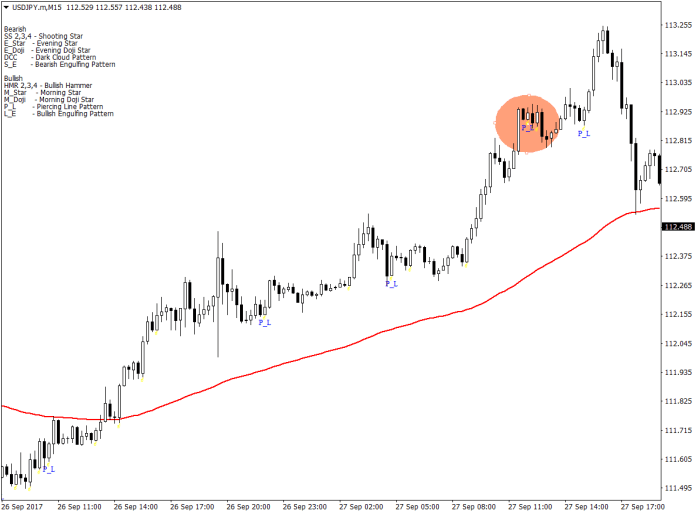

How to Trade the Piercing Line Pattern?

Piercing line patterns are very common in a forex chart. You could see several of this in a chart at a time. And given that the piercing line pattern is an indication that the bulls are ready take over the market, these patterns present opportunities for profitable trades.

So, what is a piercing line pattern? The piercing line pattern is a bullish reversal pattern composed of two candles, a bearish candle followed by a bullish candle. To qualify as a piercing line pattern, the bullish candle must close above at least 50% of the prior bearish candle.

In a sense, the piercing line pattern could be said as the bullish counterpart of the dark cloud cover pattern.

Due to its simplicity, this pattern is very common. For this reason, being selective when trading the piercing line pattern would be a good idea. Combined with other indicators, rules and filters, the piercing line pattern could be a very profitable pattern to trade.

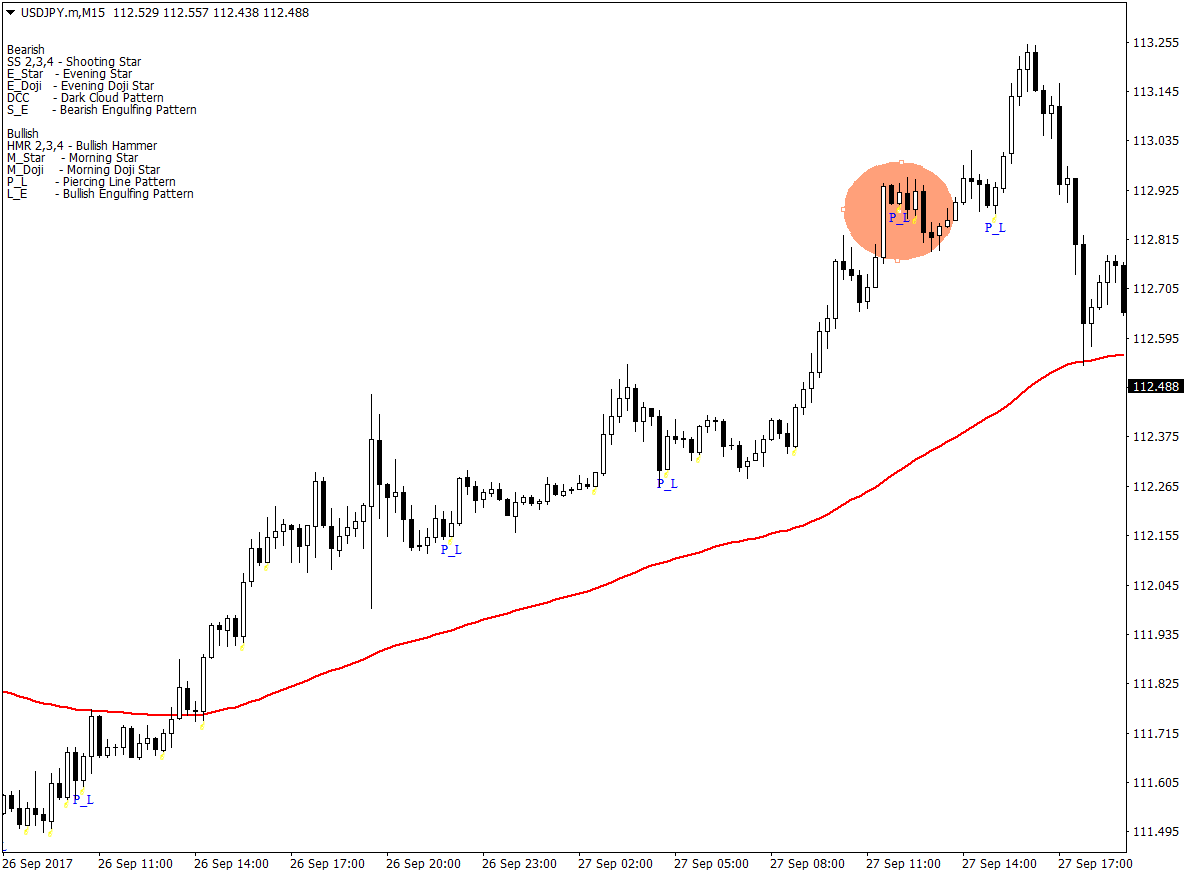

The 100 Exponential Moving Average (EMA) Trend Filter

One of the most important filters that could be applied when trading the piercing line pattern is the trend. Although these patterns also work in a long-term downtrend, trading with the trend would definitely increase the probability of the trade gaining profit.

The 100-exponential moving average (EMA) is an excellent indicator of the market’s intermediate trend. In an uptrend, the 100 EMA tends to slope upward, while on a downtrend the 100 EMA tends to slope downward. Another way to determine the trend using the 100 EMA is with the location of price in relation to the 100 EMA. If price is above the 100 EMA, the market is said to be in an uptrend, while if it is below the 100 EMA, then the market is in a downtrend.

The Entry Rules

For the piercing line pattern to be effective, we will be filtering out setups that goes against the trend.

The rules for entry are as follows:

- Price should be above the 100 EMA

- The 100 EMA should be sloping upwards indicating an uptrend

- The right edge of the 100 EMA shouldn’t be curling downwards

- A valid piercing line pattern could be identified

To make it easier to identify piercing line patterns, we will be using the Candlestick Recognition Master indicator. This indicator conveniently plots P_L whenever a piercing line pattern is detected. The detected piercing line pattern will be our entry candle.

The Stop Loss

For simplicity, we will be putting the stop-loss just a few pips below the pattern.

The Take-Profit

As for the take-profit, we will be using a fixed 2:1 risk-reward ratio. This means that for every pip risked on the stop loss, we should be gaining 2 pips if the take-profit target is hit.

This would allow us to have a positive risk reward ratio, thus allowing us to have an edge against the market, even if our win rate ratio is just around 50%.

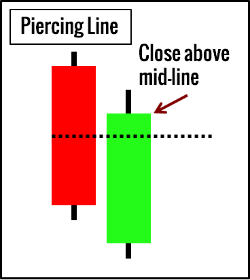

The Trade Setups

As said, several trading opportunities could be found in a day using the piercing line pattern. Below is an example of this occurrence.

These trading opportunities using the piercing line pattern are found in a clear bullish trending chart. The 100 EMA is sloping upwards and price action has been staying above the 100 EMA. Because these rules were ticked, the piercing line patterns on this section of the chart are high probability patterns. If you would also notice, this is a clear uptrend even just by looking at the price action. The formation of the piercing line pattern are merely minor retracements when the bulls are taking a breather.

Because these setups are high probability setups, the take profit targets of 2:1 are easily reached.

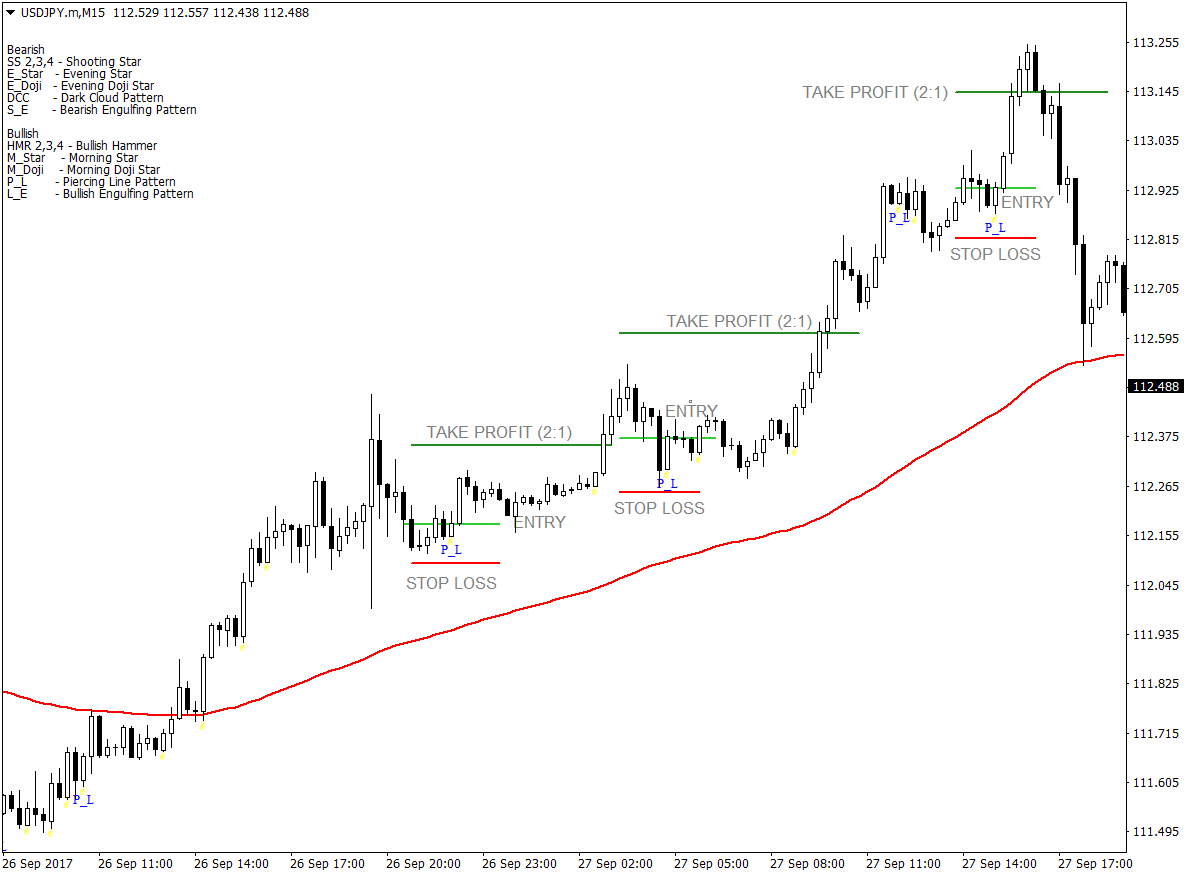

The Failed Setup

Even though the piercing line pattern is a reliable bullish reversal pattern, and even though we have placed a trend filter to go along with our trading rules, there are still instances wherein a setup could fail. Below is an example of one found on the same chart.

This setup is an example of how a piercing line pattern could still fail. Even though price did rally in the long run, price retraced further back more before the rally and stopped-out the trade. Still, there was another opportunity that could have been taken prior to the actual rally.

Conclusion

On this 15-minute chart alone, four opportunities were spotted using the piercing line pattern. Out of the four, three were in profit, and one was stopped out. However, those three successful trades gained 2:1. If our money management strategy is based on a fixed percentage of our trading account, say for example 1% per trade, on this chart alone, in a span of about 1 day, on a single currency, the account could have gained 5%.

This strategy could work as a scalping, day trading, or swing trading strategy. However, if applied as a scalping or day trading strategy, this would have allowed for a quick growth on the account due to the multiple opportunities presented in a day.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: