The market moves in a few ways. For the most part the market would range, reverse or trend. Although there are many different types of scenarios that could occur, all of it could be categorized into these three market conditions. Price could breakout, bounce off a support or resistance or do a minor mean reversal. Still, they all fit into one of the three conditions. The only difference is the timeframe. Breakouts are actually trending markets when zoomed in on the lower timeframe. Bounces off a support or resistance are full on reversals when zoomed in. Minor mean reversals are actually full reversals on the lower timeframe or could be small retracements on the higher timeframe.

One of the best ways to trade the forex market logically is by looking for points of confluence between these differing conditions in order to make sense of a trade setup.

Mean reversals and retracements are one of the scenarios that could be combined and that would make sense. Mean reversals usually mean that price is either overbought or oversold and should revert to a mathematical average price. Retracements on the other hand mean that the market is trending and is just making a minor adjustment before it makes another thrust in the direction of the trend.

Turbo Trend Breakout Forex Trading Strategy combines retracements, mean reversals and breakouts in order to confirm a trade setup. It makes use of a few indicators that would help traders identify probable trade setups.

3C Turbo JRSX

3C Turbo JRSX is a custom technical indicator which was designed to help traders spot trend direction bias, mean reversal opportunities, and momentum.

3C Turbo JRSX is an oscillator type of indicator. It plots a line that oscillates within the range of 0 to 100 with a midpoint at 50. If the oscillator line is above 50, the short-term trend bias is bullish. If it is below 50, then the short-term trend bias is bearish.

It also has markers at 30 and 70. If the line drops below 30, then the market is considered oversold, while if the line breaches above 70, then the market is considered overbought. Inversely, if the line drops below 30 and continues moving lower, then there is a bearish momentum, and if the line breaches above 70 and continues rising, then there is a bullish momentum.

The 3C Turbo JRSX oscillator line behaves rather smoothly. However, it also is very responsive to price movements. This creates an oscillator that allows traders to observe the cyclical waves of price action while not being too susceptible to market noise and not too lagging to be used for trade signals.

50 Exponential Moving Average

Moving averages are a mainstay in many trading strategies. Most traders have some sort of moving average which they incorporate in their trading strategy. This is because moving averages are quite useful and effective tools.

Moving averages are generally used to identify trend direction and bias. It is usually based on the slope of the moving average line and the location of price in relation to the moving average line.

Moving averages are also used to identify potential trend reversals. Traders would usually look for crossovers of moving averages or a moving average and price in order to spot potential trend reversals.

Another use for moving averages is as a dynamic support or resistance. Many traders usually use these lines as a support or resistance level where price could bounce off after a retracement.

Although moving averages are great, the question is which one to use. One of the most popular moving average settings used by many traders is the 50-period Exponential Moving Average (EMA). The 50 EMA is characterized by a smooth yet responsive moving average line that works well for identifying the mid-term trend.

Trading Strategy

Turbo Trend Breakout Forex Trading Strategy trades in the direction of the trend using the 50 EMA, while being in confluence with overbought or oversold conditions using the 3C Turbo JRSX indicator.

The 50 EMA is used to identify the direction of the trend and as a dynamic support or resistance. Trend direction is based on the general location of price in relation to the 50 EMA as well as the slope of the 50 EMA line.

Price should then retrace to the 50 EMA line and show signs of congestion or price rejection. This should also cause the 3C Turbo JRSX indicator be temporarily overbought or oversold. At the same time, the retracements should create a minor support or resistance line where price could breakout from.

A trade entry becomes valid when price action confirms the bounce while being in confluence with the mean reversal indication form the 3C Turbo JRSX indicator and the breakout from the support or resistance line.

Indicators:

- 50 EMA

- 3c_Turbo_JRSX_wAppliedPrice

Preferred Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

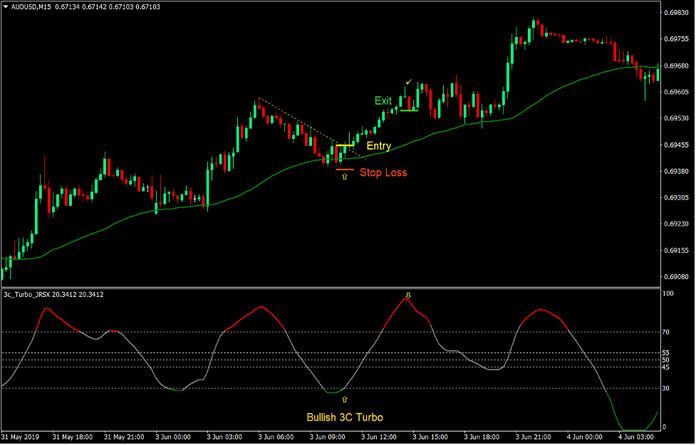

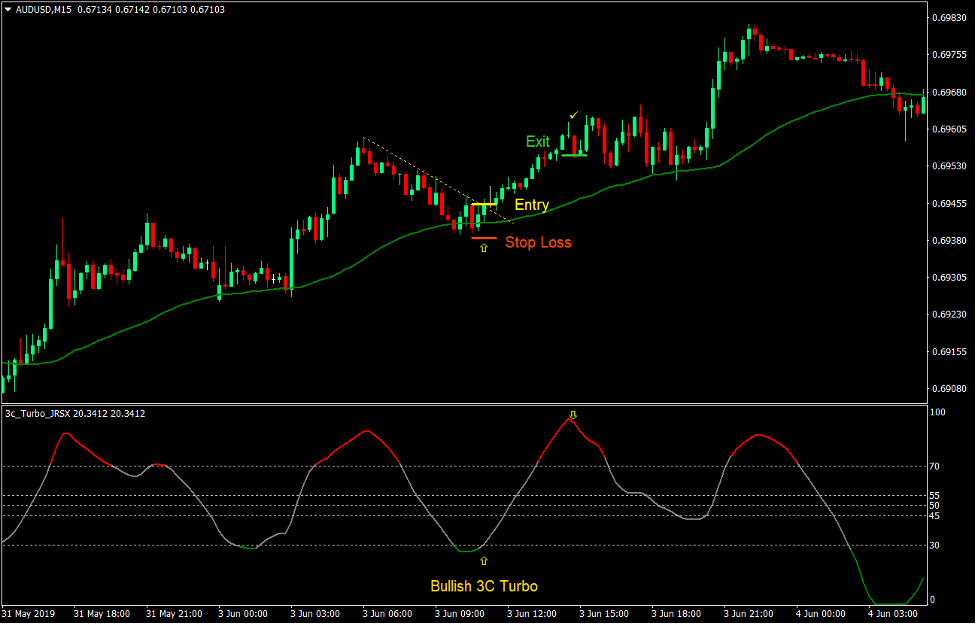

Buy Trade Setup

Entry

- The 50 EMA line should be sloping upward.

- Price action should be above the 50 EMA line.

- Price should retrace towards the 50 EMA line.

- A diagonal resistance line should be observed.

- Price should reject the area of the 50 EMA line and break above the resistance line.

- The 3C Turbo JRSX indicator should reverse from an oversold condition.

- Enter a buy order upon confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the 3C Turbo JRSX indicator slopes down.

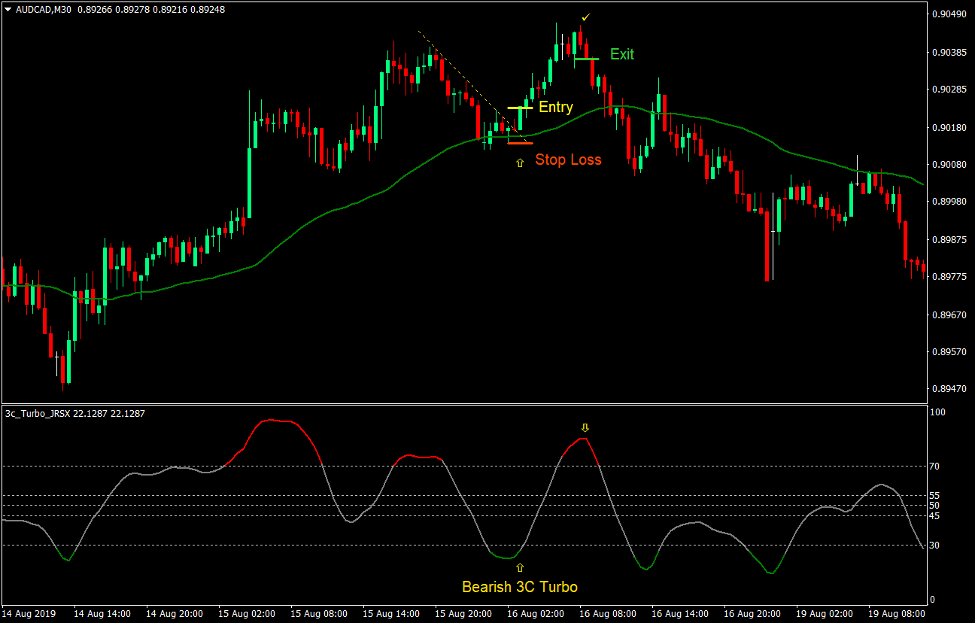

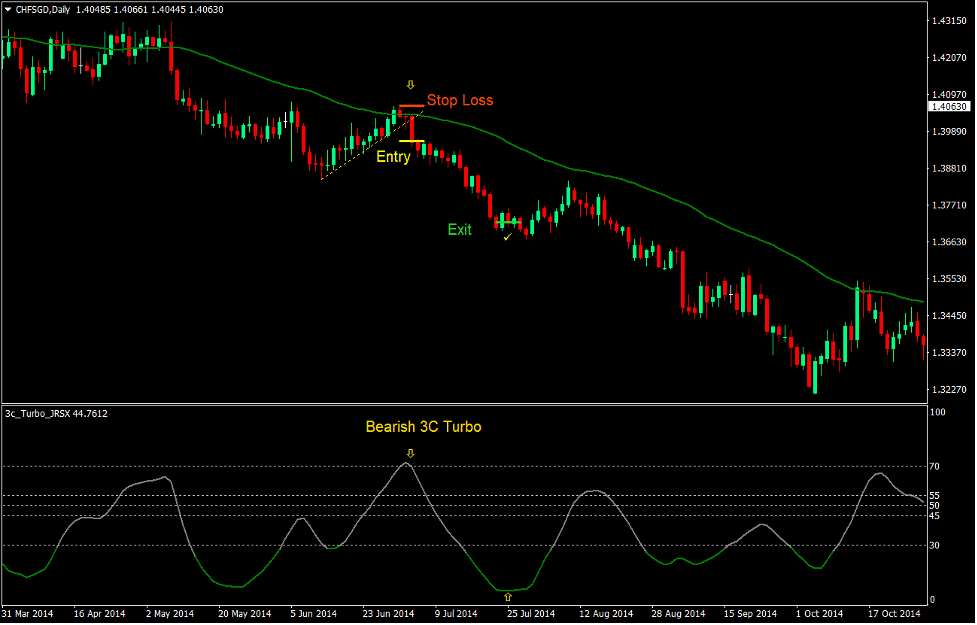

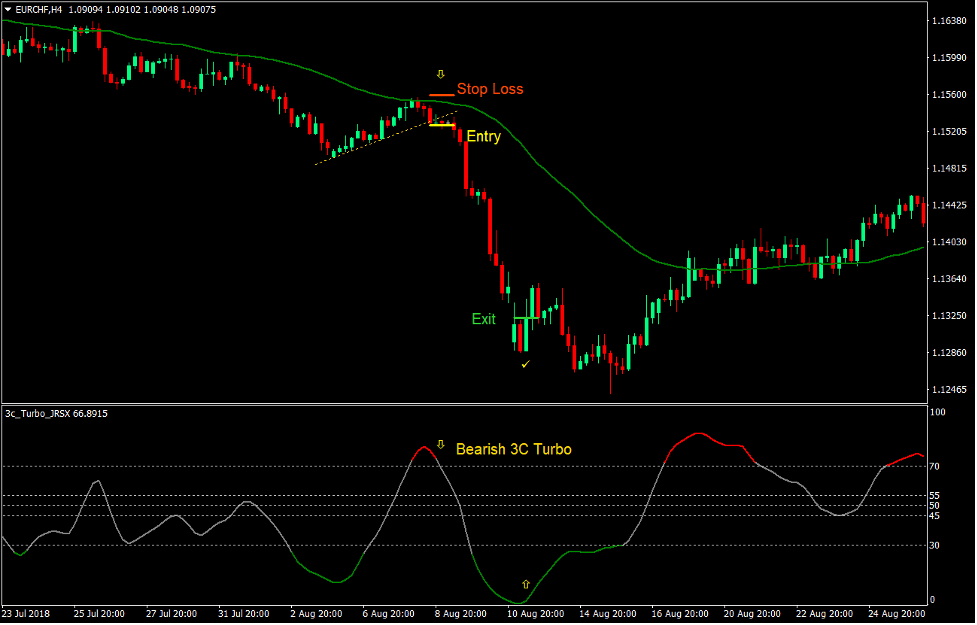

Sell Trade Setup

Entry

- The 50 EMA line should be sloping downward.

- Price action should be below the 50 EMA line.

- Price should retrace towards the 50 EMA line.

- A diagonal support line should be observed.

- Price should reject the area of the 50 EMA line and break below the support line.

- The 3C Turbo JRSX indicator should reverse from an overbought condition.

- Enter a sell order upon confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the 3C Turbo JRSX indicator slopes up.

Conclusion

This trading strategy has a relatively decent probability compared to most strategies. It would allow traders to consistently profit from the market.

However, although it has a decent probability, it does have a lower reward-risk ratio, which is common for most mean reversal strategies. If the win rate is greater than 50%, you should be good if the reward-risk ratio is not less than 1:1.

It also does provide opportunities for high yielding trades because it is open ended. If a trade setup would result in an explosive momentum move, then traders could profit big time in a single trade.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: