Trend reversals are excellent trading opportunities. It allows traders to profit from the market as price action starts to reverse against an established trend. This type of market condition provides the possibility that price may reach the starting point of the previous trend or even breach it, resulting in trades with higher yields for traders who were able to capitalize on such trading opportunity.

This trading strategy is an example of how traders may observe and anticipate potential trend reversals based on price action and momentum breakouts.

Trendlines as Support and Resistance Levels

In a trending market, price action would often have an observable pattern based on its swing points. In an uptrend market, the swing highs and swing lows tend to rise consistently, while in a downtrend market, the swing highs and swing lows would consistently drop. These price swings often create a channel like structure where traders may anticipate the price swings to reverse on the short-term depending on the trajectory of the trend.

Trendlines are lines that traders may plot on the price chart to connect the swing highs and swing lows of price action. It is on these lines where traders would observe for potential bounces as the market continues its trending characteristics.

The assumption is that the market would continue to trend as long as the market respects the trendline. For this reason, traders may also consider trendlines as support and resistance levels.

Although the market does tend to respect trendlines during a trending market, the market does eventually break the identified support and resistance levels. This signifies the end of the trend and a potential market reversal.

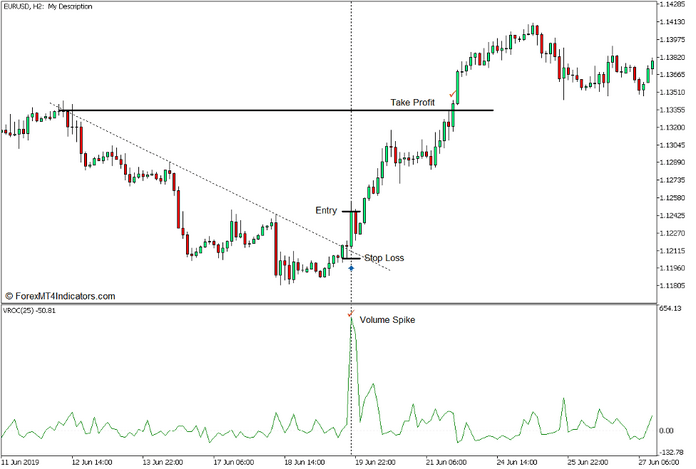

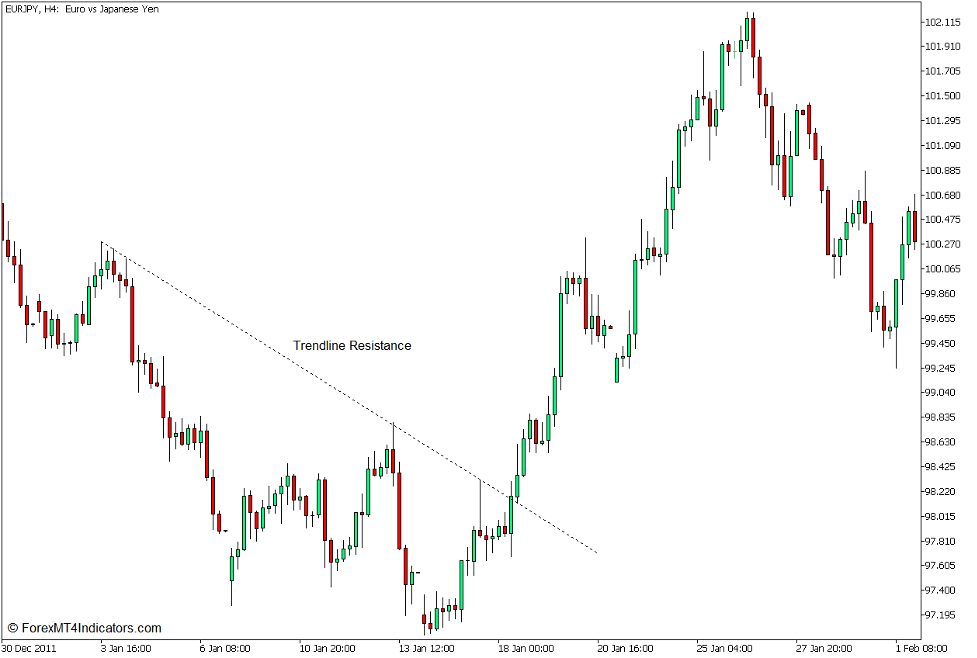

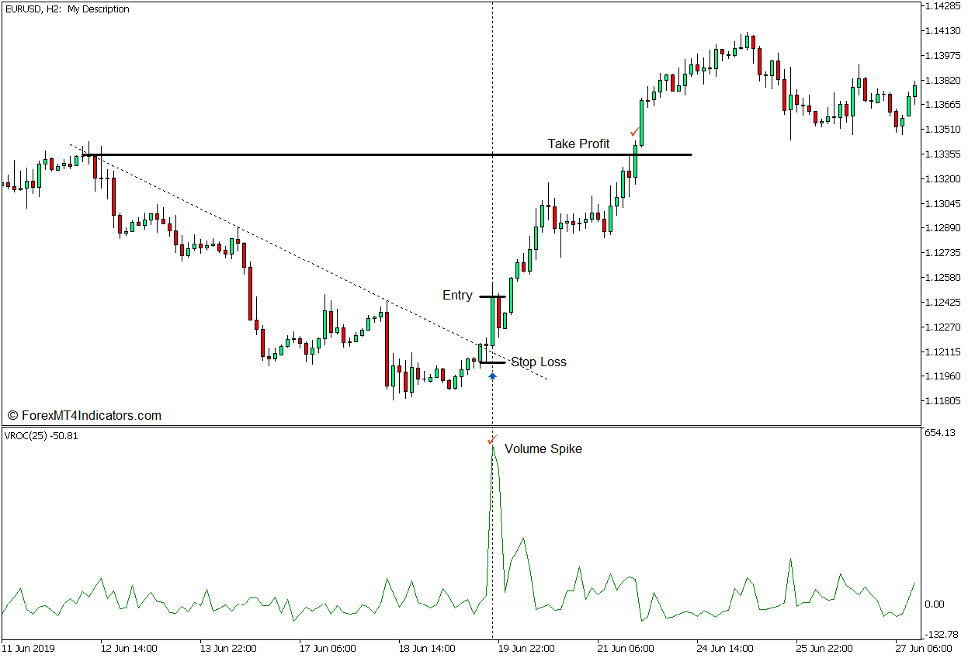

The sample chart below shows a resistance trendline. This trendline connects three swing highs which are consistently dropping. Price then broke through the trendline and started to reverse to the upside.

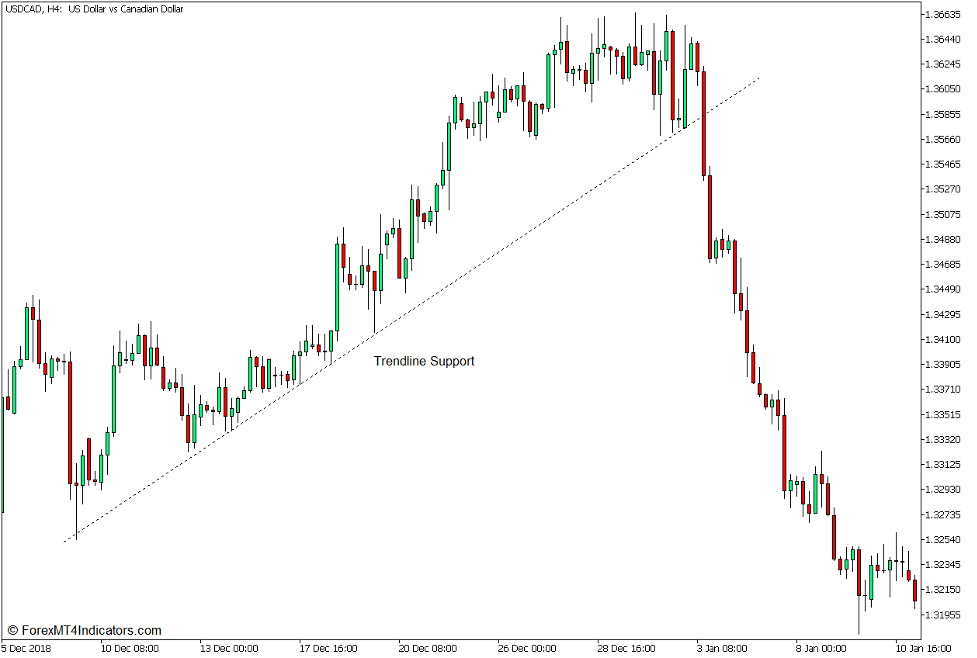

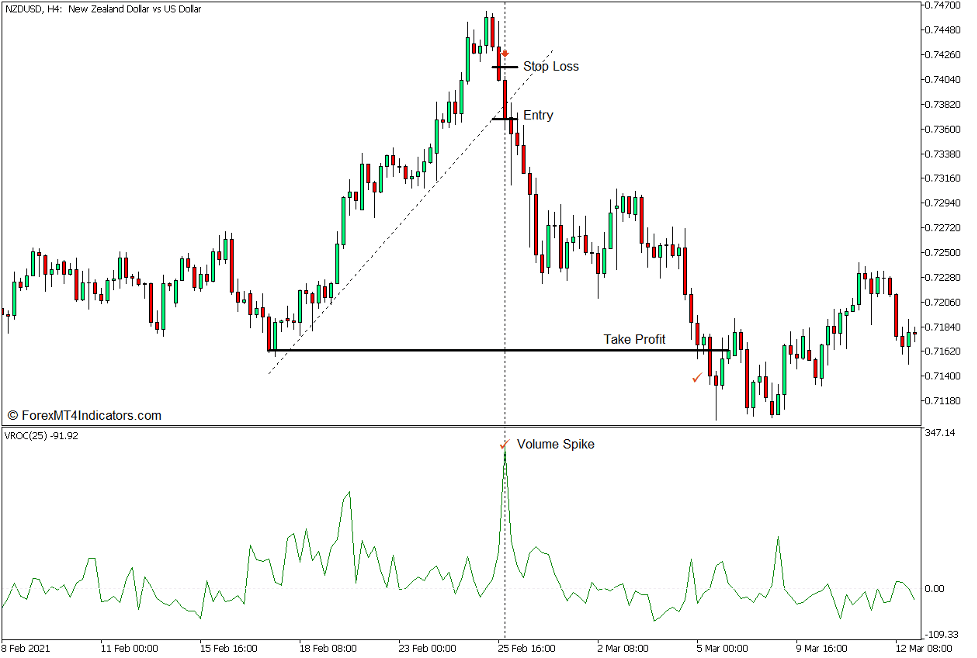

The second sample chart below shows a trendline considered as a support line. It has several minor swing lows that did not cross below the trendline. However, as with all trends, it ended and reversed as the market broke below the support trendline with strong momentum.

Volume Rate of Change Indicator as a Momentum Breakout Confirmation

Volume Rate of Change (VROC) is a technical trading tool which was developed to help traders observe the strength of a price action based on volume. It is a simple technical indicator which plots a line that is based on the volume of a series of historical price candles. This line is drawn on a separate indicator which oscillates around a dashed line, which is set at zero.

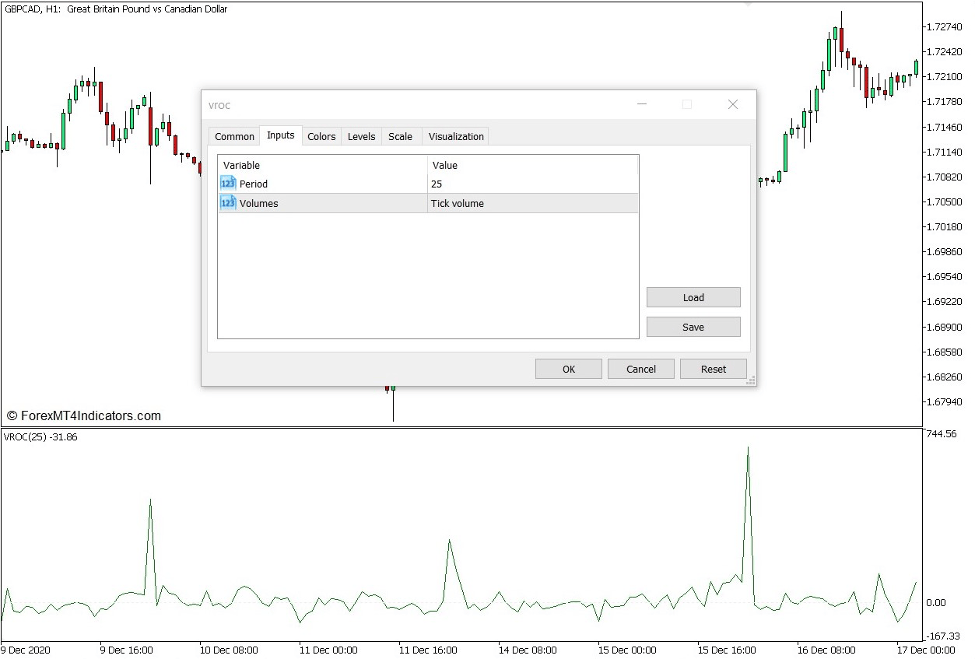

Users may modify the characteristics of the VROC line by manipulating the variables within the indicator’s settings.

“Period” allows users to modify the number of candles or bars which the indicator would use to calculate for the VROC line.

“Volumes” allows users to modify the type of volume which the indicator would use for its calculations. “Tick volume” is based on the number of price movements within the candle, while “Real volume” is based on the actual volume of each trade transaction from the broker. “Real volume” is ideally used however this data is not always available for most broker servers.

Trading Strategy Concept

Trend reversals based on trendline support and resistance breakouts are excellent trading opportunities. It allows traders to cash in on profitable trades as the market starts to reverse towards the opposite direction. However, there are also many instances wherein the market would “fake out” traders into thinking that price action is reversing against the trend. This often results in a quick loss right after traders enter the market assuming that the trend is reversing.

The key to identifying a high probability trend reversal is by looking for breakouts with strong momentum. Most traders would observe momentum solely based on the size and characteristics of the breakout candle. Although this method may work, it is not always reliable.

Another method which many professional traders use to confirm a breakout is by looking at volume. Volume spikes indicate that a signal candle has significant momentum behind it, resulting in breakout trade signals that have higher tendencies to continue in the direction of the reversal due to the momentum of the breakout.

The Volume Rate of Change (VROC) indicator is an excellent tool for identifying such momentum breakout signals. Traders may confirm whether a breakout signal has momentum or not based on whether the signal candle is in confluence with a volume spike on the VROC line.

Buy Trade Setup

Entry

- Identify a resistance trendline by connecting swing highs.

- The resistance trendline should have three or more swing highs to be considered as a valid trendline.

- Wait for a strong momentum candle to break above the trendline.

- The bullish momentum breakout should be in confluence with a volume spike on the VROC line.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss below the entry candle.

Exit

- Set the target take profit on the next swing high observed on the price chart.

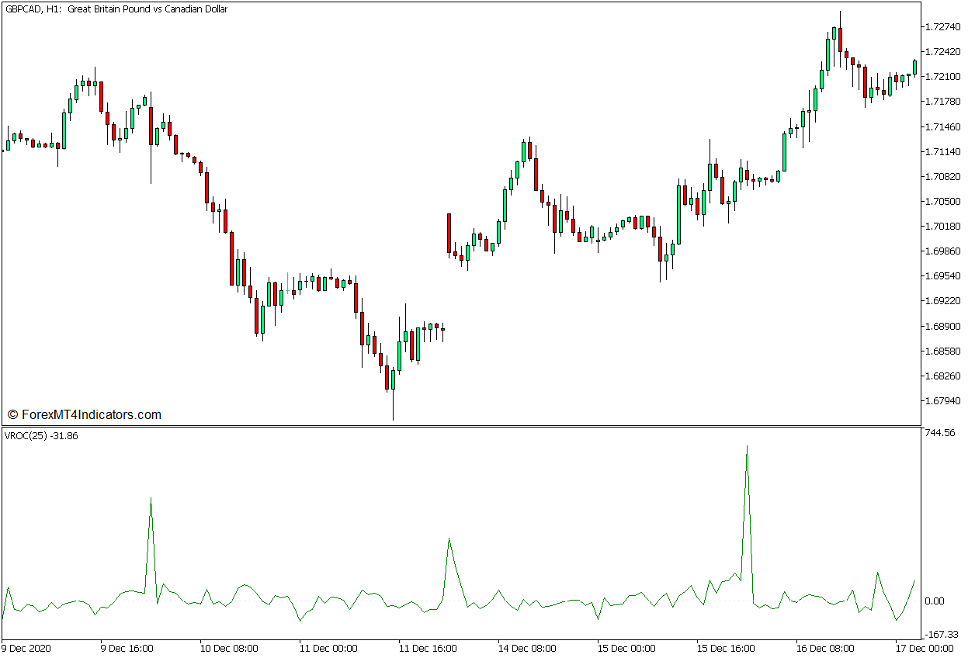

Sell Trade Setup

Entry

- Identify a support trendline by connecting swing lows.

- The support trendline should have three or more swing lows to be considered as a valid trendline.

- Wait for a strong momentum candle to break below the trendline.

- The bearish momentum breakout should be in confluence with a volume spike on the VROC line.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss above the entry candle.

Exit

- Set the target take profit on the next swing low observed on the price chart.

Conclusion

Trend reversal strategies which provide trend reversal signals based on breakouts from a trendline support or resistance are basic trade setups that many professional traders use. Although such trading strategy tend to be very effective, it could also provide a lot of false signals which we called “fake outs”.

This strategy improves on the basic trendline breakout trend reversal strategy by adding a confirmation based on volume. This improves the quality of the breakout signal as it also confirms the presence of a strong momentum during the breakout.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: