There are several ways to trade the forex markets. There are momentum and breakout strategies, trend reversal strategies, trend-following strategies, mean reversals, supply and demand, pattern trading strategies, and more. Most traders would use strategies that fall in one of these categories. Seasoned traders on the other hand combine two or more of these different types of strategies into one trading system. Some may be doing a trend-following strategy on a higher timeframe while taking trend-reversals on the lower timeframe. Some may be trading trend reversal strategies with a confluence of a pattern trading strategy. Different traders use different approaches. The key is in finding confluences with different rationale behind the trade and combining it in one setup. However, most of these strategies become too complicated for new traders.

Super Trend Retracement Forex Trading Strategy is a strategy that is a combination of a trend-following strategy and a mean reversal strategy. This type of strategy is unique because it combines two opposite types of strategies. Trend-following strategies trade based on the flow of the market, while mean reversals often trade against the flow of the short-term momentum. Having both strategies combined into one provide traders a higher probability trade setup.

The beauty of this strategy is that it remains simple despite having to combine two different concepts. It uses only two technical indicators. However, these two technical indicators work synergistically to produce high probability trade setups.

Super Trend Indicator

Super Trend indicator is a trend-following technical indicator. It helps traders identify trend reversals and trend direction.

This indicator is based on the Average True Range (ATR). Many traders believe that the ATR can be used to identify trend direction. The concept behind this idea is that if price reverses its current trend direction by more than three times the current ATR, then the trend is considered to have reversed.

The Super Trend indicator simplifies this concept by plotting a line on the price chart based on the trend. If the market is in an uptrend, the line would be plotted below price. If the market is in a downtrend, then the line would be plotted above price. The indicator then shifts the line to indicate a trend reversal whenever price breaches and closes beyond the Super Trend line.

This indicator could be used to identify trend reversals as an entry signal. Traders simply take the shifting of the Super Trend line as a trend reversal entry signal.

It could also be used as a trend filter indicator. Traders could use a different short-term momentum indicator as an entry signal, while filtering trades that are going against the trend using the Super Trend indicator.

Stochastic Cross Alert

The Stochastic Oscillator is a widely used technical indicator. It is an oscillator that could help identify short-term momentum or trend direction, short-term trend reversals, and overbought or oversold market conditions.

The classic Stochastic Oscillator plots two lines that oscillate within the range of 0 to 100. It also has a marker at 20 and 80. Bullish crossovers occurring below 20 are considered high probability oversold mean reversal signals, while bearish crossovers occurring above 80 are considered high probability overbought mean reversal signals.

The Stochastic Cross Alert indicator simplifies and streamlines this process. Instead of having to look at the usual Stochastic Oscillator, this indicator plots an arrow to indicate high probability mean reversal signals. Traders could use these arrows as a short-term trend reversal signal coming from an overbought or oversold market condition.

Trading Strategy

This trading strategy combines the trend-following characteristics of the Super Trend indicator and the mean reversal signals coming from the Stochastic Cross Alert indicator.

The Super Trend indicator is mainly used as a trend filter. Signals that are going against the trend as indicated by the Super Trend indicator line will be filtered out as these signals are considered low probability.

The Stochastic Cross Alert indicator will be used as the main entry trigger. Even on a trending market, price would still have to retrace. If the retracements are deep enough, the Stochastic Oscillator would register an overbought or oversold reading. As the market reverses from these overbought or oversold conditions, the Stochastic Cross Alert indicator would plot an arrow pointing the direction of the main trend. These arrows would be taken as an entry signal for this strategy.

Indicators:

- SuperTrend (default setting)

- Stochastic_Cross_Alert (default setting)

Preferred Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

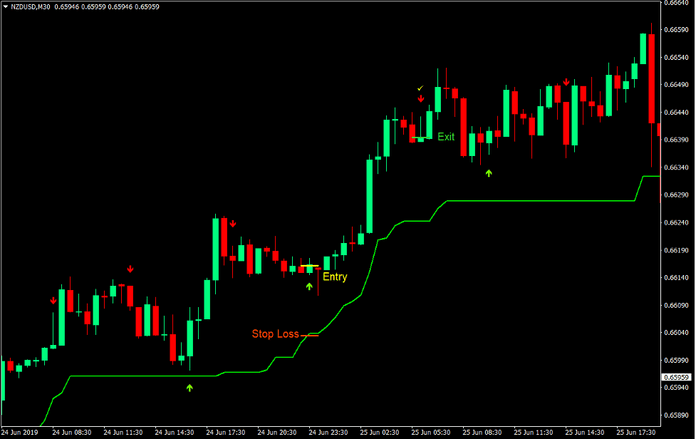

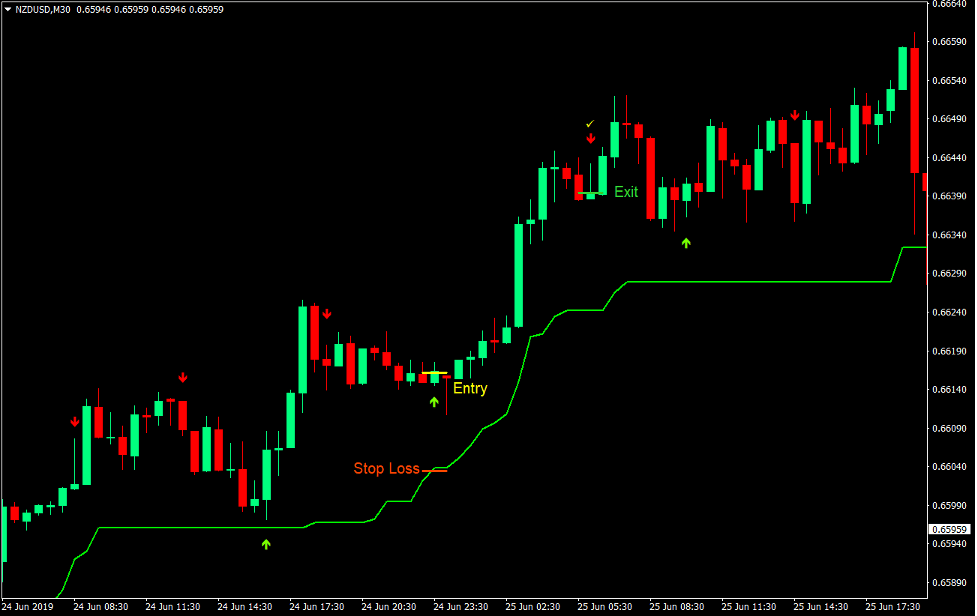

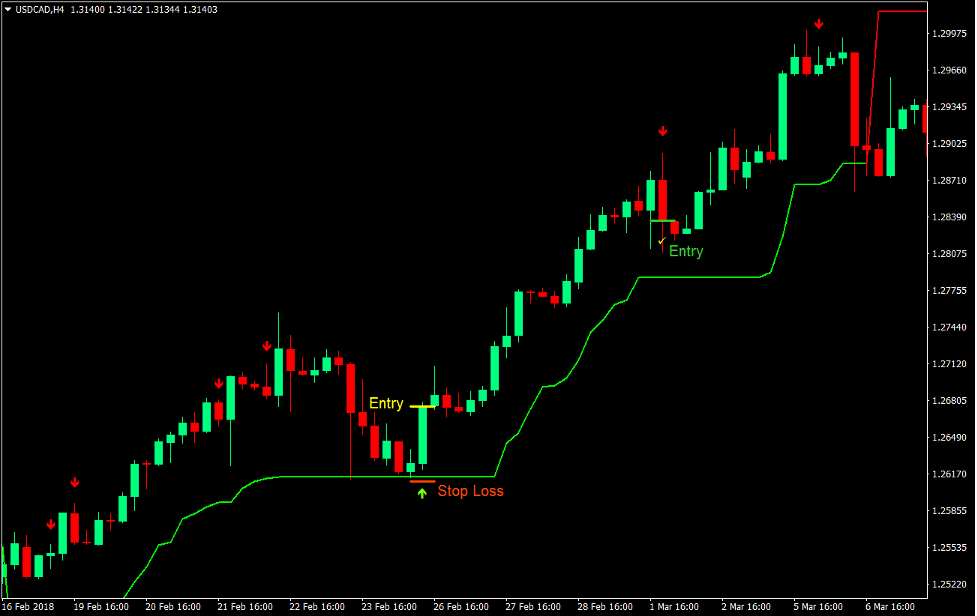

Buy Trade Setup

Entry

- Price should be above the lime Super Trend line.

- Price action should be trending up and should be plotting higher swing highs and swing lows.

- Price should retrace towards the lime Super Trend line.

- The Stochastic Cross Alert indicator should plot an arrow pointing up.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the Super Trend indicator line.

- Trail the stop loss as the Super Trend line adjusts higher.

Exit

- Close the trade as soon as the Stochastic Cross Alert indicator plots an arrow pointing down.

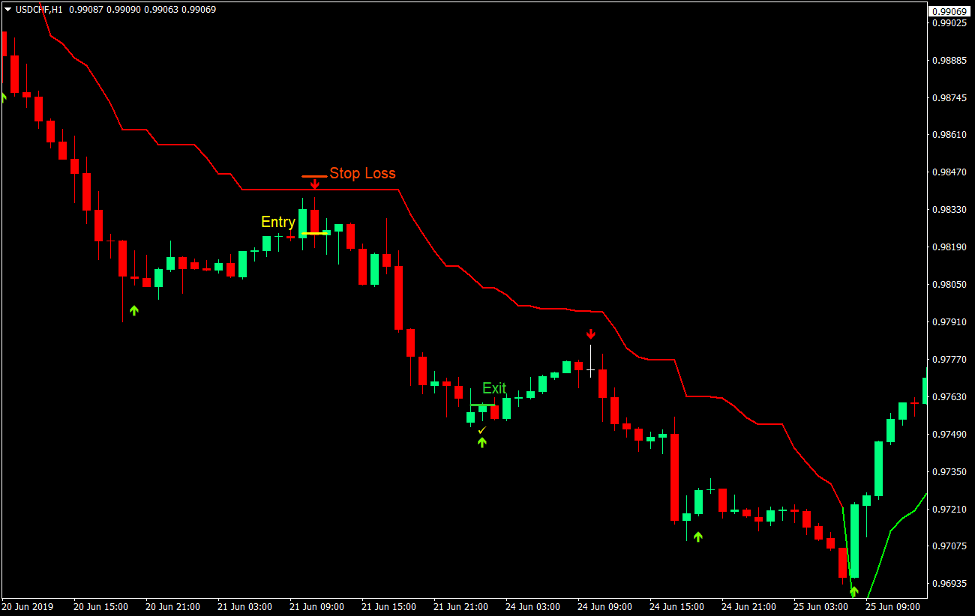

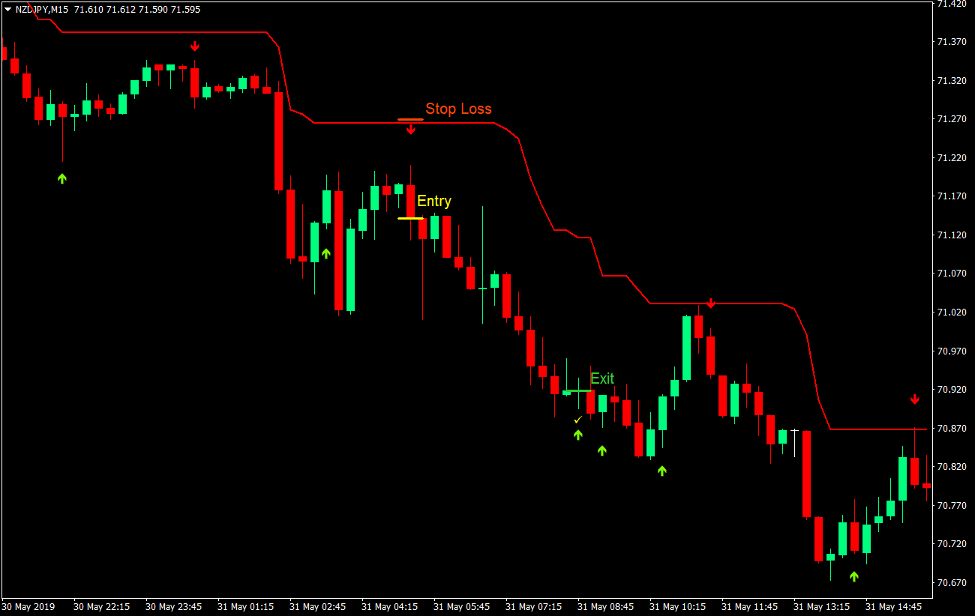

Sell Trade Setup

Entry

- Price should be below the red Super Trend line.

- Price action should be trending down and should be plotting lower swing highs and swing lows.

- Price should retrace towards the red Super Trend line.

- The Stochastic Cross Alert indicator should plot an arrow pointing down.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the Super Trend indicator line.

- Trail the stop loss as the Super Trend line adjusts lower.

Exit

- Close the trade as soon as the Stochastic Cross Alert indicator plots an arrow pointing up.

Conclusion

This strategy is a high probability trading strategy that works well in trending market conditions. It is best used in a market that is trending with regular swing highs and swing lows. If the market trend has a strong momentum, price would tend to continue without retracing deep enough. In these cases, there will be less trade signals.

In the right market condition, this strategy could produce three to five signals in a single trend. Sometimes even more. The key is in waiting for the right market condition and trading the strategy accordingly.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: