“Let your winners run!” You would often hear this from seasoned trend-based traders and there is a reason for that. Trend trading is profitable often because of the high reward-risk ratio that trend trading strategies bring. Closing trades too early undermines a trader’s ability to squeeze every last pip out of a trade.

Before, we get into how to let our winning trades run, let us first discuss the general idea how trend traders would try to get a higher probability trade. Often, traders don’t just take trades on every twist and turn of the market. They would usually try to align their trade direction with a bigger picture trend. One of the most common method is by using a multi-timeframe analysis. They would often go a timeframe or two higher than where they are trading at and assess where the bigger picture trend is going. Then they would take trades using the bigger picture trend. However, this is not the only way to look at the bigger picture trend. Another way to do it is to use a long-term moving average and base the trend direction on it. It is easier to do and allows traders to look at the bigger picture even on one timeframe.

Then, as trend traders catch a trending wave, they would often have a method of exiting the trade based on an exit strategy that allows them to identify when the trend is showing signs of cooling down. Trend traders don’t just use instinct to get out of a trade. The more objective the decision-making is, the better.

Smooth Trend Forex Trading Strategy is about catching high probability trades based on the bigger picture trend and letting profitable trades run.

The Heiken-Ashi Smoothed Indicator

The Heiken-Ashi candlesticks is a variation of candlesticks that is based on the average price. As the average price rises and falls, the candlestick changes color. This allows traders to objectively see where the trend has changed.

The Heiken-Ashi Smoothed indicator however is quite different. Unlike its cousin, this indicator is not a candlestick. It is far from being a candlestick. Instead, it resembles more closely the movement of moving averages. However, instead of printing lines, it prints candlesticks that changes colors whenever the trajectory of the indicator changes.

Comparing the two Heiken-Ashis, the candlestick version does seem to work on very short trend changes. The moving average version or the “smoothed” version however, does seem to work better when determining intermediate term trends, which allows traders to stay longer in a trade.

The Fisher Indicator

The Fisher custom indicator is an oscillating indicator that prints histograms. It is an unbounded indicator meaning it is free to move on an infinite price range as price moves up and down.

This indicator seems to work well on determining the intermediate-term trend. The advantage is that it somehow responds a tad quicker than most indicators.

Trading Strategy Concept

The first element in this strategy is the 200 Exponential Moving Average (EMA). This moving average is typically used to determine the long-term trend. This is typically done by determining the location of price in relation to the 200 EMA. If price is above the 200 EMA, then the long-term trend is said to be bullish. If price is below it, then the long-term trend is considered bearish.

Then, we will be looking at the Fisher custom indicator as our initial intermediate-term filter. The direction of the Fisher indicator should be in line with the 200 EMA. If the 200 EMA is bullish then the Fisher indicator should also be bullish. If the 200 EMA is bearish, then the Fisher indicator should also be bearish.

Then, as for our entry trigger, we will be waiting for the Heiken Ashi Smoothed indicator to reverse and agree with the 200 EMA and the Fisher indicator. If these three indicators are agreeing with each other, then we take the trade.

The exit will be based on the Fisher indicator. This is because the Fisher indicator provides signals a tad earlier than the Heiken Ashi Smoothed indicator. This would allow us to exit the trade earlier and keep much of the profits.

Indicators:

- Heiken_Ashi_Smoothed

- 200 EMA (gold)

- Fisher

Timeframe: 5-min, 15-min, 30-min, 1-hour, 4-hour and daily charts

Currency Pair: any major and minor pair plus some crosses with enough volatility

Trading Session:

- 5-min and 15-min charts: London and New York Session

- 30-min and above: any

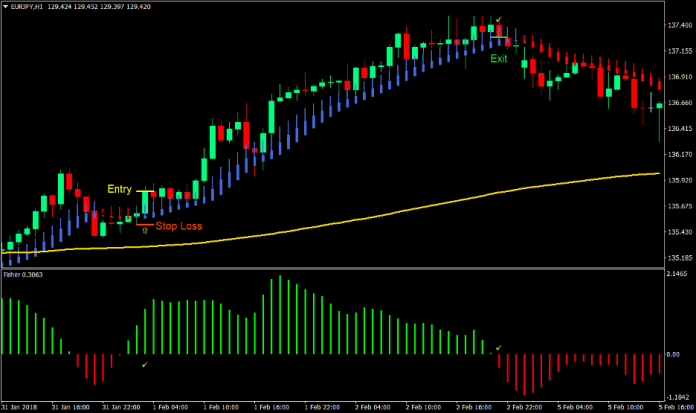

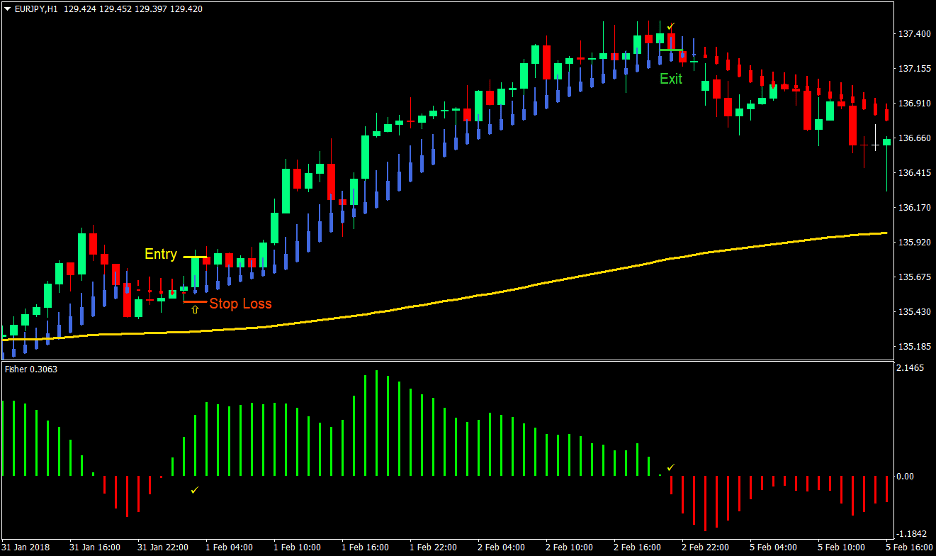

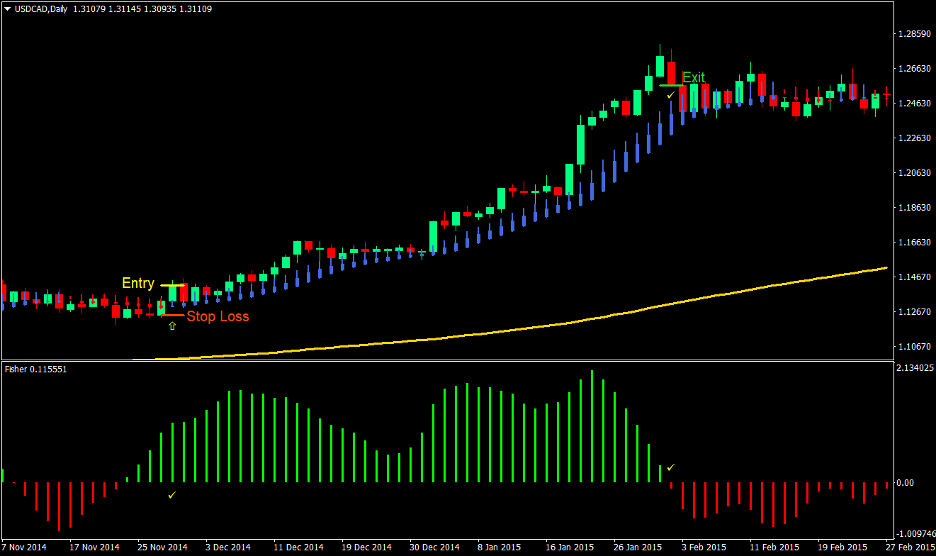

Buy (Long) Trade Setup

Entry

- Price should be above the 200 EMA

- The Fisher indicator should print lime histograms indicating a bullish trend

- Enter a buy order as soon as the Heiken Ashi Smoothed indicator prints a royal blue candle indicating the confirmation of the bullish trend

Stop Loss

- Set the stop loss a little below the Heiken Ashi Smoothed candles

Exit

- Close the trade as soon as the Fisher indicator prints a red histogram indicating the probable end of the bullish trend

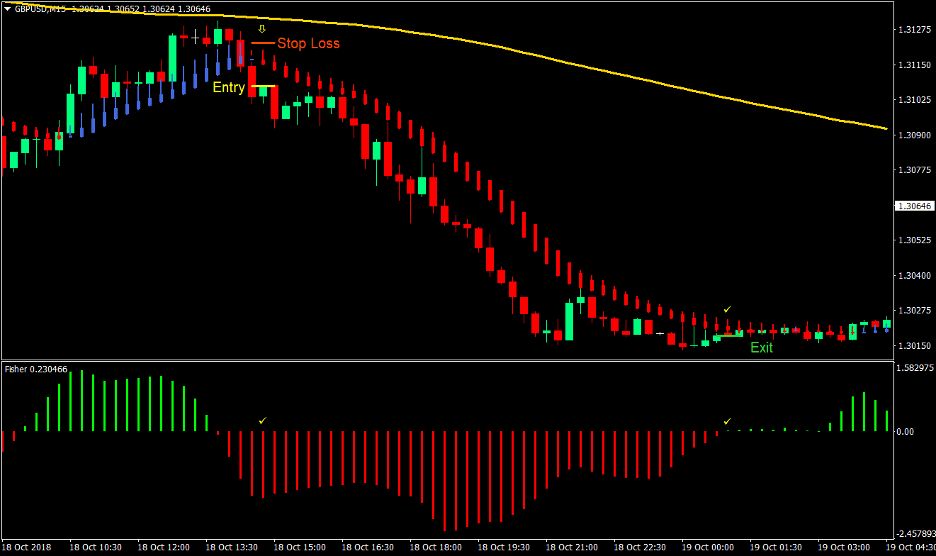

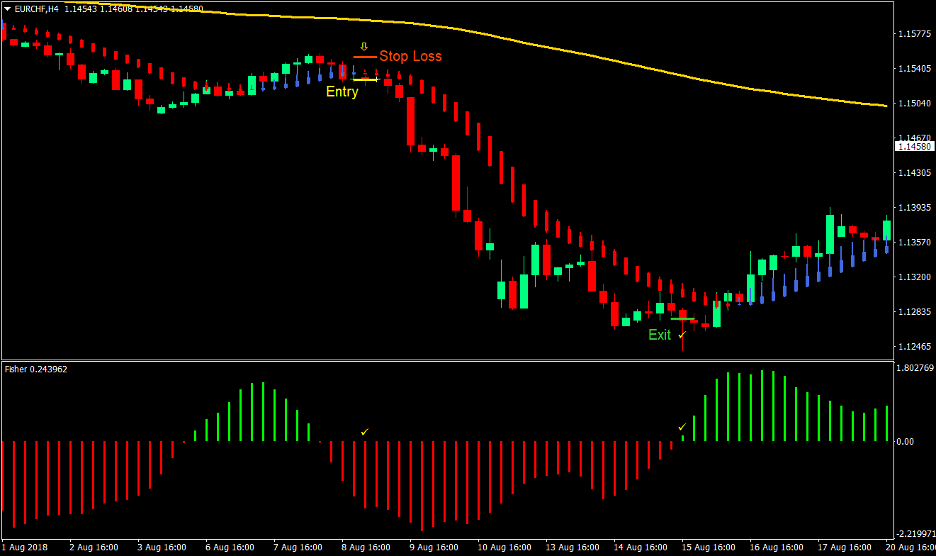

Sell (Short) Trade Setup

Entry

- Price should be below the 200 EMA

- The Fisher indicator should print red histograms indicating a bearish trend

- Enter a sell order as soon as the Heiken Ashi Smoothed indicator prints a red candle indicating the confirmation of the bearish trend

Stop Loss

- Set the stop loss a little above the Heiken Ashi Smoothed candles

Exit

- Close the trade as soon as the Fisher indicator prints a lime histogram indicating the probable end of the bearish trend

Conclusion

The Heiken Ashi Smoothed indicator is probably one of the most accurate intermediate term trend indicators. This indicator just seems to work well in determining when the trend has changed. However, taking trades on every turn it makes might not have a high probability. This is because although it works well in determining the intermediate trend, if it is going against the long-term trend, it still wouldn’t have as high a probability as compared to if it going with the long-term trend. Logic would tell us that the long-term trend would be more powerful than a shorter-term trend. By aligning the long-term trend with the Heiken Ashi Smoothed indicator, we get to have a higher probability on our trades. Add to it the advantage of exiting a profitable trade as the intermediate trend starts to reverse using the Fisher indicator, we get to squeeze out much of the profit from a winning trade.

The key to this strategy is having a high reward-risk ratio. Sure, there will be some losing trades but the winning trades should cover for the losses plus much more.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: