QQE Indicator Based Scalping or Day Trading Strategy

Scalpers and day traders have a common skill to master – SPEED! They need to be able to decide in a matter of a few minutes or even just a few seconds. For this reason, they often try to find ways to simplify their trading decisions to a preset rules of “ifs” and “thens”. By having a preset decision making framework, the decisions are already made prior to the actual trade. This allows traders to execute automatically as the market presents opportunities.

One of the advantages of using an indicator based strategy is that this presetting of rules could be done easier compared to a non-indicator based strategy. Price action for example is very subjective and needs a skilled eye to assess the charts.

The QQE Indicator Advantage

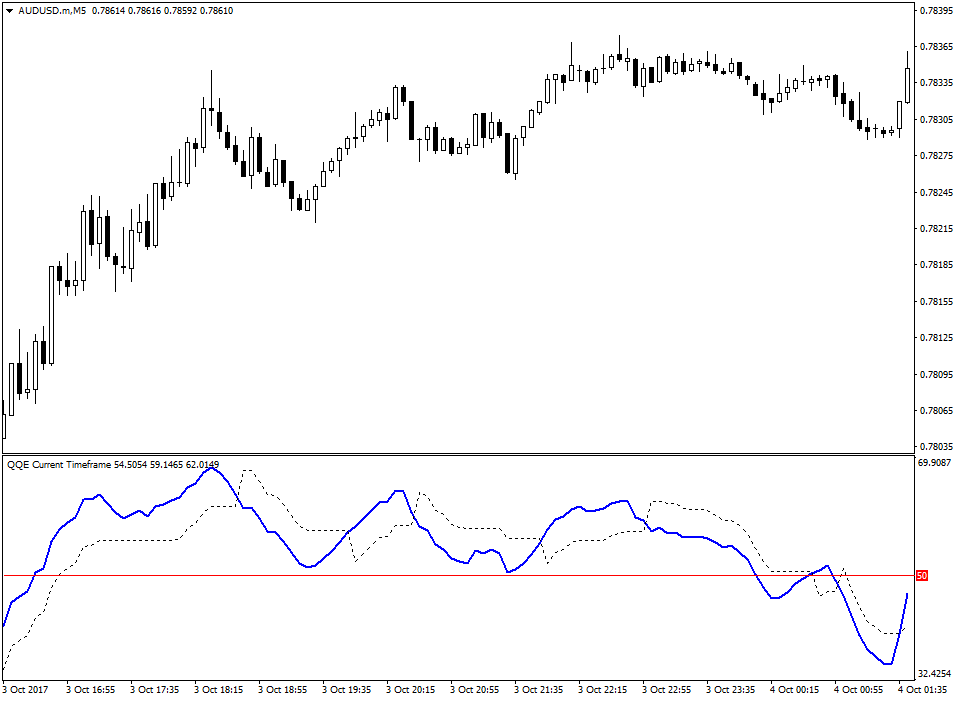

The QQE indicator is an oscillating indicator based on a complex mathematical equation that plots two lines, one fast and one slow. Having two lines oscillating allows for crossovers between the fast and the slow lines, which may be used as confirmation of a minor trend bias.

Another advantage of the QQE indicator is the 50% line. This could be added as another filter for the trading rules. Having the QQE lines above the 50% line indicates that price is on an uptrend while lines below the 50% line indicates that price is on a downtrend.

The chart below is an example of what a QQE indicator looks like.

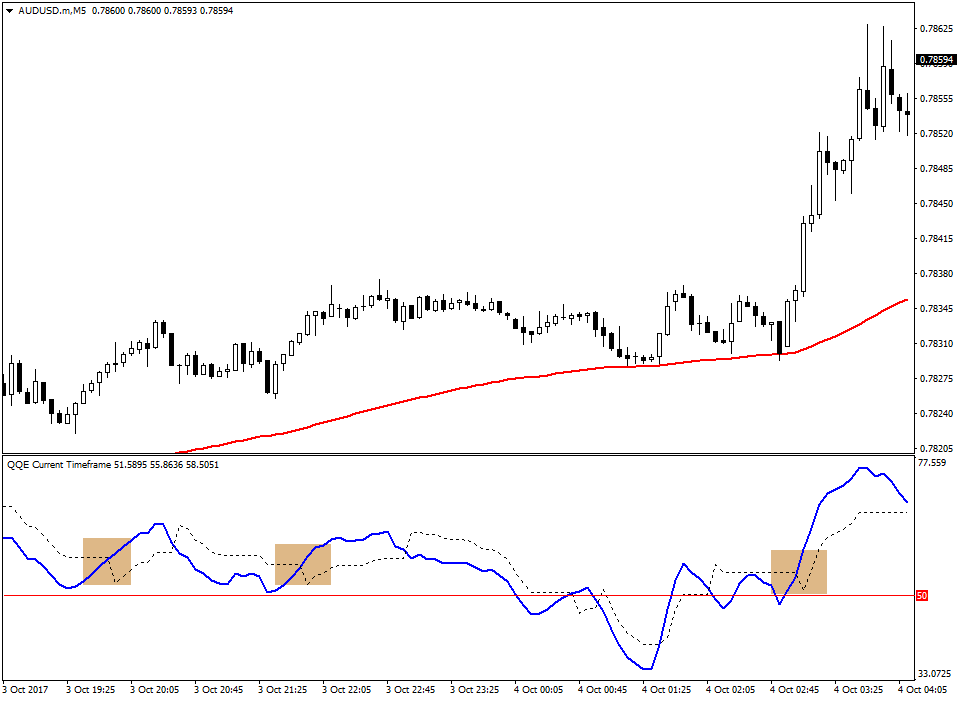

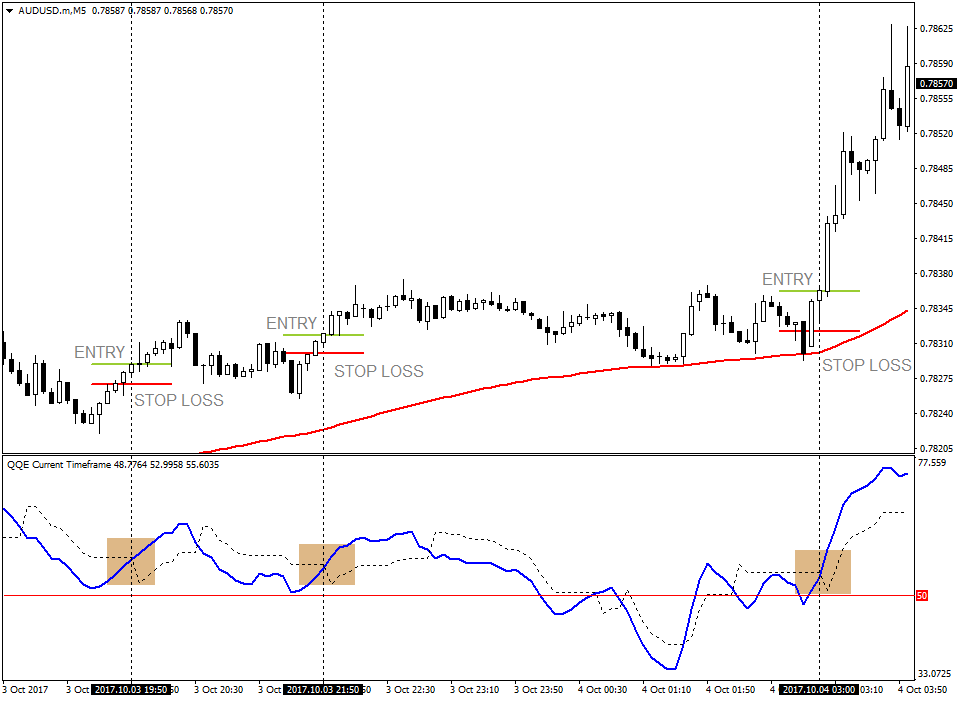

The 100 Exponential Moving Average (EMA) Filter

Another trend filter that we may employ is the 100 exponential moving average (EMA). Using the 100 EMA allows us to identify a somewhat long-term trend. This gives us an idea of the general trend for the day. What we should be looking for is the direction of the 100 EMA slope, the location of price in relation to the 100 EMA and the behavior of price around the 100 EMA. Price shouldn’t be whipsawing the 100 EMA, bobbing up and down. This would indicate a ranging market, which is not in this strategy’s alley.

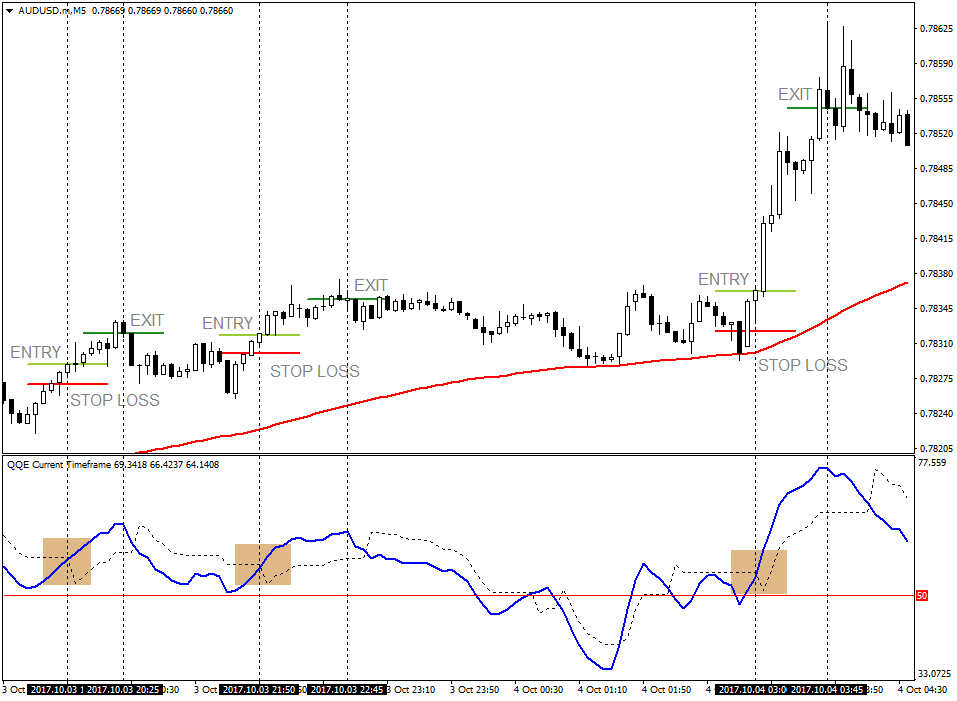

The Long Setup – Entries & Stop Losses

Here are the rules for a long (buy) setup:

- Price should be above the 100 EMA

- The 100 EMA should be sloping upwards

- Previous price action should not be whipsawing the 100 EMA

- Both QQE lines should be above the 50% level

- The blue QQE line should be sloping upwards

Unless all these rules are not ticked, then no buy trade should be considered.

However, these rules are just a prerequisite for us to enter a long trade. What we should be looking for is a crossover between the fast (dashed line) and the slow (solid blue line) QQE lines. We only enter the trade if the slow QQE crosses over the fast QQE line going up. This would be the trigger for us to enter the trade.

In the picture below, you would see an example of the solid blue line crossing over the dashed line, with all the other rules satisfied.

To complete the setup, our stop losses should be placed just a few pips below the entry candle.

Buy setups should look somewhat like the setups above. The entry candles are at the QQE crossover point and the stop losses are just a few pips below the entry candles.

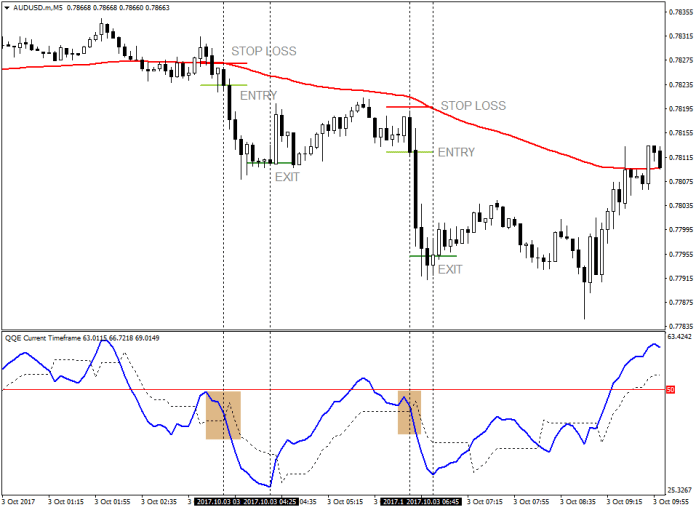

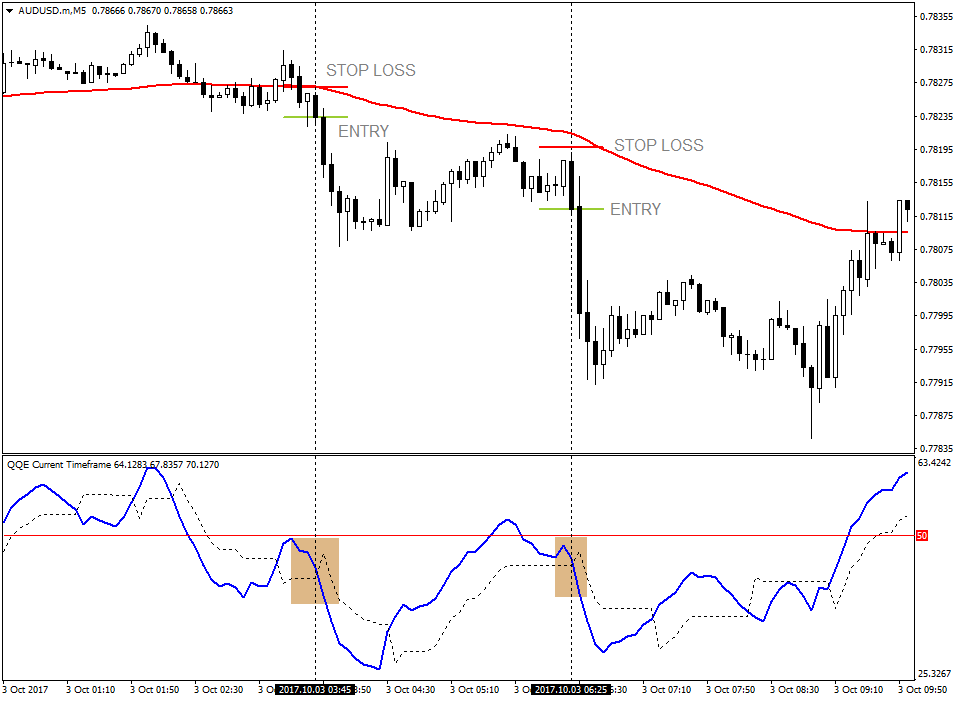

The Short Setup – Entries & Stop Losses

The rules for a short trade is just the opposite of the buy trade rules.

- Price should be below the 100 EMA

- The 100 EMA should be sloping downwards

- Previous price action should not be whipsawing the 100 EMA

- Both QQE lines should be below the 50% level

- The blue QQE line should be sloping downward

The trigger would also be a crossover of the two QQE lines. We will be entering the sell trade as soon as the solid blue line crosses the dashed line going down.

As for the stop loss, it would be just a few pips above the entry candle.

1:1 Risk Reward Take Profit

Because the trade is based on entering the market at an already established thrust, the room for movement is somewhat lessened as compared to entering at the actual reversal point. For this reason, we will not be setting a target that is too high. A 1:1 take profit would already be sufficient. However, since this is a trade already confirmed by the QQE indicator, the win rate ratio would be a little higher.

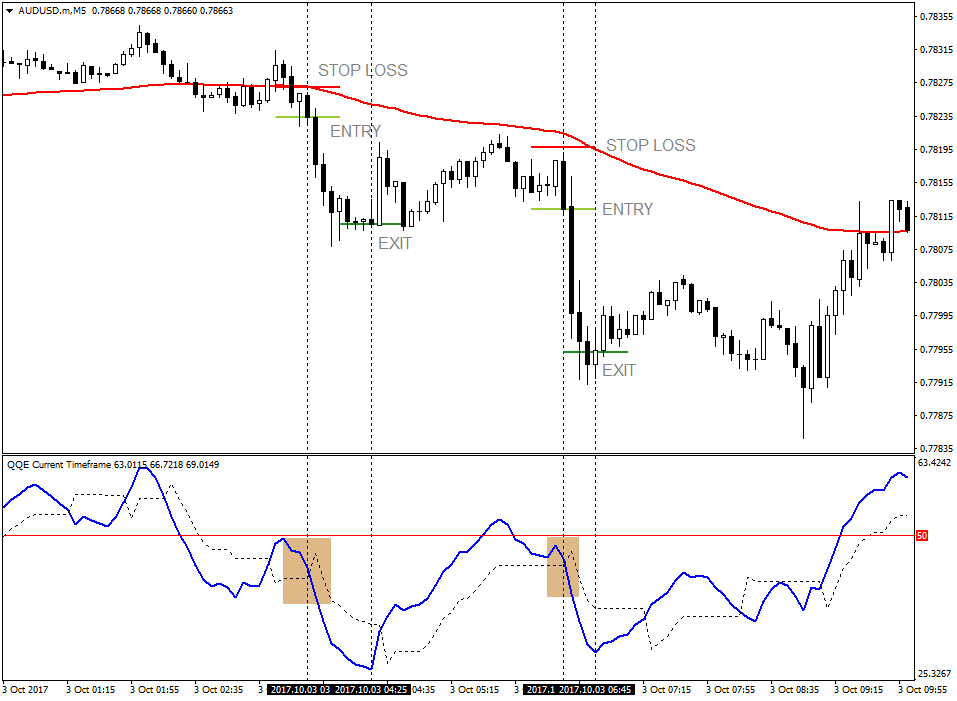

QQE Indicator Based Exit

Some traders might find the 1:1 take profit a little too low for their taste. No need to fret though, there is another way we could exit our trades and hopefully at a profit. We could use the QQE indicator as an exit trigger. Our exit trigger will be based on the curling back of the slower (solid blue line) QQE line. As soon as we notice the blue line curling against our trade, then we should close our trade.

If it is a buy trade, then we should exit our trade if the solid blue line curls down.

If it is a sell trade, then we should exit our trade if the solid blue line curls up.

Conclusion

This type of strategy is a strategy that waits for a confirmation of the reversals prior to the entry. Notice how the entries on the sample trades above are just continuations of thrusts. These entries are not the actual reversals but are entries already confirmed by the QQE indicator. The potential for profits is somewhat decreased due to the strategy’s later response, waiting for the confirmation of the QQE indicator. However, entering on a confirmed thrust lessens the risk of a fake reversal.

The advantage of this strategy is its “if-then” type of decision making. This somewhat automates the trader’s decision making. In fact, this type of strategy could be programmed into a computer algorithm. This will allow the trader to trade all opportunities presented by the market.

With regards to the take profits, you may have three choices here. One, is to use the 1:1 risk-reward ratio. This is more conservative since the take profit targets are not that hard to hit. It is also sensible, since we are entering an already established thrust.

Another option would be to use the QQE indicator as the exit trigger. This allows the trader to gain more pips on big thrusts. However, its setback is that sometimes the QQE indicator may cause the trader to wait for price to reverse at a loss prior to exiting the trade. With that said, this type of exit strategy is more aggressive.

Lastly, the trader may use both types of exit with a 50-50 volume. The trader must set a fixed 1:1 risk-reward ratio on 50% of the position, while leaving another 50% of the position open for the QQE based exit.

With this strategy, it is best to use a money management system that starts with small volumes then gradually increasing the position sizes as the winning streaks continue. A wise money management should be in place, given that the risk-reward ratio is not that high, especially when using the 1:1 take profit target.

Trade wisely!

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: