Simplified Fibonacci Trading Strategy and Tools You Need

Fibonacci!!! Sounds like pizza or pasta? Nah! But the profits you could get coz of it is certainly tastier than any Italian resto could offer. Why? Because, if you’d use it wisely, it brings in the dough. Many professional traders were able to make lots of money, buy sports cars, and live the high life all because of it. Heck, I even know of one who has a BMW, Ferrari, and Porsche because of it. He made lots of money, he tattooed the Fibonacci numbers on his knuckles.

So, let me tell you a very simple way to use it! One word…RETRACEMENTS. Retracements are the slight reversals of a market. It is the temporary cheapening of price in an uptrend, or the temporary increase of price in a downtrend.

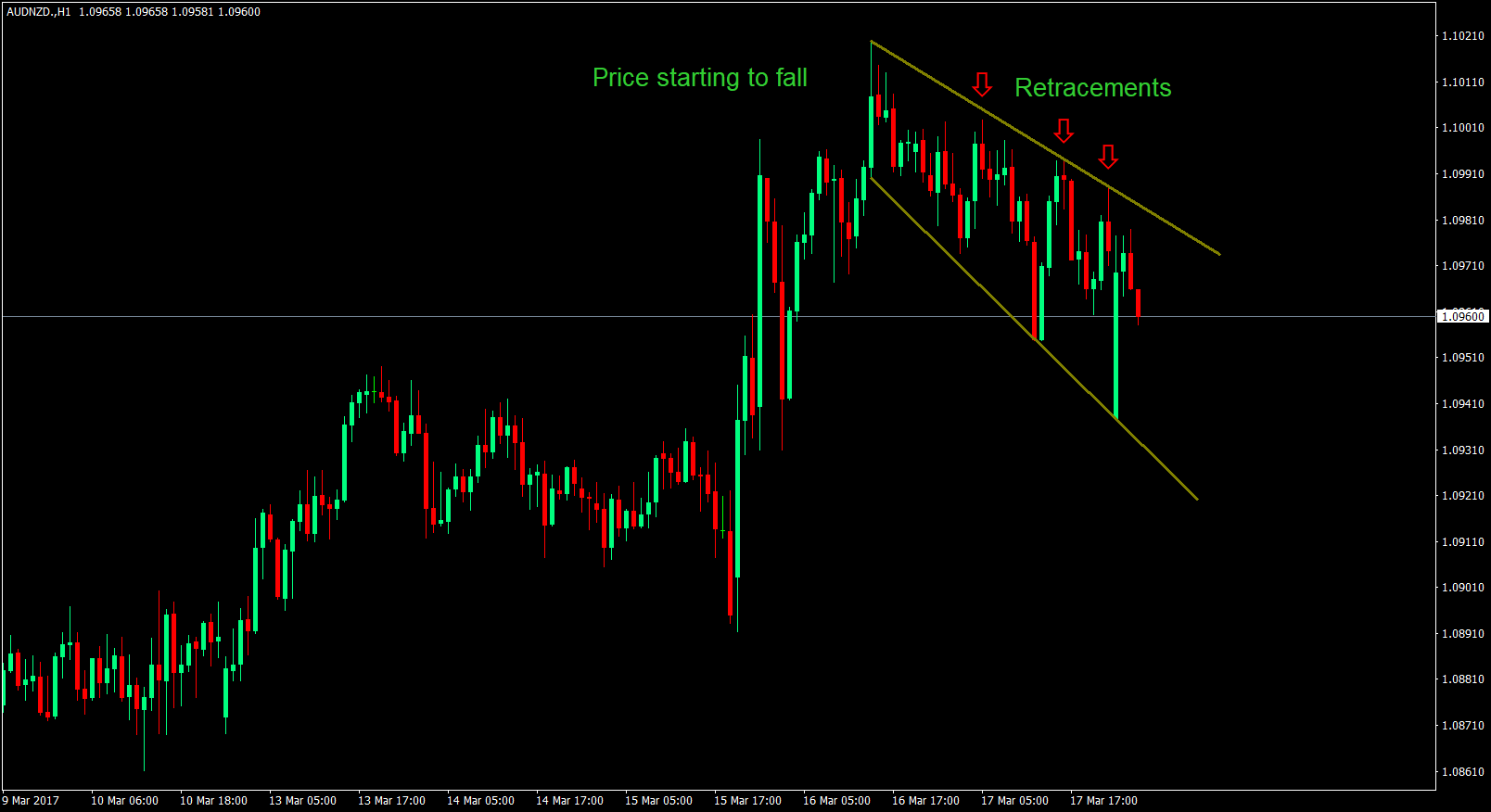

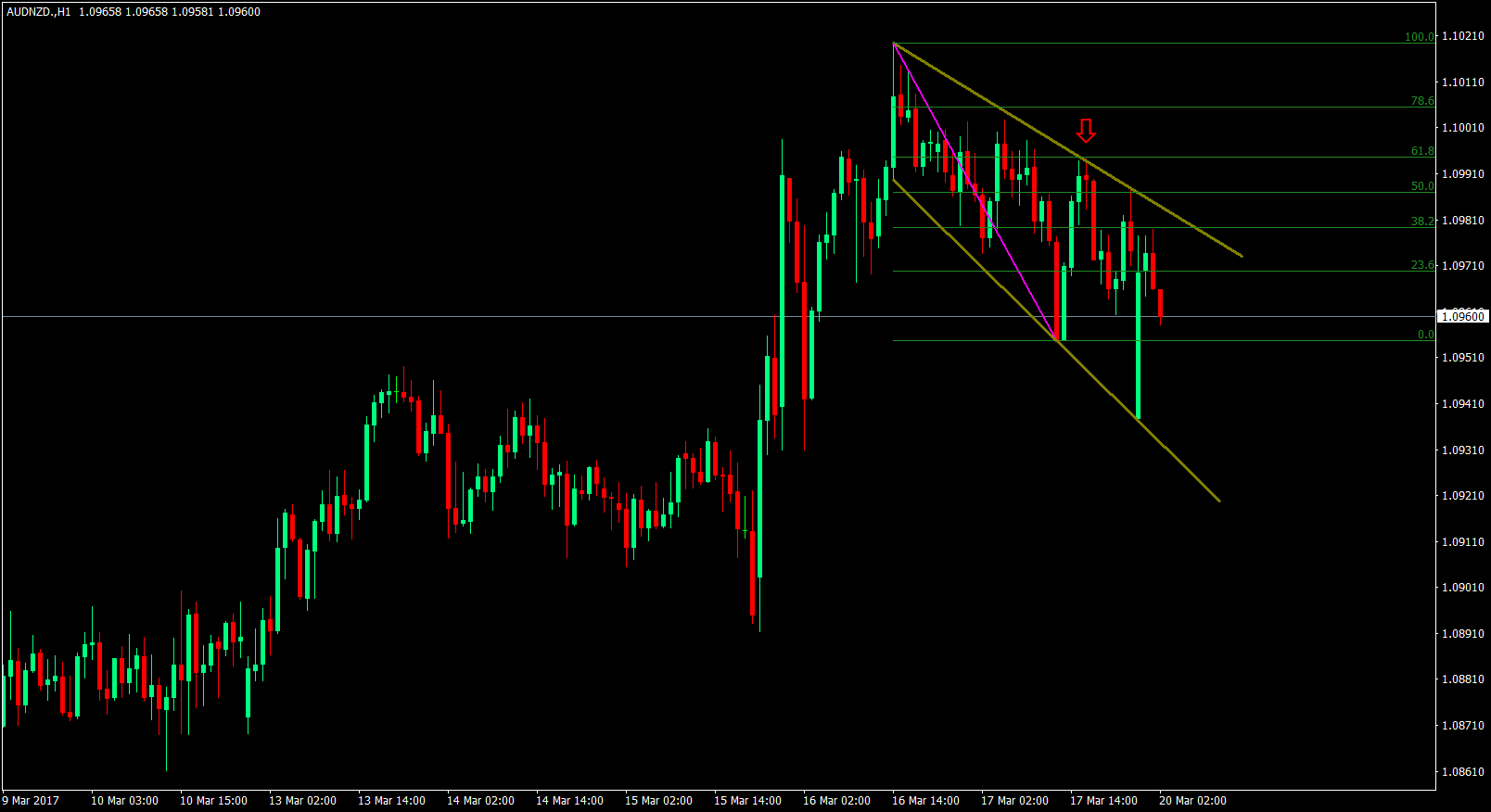

Let me show you an example of retracements in a downtrend…

Here you would see price starting to drop. However, on its way down, price has been retracing back up before continuing down. Why? Because those who sold the pair are now cashing-in thus the retracements.

Hmmm, if we could just pin point where the retracements would stop before it continues back down, we would be rich, right? Well, you’re right, that is why that guy could buy his sports cars. But how will we know? Yes! You guessed it right… Fibonacci Retracements.

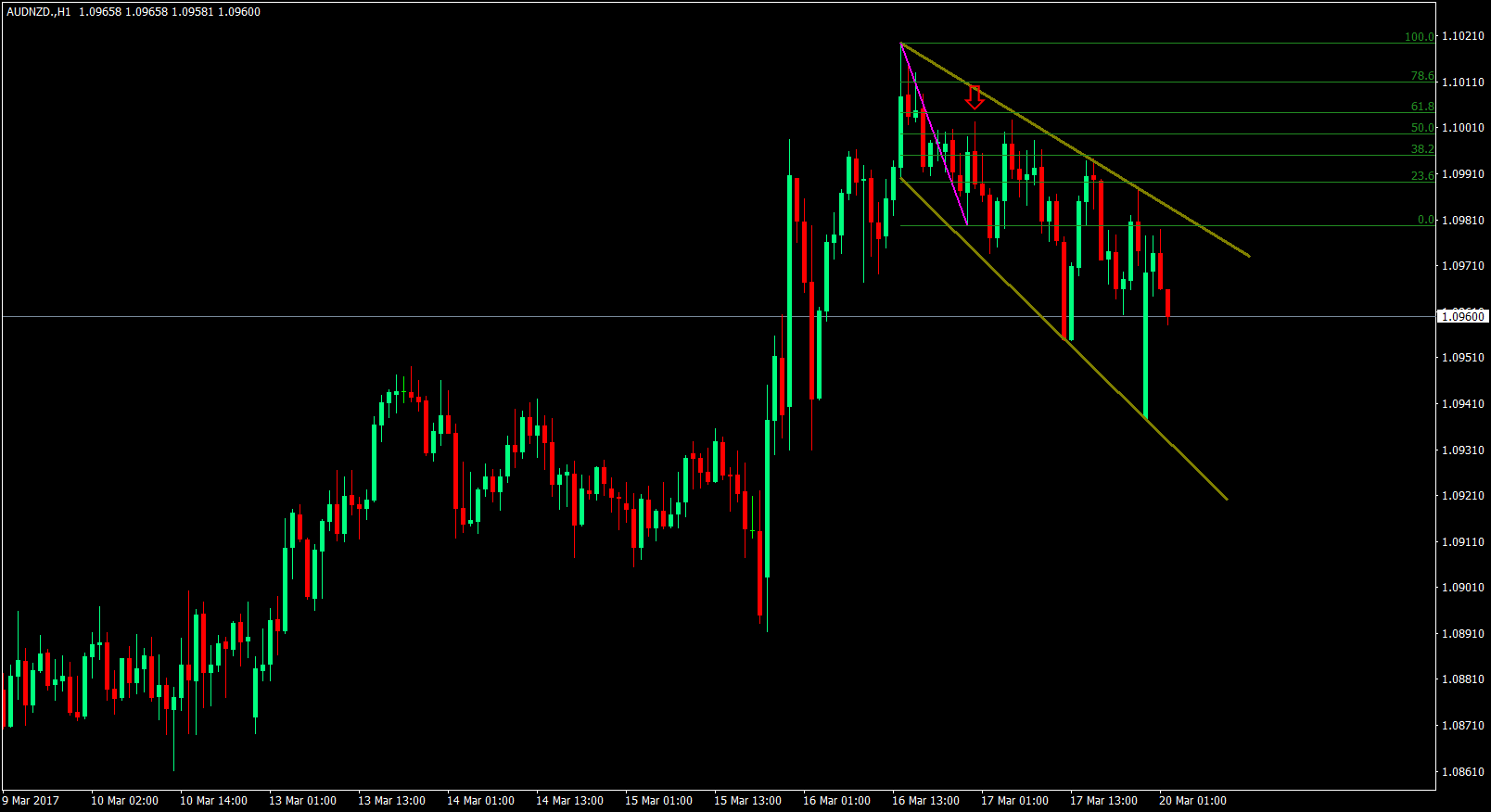

Exhibit 1… price retracing to 50% fib before continuing down.

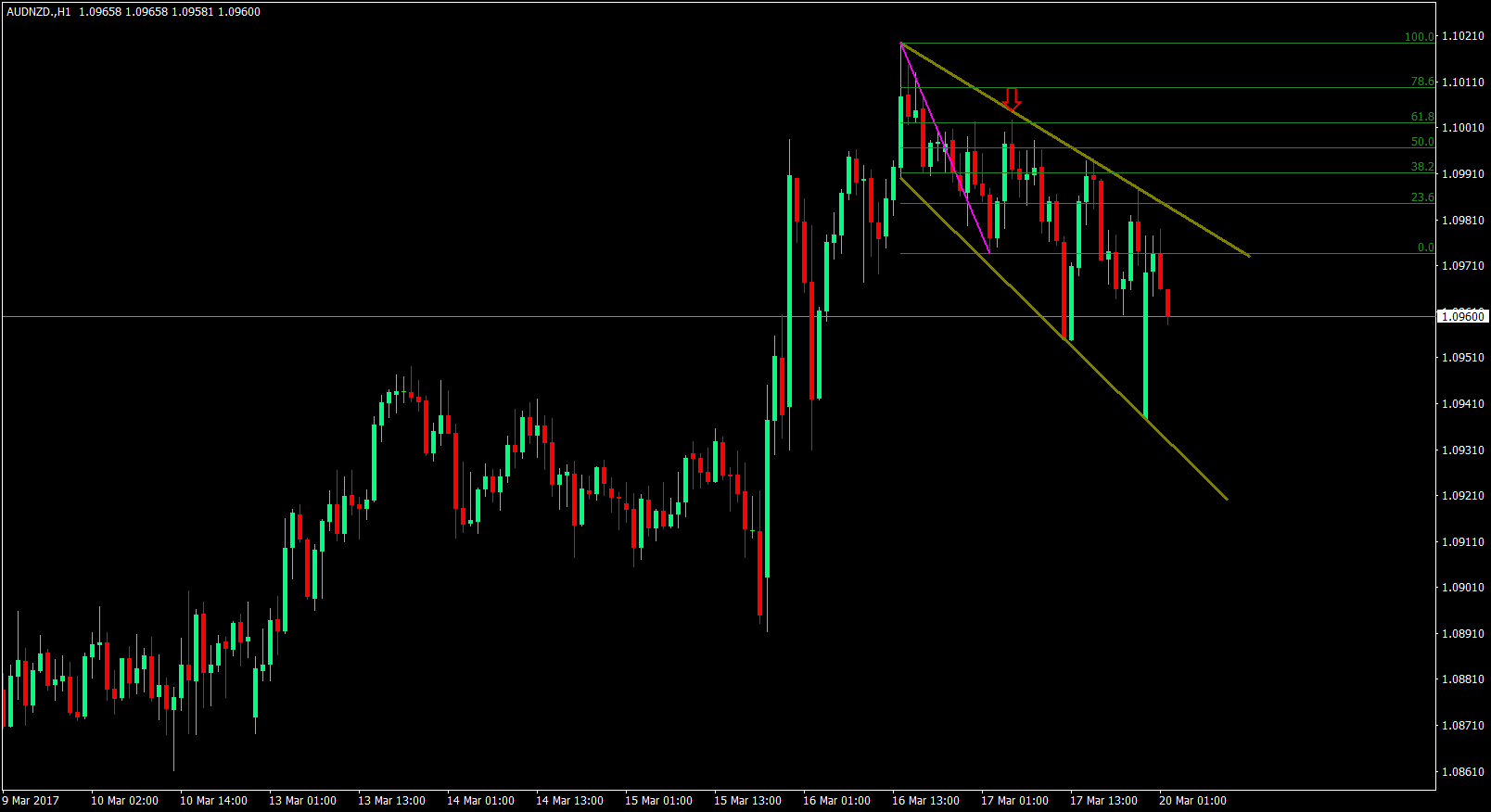

Exhibit 2…price retracing to 61.8% fib before continuing down.

Exhibit 3… I guess you get the picture now.

So yes, we can use Fibonacci Retracement tools to predict where it might stop, reverse, and continue its path down. And yes, we can use the standard Fibonacci Retracement tool from MT4. But, for the untrained eye, the Fibonacci Retracement tool is very subjective. Plus, the fact that we are trading on the right edge of the chart, meaning we don’t know what is gonna happen next, makes it a lot harder.

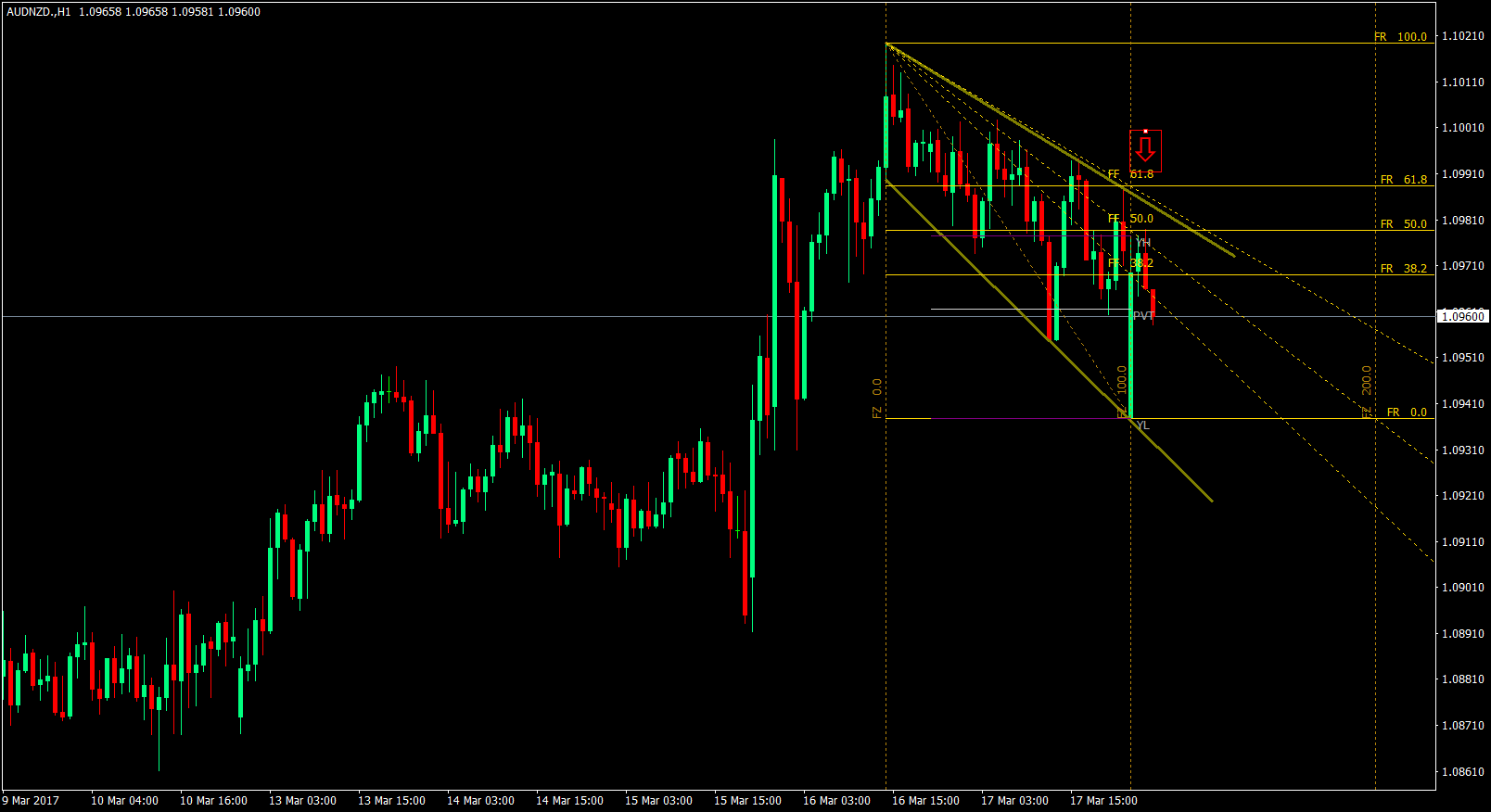

Don’t despair though, there is an indicator for every problem. We have an indicator that automatically plots the Fibonacci Retracement ruler, even though no retracement has been completed yet. This removes the subjectivity of plotting it on the chart.

The Entry

Rule 1, on the entries, don’t trade before the candle closes. One common mistake that people do is trading even before the candle closes. Yes, in this chart you could have earned more if you entered before the candle closes, but there are times when the candle reverses before it closes. That means that your direction is wrong, your entry is wrong, the whole trade is wrong, and you would lose money on that trade.

Rule 2, enter on the open of the next candle. It goes to say, if you should wait for the signal candle to close, then you trade on the open of the entry candle.

Rule 3, check your risk reward ratio before you do the trade. It doesn’t mean that if you have everything lined up, you should enter the trade right away. Why? Because you could potentially lose more than what you could earn. If the signal candle is too long, you’ll be risking more pips as compared to what you will gain based on your Take Profit, it would be senseless to enter the trade.

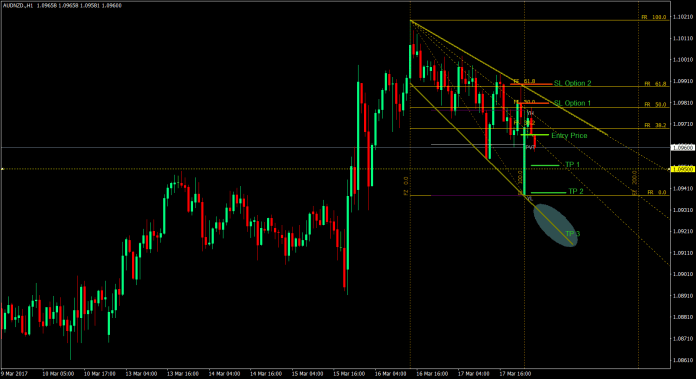

Stop Loss

There could be 2 options for the Stop Loss. First Option is that you put the Stop Loss just a little above the signal candle. The advantage for this is that you could jack up your volume since the number of pips that you would be risking is minimal. The disadvantage though is that there is a higher probability of getting your Stop Loss hit before the price goes your direction.

Second Option is to put the Stop Loss just beyond the previous fib level, in this case the 61.8% fib level. The advantage for this is that it is a safer Stop Loss, far from the price, however, the disadvantage is that you would have a smaller position since you will be risking more pips.

Target Price

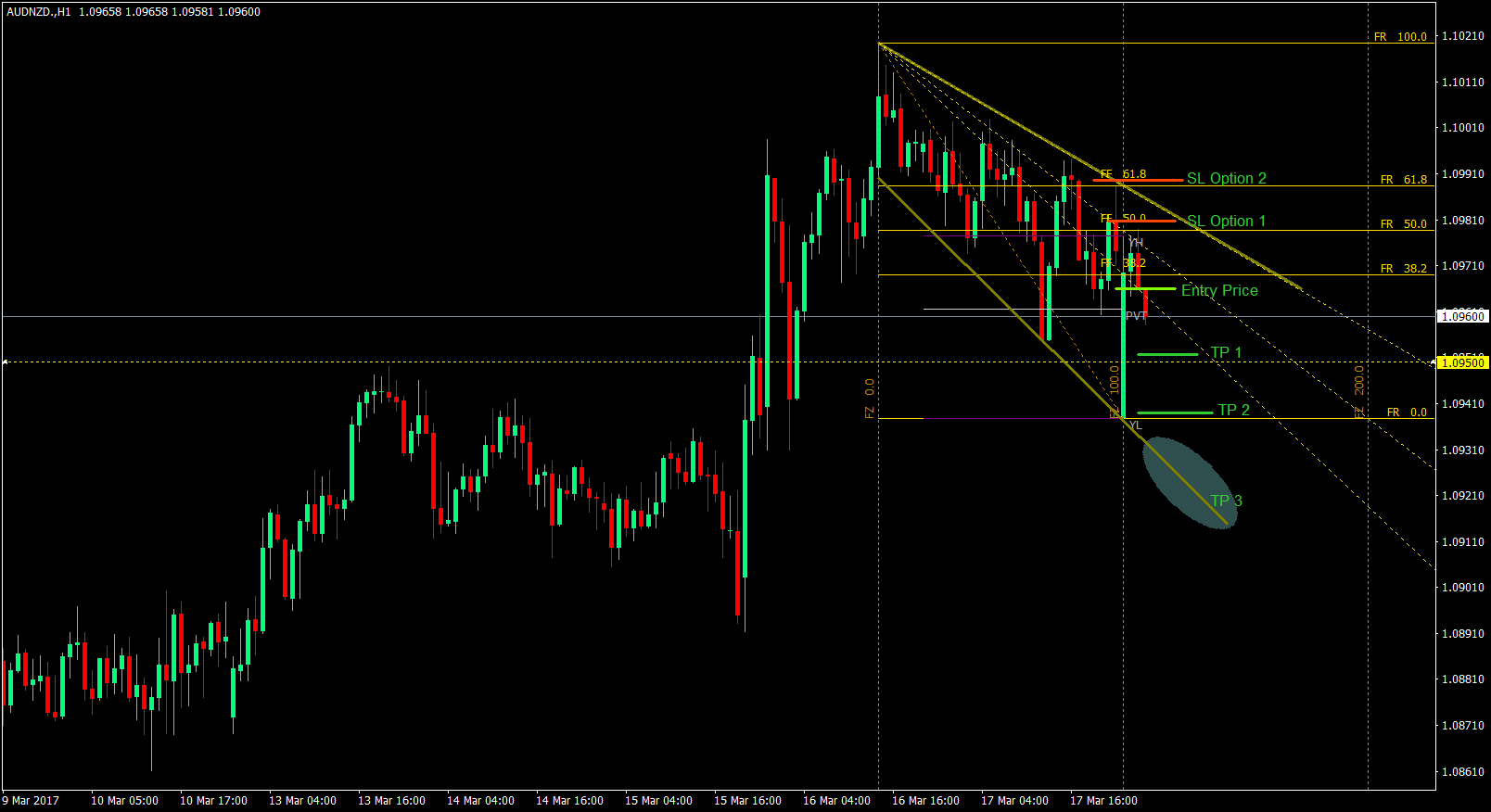

Personally, I advocate for partial Take Profits. Why? Because it ensures that I have already cashed-in and it also allows me to squeeze a little bit more profits from the trade.

So where would I put my Take Profits in this trade?

Target Price 1 would be just before the whole numbers? But first, what are whole numbers? Whole numbers are prices wherein there is a whole increment. Traditionally speaking, whole numbers are increments of 100 pips. So, it could be 1.0900, 1.1000, 1.1100, and so on and so forth. Why are these important? Because institutional position traders think that way. They don’t mind the nuisance of the small pips, but take positions depending on what they project prices would be months down the line. If they have pending buy orders on those levels, price could shoot back up if those are filled. But I’m taking it a bit further, I’m doing 50 pips, coz times have changed and we must think in advance as compared to other traders. This will constitute 50% of my position. Once price hits that level, I’ll close 50% of my position. Also, I’d be moving my Stop Loss to a positive Stop Loss just to make sure I don’t lose money.

Target Price 2 would be just before the previous lowest low (or highest high for an uptrend). Why? Because price previously went back up from there and there might still be some more pending buy orders that were not filled that could take prices back up. Here, I will close 25% of my position, leaving the last 25% as a Hail Mary throw to the finish line.

Target Price 3 will be on the diagonal trendline. Many traders trade based on the trendline and they might reverse the trade once the trendline is hit. So, on the slightest bounce off the trend line, I’ll be closing my position.

Conclusion

Fibonacci is a great tool for you to earn your fortune in forex. Many highly successful, professional and retail traders use it. Why shouldn’t you? Although no one can explain why it works, but it works, and that is what matters. As long as you are able to use it wisely, with the correct money management, you could be a profitable trader and bring in the dough with this one.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: