"Ortaya çıkan her zaman aşağıya iner." Fizikte geçerli olan kanun ticarette de geçerlidir. Trendler, arkasında ivme olduğu sürece harikadır, ancak er ya da geç bir trendi yönlendiren ivme yok olacaktır. Trendi takip etmeye çalışan ancak piyasaya biraz geç giren trader'lar, piyasa tersine dönmeye başladığında kendilerini derin sularda bulacaklar. Bu, çoğu trend yatırımcısı için zorlu bir durum olabilir, ancak bu tür koşullarda gezinmeyi öğrenenler, bu tür çalkantılı trend dönüşlerinden kâr edebilirler.

Bir trendin tersine dönmesinin birçok olası nedeni vardır. Bu temel bir haber bülteni, bir ticaret savaşı, para politikası değişikliği, büyük bir bankanın büyük bir pozisyon açması, bir destek veya direnç vb. olabilir. Sebeplerden bazıları tahmin edilebilirken birçoğu tahmin edilemez. Öngöremediğimiz, kontrol edemediğimiz ve onlardan para kazanamadığımız şeyler. Ancak teknik analizle tahmin edilebilecek bazı nedenler vardır, bunlardan biri de fiyat reddidir. Fiyat reddi, fiyatın çok yüksek veya çok düşük belirli bir seviyeye ulaştığı ve yatırımcıların bunu fark etmeye başladığı noktadır. Piyasa, fiyatın bu noktaya ulaştığını fark ettiği anda, fiyatın bu noktayı aşması zor olacaktır. Daha sonra fiyat durmaya ve tersine dönmeye başlar. Fiyat reddini tahmin etmenin birçok yolu vardır; bunlardan biri fiyatın aşırı alım mı yoksa aşırı satım mı olduğunu belirlemektir. Fiyat aşırı alım veya aşırı satım piyasa koşullarını reddetmeye başlar başlamaz fiyat tersine dönmeye başlayabilir.

Bollinger Trend Tersine Çevirme Forex Ticaret Stratejisi, bu bilgiyi kullanan bir stratejidir. Oluşturduğu geri dönüş sinyalinin aşırı alım veya aşırı satım piyasa koşullarından başlayıp başlamadığını yatırımcılara göstererek trendin tersine dönmesini öngörür.

Bollinger Bantları

Bollinger Bantları, John Bollinger tarafından 1980'lerde geliştirilen teknik bir göstergedir. Trend yönünü, oynaklığı ve aşırı alım veya aşırı satım piyasa koşullarını belirler. Bu nedenle Bollinger Bantları, yatırımcılara tek bir bakışla tonlarca bilgi verebilecek ticaret göstergelerinden biridir.

Bollinger Bantları orta çizgiye göre trendin yönünü gösterir. Bunun nedeni Bollinger Bantlarının orta çizgisinin temelde Basit Hareketli Ortalama (SMA) olmasıdır. Çoğu hareketli ortalama gibi Bollinger Bandının orta çizgisi de trendin yönünü belirlemek için kullanılabilir. Yatırımcılar trendin yönünü belirlemek için fiyatın konumunu veya eğim açısını kullanabilirler. Ayrıca, başka bir hareketli ortalamayı kullanarak bir geçiş yoluyla veya fiyatların üzerinden geçtiği işlemleri alarak trendin tersine çevrilme sinyallerini belirlemek için de kullanılabilir.

Ayrıca dış bantlarının özelliklerine bağlı olarak volatiliteyi de gösterir. Dış bantlar orta hattan standart sapmanın hesaplanmasına dayanmaktadır. Değişken piyasa koşullarında, dış bantlar genişleme eğilimi gösterirken, piyasanın zayıf oynaklığa sahip olduğu zamanlarda dış bantlar da daralma eğilimindedir.

Son olarak fiyatın aşırı alım veya aşırı satım durumunu da gösterir. Dış bantlar genellikle fiyatın aşırı alım mı yoksa aşırı satım mı olduğunu gösteren belirteçler olarak kullanılır. Fiyat çizgilerin dışındaki alanı reddetmeye başladığında, birçok tüccar bunu aşırı alım veya aşırı satım piyasasında fiyat reddinin bir göstergesi olarak görecektir.

Jurik Hareketli Ortalama

Jurik Hareketli Ortalama (JMA), hareketli ortalamanın değiştirilmiş bir versiyonudur. Azaltılmış gecikmeyle hareketli bir ortalama çizmek amaçlandığı gibidir. Gecikmeyi azaltmaya çalışan başka birçok hareketli ortalama da var; bunlardan biri Üstel Hareketli Ortalama (EMA). Ancak Jurik Hareketli Ortalama ile karşılaştırıldığında EMA, JMA'ya kıyasla daha fazla gecikme gösterme eğilimindedir.

Klinger Hacim Osilatörü

Klinger Hacim Osilatörü (KVO), Stephen J. Klinger tarafından geliştirilen teknik bir göstergedir. Trendi belirlemek için hacim bazlı bir yaklaşımı dikkate alan salınımlı bir göstergedir. Aynı zamanda kısa vadeli trend sinyalleri sağlama ve aynı zamanda uzun vadeli trend yönlerini göstermede faydalı olma arasında bir denge kurmaya çalıştığı için oldukça benzersizdir.

Ticaret Stratejisi

Bu strateji, bir fiyat reddi ile başlatılan teyit edilmiş trend dönüşleri hakkında ticari sinyaller sağlayan bir trend tersine çevirme stratejisidir. Bollinger Bantları bu stratejide kullanılan odak göstergesidir. Geri dönüşün ilk aşaması, dış bantlar olan aşırı alım veya aşırı satım bölgelerinin fiyatının reddedilmesi olmalıdır.

Dış bantlarda fiyat reddi gözlemlendikten sonra, Jurik Hareketli Ortalamanın (JMA) Bollinger Bantlarının orta çizgisi üzerinden geçmesiyle gösterilen trend tersine dönmeye başlamalıdır.

Son olarak trendin tersine çevrilmesi, geçişin yönü ile uyumlu histogram çubukları gösterilerek Klinger Hacim Osilatörü (KVO) tarafından onaylanmalıdır.

göstergeler:

- Bollinger Bantları

- Dönem: 28

- JMA

- Uzunluk: 28

- K.V.O.

- Hızlı EMA: 84

- Yavaş EMA: 120

- Tekil EMA: 26

Zaman aralığı: 4 saatlik ve günlük grafikler

Döviz Çiftleri: majör ve minör çiftler

Ticaret oturumu: Tokyo, Londra ve New York oturumları

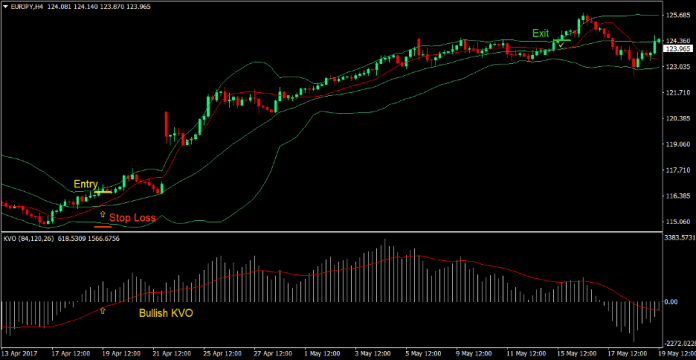

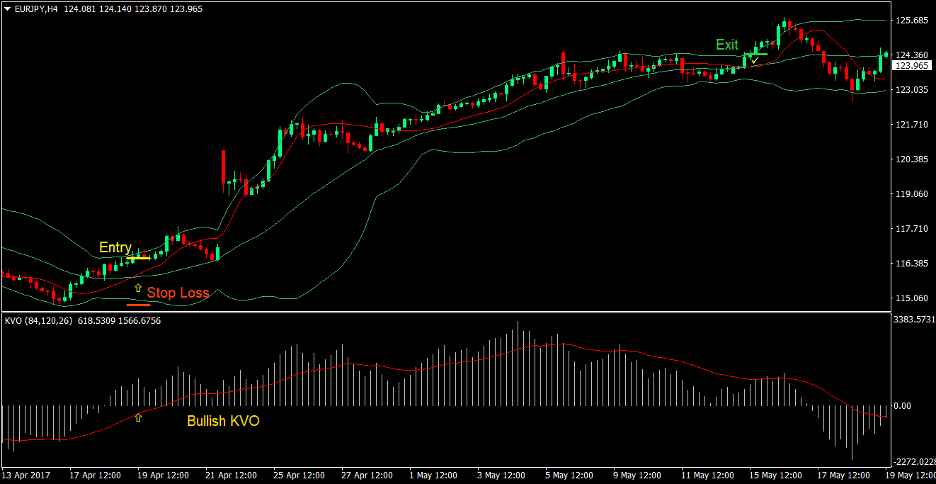

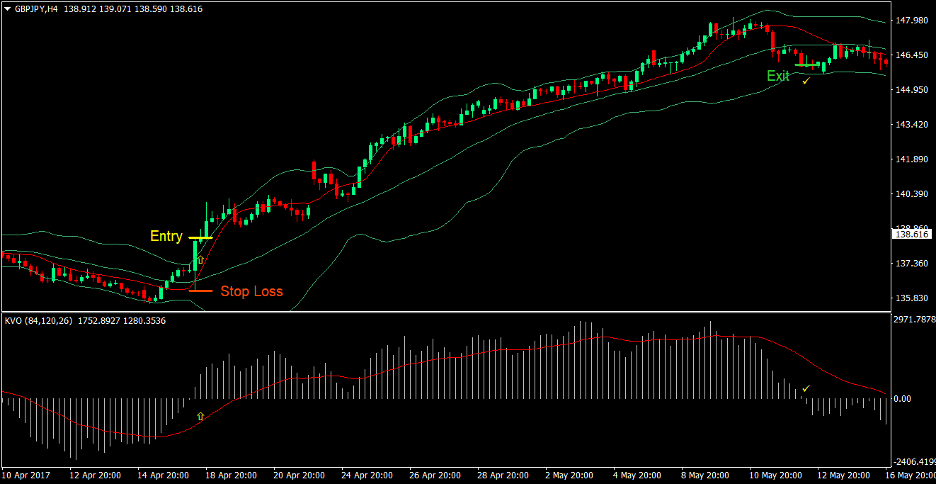

Ticaret Kurulumu Satın Al

Girdi

- Fiyat hareketi, alt Bollinger Bandının fiyat reddini karakterize etmelidir

- KVO göstergesinin histogramları sıfırın üzerine çıkmalı ve yükseliş eğilimini gösteren pozitif histogramlar yazdırmalıdır

- Jurik Hareketli Ortalaması (JVA), yükseliş eğiliminin tersine döndüğünü gösteren Bollinger Bandının orta çizgisinin üzerine çıkmalı

- Bu ters sinyallerin birbirine biraz yakın olması gerekir

- Yukarıdaki koşulların birleştiği noktada bir satın alma emri girin

Zarar Durdur

- Zararı durdurmayı giriş mumunun altındaki destek seviyesinde ayarlayın

Çıkış

- KVO histogramı negatif olur olmaz işlemi kapatın

- JVA çizgisi Bollinger Bantlarının orta çizgisinin altına geçtiğinde işlemi kapatın

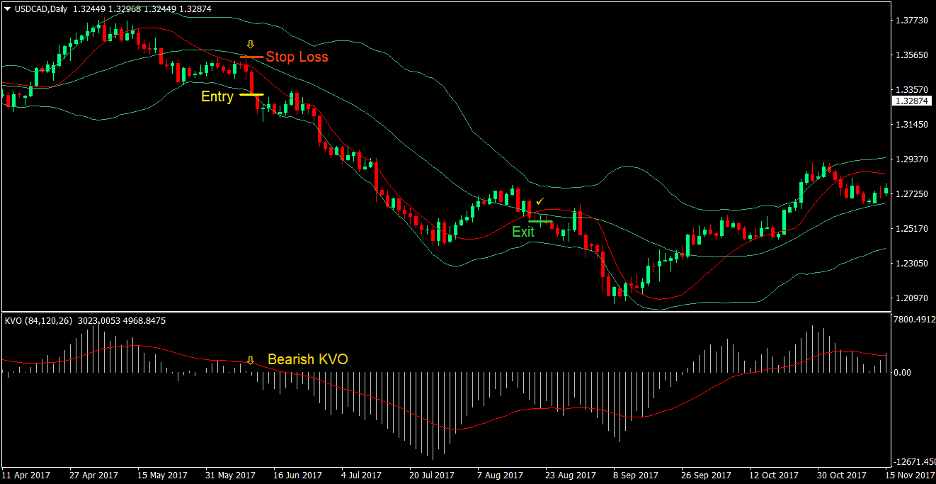

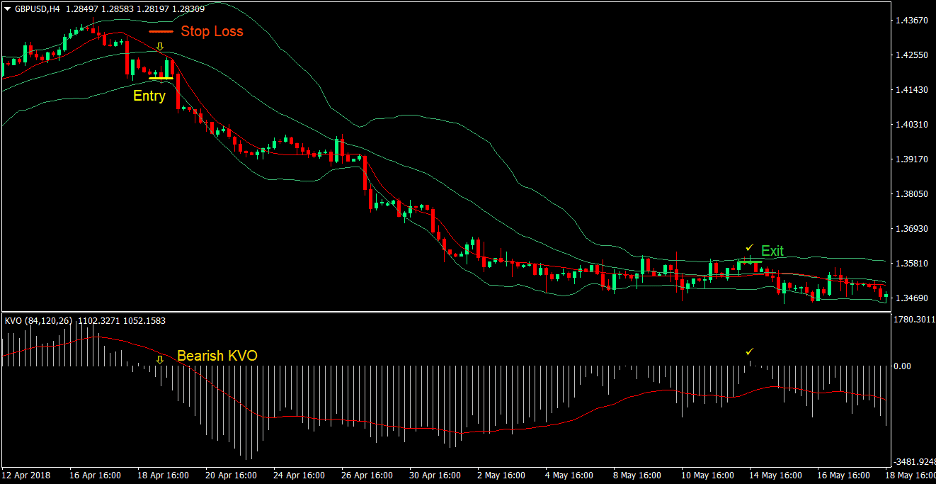

Ticaret Kurulumu Sat

Girdi

- Fiyat hareketi üst Bollinger Bandının fiyat reddini karakterize etmelidir

- KVO göstergesinin histogramları sıfırın altını geçmeli ve düşüş eğilimini gösteren negatif histogramlar yazdırmalıdır

- Jurik Hareketli Ortalaması (JVA), düşüş eğiliminin tersine döndüğünü gösteren Bollinger Bandının orta çizgisinin altına geçmelidir

- Bu ters sinyallerin birbirine biraz yakın olması gerekir

- Yukarıdaki koşulların birleştiği noktada bir satış emri girin

Zarar Durdur

- Durdurma kaybını giriş mumunun üzerindeki direnç seviyesine ayarlayın

Çıkış

- KVO histogramı pozitif hale gelir gelmez işlemi kapatın

- JVA çizgisi Bollinger Bantlarının orta çizgisinin üzerine geçtiğinde işlemi kapatın

Sonuç

Bu trendi tersine çevirme stratejisi, Bollinger Bantlarının fiyat reddine dayanan bir stratejidir. Bollinger Bantlarının dış bantlarının fiyat reddini kabul eden birçok tüccar var. Bazıları fiyatın reddedildiğini gösteren mumlarla işlem yaparken, daha muhafazakar tüccarlar orta çizginin üzerinden işlem yapıyor. Ancak bu strateji, Klinger Hacim Osilatörünün (KVO) trend yönü ile doğrulandığı üzere, olağan Bollinger Bantları tersine çevirme stratejisiyle karşılaştırıldığında daha iyi bir olasılığa sahiptir. Bu, fiyatın reddedilmesiyle başlatılan trendin tersine çevrilmesinin arkasında hacmin bulunduğunu ve bu durumun aslında bir trendle sonuçlanabilecek bir giriş sinyaline sahip olma olasılığını artırdığını gösteriyor.

Önerilen MT4 Komisyoncuları

XM Broker

- Ücretsiz $ 50 Anında Ticarete Başlamak için! (Çekilebilir Kar)

- Para Yatırma Bonusu $5,000

- Sınırsız Sadakat Programı

- Ödüllü Forex Brokerı

- Ek Özel Bonuslar Yıl boyunca

>> XM Broker Hesabına buradan kaydolun <

FBS Aracısı

- Ticaret 100 Bonus: Ticaret yolculuğunuza başlamak için ücretsiz 100$!

- 100% Depozito: Yatırdığınız parayı 10,000$'a kadar ikiye katlayın ve artırılmış sermayeyle işlem yapın.

- 1'e kadar kaldıraç: 3000: Mevcut en yüksek kaldıraç seçeneklerinden biriyle potansiyel kârı en üst düzeye çıkarmak.

- 'Asya'nın En İyi Müşteri Hizmetleri Komisyoncusu' Ödülü: Müşteri desteği ve hizmetinde tanınan mükemmellik.

- Mevsimsel Promosyonlar: Tüm yıl boyunca çeşitli özel bonusların ve promosyon tekliflerinin keyfini çıkarın.

>> FBS Broker Hesabına buradan kaydolun <

İndirmek için aşağıya tıklayın: