Pivot Points Indicator

There is a myriad of indicators available to forex traders out there. However, there are only a few which are commonly used by the pros. Pivot Points indicator is one of the very few indicators that the professionals commonly use. It is used by big institutional traders trading for the big banks. If they are using it, then we as retail traders might also benefit from using this indicator.

The Pivot Points indicator is a technical analysis indicator used to identify key areas of interest on the price chart over different timeframes. It is composed of the Pivot Point (PP), which is its midline and main line, Support 1 (S1), Support 2 (S2), Resistance 1 (R1), and Resistance 2 (R2).

The Pivot Point (PP) is basically the average of the high, low and close of the previous period. It could be based on the previous day, week or month.

The following are the various computations for the other lines.

R1=(P x 2)-Low

R2=P+(High-Low)

S1=(P x 2)-High

S2=P-(High-Low)

These lines are then plotted on the price chart marking support and resistance areas where price could have some action. The unique thing about Pivot Points is that many professional traders are looking at the same support or resistance line. In trading, having a bulk of the market looking at the same key area and having the same idea of what price is about to do means a lot. It could mean a strong and reliable trade setup.

If you would observe price charts, you would notice how price would often respect the area around these supports and resistances. Price would usually bounce off it during a market reversal scenario or would get attracted to it during a strong momentum price movement.

Pivot Points Trading Strategy

This strategy shows how the price would often bounce off the Pivot Point support and resistance lines.

It makes use of two moving average lines to confirm a trend reversal and make entry triggers more objective. We will be using the 7-period Exponential Moving Average (EMA) and a 21-period Exponential Moving Average (EMA).

However, traders should still observe price action and how price is behaving around the area near the Pivot Points in order to determine what price might do.

Traders should also determine if the reward-risk ratio of the trade is worth taking by determining if the entry is farther from the next Pivot Point line compared to the support or resistance line where it bounced.

Indicators:

- PivotWeekly (default setting)

- 7 EMA (Green)

- 21 EMA (Gold)

Preferred Time Frames: 30-minute and 1-hour charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

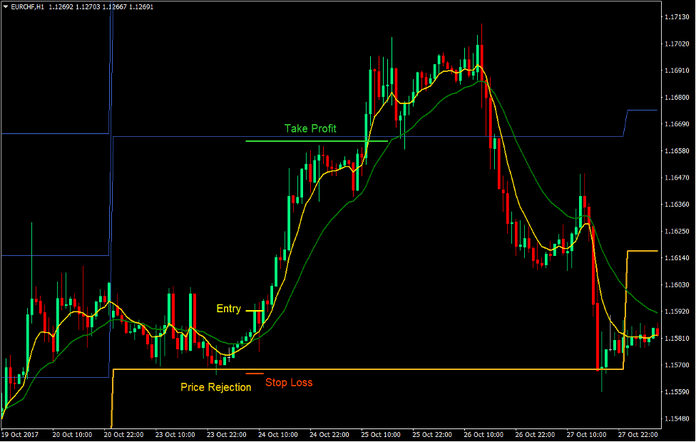

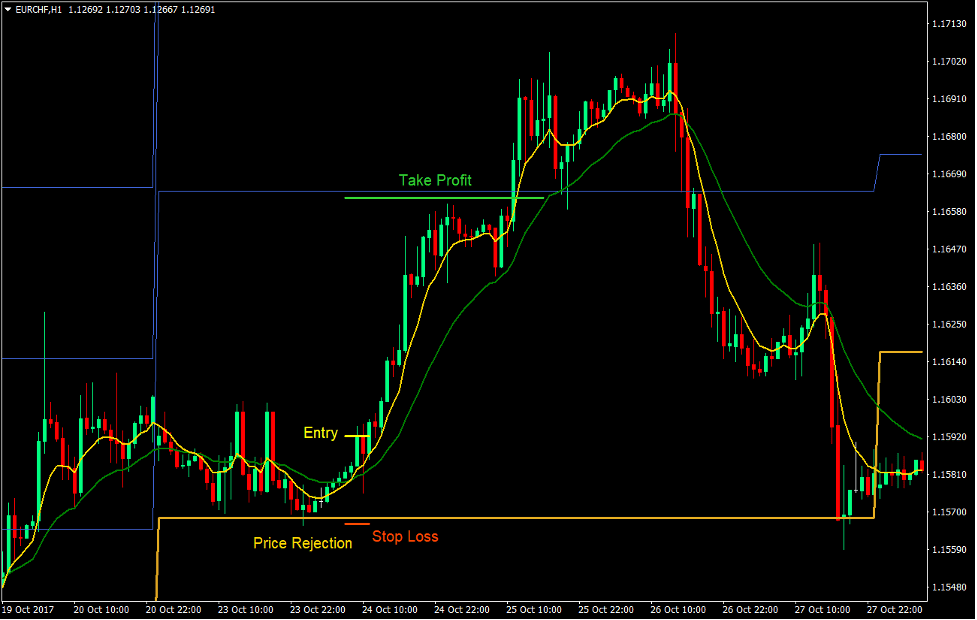

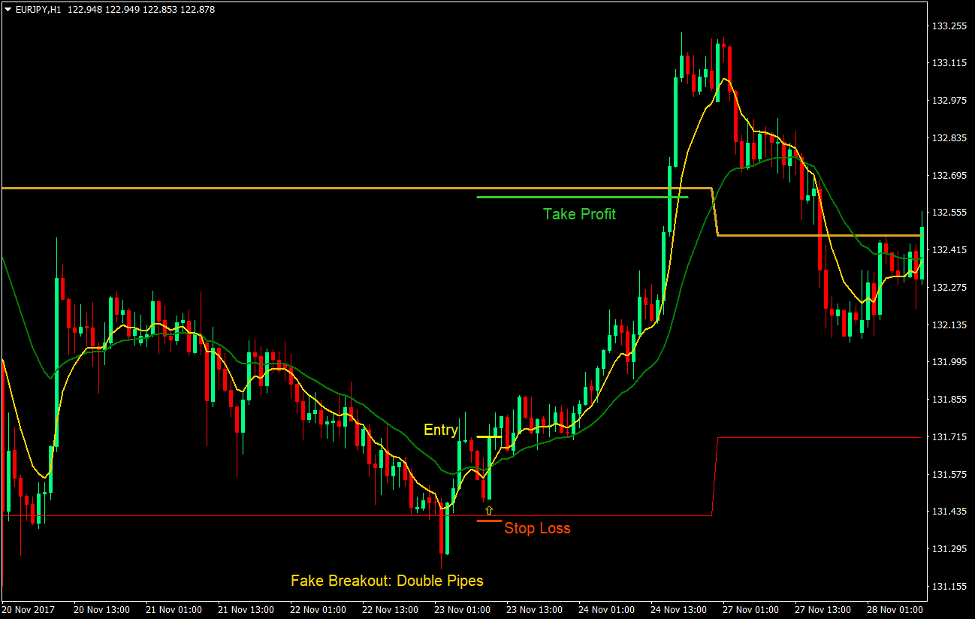

Buy Trade Setup

Entry

- Price should show signs of price rejection from any of the Pivot Point lines, which is acting as a support line, based on price action and candlestick patterns.

- The 7 EMA line should cross above the 21 EMA line.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss below the support line.

Exit

- Set the Take Profit target a little below the resistance line above price.

Sell Trade Setup

Entry

- Price should show signs of price rejection from any of the Pivot Point lines, which is acting as a resistance line, based on price action and candlestick patterns.

- The 7 EMA line should cross below the 21 EMA line.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss above the resistance line.

Exit

- Set the Take Profit target a little above the support line below price.

Conclusion

Pivot Points is one of the most important indicators used by professional traders. Traders would often look for bounces off the Pivot point to determine a good trend reversal signal.

Although the strategy above uses a moving average crossover to determine and entry signal, many professional traders base their decision on price action. Traders who have developed the skill to anticipate trend reversals could make use of price action alone as a basis for entry signals.

It is also important to note that with Pivot Points, the key is in having the same line that other traders are looking at. Daily Pivot Points does work. However, because brokers are based on different countries and close on different times of the day, the lines plotted on different platforms could differ. For this reason, it is best to stick with the Weekly Pivot Points as they tend to be more reliable.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: