Swing Reversal Forex Trading Strategy

Chaos! That is what the market looks like when we first see a price chart. While there are times when the market would show order amidst the chaos, often this is not the case. Trending markets, yes, they do have some sort of structure, but the market doesn’t trend for the most part. It usually just chops around, bouncing up and down a range, breaking above resistances for a while, diving below new lows only to come back up again, whatever it may be. Now, on those mundane days, the market usually does this, and it looks chaotic to the untrained eye. But how do we trade in these types of market? How do we put order and predictability to a chaotic market?

Swing Point Support and Resistance

Now, I don’t think this is an official trading term, but the market does have swing points. So, what is a swing point? If you’d observe the market, although price usually just moves up and down erratically, it usually has a direction for several candles. It goes up for several candles, then it goes down for some time, then goes back again, and repeats this unending cycle. As price does this, as it reverses in either direction, it creates highs or lows. These highs and lows are the swing points. It is either a swing high or swing low.

Although the market seems chaotic in any market condition other than a trending market, the market creating swing highs and swing lows is a common theme in any market condition. This is true whether the market is trending, ranging, chopping, reversing, etc.

What is interesting with these swing points is that it is a natural support or resistance. Imagine if you are following a stock price. You know that a particular stock price has been going up for more than a week. Then, suddenly it took a nose dive for a few days. Then, as it starts to pick up again, you notice it rising so you start buying. Then, it reached the point when it is at the same level before it took a nose dive. What would you do? Would you continue buying it or be more cautious? Some would buy thinking it might go up even more, but others would also be more cautious knowing that this was the point where the market thought that price was too expensive. That is why swing highs are natural resistances. Flip it over and you’ve got swing lows as supports.

Trading Strategy Concept

Knowing that swing highs are natural resistances and swing lows are natural supports, we will use this knowledge to observe for possible reversals around these areas.

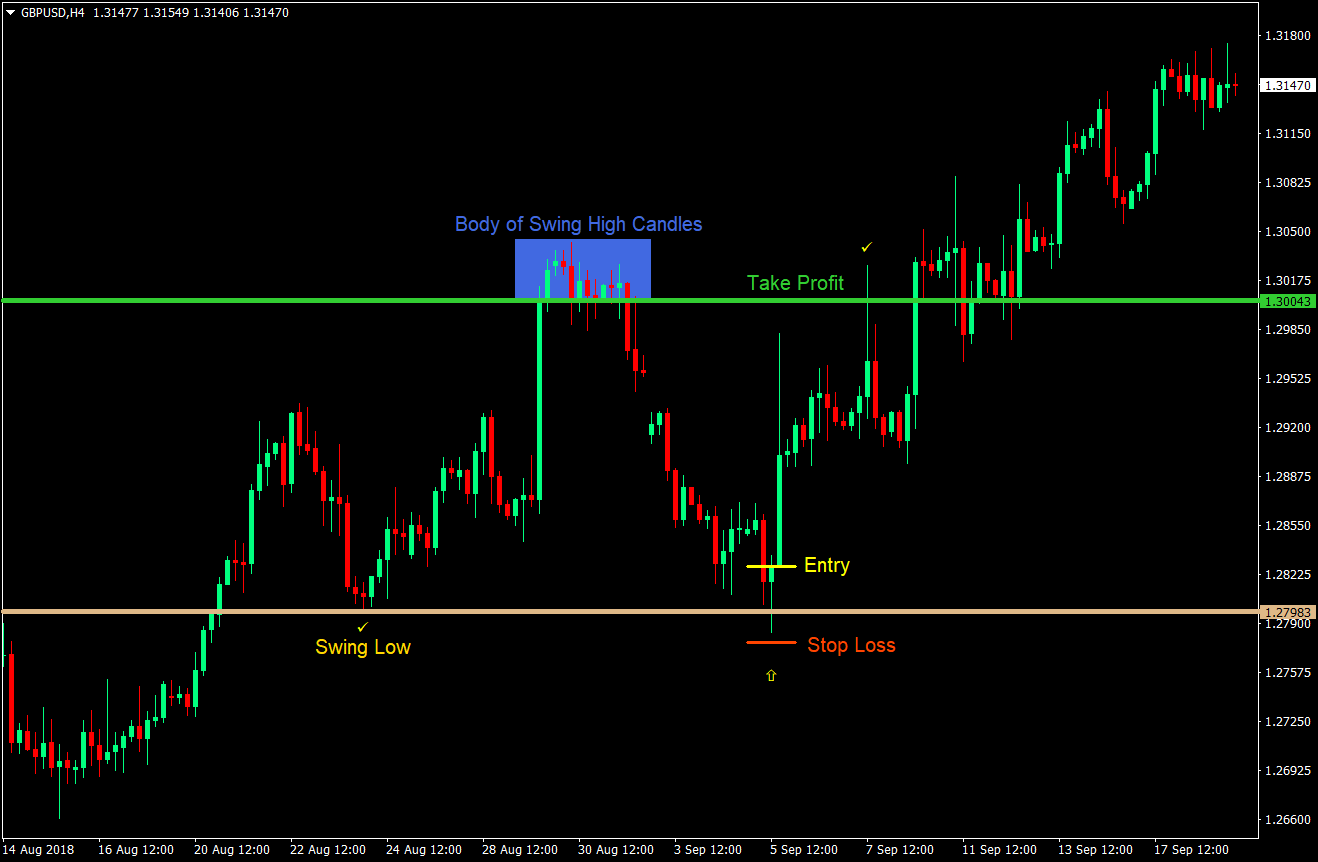

On the 4-hour chart, we will be observing for swing highs and swing lows. Once we observe a prominent swing high or swing low, we mark it with a horizontal line noting it as a resistance or a support. Then we wait for the market to revisit these areas. As price revisits these areas, we will be looking for a scenario where price would poke beyond these horizontal lines, then reverse, all within one candle. This would result to a candle with a long wick on one side touching the line and little to no wick on the side opposite the line.

What this scenario indicates is a rejection or either a support or a resistance. Not only is it a rejection of support or resistance, it all happened within a 4-hour candle. This means price reversed intraday. Many day and swing traders who were looking for a breakout of the previous swing high or low would be trapped in a losing trade and could soon have their stop losses hit. As soon as the stop losses are hit, this would trigger price to quickly reverse. If you would notice the examples to be shown below, most of the trade setups have a big candle right after the pin bar candle. This is because of the immediate rally after the failed breakout.

Indicators: none

Currency Pair: any

Timeframe: preferably 4-hour charts

Trading Session: any

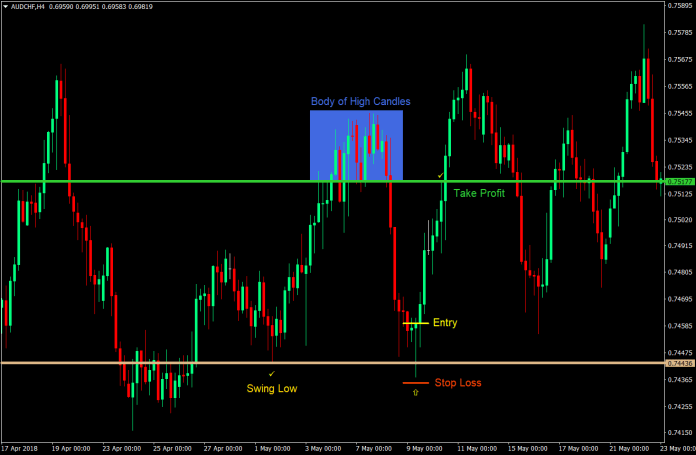

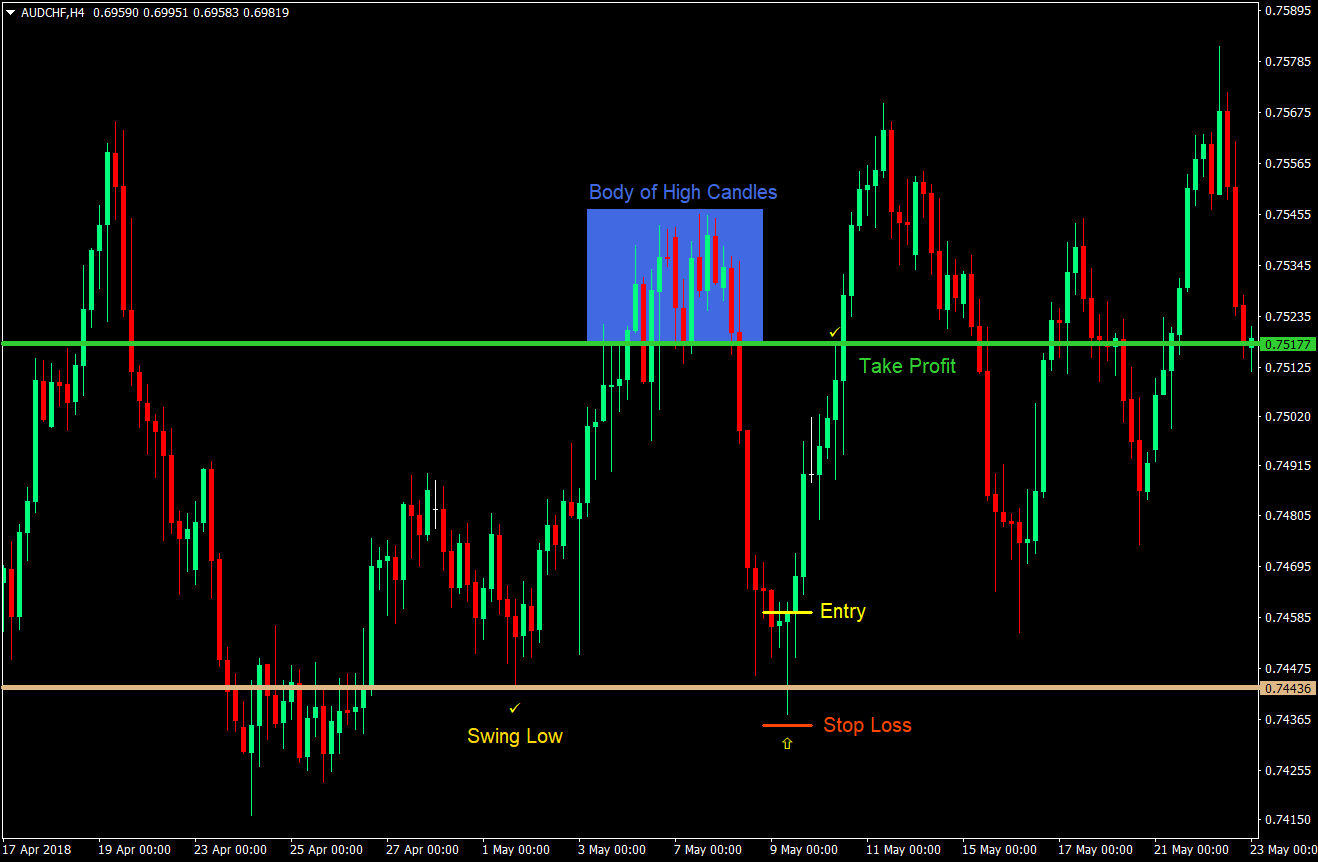

Buy (Long) Trade Setup

Entry

- Note the last prominent swing low

- Wait for price to revisit the swing low

- Wait for price to poke below the swing low and close back above it forming a bullish pin bar candle

- Enter a buy order at the close of the candle

Stop Loss

- Set the stop loss a little below the low of the entry candle

Take Profit

- Note the last swing high and observe the body of the candles on the last swing high

- Set the take profit target at the body of those candles

- Employ a trailing stop loss in case price doesn’t reach the last swing high area

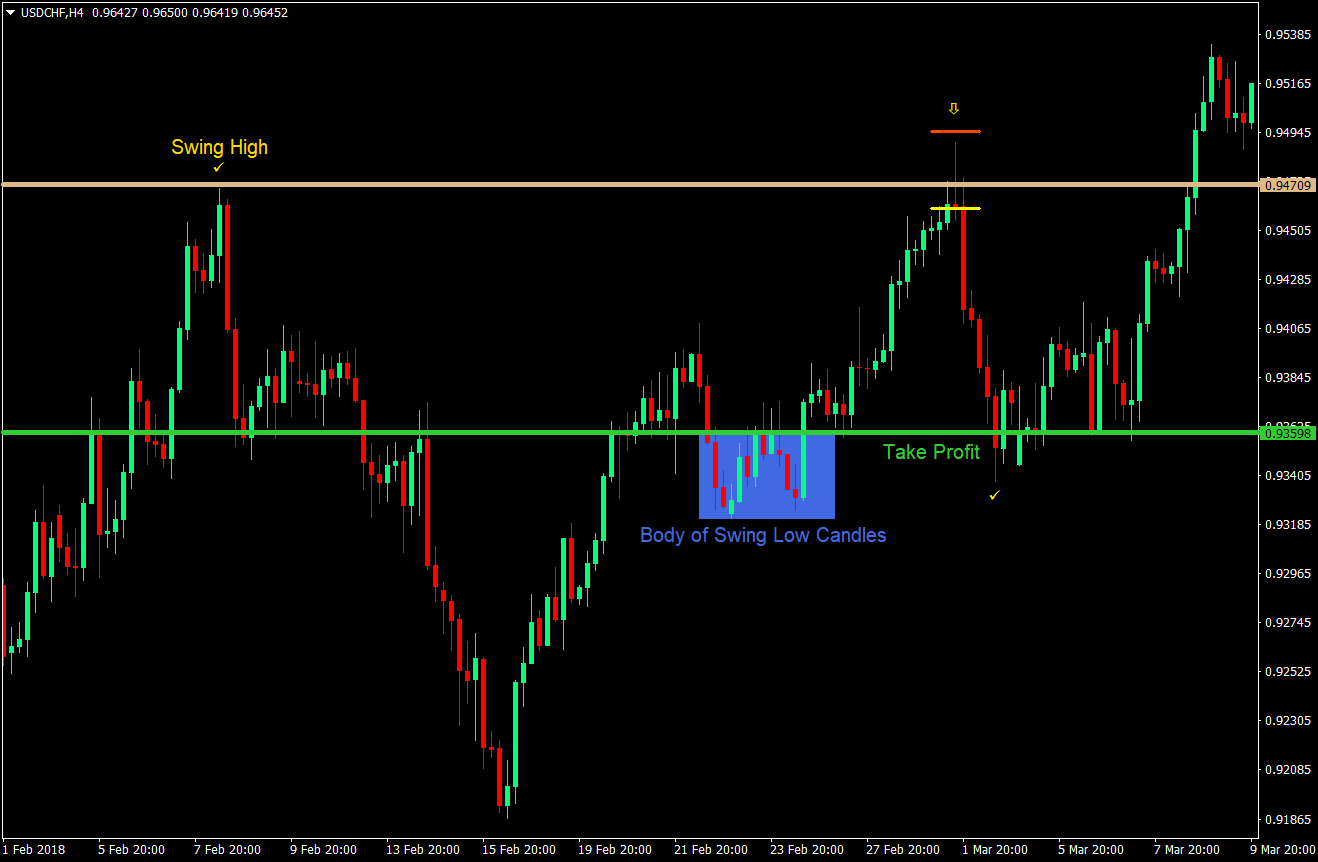

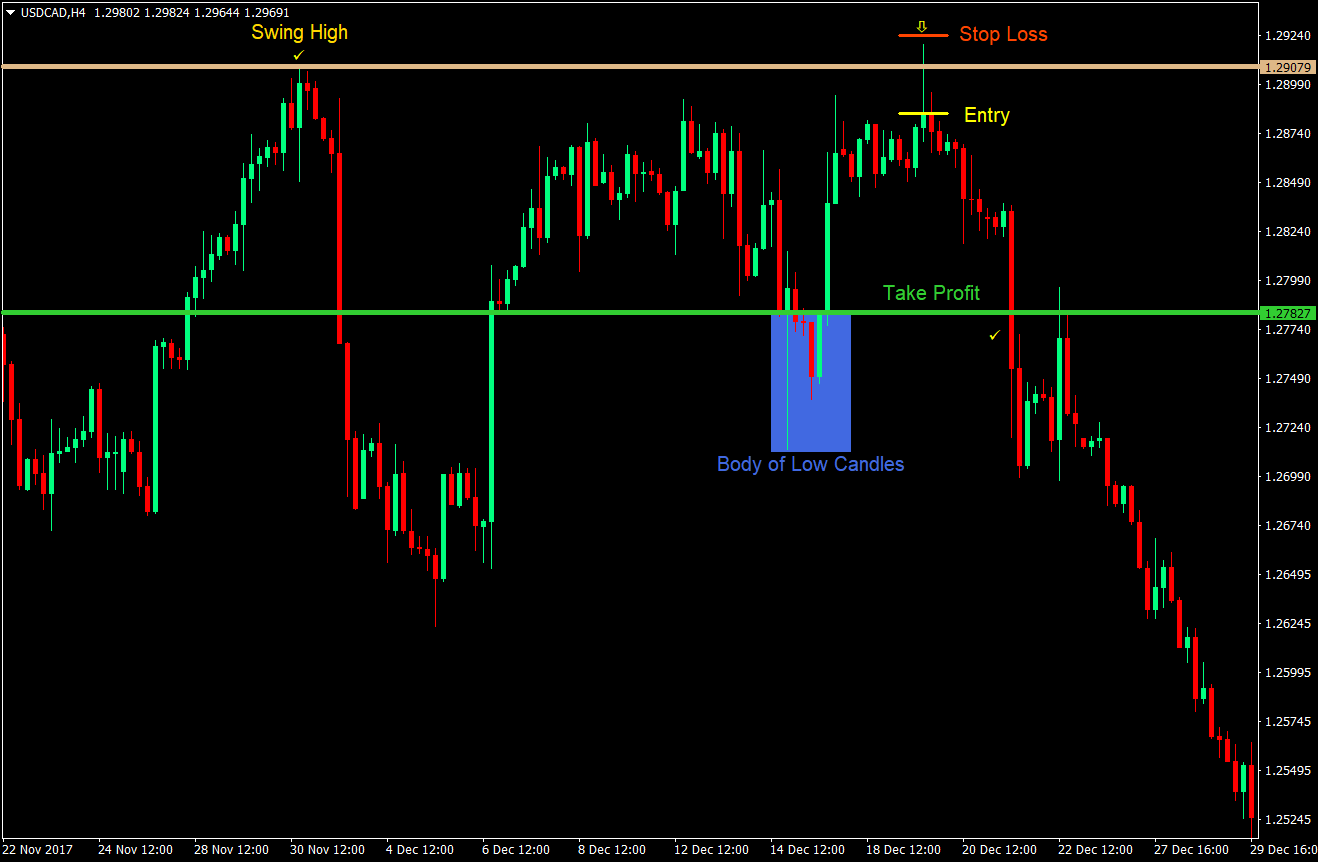

Sell (Short) Trade Setup

Entry

- Note the last prominent swing high

- Wait for price to revisit the swing high

- Wait for price to poke above the swing high and close back below it forming a bearish pin bar candle

- Enter a sell order at the close of the candle

Stop Loss

- Set the stop loss a little above the high of the entry candle

Take Profit

- Note the last swing low and observe the body of the candles on the last swing low

- Set the take profit target at the body of those candles

- Employ a trailing stop loss in case price doesn’t reach the last swing low area

Conclusion

The beauty of this strategy is that you wouldn’t have to look for or wait for the market to trend. In fact, you could start observing the swing highs and lows on any market condition and wait for the setup to occur. On trending market conditions, this setup could occur as a start of a ranging market condition or a flag setup on the higher timeframe. On ranging market conditions, this is a natural reversal strategy that trades on the supports and resistances. This could also be traded on choppy environments, only that be a little conservative on setting take profit targets and aggressive on trailing stop losses because price might not quite reach, poke or break the swing high or low.

You might also observe that there are cases where price could break beyond the swing high or low and start to rally. If you would like to take advantage of these long term trades, you may opt to leave a portion of the position and let price run.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: