsiz $ 50 Anında Ticarete Başlamak için! (Çekilebilir Kar)

- Para Yatırma Bonusu $5,000

- Sınırsız Sadakat Programı

- Ödüllü Forex Brokerı

- Ek Özel Bonuslar Yıl boyunca

>> XM Broker Hesabına buradan kaydolun <

FBS Aracısı

- Ticaret 100 Bonus: Ticaret yolculuğunuza başlamak için ücretsiz 100$!

- 100% Depozito: Yatırdığınız parayı 10,000$'a kadar ikiye katlayın ve artırılmış sermayeyle işlem yapın.

- 1'e kadar kaldıraç: 3000: Mevcut en yüksek kaldıraç seçeneklerinden biriyle potansiyel kârı en üst düzeye çıkarmak.

- 'Asya'nın En İyi Müşteri Hizmetleri Komisyoncusu' Ödülü: Müşteri desteği ve hizmetinde tanınan mükemmellik.

- Mevsimsel Promosyonlar: Tüm yıl boyunca çeşitli özel bonusların ve promosyon tekliflerinin keyfini çıkarın.

>> FBS Broker Hesabına buradan kaydolun <

İndirmek için aşağıya tıklayın: