Trading is a practical transaction engaged in for the purpose of gaining a profit. In the past, traders look for physical goods which they could buy at a low price, then turn around and look for buyers willing to buy the good at a higher price.

Nowadays, platforms have been developed to automate the process of trading. Traders no longer need the physical good, stock, commodity or currency. All we need is a computer and an internet connection. This speeds things up. Transactions no longer need to be done physically, yet the same fundamentals still exist. To make money, traders need to buy low and sell high. Those who could do this simple task just by looking at charts stand to make so much money.

So, how do we buy low and sell high. One concept would be to look for markets that are clearly trending and buy anytime the market dips a bit. These are called retracements.

Moving averages are good indicators that could help traders identify if price is low enough to warrant a good buy, yet at the same time identify that the market is still trending.

Turbo 100 Retracement Forex Trading Strategy makes use of this concept. It allows traders to enter trades as price revisits the average price and make profits as the market resumes its trend.

3c Turbo JRSX

3c Turbo JRSX is a custom technical indicator that helps traders identify momentum as well as overbought and oversold price conditions.

It is an oscillating indicator that is bound within the range of 0 to 100. It also has markers on level 30 and 70. The market is considered oversold whenever its line is below 30 and overbought whenever its line is above 70.

Its oscillating line also changes color depending on whether the market is oversold or overbought. Traders could use this as an indication that price might reverse and take trades whenever the color of the line reverts to gray.

The 3c Turbo JRSX line is characteristically very smooth. This provides a stable and reliable momentum indicator which has lesser false signals compared to other oscillators.

Trading Strategy

This trading strategy trades on trending markets that are based on the intermediate trend.

Moving averages acting as dynamic supports and resistances is a great technique to use as a retracement entry signal. In fact, many fast-paced traders trade on bounces off the 10 or 20-period moving average line.

The 100-period Simple Moving Average (SMA) is a unique moving average line because it is an intermediate-trend moving average line. It is quite longer than the commonly used 50-period moving average line and is shorter than the widely accepted long-term moving average line, which is the 200-period moving average.

However, this moving average line could provide excellent retracement trade opportunities for discerning traders. This is because the 100 SMA line, when zoomed out, could equate with a higher timeframe 20-period SMA line. The 100 SMA line on a 1-hour chart is somewhat like a 20 SMA line on a 4-hour chart. The 15-minute chart equates with the 1-hour chart, and so on and so forth.

The advantage of using the 100 SMA line is that traders could see the minute movements of price action on a lower timeframe. They could also see minor overbought or oversold conditions which could provide excellent momentum reversal trade setups.

Indicators:

- 100 SMA (Gold)

- 3c_Turbo_JRSX_wAppliedPrice (default setting)

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

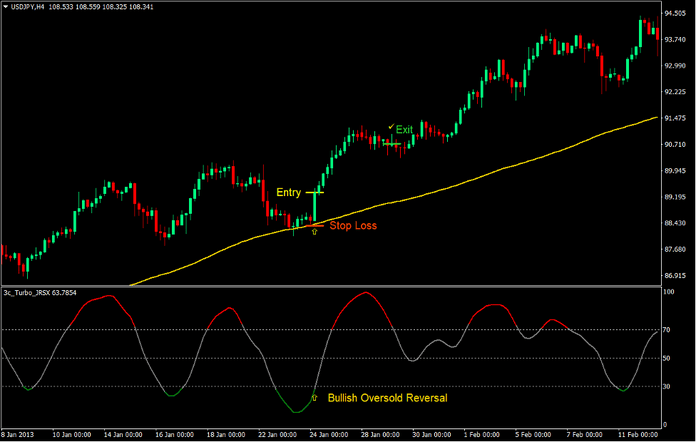

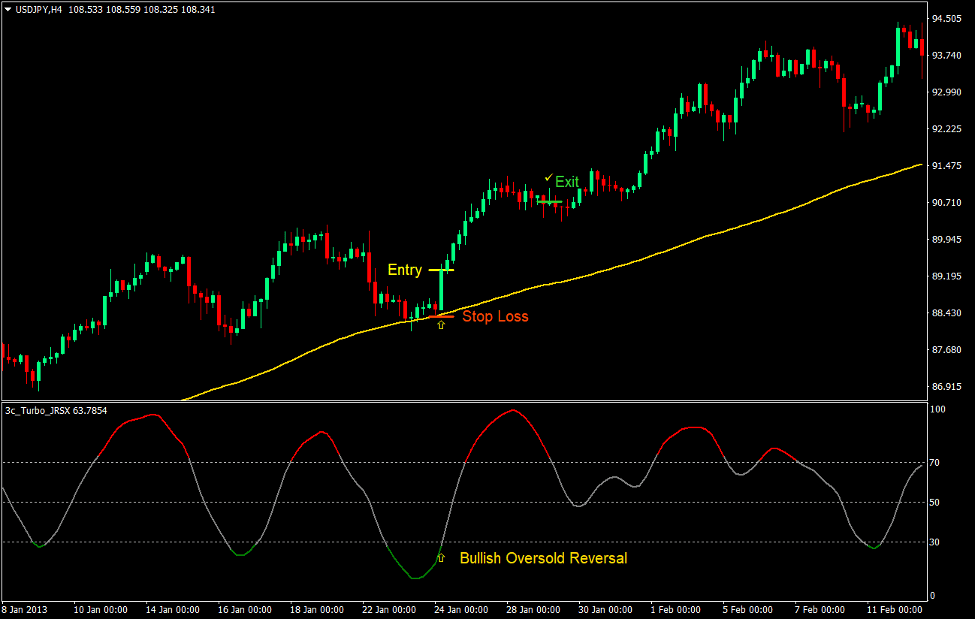

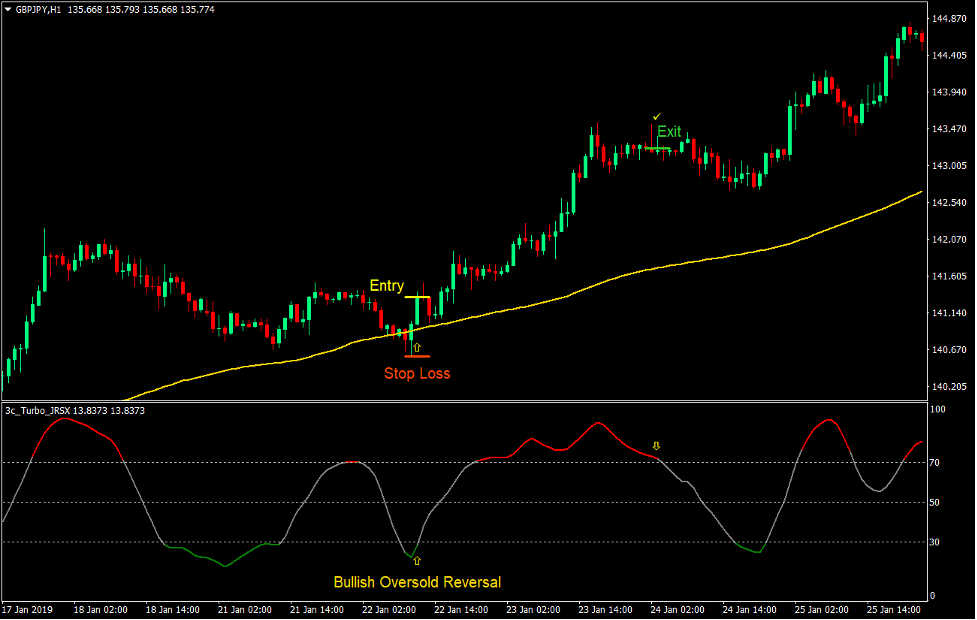

Buy Trade Setup

Entry

- Price should be above the 100 SMA line.

- The 100 SMA line should be sloping up.

- Price should retrace towards the 100 SMA line.

- The 3c Turbo JRSX line should be temporarily oversold.

- Enter a buy order as soon as the 3c Turbo JRSX line changes to grey.

Stop Loss

- Set the stop loss at the fractal below the entry candle.

Exit

- Close the trade as soon as the JRSX line reverses from an overbought condition.

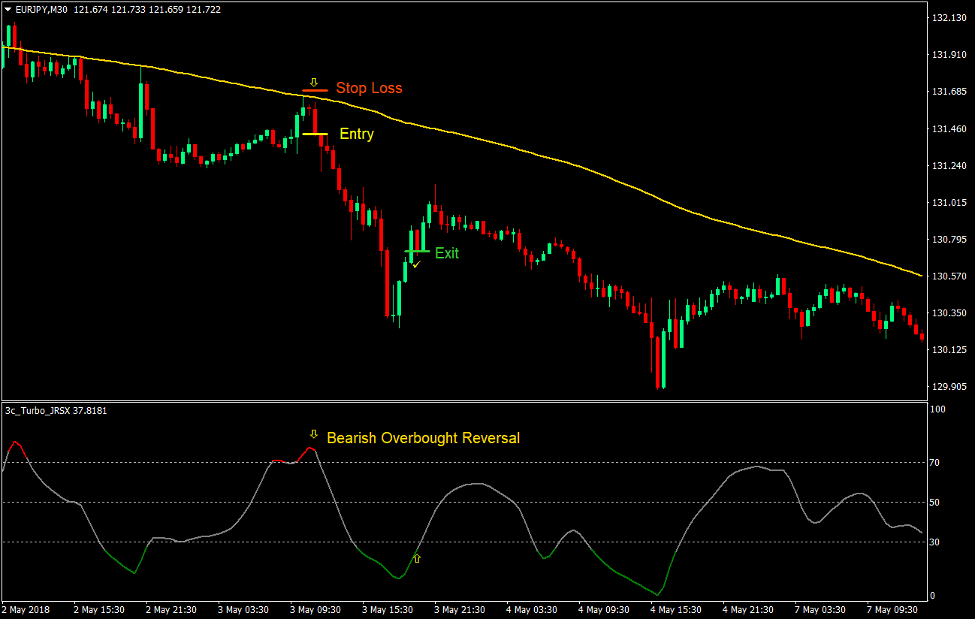

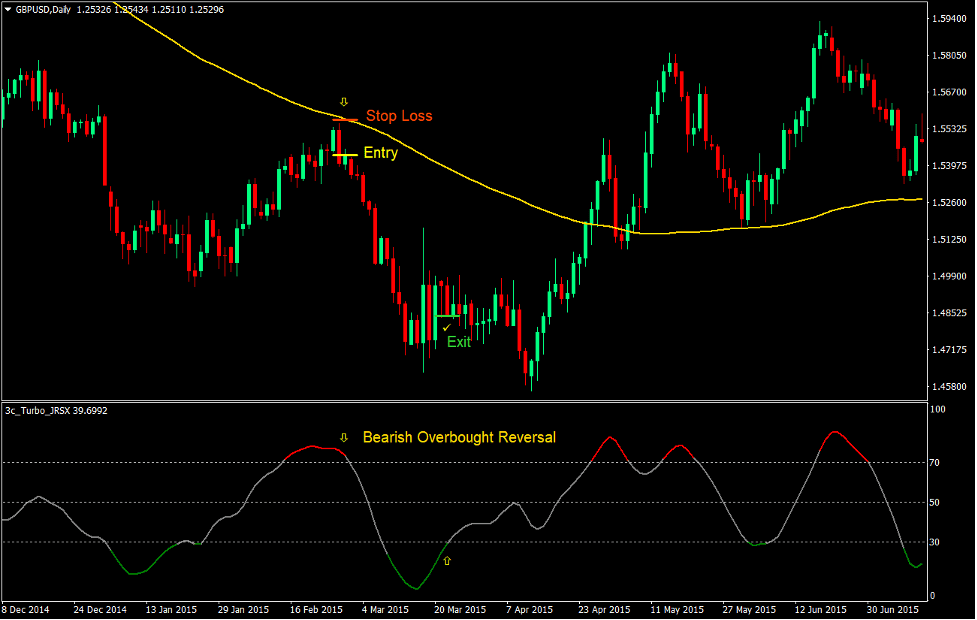

Sell Trade Setup

Entry

- Price should be below the 100 SMA line.

- The 100 SMA line should be sloping down.

- Price should retrace towards the 100 SMA line.

- The 3c Turbo JRSX line should be temporarily overbought.

- Enter a sell order as soon as the 3c Turbo JRSX line changes to grey.

Stop Loss

- Set the stop loss at the fractal above the entry candle.

Exit

- Close the trade as soon as the JRSX line reverses from an oversold condition.

Conclusion

This strategy works very well during trending market conditions.

To trade this strategy effectively, traders should identify the long-term trend. The chart could also be zoomed out in order to identify the trend direction more clearly. Traders could also mark supports and resistances on the higher timeframe to identify if the area being traded at is a good area for a reversal.

As with most strategies, this strategy also requires practice. Once mastered, this strategy could help you earn a fortune.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: